S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERAs Tropical Storm Nicholas threatened flash-flooding and a storm surge for the Texas Gulf Coast on Sept. 13, Louisiana electric utilities progressed restoring power from Hurricane Ida, but more than 110,000 customers still lacked service as of mid-afternoon.

Power demand in the Electric Reliability Council of Texas was lighter than usual, but power prices on Sept. 13 stronger than any of the past give years on that date.

The National Weather Service in its 1 pm CT Sept. 13 public advisory said the southern and middle Texas coasts faced "flash flooding, dangerous storm surge and gusty winds" from Nicholas, which packed maximum sustained winds of 60 mph.

The storm was forecast to stay just offshore and "could be near hurricane strength when it reaches the northwest Gulf Coast," with tropical-storm-force winds extending as much as 115 miles from the center. The latest forecast shows the storm making landfall before 7 am Sept. 14 between Corpus Christi and Port Lavaca.

Lighter loads, stronger prices

As of about 3:15 pm CT, ERCOT's systemwide power demand had reached 56 GW, and the system was forecast to only reach 57.9 GW for the day, less than the previous five-year average of almost 59 GW on Sept. 13, ERCOT data shows.

However, this year's strong natural gas prices kept real-time and day-ahead on-peak locational marginal prices well above average for Sept. 13.

Colonial Pipeline Restoring Full Operations After Hurricane Nicholas

Colonial Pipeline said it resumed refinery products flows on Line 2 early on Sept. 15, restoring the major fuel artery to normal operations in the aftermath of Hurricane Nicholas' South Texas landfall.

Read the Full ReportFreeport LNG's Three Trains Knocked Offline After Nicholas Makes Landfall in Texas

Freeport LNG was unable to produce LNG on Sept. 14 as all three liquefaction trains were knocked offline likely due to power issues caused by Hurricane Nicholas, a spokesperson said.

Read the Full ReportLess Than 30% of U.S. Gulf Oil Still Offline After Hurricanes Ida, Nicholas

Less than 30% of US Gulf of Mexico crude production remained offline Sept. 15 in the aftermath of hurricanes Ida and Nicholas, although the delayed restoration of onshore facilities continued to slow the return to normalcy in offshore operations.

Read the Full ReportColonial Pipeline Shuts Main Line 1 and 2 on Nicholas-Related Houston Power Outage

Colonial Pipeline has resumed operations on its Line 1 refined products pipeline, while Line 2 remains down because of power outages caused by Hurricane Nicholas, the company said Sept. 14.

READ THE FULL ARTICLEFreeport LNG's Three Trains Knocked Offline After Nicholas Makes Landfall in Texas: Company

Freeport LNG was unable to produce LNG on Sept. 14 as all three liquefaction trains were knocked offline likely due to power issues caused by Hurricane Nicholas, a spokesperson said.

READ THE FULL ARTICLE

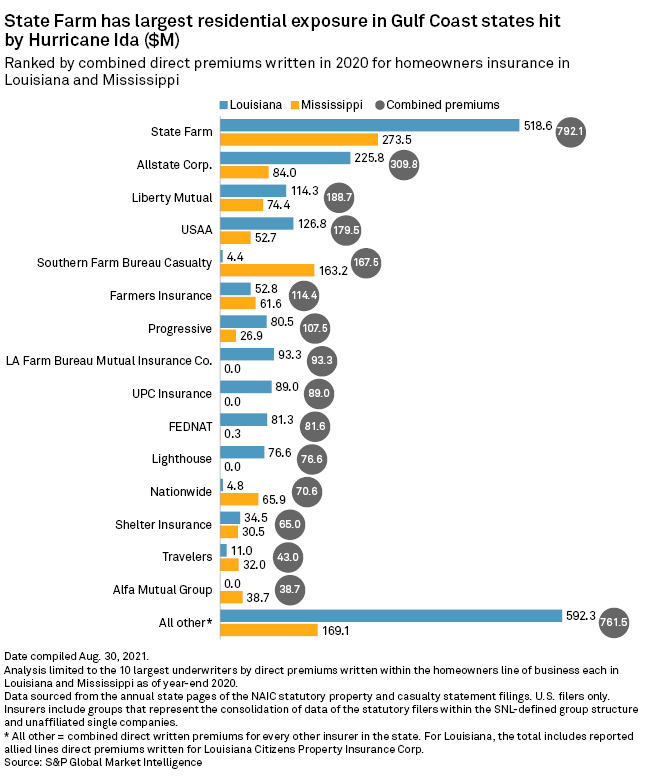

Preliminary loss estimates from Hurricane Ida approach $25 billion, but should remain well below what the U.S. Gulf Coast saw in August 2005 when it was devastated by Hurricane Katrina.

'We've Been Here Before': Entergy Exec Addresses Ida's Destruction

With New Orleans still in the dark more than 24 hours after Hurricane Ida roared ashore, an Entergy Corp. executive said the powerful storm barreled along the company's transmission system with "jaw-dropping wind" pummeling its infrastructure.

"The path of the storm was trailing our transmission system," Rod West, group president of utility operations for Entergy, told S&P Global Market Intelligence. "When you think about the configuration of that spider web of the transmission grid ... it's like the storm hugged it."

P&C Stocks Slide as Ida Barrels Through Gulf Coast, Deluges Northeast

Insurance companies' share prices dipped in the wake of Hurricane Ida and the broader market lost ground after the release of an August jobs report that missed expectations.

The S&P 500 closed the week ending Sept. 3 up 0.58% at 4,535.52, even as the Labor Department said 235,000 jobs were added in August. That was well short of a consensus expected increase of 733,000 and the 1.1 million jobs the economy added in July.

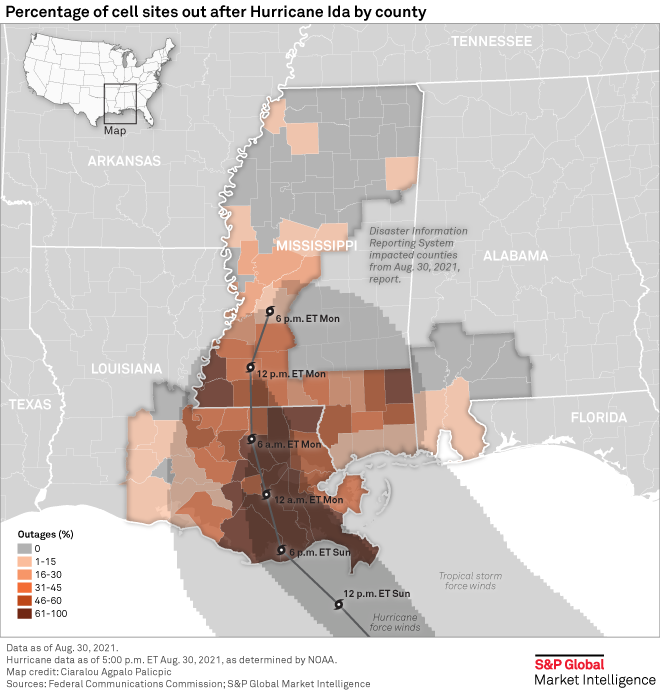

Wireless carriers are busily working to restore cell service in areas hard hit by Hurricane Ida, but power outages and flooding remain a hurdle.

Over 1 million power customers are expected to be without power for weeks. About 12.7% of cell sites in the affected area remain out of service, with the greatest outages in Louisiana, the Federal Communications Commission reported Sept. 1. The figure was down from 17.1% a day earlier and 28.1% on Aug. 30.

In Louisiana, 28.5% of cell sites in the state's impacted areas remain out of service as of Sept. 1, down from 38.1% a day earlier. Counties with more than 50% of cell sites down include Lafourche, Plaquemines, St. Helena, St. James and Terrebonne. On Aug. 31, all of the 81 cell sites in Terrebonne County had been down.

Alabama and Mississippi are experiencing service disruptions of a lesser degree. On Sept. 1, Alabama had 5 cell sites down on its coast, while Mississippi had 31.

AT&T Inc. is the provider for 911 call centers in Louisiana. Emergency services in the state are currently transitioning to AT&T's ESInet Service, which aims to create more reliable, insightful emergency service calls, but outages on the network are making it impossible for many to get ahold of emergency personnel.

The Orleans Parish Communication District notified the public on Aug. 30 that it was experiencing technical difficulties due to outages at AT&T. They told citizens the best way to seek help would be approaching police officers and going directly to fire stations.

According to an Aug. 31 statement from the company, 90% of AT&T Inc.'s Louisiana network was operating normally as of 9 p.m. CT. The previous day, AT&T's Louisiana service was operating at 82% normal.

Power Restoration Slow for Some Louisiana Petrochemical Producers Post-Ida

Louisiana petrochemical producers affected by Hurricane Ida's Aug. 29 landfall furthered their efforts Sept. 9 to begin or continue restarting operations, with some working to secure access to power and feedstocks, market sources said.

Read the Full Article440,000 Louisiana Customers Offline Because of Ida; Real-Time Prices Up on Heat

Almost 440,000 Louisiana electricity customers remained offline as of 2 pm CT Sept. 7, nine days after Hurricane Ida came ashore near Port Fourchon packing 150-mph winds and torrential rains, but the two biggest investor-owned utilities in the area reported good progress on restoring service, despite triple-digit heat indexes.

Read the Full ArticleRemnants of Hurricane Ida Spread Power Market Weakness to U.S. Northeast

The number of electricity customers without service in Pennsylvania, New Jersey and New York due to damage from the remnants of Hurricane Ida totaled 133,242 as of 3 pm ET Sept. 2, according to utility websites.

Read the Full ArticleStill 1 Million in Dark After Ida, Damage Goes Northeast, but Entergy Progresses

More than a million electricity customers were left without power around 1 pm CT Sept. 1 as the remnants of Hurricane Ida continued from its initial landfall in Louisiana into the Northeastern US, but progress was made Louisiana.

Read the Full ArticleClimate-exacerbated disasters cost companies and investors billions. Natural capital costs were 77% higher than net income for major global companies in 2019, and 66% of such companies will have at least one asset under high physical risk in 2050.

ACCESS THE TOPIC PAGEDamage assessments at Louisiana petrochemical facilities affected by Hurricane Ida continued Sept. 2, as most awaited restoration of power.

"Entergy is working their way up the river, and it's slow," a market source said of the region's major power provider's efforts to restore access to electricity in the Category 4 storm's wake.

Some facilities had power, such as Shell Chemicals' Geismar complex and Formosa Plastics USA's operations, 22 miles north in the state capitol of Baton Rouge, but most remained without electricity amid lengthy damage assessments. Some with power still lacked inflows of critical feedstocks, such as industrial gases, as third-party suppliers awaited power restoration.

Westlake Chemical on Sept. 2 declared force majeure on caustic soda throughout the company's system in the storm's aftermath, according to a customer letter seen by S&P Global Platts.

Westlake had already declared force majeure Sept. 1 on downstream vinyl chloride monomer and polyvinyl chloride, also citing impacts from the storm on its two complexes in Geismar and Plaquemine along the Mississippi River, according to a separate customer letter seen by Platts.

Caustic soda, a byproduct of chlorine production, is a key feedstock for alumina and pulp and paper industries. Chlorine is the first link in the production chain for PVC, a construction staple used to make pipes, window frames, vinyl siding and other products. VCM is the immediate precursor to PVC.

Port Fourchon, LOOP Enter Recovery Mode After Sustaining Damages, Timeline Unclear

Port Fourchon and the associated Louisiana Offshore Oil Port entered into a recovery mode Aug. 31 after sustaining damages from Hurricane Ida and a timeline for restoring operations remains unclear, but there is optimism that most of the facilities "stood up well" to the major Category 4 hurricane, said a spokesperson for the Greater Lafourche Port Commission.

Read the Full ArticleOil, Gas Majors Continue Assessing Gulf of Mexico Operations Damage from Hurricane Ida

More oil and gas exploration and production companies late Aug. 30 said they were currently assessing damage from Hurricane Ida's devastating winds and torrential rains, a day after the storm slammed the Louisiana coast.

Read the Full ArticleHelipad Damages Hampering Restoration of Offshore U.S. Gulf Oil and Gas Production

Heliport and marine terminal damages from Hurricane Ida are hampering crew transportation and the aerial assessments of deepwater US Gulf platforms, slowing the process to return the oil and gas production shut ahead of the Category 4 storm's landfall.

Read the Full ArticleU.S. Energy Information Administration raised its spot natural gas price estimates for the rest of 2021, as flat production further hindered by Hurricane Ida combined with lower natural gas injections and robust exports to affect the agency's short-term outlook.

EIA in its September Short-Term Energy Outlook raised its forecast for Q3 Henry Hub natural gas spot prices by 29 cents to $4/MMBtu. The Q4 forecast rose even more sharply, by 54 cents from the previous month's estimates to $4/MMBtu.

"Hurricane Ida affected natural gas production at a time that the United States was already experiencing higher natural gas prices due to growth in exports, strong domestic natural gas consumption, and relatively flat natural gas production," said EIA Acting Administrator Steve Nalley, in a statement accompanying the report. "Lost production from the storm combined with these current market conditions has limited our ability to build up natural gas inventories, and we expect that will keep prices higher in the short term than we had previously thought."

The agency projected Henry Hub prices would average $3.63/MMBtu for full-year 2021 and $3.47/MMBtu in 2022 -- up 21 cents and 39 cents, respectively, from the previous month's estimates.

EIA expects natural gas and crude oil production, as well as refining, will gradually come back online through September, after Hurricane Ida led producers to close more than 90% of capacity in the Gulf of Mexico, it said.

On the NYMEX, Henry Hub futures prices on Sept. 8 jumped more than 30 cents, with the December and January contracts climbing to historic highs at over $5/MMBtu, as the market grows increasingly concerned over the sustained drop in offshore production and persistently low US inventory levels.

In highlighting higher August spot prices, EIA said the rise mostly reflected growth in LNG exports, rising consumption for sectors other than power, and relatively flat production.

"Forecast Henry Hub prices this winter reach a monthly average peak of $4.25/MMBtu in January and generally decline through 2022, averaging $3.47/MMBtu for the year amid rising US natural gas production and slowing growth in LNG exports," the outlook said.

U.S. Oil Inventories Expected Lower Amid Lingering Impact of Hurricane Ida

U.S. oil inventories likely declined in the week ended Sept. 10, analysts surveyed by S&P Global Platts said Sept. 13, amid lingering disruptions to both US Gulf Coast production and refining capacity in the wake of Hurricane Ida.

READ THE FULL ARTICLEHurricane Ida's Pricing Effects Ripple across Texas with 77% of U.S. Gulf Oil, Gas Still Offline

The ongoing crude oil production shortage in the U.S. Gulf of Mexico following Hurricane Ida is now triggering demand increases and price hikes for both domestic light sweet crudes from the Permian Basin and for more imported crude grades.

Read the Full ArticleU.S. Gasoline Stocks Plunge as Refineries Struggle to Ramp Up Post Ida: EIA Data

U.S. gasoline inventories saw their biggest draw since late February in the week ended Sept. 3, U.S. Energy Information Administration data showed Sept. 9, as Hurricane Ida forced the closure of the bulk of Louisiana refinery capacity.

Read the Full ArticleNearly 185,000 b/d of U.S. Gulf Oil Production Returns as Ida Recovery Continues

About 185,000 b/d of U.S. Gulf oil production returned Sept. 10 from a day prior as the recovery from Hurricane Ida began to pick up some momentum, even though nearly two-thirds of Gulf oil volumes and three-quarters of natural gas output remained offline.

Read the Full ArticleLouisiana Petrochemical Producers Beginning Restarts Post-Ida

Louisiana petrochemical producers that shut down ahead of Hurricane Ida's Aug. 29 landfall were increasingly regaining access to electric power and industrial gas feedstocks, allowing restarts to begin.

Read the Full ArticleCompanies and investors are exposed to physical risks at the asset level, including floods, droughts, wildfires, heatwaves, and other extreme weather events. Substantial investments are needed to prepare against the effects of climate change.

ACCESS THE TOPIC PAGEWeekly U.S. coal ship departures plummeted in the week ended Sept. 5 due to Hurricane Ida and its aftermath.

Twenty-nine coal ships carrying nearly 1.48 million dwt of coal departed the U.S., down 42.2% from 2.55 million dwt on 41 ships the previous week, Platts cFlow trade-flow analytics software showed Sept. 7.

The laden and part-laden ships departed the United States' major shipping zones – the Gulf, Atlantic and West Coasts – between Aug. 30 and Sept. 5, according to cFlow data. Gibraltar was set to receive the most U.S. coal shipments, at 2.74 million dwt. Japan followed with 1.32 million dwt, and Turkey was scheduled to receive the third-most US coal shipments.

Gulf Coast

With shipments delayed by Hurricane Ida, coal ship departures from the Gulf Coast dropped 64.7% week on week. Gulf Coast coal ship departures fell to a 10-week low of six carriers. At 119,041 dwt of coal, Turkey was the top destination for U.S. coal shipped from the Gulf Coast. Brazil followed with 63,474 dwt of Gulf Coast-shipped coal destined for its shores. Rounding out the top three was Guatemala, set to receive 37,685 dwt of coal from the U.S. Gulf Coast.

Atlantic Coast

Similarly affected by severe weather, Atlantic Coast coal shipments decreased 30% week on week to 14 ships. Destined to receive 274,385 dwt of U.S. coal, Gibraltar was the top destination for coal shipped from the Atlantic Coast. The United Kingdom followed, set to receive 114,890 dwt of US coal. The country importing the third-largest amount of U.S. Atlantic Coast coal was Sweden, scheduled to receive 84,000 dwt.

West Coast

While fewer coal ships departed from the Gulf and Atlantic regions, week-on-week West Coast coal ship departures increased by 125%. In the week ended Sept. 5, nine coal carriers departed the West Coast, up from four the week before and three in the year-ago week. Set to receive 1.32 million dwt of coal, Japan was the top destination for US coal shipped from the West Coast. Chile followed with 61,338 dwt of coal headed for its shores from the U.S. West Coast. Panama was scheduled to receive 46,500 dwt of US coal shipped from the West Coast.

China Looks to Shift Away from U.S. for Soybean Amid Slow Export Sales After Hurricane Ida

Chinese buyers are looking to shift away from the US to meet their soybean needs following slow US export sales after the Hurricane Ida hit New Orleans- a major grain export hub - late last month

READ THE FULL ARTICLEClean Tanker Freight Hits Year-Lows Amid USGC Diesel Shortage, Refining Shutdowns

Clean tanker owners are opting to sit their ships rather than trade at current spot market levels, with freight having fallen to year-lows in the wake of U.S. Gulf Coast refinery shutdowns after the landfall of Hurricane Ida in Louisiana Aug. 29.

Read the Full ArticleLouisiana Coal Ship Departures Resume After Hurricane Ida: cFlow

After an eight-day hiatus due to Hurricane Ida, coal ship departures from Louisiana resumed in the week starting Sept. 5, data from Platts trade-flow software cFlow showed Sept. 10.

Read the Full ArticleU.S. Export PVC Prices Hit Fresh All-Time High on Ida Fallout

Hurricane Ida's impact on U.S. export polyvinyl chloride prices emerged Sept. 10 with confirmations of deals done for September volumes in a range of $1,900-$1,950/mt FAS Houston, a fresh all-time high since S&P Global Platts began assessing the market in 1983.

Read the Full ArticleHurricane Ida Roils Global Shipping Markets: Sources

Global shipping markets have been roiled by major disruptions after Hurricane Ida made landfall along the U.S. Gulf Coast on Aug. 29, as shipments ranging from LNG and naphtha to grains and gasoil are delayed and refineries shut down temporarily, market participants said Aug. 31.

Read the Full Article