S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

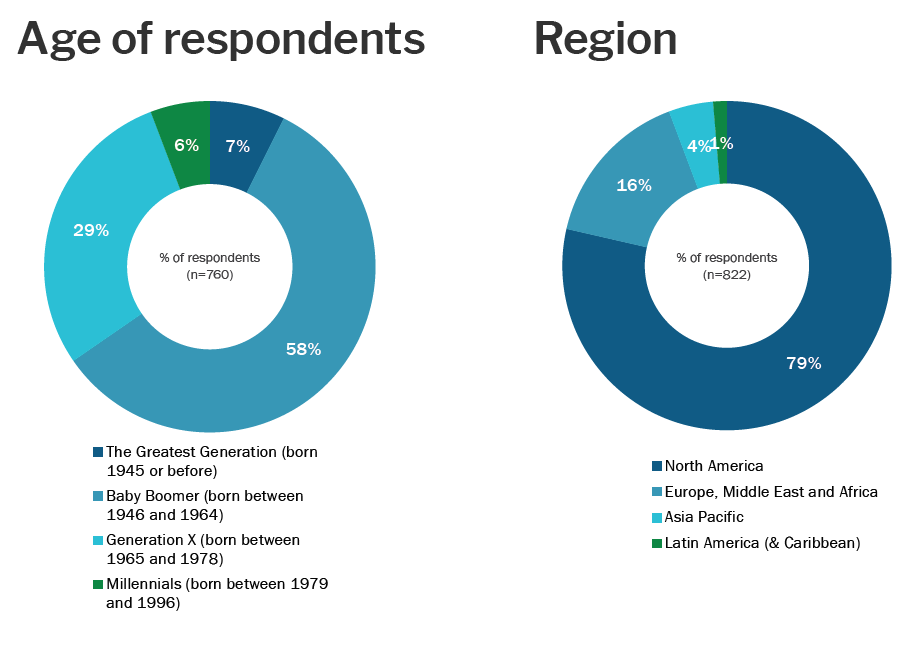

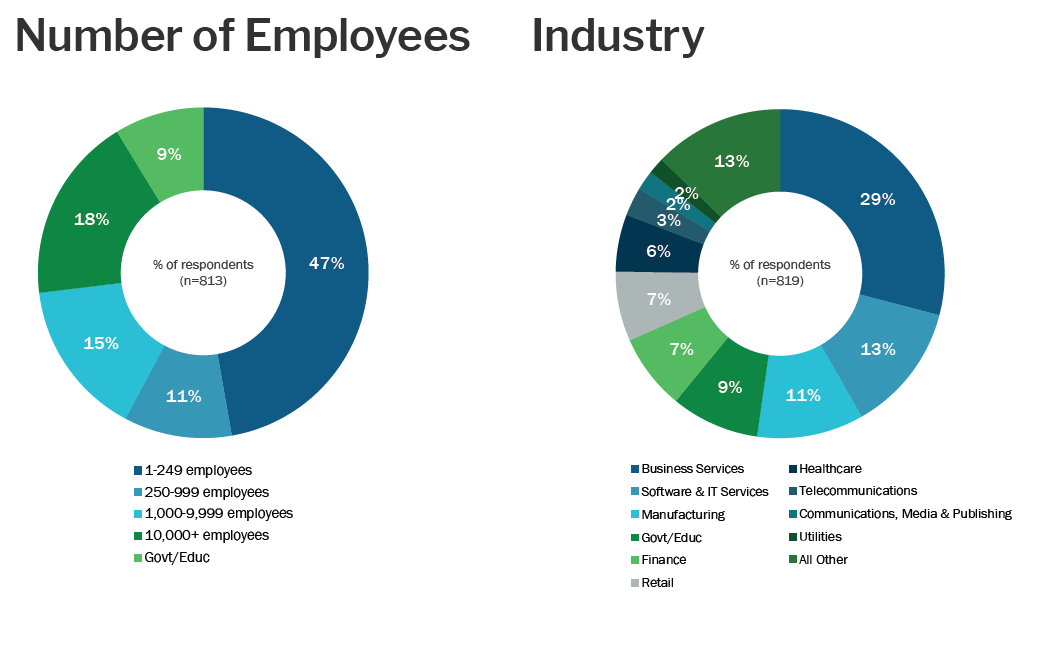

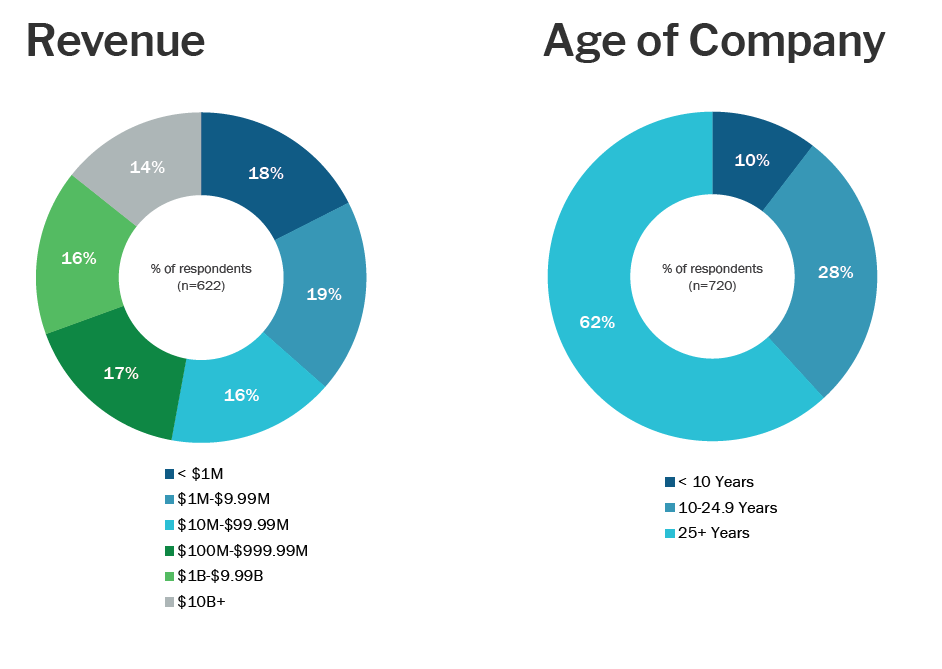

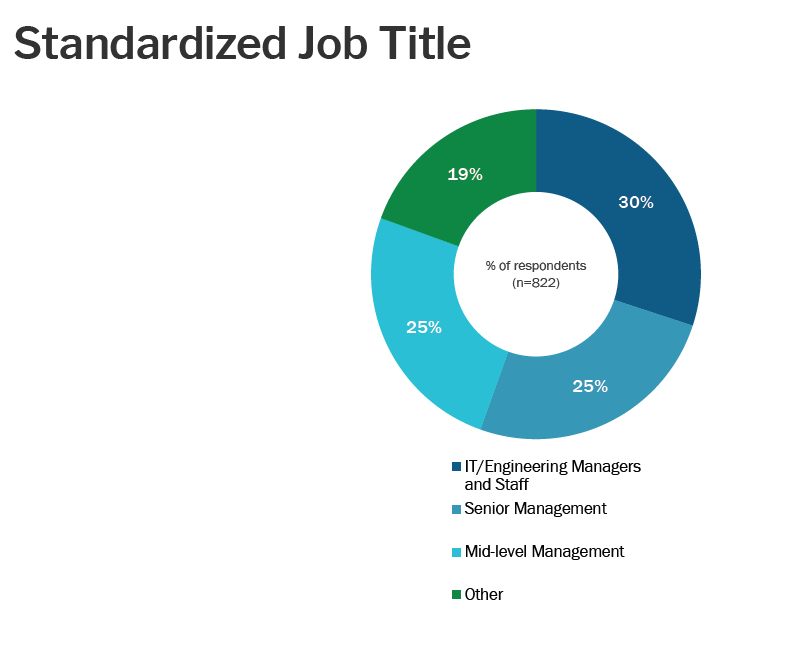

The Voice of the Enterprise: Digital Pulse, Coronavirus Flash survey wave was conducted in March 2020. The survey represents approximately 820 completed interviews and 15 hour-long interviews from pre-qualified IT decision-makers. This survey focuses on the impacts to businesses of the global COVID-19 coronavirus outbreak.

Published: March 2, 2020

By Liam Eagle

Highlights

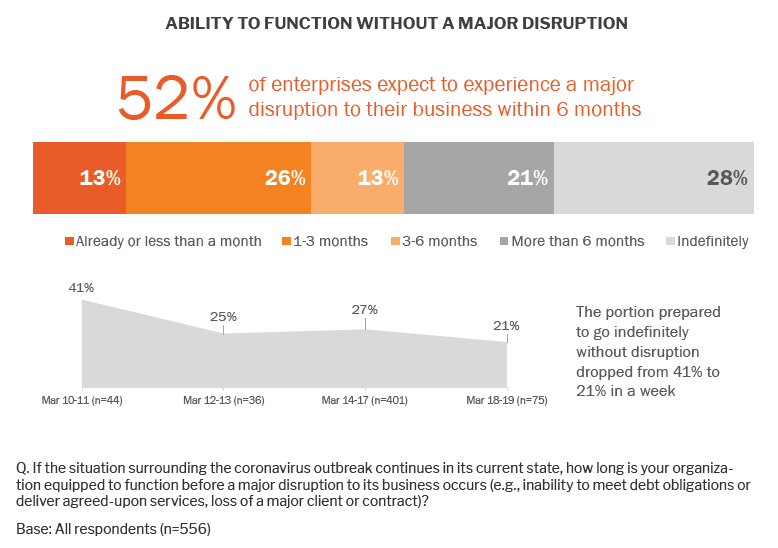

Enterprises expect major business disruption. More than half (52%) of respondents say a continuation of the current situation would create a major disruption in their business within the next six months. Thirteen percent say they have already experienced one or expect to within the month.

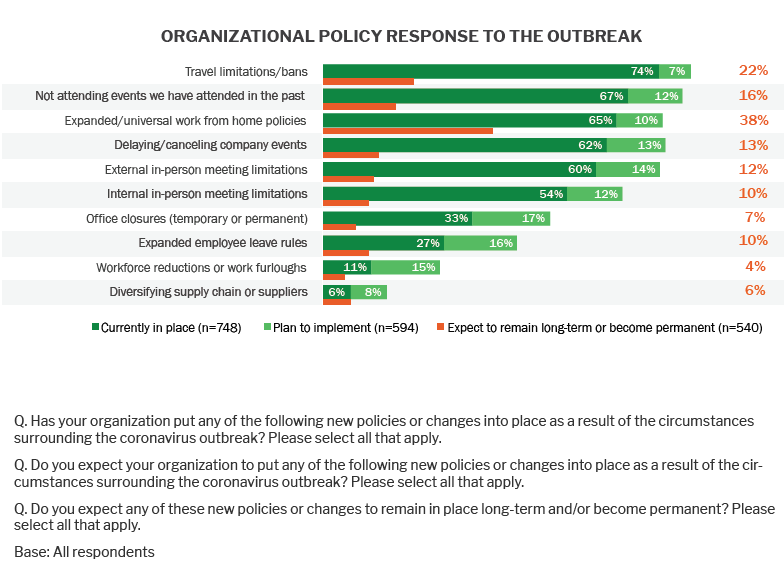

The impact includes both standard and strategic operations. More than three-quarters of businesses are implementing policies including travel bans (81%) and expanded work-fromhome policies (75%). Significant portions are also delaying or canceling strategic efforts such as hiring (34%) and product/service rollout (22%).

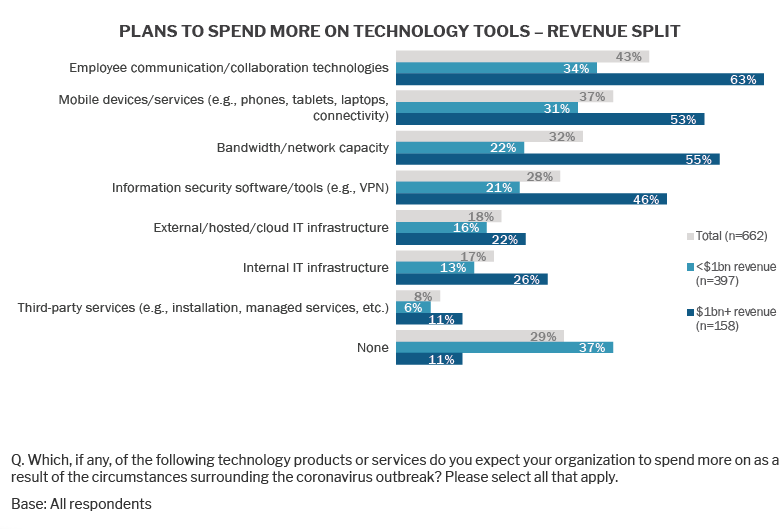

Companies are spending more on key supporting technologies. Many businesses expect to spend more on employee communication and collaboration (43%), mobile devices and services (37%), bandwidth and network capacity (32%), and information security (28%) among other things.

A permanent influence on modes of working is likely. Significant portions of respondents expect policies implemented in response to the coronavirus outbreak to be permanent. These include work-from-home policies (38%), travel limitations (23%) and reduced event attendance (16%).

Many enterprises believe the outbreak could lead to a major disruption of their business, meaning inability to repay debt or deliver services, or the loss of a major client. More than half of enterprises expect a disruption of this magnitude in the next six months, and confidence in their ability to persist withoutone is decreasing with time. Strategies for avoiding or weathering this disruption may include changes to how IT is consumed or executed.

Major disruption is already taking place. About 13% of respondents are already experiencing such a disruption or expect one within the month. That number increases to 39% within three months and 52% within six months.

Confidence in insulation against disruption is waning. Overall, 28% of respondents feel their organizations could operate indefinitely without a major disruption. However, this number decreased significantly while the survey was in field, from 40% among the earliest respondents to 21% just a week later.

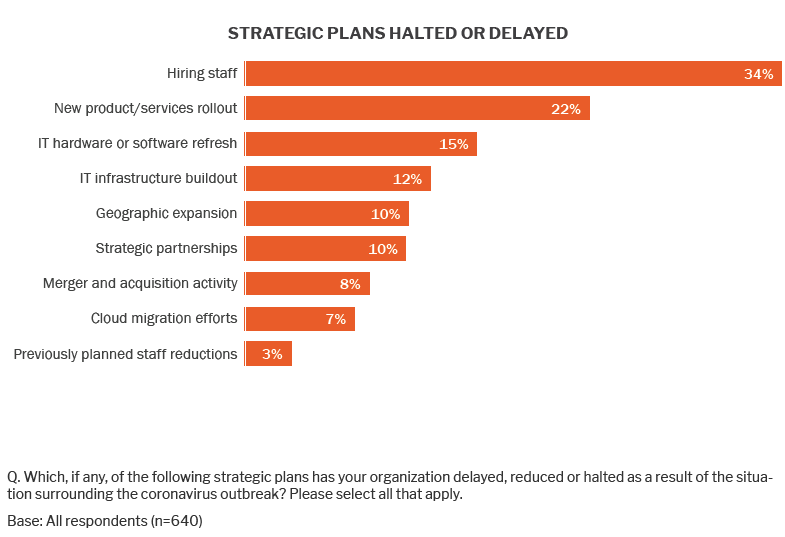

Enterprises say they have already halted or delayed major strategic undertakings as a result of the outbreak, with the most significant impacts extending to recruitment and product launches.

New hiring delayed. The strategic plan most commonly being put on hold by enterprises is the hiring of new staff (34%).This is broadly the top response across almost all respondent categories. It will likely become clearer over the longer term (including to the organizations themselves) whether these are temporary delays or longer-term hiring freezes.

Holding off on launching products. The other most commonly delayed strategic move is new product or service rollout (22%), a decision that aligns with widely seen reductions in customer demand. This saw variation across vertical markets, with service delays being fairly common among government and education organizations (30%) and less so among financial services (12%), for example

Enterprise response to the coronavirus outbreak in the form of new policies is broad and, in the case of some policies, nearly universal. For some of these new policies, significant portions of organizations responding to the survey suggest they are likely to remain long-term or permanently.

A widespread policy response. Close to three-quarters of organizations surveyed have either already implemented or plan to implement policies such as limitations or bans on in-person meetings, both internal (66%) and external (74%), along with delaying and canceling events (75%), expanding work from home policies (75%), not attending events they have previously attended (79%) and enacting travel bans (81%).

Most of these policies are being even more widely implemented in EMEA, where, for instance, 86% of organizations surveyed have already implemented travel bans, compared to 71% in North America.

Sticking with what works. Significant proportions of enterprises expect some of these new policies to become more permanent organizational policies – especially expanded remoteworking policies (38%), limits on employee travel (22%), and not attending events they previously might have (16%).

As enterprises more formally institute remote working policies and setups, they expect to spend more on the technologies to support these systems in the future, including communications tools, bandwidth and information security resources. The anticipation of these increased investments is much stronger among larger organizations.

Acquiring the right tools for remote work. The technologies topping the list for expected spending increases include employee communication and collaboration tools (43%), mobile devices and services (37%), bandwidth and network capacity (32%) and information security (28%). All of these relate directly to the remote working use case, which is clearly an immediate and growing IT priority.

Larger enterprises have a large task ahead. With greater workforces come more complex communication and collaboration challenges – a gap reflected in the significantly greater extent to which large organizations (more than $1bn in revenue) expect spending increases compared to smaller ones (less than $1bn in revenue). The larger firms much more commonly expect increased spending on communication and collaboration (63% vs 34%), mobile devices (53% vs 31%), bandwidth (55% vs 22%) and information security (46% vs 21%).

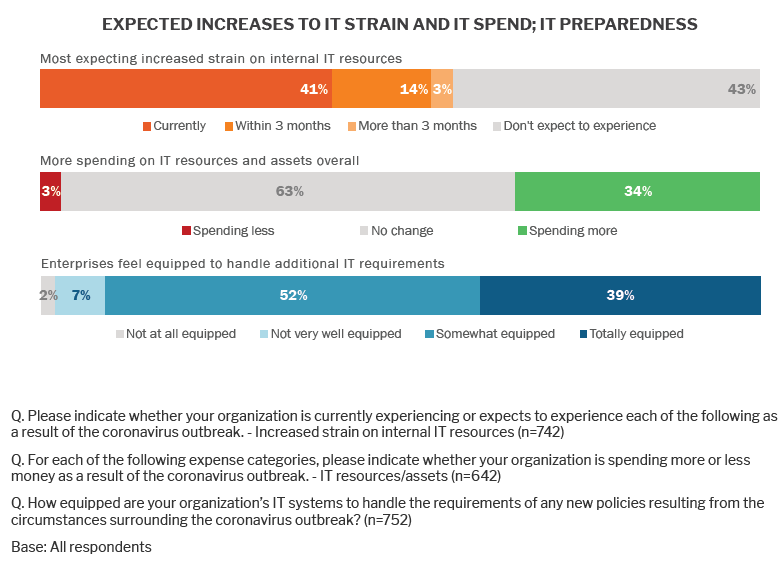

The new realities of remote working are already driving both increased strain on IT resources as well as increased spending on IT assets and resources at enterprises, a trend that is likely to continue. However, a strong majority of organizations believe their IT systems are equipped to handle the additional demand created by new working policies and practices.

Most enterprises expect increased strain on resources. Among enterprises surveyed, 41% are already experiencing increased strain on internal IT resources, and another 14% expect to begin experiencing it within the next three months, with another 3% beyond three months. Additionally, 34% of enterprises say they are spending more on IT resources and assets (51% of companies with more than $1bn in revenue).

IT systems are up to the task. Despite the growing demand, most enterprises believe their systems are prepared, with 91% of respondents indicating their IT systems are either somewhat or totally equipped to handle the requirements of new policies resulting from the outbreak.

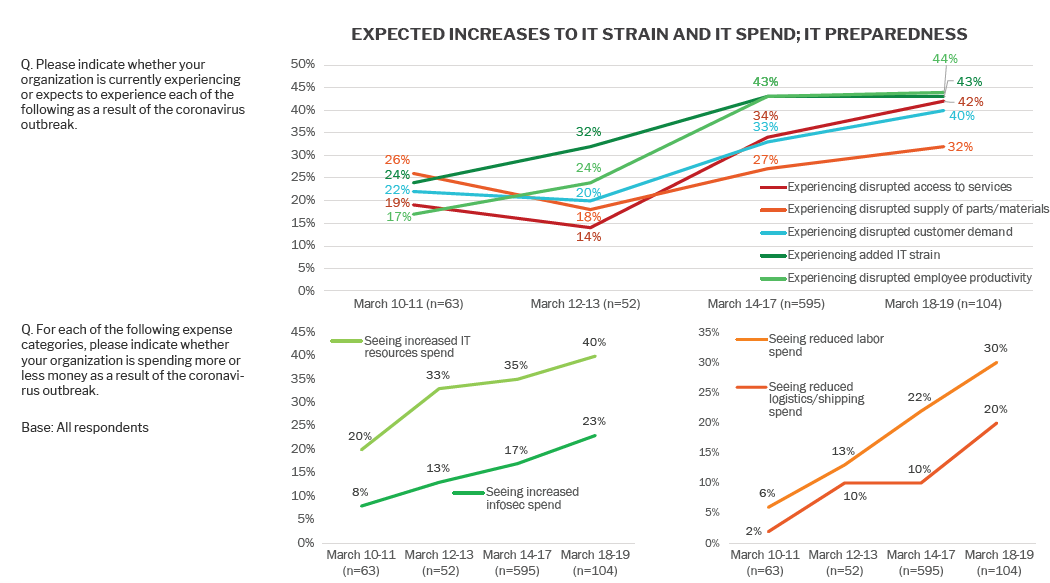

Appreciating the rapidly evolving context in which this survey was conducted is key to understanding (and extrapolating from) the results. The situationsurrounding the COVID-19 outbreak escalated globally while this survey was in field, and we saw responses shift significantly between the earliest group to complete it (March 10-11) and the last (March 18-19). We expect these trends to continue beyond the timing of the survey, and attitudes expressed by respondents may have already changed.

Tracking the impact. Between the earliest group of respondents and the latest, the portion experiencing increased strain on IT roughly doubled (24% to 43%), as did the groups seeing lost customer demand (22% to 40%), reduction in employee productivity (17% to 44%), and reduced access to services (19% to 42%). We also saw a slightly smaller increase in the portion experiencing reduced supply of parts and materials (26% to 32%).

Spending impact realized quickly. Time also had a big effect on those spending more on IT resources (20% to 40%) and information security (8% to 23%), as well as those spending less on labor (overtime, contractors) (6% to 30%) and on logistics and shipping (2% to 20%).

Service providers must help businesses stay operational. Technology will play a critical role in the continued operation of many businesses with the demands of drastically changing working conditions. But businesses are currently more focused on adapting to immediate needs, and big-picture strategic moves are likely to be on hold. However, the demand for specific workforce technologies and the resources to operate them effectively is immediate.

Adapt to major impacts on purchasing and procurement processes. Although the effects have already been dramatic, early surveying captured attitudes at the early stages of a rapidly escalating situation. Enterprises are just beginning to appreciate the likely impacts on supply chain, access to capital and other influences on their approach to consuming technology.

Prepare for the new normal. When enterprise attention returns from the immediate or nearterm demands of the COVID-19 outbreak, it is unlikely to be business as usual. Service providers should prepare to operate in a world that may have dramatically different attitudes about remote working, business travel, live conferences and other likely casualties of the outbreak.

451 Research runs a panel of highly accredited senior IT executives. Members of this proprietary panel, which consists of IT decision-makers, participate in surveys focused on enterprise IT trends.

The Voice of the Enterprise: Digital Pulse, Coronavirus Flash Survey wave was conducted in March 2020. The survey represents approximately 820 completed interviews and 15 hour-long interviews from pre-qualified IT decision-makers. This survey focuses on the impacts to businesses of the global COVID-19 coronavirus outbreak.