S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Published: April 1, 2020

Highlights

For more than a decade, growth in U.S. labor productivity (as measured by output per hour of work) has generally declined—sometimes rather sharply.

S&P Global believes this lost decade of productivity gains could have been far different had the federal government increased infrastructure investment to match the levels of just a few decades earlier.

Most experts say U.S. transportation, water, and other systems face major shortfalls. The country’s vast network of transportation infrastructure along with its power grids and communications facilities were, in many cases, built decades ago (or more). Delayed maintenance and updates have effectively clipped the economy’s wings.

While research suggests that infrastructure could be the catalyst the U.S. economy needs to generate productivity and growth, today infrastructure spending remains neglected. Public investment could be used to spur productivity growth.

For a PDF of this report, please download.

As the U.S. economy chugs along in what is now the longest expansion in the country’s history, there’s one factor that hasn’t contributed much to the record run: productivity growth. In fact, for more than a decade, growth in U.S. labor productivity (as measured by output per hour of work) has generally declined—sometimes rather sharply.

S&P Global believes this trend is at least partly responsible for an economic recovery that, while historically long, has also been comparatively lackluster. We also think that this lost decade of productivity gains could have been far different had the federal government increased infrastructure investment to match the levels of just a few decades earlier.

In February of 2009, President Barack Obama signed into law the American Recovery and Reinvestment Act (ARRA) in an effort to save and create jobs in the wake of the Great Recession—an outcome that economists today largely agree was achievable, though the labor market recovery was the slowest in the U.S. post-World War II. The legislation earmarked more than $100 billion for infrastructure investment with the idea that productivity gains and state and local infrastructure investment would be a major boon to growth. That didn’t happen to the degree that many had hoped.

On the contrary, productivity growth in the nonfarm business sector has averaged just 0.9% from 2011-2019. That’s less than half the average from 1956-1975, and well below the 3% in the decade from 1996-2005, when investments in information and communications technology—specifically internet connectivity—spurred a revolution in the American workplace.

We believe that the disappointments of the ARRA may have more to do with the comparatively small amounts dedicated to infrastructure than its intent. Consider that the U.S. spends roughly $700 billion a year on defense. Heck, the government pays almost $500 billion a year in interest on the national debt. Meanwhile, spending on the roads, bridges, and energy and communication systems (among others) that keep the world’s biggest economy moving has been on a downward trend for more than a half-century. Government investment in infrastructure as a share of GDP is now approximately 1.3%, down from 1.7% a decade ago and half the high of 2.5% in 1967.

Not that efforts haven’t been made. In 2015, a bipartisan effort saw the passage of the Fixing America’s Surface Transportation (FAST) Act—the first law in more than a decade to secure long-term federal funding for highways, transit, passenger railway, and other surface infrastructure—to the tune of $305 billion for fiscal years 2016-2020. The FAST Act allowed federal funds to be used in public-private partnerships (P3s) for infrastructure, and oversaw the Highway Trust Fund, a transportation fund that receives money from federal fuel taxes and finances most federal spending on highways and mass transit. On the downside, the Congressional Budget Office says the fund may become insolvent by 2021, and the FAST Act faces the option for renewal in the coming year.

At the same time, President Donald Trump has emphasized the importance of strengthening infrastructure across the U.S.—albeit with limited legislative success. Following his 2018 State of the Union Address, in which the president introduced his Building A Stronger America initiative, the administration proposed $200 billion in federal support to stimulate a total of $1.5 trillion in infrastructure spending over a 10-year period. In making states, municipalities, and the private sector responsible for completing the majority of projects needed to accomplish this goal, the plan seemed to run counter to the administration’s fiscal 2019 budget proposal—which cut funding from many existing federal infrastructure programs. The Penn Wharton Budget Model estimated in 2018 based on past evidence that the new federal aid would lead to state and local governments increasing infrastructure investment by less than the value of the aid itself, with little to no impact on the economy. Nevertheless, in a much-discussed deal, Democrats and Republications agreed in April to spend $2 trillion on American roads, bridges, power grids, water, and broadband infrastructure. How that plan would be paid for was left undetermined, as President Trump nixed the agreement shortly afterward, pressured by Republican lobbying groups and citing the various political investigations of the president as reasoning for abandoning the plan. Administration officials have stated that further efforts to pass such plans are unlikely.

Most experts say U.S. transportation, water, and other systems face major shortfalls. In its most recent report card (2017), the trade group American Society of Civil Engineers gave the U.S. a grade of D+—the same score given in 2013. The country’s vast network of transportation infrastructure along with its power grids and communications facilities were, in many cases, built decades ago (or more). Delayed maintenance and updates have effectively clipped the economy’s wings. For example, the Department of Transportation said as recently as last year that 64% of the country’s highways are in less than good condition, alongside 25% of bridges in need of significant repair—with an estimated backlog of $836 billion in unmet capital and investment needs. At the same time, international peers have leapfrogged the U.S. with more efficient and reliable services, and their public investment in infrastructure is on average nearly double that of the U.S.

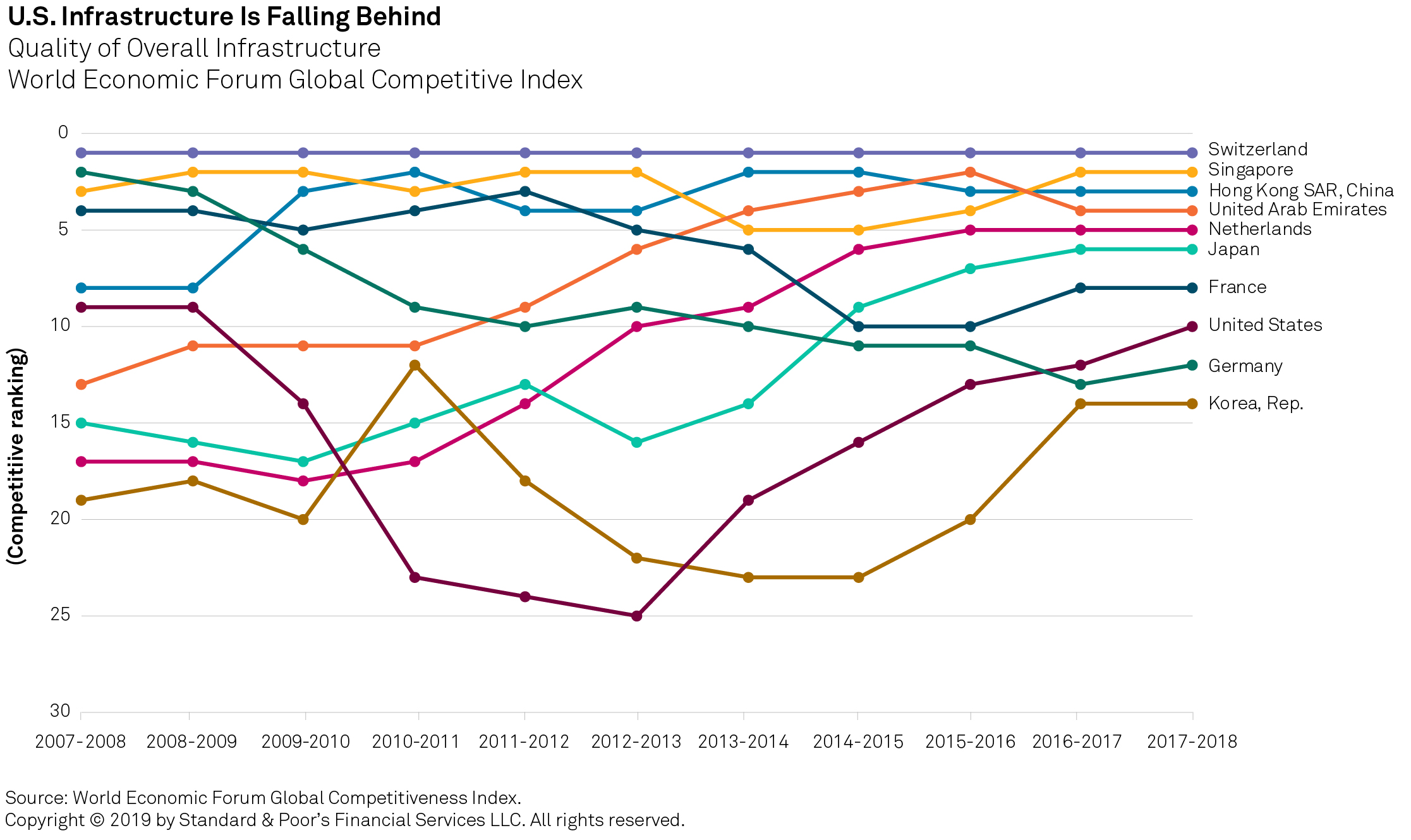

Research by the McKinsey Global Institute in 2015 found that while the world spent 14% of global GDP, or $9.5 trillion, on infrastructure that year, $3.7 trillion was needed in investment in infrastructure every year until 2035 to keep pace with global GDP growth. Meanwhile, the U.S.’s quality of overall infrastructure declined 0.34% from 2007-2017, according to the World Economic Forum’s 2017 Global Competitive Index, with the country ranking 10th out of 137 countries—above Germany but behind Hong Kong, Singapore, the Netherlands, Japan, the United Arab Emirates, Switzerland, France, and South Korea.

It’s important to identify the potential benefits of an infrastructure investment on productivity and future economic activity. This effectiveness depends on a number of factors, including how much slack is in the economy, how high interest rates are, and how investments are financed—all of which makes it difficult to determine the long-term effects of such projects on overall economic activity. But experience helps us come to certain conclusions.

It’s clear that the proverbial “bridge to nowhere” would result in little economic gain. But based on numerous studies, if an infrastructure project is done wisely, economic gains from the productivity enhancement would boost GDP for many years. Moreover, policy makers need to recognize how detrimental reductions in infrastructure investment could be on economic growth and government net worth in the long run.

A series of papers by economist David Aschauer in the late 1980s and early 1990s, supported by research by Alicia Munnell at the Federal Reserve Bank of Boston in 1989 and 1990, found that the rate of return to public capital was significantly higher than that of private capital. Critics argued that the time-series component used in their research suffered from both causality and simultaneity problems. Later research by James Heintz in 2010 addressed the simultaneity problem using a vector error correlation model, and also found that solving the simultaneity problem this way would also solve the causality problem. Replicating Heintz’s analysis for the period 1949-2015, Josh Bivens of the Economic Policy Institute found that a 10% increase in the public capital stock boosts private-sector output by 1.5%-2% or a rate of return of 30%-40%.1 The Council of Economic Advisors seems to agree that infrastructure investment would be a net gain to economic growth. In a February 2018 report titled "Infrastructure Investment to Boost Productivity and Growth," they estimated that “a 10-year, $1.5 trillion infrastructure investment initiative could add between 0.1 and 0.2 percentage point to average annual real growth in gross domestic product under a range of assumptions regarding productivity, timing, and other factors.”

While reams of research suggest that infrastructure could be the catalyst the U.S. economy needs to generate productivity and growth, today infrastructure spending remains neglected. Average growth in the real (inflation-adjusted) stock of public capital was a healthy 4.5% from 1949-1973, while average productivity growth was around 2.6%. It dropped significantly from then until 1995, as did productivity growth over the same period. Productivity then picked up dramatically in the second half of the 1990s through the early 2000s, driven by a large increase in private-sector investments in information and communications technology (ICT) equipment. Through capital deepening and better production processes, these investment lead to a significant rebound in overall productivity over that period.

Productivity growth has since been stagnant. To be sure, the underlying trend in productivity has been greatly distorted by the severity of the Great Recession. But given that the post-1995 acceleration in productivity was driven largely by the rise in ICT investments, and that both productivity growth and ICT investments have decelerated since the early 2000s, it seems likely that the ICT boom won’t be an engine of economic expansion in the coming decade.

So, how do we return to the strong levels of productivity growth seen in the past? Maybe the private sector will see investment opportunities in some as-yet-unrecognized sector, but that’s uncertain. What is certain, however, is that public investment could be used to spur productivity growth. Given that public capital has lagged or stagnated as both a share of the overall economy and relative to the private capital stock in recent decades, there should be ample opportunity for high returns on public investment, with little worry about quickly reaching a point of diminishing returns.

It’s also worth looking at government investment on infrastructure beyond the short-term benefits to jobs and aggregate demand. Such spending yields long-term benefits as well; significant investments in large projects can enhance efficiency and allow goods and services to be transported more quickly and at lower costs.

Naturally, the “multiplier effect” of infrastructure spending on the economy is lowest when GDP growth is strongest, as higher production costs cut into investment returns. We understand the temptation to delay project spending until the inevitable next downturn, but given the maturity of the ongoing U.S. expansion, the time to strike may be now. Yes, a tight labor market is putting upward pressure on wages, and the various trade and tariff disputes the Trump administration has engaged in have bolstered the cost of building supplies (particularly steel); but, given the potential productivity gains from wise investment, paying a little extra now would likely be worth it. Moreover, given heightened economic risks to the U.S. economy, it would not surprise us if the U.S. falls into a recession just as shovels for these projects break ground.

This is especially true when we look at the growing signs indicating that the U.S. economy has weakened. S&P Global economists now see the risk of a recession starting in the next 12 months at 30%-35%—more than twice what it was a year ago. We forecast full-year U.S. GDP growth to slow to 2.3% this year and just 1.7% next year, followed by average annual expansions of 1.8% for 2021-2023.

In a recession—or anything close to it—jobs will surely be lost. Now is the time to plan for this eventuality. This way, once projects are “shovel ready,” the U.S. will be ready to offer jobs to workers stranded by another downturn.

1 See Josh Bivens EPI, “The potential macroeconomic benefits from increasing infrastructure investment”, July 18, 2017.

Written by Joe Maguire. Research contributed by Molly Mintz. Illustrations by Victoria Schumacher.