Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

By Roman Kramarchuk, Dan Klein, Bruno Brunetti, Ira Joseph, Mark Mozur, Matthew Williams, Karl Nietvelt, Massimo Schiavo, Pierre Georges, Simon Redmond, Elena Anankina, Aneesh Prabhu, Gloria Lu, Gabe Grosberg, Danny Huang, Thomas Watters, Trevor D'Olier-Lees, Marion Amiot, Shaun Roache, and Beth Ann Bovino

Highlights

Editor's Note: This report on the Energy Transition, by S&P Global Ratings and S&P Global Platts Analytics, is a thought leadership report that neither addresses views about ratings on individual entities nor is a rating action. S&P Global Ratings and S&P Global Platts are separate and independent divisions of S&P Global.

The COVID-19 pandemic has drawn increased attention to climate policy and economic resilience. Europe dedicated €225 billion of its recovery fund to the energy transition. In the U.S., the Democratic Party presidential candidate is targeting a net-zero economy by 2050. President Xi has recently signaled a bold intention for China to become carbon neutral by 2060, but near-term energy intensity could increase with stimulus focused on heavy industry and restrictions on new coal plants relaxed.

According to S&P Global Platts Future Energy Outlooks more than 10 times the emission reductions resulting from COVID-19 will be needed to meet the 2 degree target through 2050. However, the pandemic's effects will cumulatively lower energy sector CO2 combustion emissions by 27.5 gigatons over 2020-2050--equivalent to almost one full-year of emissions. A mosaic of solutions beyond just renewables and fossil fuel demand destruction will be needed. Hydrogen, carbon, capture utilization and storage, and biofuels will all likely play roles in transforming and decarbonizing the interconnected global energy system.

COVID-19 has reduced long-term world oil demand by 2.5 million barrels per day. That decline is, however, not enough to substantively bring forward the year of peak oil demand that S&P Gobal Platts Analytics projects for the late 2030s. Under its sensitivity analysis, oil demand could peak in 2025 if policies and business and consumer behaviors change drastically, including near total adoption of working from home, reshoring of supply chains, widespread electrification of road transportation, and a halving of growth in air traffic.

Lower global energy demand threatens gas more than other fuel sources over the next 10-20 years. That's because as a transition fuel, gas is squeezed between the decline in primary energy demand, the increasing penetration of renewables, and the stickiness of coal demand--particularly in Asia. Still, we do not expect global gas demand to peak over the next 20 years, owing to growing industrial use, led by China, India, and the Middle East.

We believe the global growth outlook for renewables generally remains intact, but not all lights are green. Notwithstanding the increased cost competitiveness of renewables and supportive policies, we also see important headwinds: decreasing subsidies and tax credits, lower power prices, and competing traditional fossil fuels, as well as rising merchant risks and ongoing integration needs with storage.

The COVID-19 pandemic is one of the most severe economic and energy shocks in modern history. On top of the massive disruptions to business, mobility, and everyday life, there clearly will be longer-lasting implications for the energy transition away from fossil fuels. While the shocks from the pandemic are leading to reductions in fossil fuel consumption and emissions, they will not be enough to put the world on a path to meet 2 degree global warming target, nor bring forward peak oil demand, nor drive coal consumption to near zero.

To achieve the targets under the Paris Agreement and limit global climate change, the energy transition will need to include a mosaic of solutions beyond just renewables and fossil fuel demand destruction: Hydrogen, carbon capture utilization and storage, and biofuels are all likely to play roles in decarbonizing the interconnected global energy system. Recent announcements from policymakers, leading energy companies, and end users illustrate the many kinds of climate solutions. While we continue to regularly publish our views and outlooks on all of the key pathways comprising the decarbonization mosaic, this report focuses on the impact of the COVID-19 pandemic on trends in the fossil fuels and renewables sectors.

S&P Global Ratings continues to expect global GDP to contract 3.8% in 2020, according to our latest forecast from June, worse than the 2.4% contraction in our April forecast, mainly due to a deeper, longer hit to emerging markets, led by India. Even if we see a reasonably strong recovery in GDP over 2021-2023, we expect approximately $5 trillion a year of lost economic output compared to our pre-COVID-19 forecast.

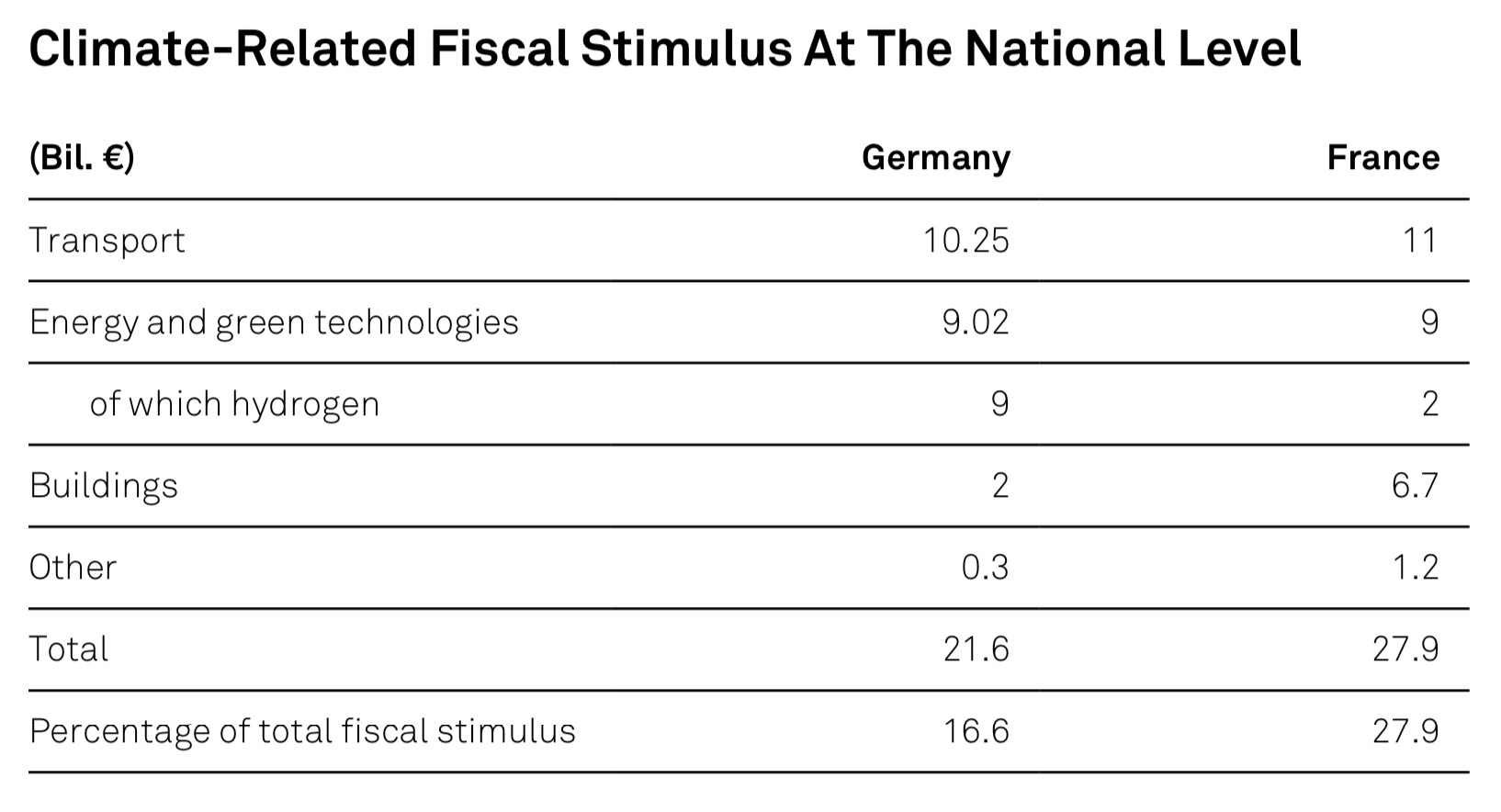

The magnitude and orientation of recovery and stimulus policies will shape GDP growth, but also the relative growth and type of energy consumption. Regionally, there are stark differences in the "greenness" of stimulus packages. The EU is clearly skewing stimulus policies to reinforce its wider commitment to work against climate change. While U.S. stimulus policies have been agnostic about clean energy to date, the U.S. presidential election represents a drastic change in course if former Vice President Joe Biden wins. China's new stimulus package is reliant on debt-financed infrastructure investment, all of which are energy intensive to construct and to operate for decades to come. China also loosened restrictions on new coal-fired power plants, partly due a greater focus on energy security, but this should be seen alongside a recent bold commitment by President Xi for China to become carbon neutral by 2060.

S&P Global Platts Analytics expects global oil demand to decline by 8.7 million b/d (down 8.4%) from the pre-COVID forecast, wiping out six years of growth. Reductions to industry and power generation, particularly in developing nations, are likely to reduce coal demand by the equivalent of 4.4 million b/d of oil (down 5.7%). Natural gas demand, due to its prevalence as a heating fuel, took less of a hit during lockdowns, declining by only 2.1 million b/d (down 3.0%) of oil equivalent from the pre-COVID forecast. Delays in renewables installations (not project cancelations) in key markets are likely to reduce renewable energy production by less than 1.0 million b/d of oil equivalent (down 3.6%) in 2020.

Its growth potential is linked to the growth of overall demand, particularly electricity demand, though limited by demand for coal and renewables. With relatively small reductions to the outlooks for coal and renewables, gas absorbed the brunt of the decline in overall energy demand. To put this another way, the proverbial bridge that natural gas has played in the energy transition has become shorter and narrower. Even so, this does not mean that global gas demand will peak over the next 10-20 years, as growth continues to stem from China, India, and the Middle East. Gas producers are focused on such new markets, with Russia's Gazprom aiming to increase exports to China to 130 billion cubic meters a year. For oil, the greater prevalence of working from home and less business travel, coupled with weaker forecast GDP, has reduced the 2030 outlook for oil demand by 1.9 million b/d (down 1.6%) compared to the pre-COVID forecast. This reduction would have been larger were it not for a downward revision to electric vehicle penetration linked with weaker oil price expectations. While the outlook for coal demand was also reduced, the adjustment was relatively small, at just 0.3 million b/d of oil equivalent (down 0.5%), as the drivers of coal demand remain largely intact--power generation and industry in developing nations, particularly China. It should be noted that S&P Global Platts Analytics projected declining coal demand over the long term even before COVID-19, driven by reductions in the U.S., Europe, and elsewhere in the OECD. For wind and solar, supportive policies and cost reductions will continue despite COVID-19, and the outlook for renewables output was reduced by only 1.2%.

This not only reflects the unprecedented drops in demand and prices caused by lockdowns, but equally the tighter financial headroom many players had going into this crisis, as well as the headwinds the sector has been facing in terms of energy transition uncertainty and declining profitability. The U.S. power and utility sector has been largely resilient, but companies need to adjust strategies. This is because we project gas-fired generation to peak in 2020 in view of the continuous shift to renewables, which could accelerate in case of a Biden win and his plan for a carbon-free power sector in 2035. In Europe, green regulations are unlikely to support gas in the long term, which have started to weigh on the regulatory returns of gas grids in Europe, even if the fuel will remain important over the next decade given coal and nuclear phaseouts, especially in Germany.

The increased cost competitiveness of renewables, the rising system costs as a result of substantial renewable subsidies of the past, and potentially more budgetary constraints caused by the COVID-19 crisis are contributing to decreasing subsidies and tax credits, as seen in Europe and the U.S. In China, renewable projects will even have to compete at grid-parity prices starting in 2021. However, the key to such cost competitiveness is the ability of projects to continue attracting low-cost funding. Investor appetite remains strong but still requires long-term price visibility in terms of power price agreements (PPAs) or fixed-price auctions, both of which are less available. COVID-19 has also triggered a cloudier outlook for long-term power and gas prices. Finally, the increasing role of renewables in the power mix has underscored the risks of curtailments and intermittency, evidenced by recent rolling blackouts in California. At the same time, as more conventional generating capacity is retired, especially in the U.S. and Europe, more batteries will be needed to boost flexibility needs or policies will need to plan for keeping more peaking capacity online. Hydrogen’s potential role as a longer-duration storage and power load management solution can move the renewables and power industry further along in the energy transition.

For investors, we see rising market risks and compressed returns given stiff competition and the phasing out of subsidies in many cases. This, together with the economic uncertainty COVID-19 brings, means that larger energy players, with strong balance sheets and vertical integration--with dispatchable generation and natural hedging through retail--may be better positioned to consolidate the industry. The oil majors could play a role given their size, existing gas and power trading, downstream fuel retail operations, and/or offshore expertise. BP has indicated it expects to employ by 2025 as much as 20% of its capital in transition businesses, including low carbon. Given highly competitive asset prices for renewables and power retail opportunities, we expect the oil majors to face a long and challenging journey along the energy transition.

COVID-19 has altered three fundamentals drivers of emissions: macroeconomics, behaviors, and policy, that combined will lower energy sector CO2 emissions by 27.5 gigatons over 2020-2050. However, this is only a minor step in the direction needed to meet the 2 degree target, which would require more than 10 times that reduction over the period. The emissions reduction achieved in 2020 nevertheless is equivalent to the decline required by 2027 in a 2 degree scenario, illustrating that sizable emissions reductions are possible.

The COVID-19 pandemic has taken a heavy economic toll on the global economy. We forecast global GDP will contract by 3.8% this year, compared with a 0.1% contraction in the 2009 global financial crisis. While all major economies reacted in the short term with large monetary stimulus, not all will accelerate the energy transition as a consequence. In the EU, which targets a net-zero carbon economy by 2050, policy support is significantly pushing renewables’ growth in Europe. The recovery fund approved by the European Commission in July 2020 dedicated €225 billion to the energy transition, to be invested in the next three years. However, China's transition to a low-energy-intensity economy, fueled increasingly by renewables, is likely to stall in 2020 and 2021 as policy stimulus ripples through the economy. In India, while the plunge in activity will reduce energy use, policymakers are unlikely to focus on the energy transition until the economy regains its footing. The U.S. federal government, meanwhile, has not provided any new support for green initiatives in stimulus measures to date beyond the current tax incentives. State mandates and ESG concerns continue to be the main impetus of U.S. installations so far, but the outcome of the November elections will be clearly a pivotal moment for policy decisions on climate change.

COVID-19's impact on the global economy and consumer behaviors has reduced long-term world oil demand by 2.5 million barrels per day, according to S&P Global Platts Analytics. However, some adjustments to the demand outlook were positive as weaker oil prices make electric vehicles less competitive, reduce the drive for efficiency, and stimulate underlying oil consumption.

The weaker oil demand therefore is not meaningful enough to substantively bring forward the timing of the peak in oil demand that S&P Global Platts Analytics projects for the late 2030s. For oil demand to peak by 2025, drastic changes would need to occur to business and consumer behavior, including near full adoption of working from home, reshoring of supply chains, and widespread electrification of road transportation. Together with added COVID-19 concerns regarding ESG risks, weaker forecasts for oil demand are forcing oil companies to reassess investments and policies. The oil majors, which have the size and financial power to do so, might decide to develop renewables that would offer them options for adapting to changing energy scenarios, build different power assets, or gradually consolidate.

Lower global energy demand due to the COVID-19 pandemic threatens the future of gas more than other fuels over the next 10-20 years. Gas will be to some extent squeezed out by lingering coal supply and growing renewables. Still, we do not expect gas demand to peak over the next 10-20 years globally, owing to industrial demand rather than power generation. China, India, and the Middle East will account for 61% of growth over the next decade. Gas demand growth has probably peaked in the U.S. power generation sector, as utilities' strategies shift to renewables and retail integration.

Smaller U.S. independent gas producers face the greatest credit impact, as the pandemic exacerbates preexisting pressure on their profitability, credit metrics, liquidity, and refinancing ability. In Europe, the Green Deal is unlikely to support gas in the long term, even if gas remains an important part of the energy mix owing to the phase-out of coal and nuclear power. Uncertainty about the future role of gas is beginning to weigh on gas utilities' regulatory returns.

COVID-19 has drawn increased attention to climate policy in Europe and is playing a role in the U.S. elections. We believe the global growth outlook for renewables generally remains intact, even if stimulus plans will likely prioritize employment and direct support measures to the economy over green growth--especially in China and emerging markets. Key risks for the sector are reductions in direct subsidies and tax credits as observed in China, Europe, and the U.S.; permitting; and a cloudier outlook for long-term prices. On the other hand, continued strong investor appetite and declining costs are allowing renewables to compete increasingly at grid-parity prices, but with lower returns and rising market risks. As a result, larger renewables players, with strong balance sheets and vertical integration to mitigate merchant risks, may be better positioned and could move to consolidate the industry.

©2020 by S&P Global Platts, a division of S&P Global Inc. All rights reserved.

The names “S&P Global Platts” and “Platts” and the S&P Global Platts logo are trademarks of S&P Global Inc. Permission for any commercial use of the S&P Global Platts logo must be granted in writing by S&P Global Inc.

You may view or otherwise use the information, prices, indices, assessments and other related information, graphs, tables and images (“Data”) in this publication only for your personal use or, if you or your company has a license for the Data from S&P Global Platts and you are an authorized user, for your company’s internal business use only. You may not publish, reproduce, extract, distribute, retransmit, resell, create any derivative work from and/or otherwise provide access to the Data or any portion thereof to any person (either within or outside your company, including as part of or via any internal electronic system or intranet), firm or entity, including any subsidiary, parent, or other entity that is affiliated with your company, without S&P Global Platts’ prior written consent or as otherwise authorized under license from S&P Global Platts. Any use or distribution of the Data beyond the express uses authorized in this paragraph above is subject to the payment of additional fees to S&P Global Platts.

S&P Global Platts, its affiliates and all of their third-party licensors disclaim any and all warranties, express or implied, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use as to the Data, or the results obtained by its use or as to the performance thereof. Data in this publication includes independent and verifiable data collected from actual market participants. Any user of the Data should not rely on any information and/or assessment contained therein in making any investment, trading, risk management or other decision. S&P Global Platts, its affiliates and their third-party licensors do not guarantee the adequacy, accuracy, timeliness and/or completeness of the Data or any component thereof or any communications (whether written, oral, electronic or in other format), and shall not be subject to any damages or liability, including but not limited to any indirect, special, incidental, punitive or consequential damages (including but not limited to, loss of profits, trading losses and loss of goodwill).

Permission is granted for those registered with the Copyright Clearance Center (CCC) to copy material herein for internal reference or personal use only, provided that appropriate payment is made to the CCC, 222 Rosewood Drive, Danvers, MA 01923, phone (978) 750-8400. Reproduction in any other form, or for any other purpose, is forbidden without the express prior permission of S&P Global Inc. For article reprints contact: The YGS Group, phone +1-717-505-9701 x105 (800-501-9571 from the U.S.).

For all other queries or requests pursuant to this notice, please contact S&P Global Inc. via email at support@platts.com.

Content Type

Location

Language