Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Global coal demand is on the rise while prices for thermal coal and metallurgical coal have climbed dramatically over the last year. As some countries have ramped up coal production, others are looking for greener alternatives.

Published: June 14, 2022

Updated: October 7, 2022

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

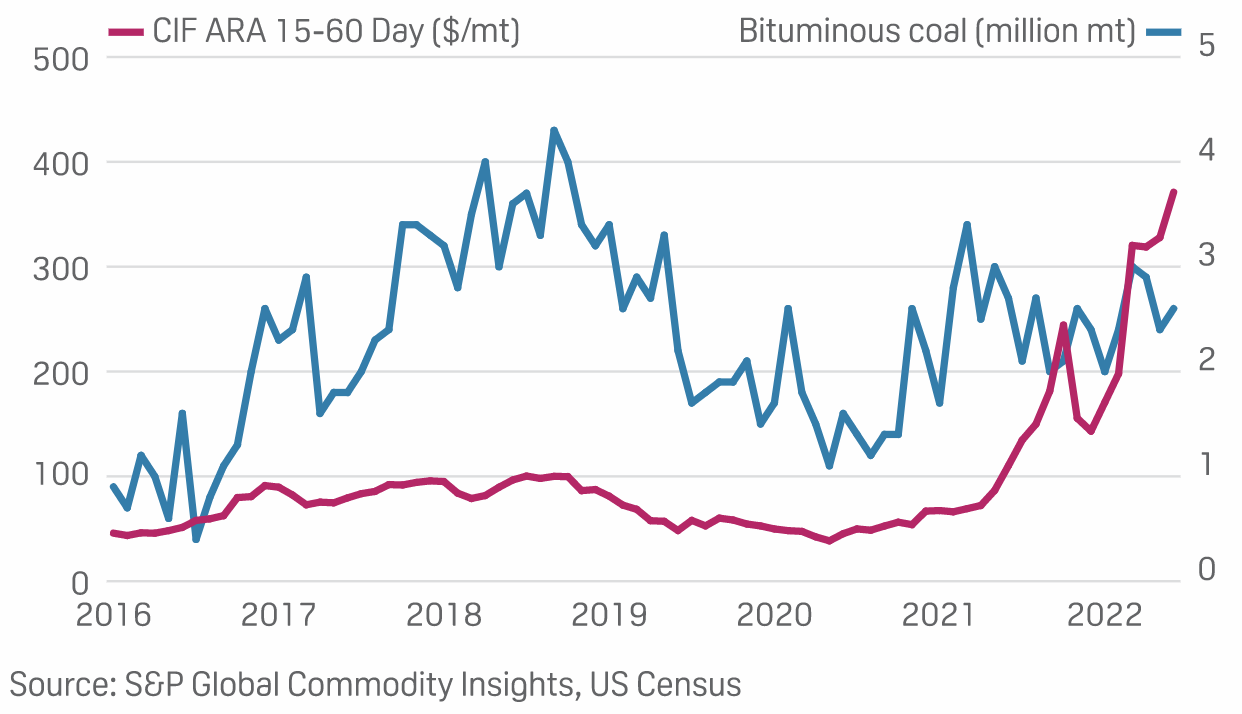

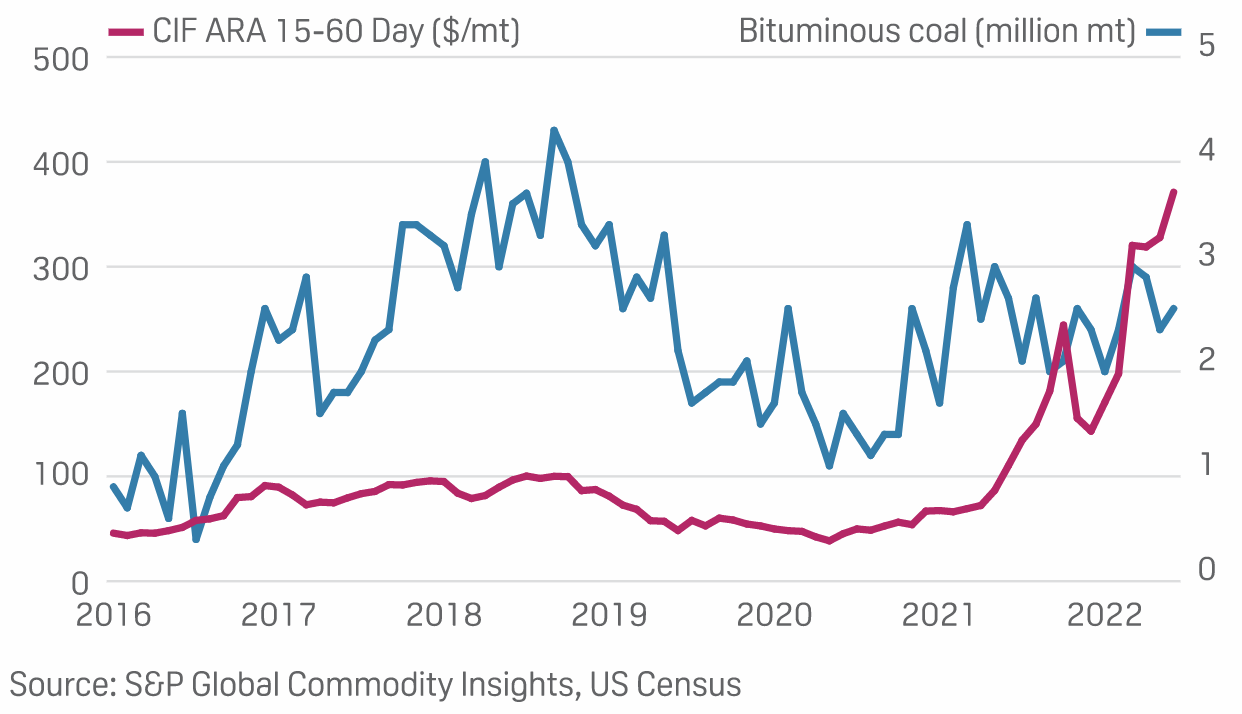

SUBSCRIBE TO THE NEWSLETTERSAn indication of demand destruction, US steam coal exports fell 15.2% on the year in June as the CIF ARA monthly average price more than tripled to $371.02/mt, according to US Census Bureau data released Aug. 4.

Glencore's Share Price Outperforms Peers As It Bucks Coal Divestment Trend

Glencore PLC's decision to add coal assets even as other large miners ditched the emissions-intensive fuel has been paying off. The diversified mining company's stock price rose 128.3% over the two-year period ended July 27, in part thanks to renewed global demand for coal.

READ THE ARTICLEEnergyCents - Ep 81: Throwback: Coal Markets Boom After Years Of Being Unfashionable

Global coal prices are at multi-decade highs as post-CoVid demand spikes in the face of underinvested supply. Coal Markets Expert Taylor Kuykendall, a Commodity Insights senior reporter for S&P Global's Capital IQ, joins EnergyCents this week to discuss the current coal market imbalance.

Listen to the Podcast

The Platts Market Data - Coal dataset provides access to the full breadth and depth of our coal market data, including benchmarks and contract price assessments.

ACCESS MOREU.S. coal exports rose in the second quarter as demand and prices remained elevated amid a global energy crisis.

Shipment volumes increased 14.8% quarter over quarter to 21.6 million tonnes and climbed 4.6% year over year, according to S&P Global Market Intelligence data.

The global coal market has become tight as several countries shunned supplies from Russia following its Feb. 24 invasion of Ukraine. High natural gas prices and the lack of new project investments have also pushed up coal prices. However, rail transportation constraints, weakening demand in China and fears of a global recession pose risks to the sector.

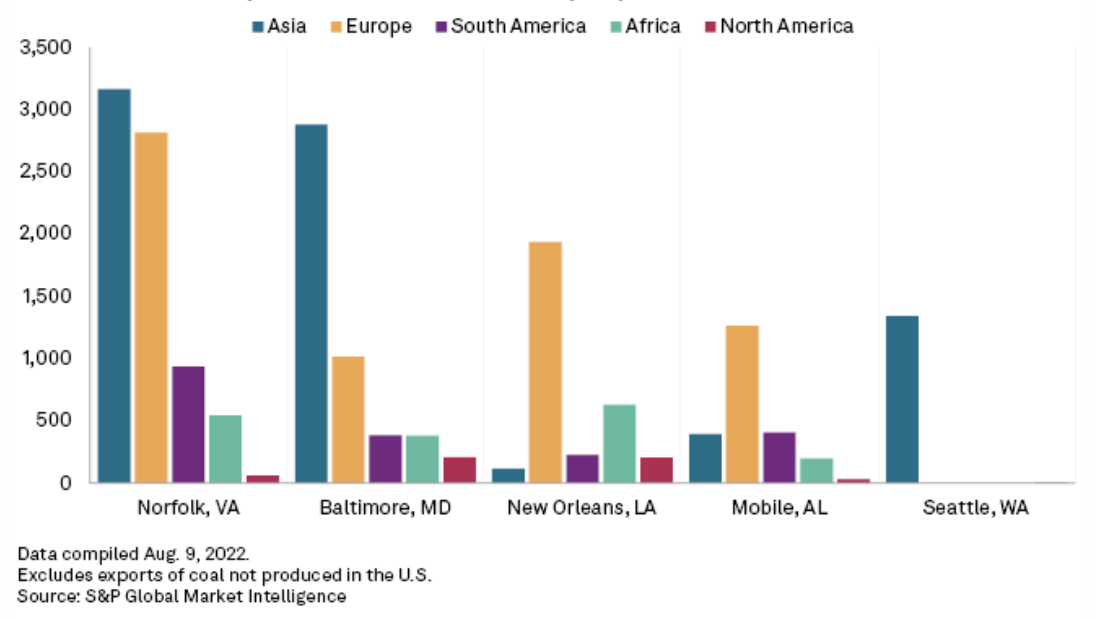

Asia and Europe received the most coal shipments from the five largest ports in the U.S.: Norfolk, Va.; Baltimore; New Orleans; Mobile, Ala.; and Seattle. Other destinations for U.S. coal exports included South America and Africa. All coal shipped through Seattle during the second quarter went to Asia.

Trade Review: Asia Met Coal Market Sees Light Ahead on Q4 Restocking Demand, Scarce Supplies

The seaborne metallurgical coal market is entering the fourth quarter on firmer footing, as weather-related disruptions stoke supply worries while year-end restocking demand from India and China keep prices supported after a volatile Q3.

Read the ArticleBangladesh to Lean on More Coal Than Natural Gas in Power Generation to Curb Costs

Bangladesh is expected to see a huge ramp up in coal-fired power generation in coming months as new capacity comes online, which will boost the share of coal in its energy mix to its highest on record.

Read the ArticleVietnam Targets Higher Coal Imports As Domestic Demand Climbs

Vietnam has forecast a substantial increase in coal imports over the next 12-15 years, particularly from the power sector, on rising domestic demand, according to a draft strategy for the coal industry from the Ministry of Industry and Trade, or MoIT.

Read the ArticleAmid long-standing global push to embrace renewables as a primary source of power generation, India does not want to be left far behind, but at the same time lowering dependence on coal is emerging to be a constant struggle, given how affordable and abundant it is.

With a slew of lucrative measures like 100% FDI under the automatic route for renewable energy and setting up of project development cell for facilitating investments, the government aims to attract domestic and international investors, which has indeed shown results with some private players showing interest.

Lower Price, Currency Flexibility Drive More Russian Thermal Coal To India

With India leveraging discounted Russian coal and banks adapting to facilitate trade in currencies other than the US dollar, data shows that the influx of Russian material -- which has been increasing significantly -- has eaten into the Indian import market of high-CV US, South African and Australian coal and experts believe that the trend is likely to continue.

READ THE ARTICLEIndia Prefers Coal For Its Abundance, Availability, Affordability: State-Owned Producer

The entry of renewable energy sources should not be viewed as a threat to coal's standing at least in the immediate future as coal would continue to fuel India's electricity generation going by the current consumption pattern, Coal India's chairman and managing director Pramod Agrawal said in the company's latest annual report published July 30.

READ THE ARTICLE

Gain vital mining news and research insights into worldwide exploration, discoveries, development, production, acquisitions activity, industrials and base metals markets forecasts and analysis, supply chain and ESG, to make well-informed decisions.

ACCESS MORE RESEARCHSoutheast Asia (SEA) was regarded as a "slow starter" in the energy transition but has accelerated the decarbonization path, with most SEA countries developing their own road maps to achieve net-zero emissions between 2050 and 2065.

Renewable deployment and coal phase-out are the two most common decarbonization pathways for SEA.

Cecillia Zheng is based in Singapore and leads Southeast Asian power market research and consulting at S&P Global Commodity Insights.

Talk to the Expert