Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Published: January 5, 2021

By Panjiva

Highlights

This report is reprinted from Panjiva, part of S&P Global Market Intelligence. Download this report here.

The U.K. left the European Union on Jan. 31, 2020 and entered a set of transitional arrangements for trade and customs that applied through Dec. 31, 2020. On Dec. 24 the two sides signed a provisional “ EU-U.K. Trade and Cooperation Agreement Agreement” (TCA) that will provide a framework for relations going forward.

We have written extensively extensively about the United Kingdom’s exit from the European Union over the past four years. This report provides a brief overview of the newly signed trade deal, the issues to watch in 2021 with potential outcomes and data points to watch.

Tariff free, but not free from frictions and uncertainties

The issue: From a supply chain perspective the important elements of the deal are rules on trade in goods, road transport, customs and dispute settlement systems. In broad terms the TCA will result in zero tariffs and quotas.

There will, however, be myriad customs formalities, rules of origin certifications and regulatory checks that are not currently in place. Mutual recognition of standards is not included in the deal though in many cases there is a recognition of the primacy of certain international bodies as well as the future development of “mutual recognition of conformity assessments” which may simplify matters in the future.

Additionally, in the very near term, there’s little time to approve the deal. The Commission will look for provisional application through Feb. 28, 2021. That will need approval from all 27 member states’ representatives by Jan. 1, 2021 to apply provisionally, after which the European Parliament can then vote on the deal in time for Feb. 28.

Likely outcome: While the timetable for approval is abbreviated the TCA should not need national parliamentary ascent as “it covers only areas under Union competence” which should shorten the time needed to ratify the deal, though legal challenges can be expected. The frictional costs of customs inspections will rapidly increase, even allowing for “authorised economic operator” (or trusted trader) schemes, with likely noticeable impacts on supply chains in the short term (see below).

Data points to note: U.K. exports to the EU had proven sickly even before the downgraded trade relations between the two countries took effect. As discussed below specific industries will face significantly different impacts over time. Industries with long supply chains, just in time inventory management and signiffcant regulations including aerospace, autos, chemicals and pharmaceuticals among others will face the most disruption.

This report considers a handful of key sectors while our future research will widen our assessments. Panjiva’s data shows that U.K. exports of key products to the EU already declined by 13.2% year over year in Q3’20 after declining sequentially since Q2’19. There’s been a significant drag from industrial products including aerospace, which dropped by 38.8%, and autos (with vehicles down by 27.2% and parts by 12.1%) as a consequence of the COVID-19 pandemic.

Customs systems in Q1’20 face outbound more than inbound issues

The issue: The EU is clear that the deal “will create barriers to trade in goods and services” and as such customs controls required under the European Union Customs Code will be applied. The latter typically requires 4% of shipments from the U.K. into the EU to be subject to inspection though there is a trusted trader status available. Importantly, the Northern Ireland Protocol means that shipments between Northern Ireland and Great Britain will be counted as imports / exports rather than internal trade.

Likely outcome: The late December customs disruptions caused by the variant COVID-19 and subsequent closure of the border, discussed in Panjiva’s research of Dec. 21, provided a high speed example of the potential disruptions that could occur in Q1 as systems bed down. There is room “for further developing customs cooperation in the future” so processes may become simpler and disruptions fewer in the future. The U.K. may apply soer import restrictions to ensure the steady flow of goods in the meantime given it is, broadly speaking, more exposed to the EU than vice versa as an importer of critical goods (see more below on food and medicines).

Data points to note: Some care will be needed with year-over-year comparisons of trade data as the two previous hard-Brexit scares led to inflated trade in early 2018 and late 2019. Additionally, the U.K. and EU publish their international trade data around six weeks (U.K.) to seven weeks (EU) in arrears and in inconsistent metrics both in terms of currency and product ontologies at the headline.

Panjiva’s analysis of official data shows U.K. imports from the EU dropped by 13.5% year over year in October. That doesn’t just reflect the comparator basis of “hard Brexit panic” though given it extended 11 straight months of lower shipments and left shipments 9.0% lower than the same level in 2018. Similarly, exports from the U.K. to the EU dropped by 12.5% after falling steadily since November 2019.

Long haul logistics due an overhaul

The issue: Short haul trucking new restrictions for hauliers only single drop / pick up in europe so limits cabotage. Existing logistics at the Hutchison Ports’ Felixstowe facility had already led the global containerlines MSC and Maersk to review their service offerings to and from the U.K. Risk to U.K. as a global hub may be reduced by licensing allowing drivers to cross several countries so Irish lorries can use U.K. land route to EU and overseas.

Likely outcome: Global shipping rates the U.K. have already accelerated past those for shipping to the EU as a consequence of additional surcharges. That spread, alongside the rates for shipping speciffcally to and from the EU will also provide a benchmark for the health of the U.K. trade economy. Regional shipping firms such as DFDS and global container lines will likely continually review their offerings and routings. Rates will therefore likely prove volatile through much of the year.

Data points to note: S&P Global Platts data shows that rates for shipping from North Asia to the U.K. reached $8,000 per FEU in late December, up from $1,600 per FEU at the start of the year and $1,700 per FEU as recently as the end of September. The dislocation in the market can be seen in backhaul rates on the same route of $1,900 per FEU in late December while inbound shipping rates from the U.S. East Coast was just $300 per FEU.

Chemicals face a bit of a REACH

The issue: As already noted, industries with significant regulatory issues face potential disruptions under the TCA versus the U.K. membership of the EU. It’s not yet clear how aligned the U.K.’s regulatory regime for chemicals will be with the EU’s REACH (registration, evaluation and authorization of chemicals) which covers around 22,000 materials. Thus far there’s only a commitment to reach a new set of agreements rather than actual agreements on alignment.

Likely outcome: Continued uncertainty for chemicals regulations will touch on most cross-border industrial supply chains. A worst-case scenario would be the ongoing requirement for dual systems of regulation. The Chemical Industries Association has previously stated costs could reach “hundreds of millions of pounds for a UK REACH alternative” for major exporters including Croda, Ineos and Johnson Mathey

Data points to note: The mix and change in exports of various chemicals groups should provide an indication of the level of disruptions caused by regulatory uncertainty. Panjiva’s analysis of offcial data shows that the EU accounted for 51.5% of U.K. exports of chemicals (excluding pharmaceuticals) in the 12 months to Oct. 31 with growth of 2.8% year over year in the past three months. The recent expansion has included a 24.8% increase in shipments of organic chemicals and a 28.3% surge in fertilizers while shipments of plastics have been in decline. Processed fertilizers are the most exposed to the EU with 62.4% of U.K. exports heading to the EU in the past 12 months, followed by non-primary plastics with 62.2% of shipments. Among the major categories shown by U.K. macro data the least exposed to the EU was organic chemicals at 45.9% of the total.

Autos may prove to be the U.K.-in-a-nutshell

The issue: The absence of tariffs and quotas should maintain the overall competitiveness of U.K. automotive manufacturing. Yet, the rules of origin set in the agreement may lead to changes in supply chains on the margin. The local value threshold for internal-combustion engine vehicles has been set at 55% for tariff-free access while for electric vehicles and hybrids that falls to 40%. For batteries the initial limit is set at just 30%, though that rises to 50% from 2024. Regulatory convergence using the UN’s Economic Commission for Europe technical standards will be applied while there is also provision for closer cooperation on ensuring continued harmonization on standards going forward.

Likely outcome: Global automakers have significant localization versus globalization decisions to make in terms of manufacturing vehicles for the U.K. and EU markets. The use of manufacturing in the U.K. as a route into the EU may be in question with a vehicle-by-vehicle review needed to decide upon the viability of specic models. Honda has already faced manufacturing disruptions due to customs and logistics disturbances while Nissan has decided not to produce the Ariya electric vehicle in the U.K.

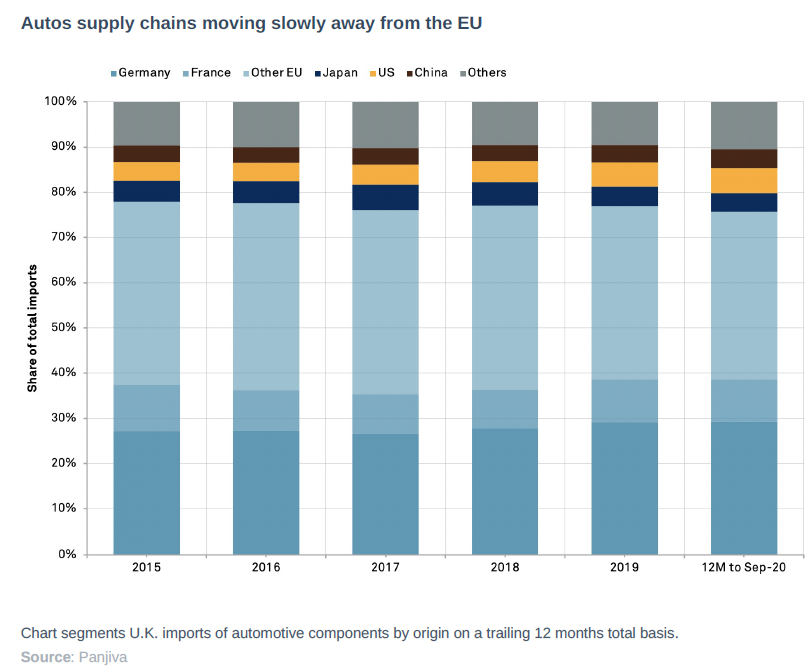

Data points to note: The mix of U.K. auto-parts imports from the EU versus overseas will provide a sign as to whether supply chains are being altered during the post Brexit period. Panjiva’s data shows that the EU accounted for 75.7% of U.K. imports of automotive components in the 12 months to Sept. 30. That compares to 77.9% in 2015 with imports from the U.S. (5.5% from 4.2%) and China (4.2% from 3.7%) having made up the difference. An added complication will come from other U.K. trade deals as they are signed outside the existing continuity agreement with Japan (4.1% compared to 4.7%).

Medical supplies in a world of nationalism

The issue: The medical supplies industry continues to be tested by the ongoing COVID-19 pandemic with the vaccine roll-out likely to take at least a year to be completed. Over the longer-term the TCA allows for manufacturing site inspections to be valid for sales of drugs in both regions, though there does not appear to be a recognition of testing of batches of drugs – particularly new products – for safety purposes. At the ingredients level there may also be complications resulting from chemicals sector regulations as noted above.

Likely outcome: The regulatory uncertainties can be offset by dual-regime testing though the increased costs on top of additional customs frictions may lead to increased costs for consumers but shouldn’t necessarily lead to supply chain disruptions. One risk may come in the first quarter from the more generalized slowdown in supply chain operations caused by new customs inspections though more conservative inventory strategies from importers including Walgreens Boots in Q4 may offset that.

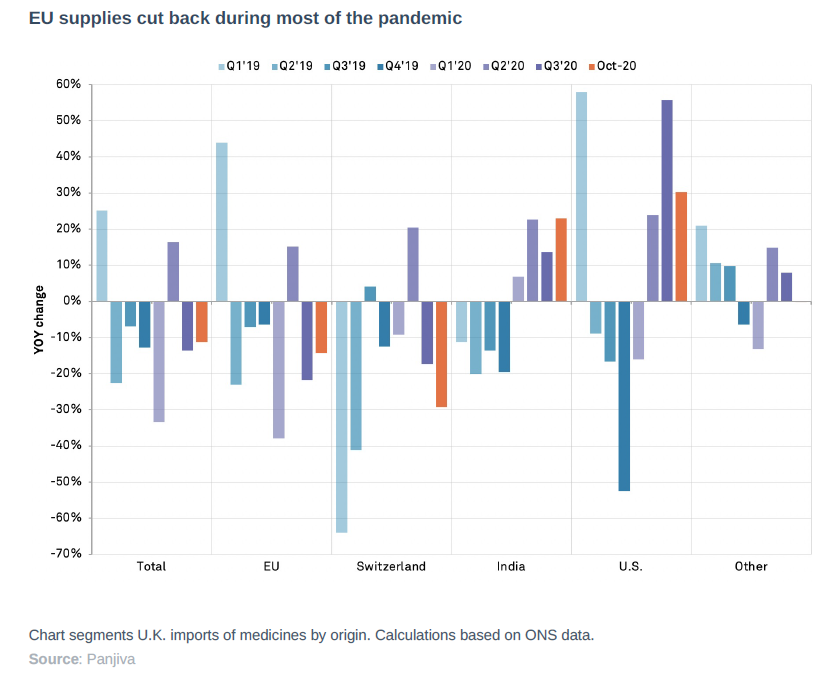

Data points to note:The U.K. is highly dependent on the EU for supplies of medicines, with 77.0% of total U.S. imports coming from the EU in the 12 months to Oct. 31 while a further 6.2% came from Switzerland. Despite the pandemic there’s been a 19.2% year over year drop in imports of pharmaceuticals from the EU, partly reflecting earlier medical protectionism by EU member states. Shipments from Switzerland also fell by 6.3% while, by contrast, imports from the U.S. and India which represent biotech and generics respectively both improved markedly.

Food finds a degree of relief, fish take the fall

The issue: While there’s an absence of tariffs and quotas there will be a potential issue with increased frictional costs for customs measures given the fragmented nature of the food production in industry. Additionally the perishable nature of products means getting paperwork right the first time will be vital. The wine industry will be allowed self-certification on conformity and quality which may reduce costs. The EU has committed to applying a full range of checks on food and agricultural products imported from the U.K.

Likely outcome: U.K. exports should remain competitive, customs costs aside, while import costs should be kept down. Indeed, Tesco’s Chairman, John Allan has stated that additional import costs will “hardly be felt in terms of the prices that consumers are paying“. Ironically given the centrality of fish to the latter stages of negotiations, the TCA only transfers 25% of EU fishing rights in U.K. waters to U.K. fishermen over 66 months.

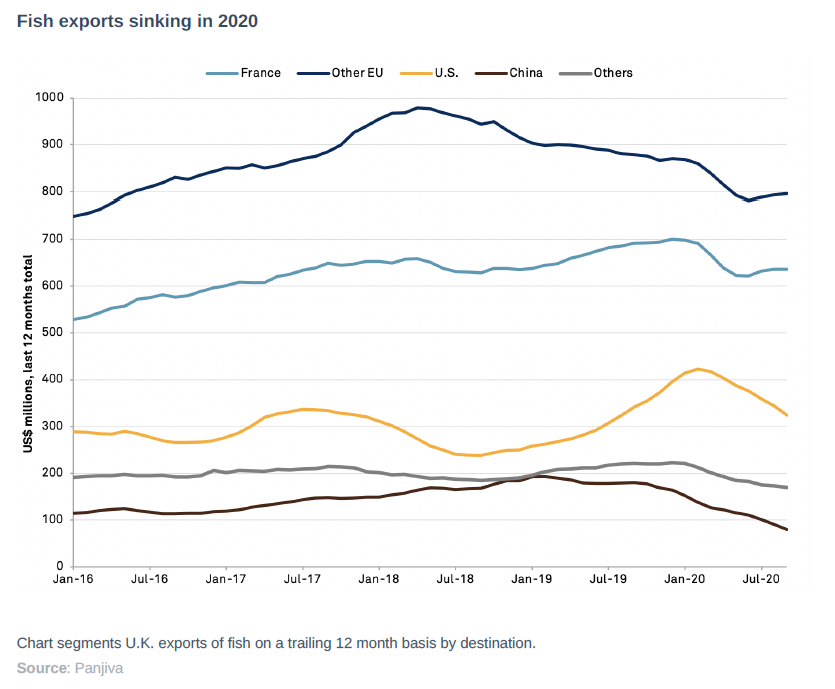

Data points to note: U.K. fish exports should inch up modestly as the share of the local waters catch accruing to U.K. fishermen improves. The industry has become more reliant on the EU as an export market in the past 12 months with the EU accounting for 71.4% of shipments compared to 68.7% in 2015. The share of exports to the U.S. has improved to 16.2% from 15.5% while shipments to the rest of the world, particularly to China, have declined. The sector has nonetheless been in decline with exports having declined by 13.3% year over year in dollar terms.

Ongoing dealings between the U.K. and EU leave significant tariff uncertainty

The issue: The 1,246 page Agreement is only the start of an ongoing evolution of relations between the EU and U.K. There will be a Partnership Council to assess progress on delivery of the deal. Complaints linked to implementation of the provisions of the so-called level playing field will be handled via domestic courts with provisions for legally binding arbitration, including the potential for cross-sector retaliation. Cooperation on industry-specific regulatory issues and standards will continue to evolve.

Likely outcome: Supply chain planning will remain extremely diffcult. The use of tariffs in the context of cross-sector retaliation linked to state aid brings the kinds of risks seen for U.S. supply chains during the trade war with China, albeit on a smaller scale. The “rebalancing mechanism” included in the TCA’s rules is arguably a harsher system than that present in other EU trade deals and can result in the overall agreement being reviewed. If the time comes to apply tariffs it’s likely that there will be a targeting of politically important sectors and products within supply chains that can cause maximum disruptions. The EU’s behavior vis-a-vis the U.S. in their ongoing aerospace disputes is instructive here.

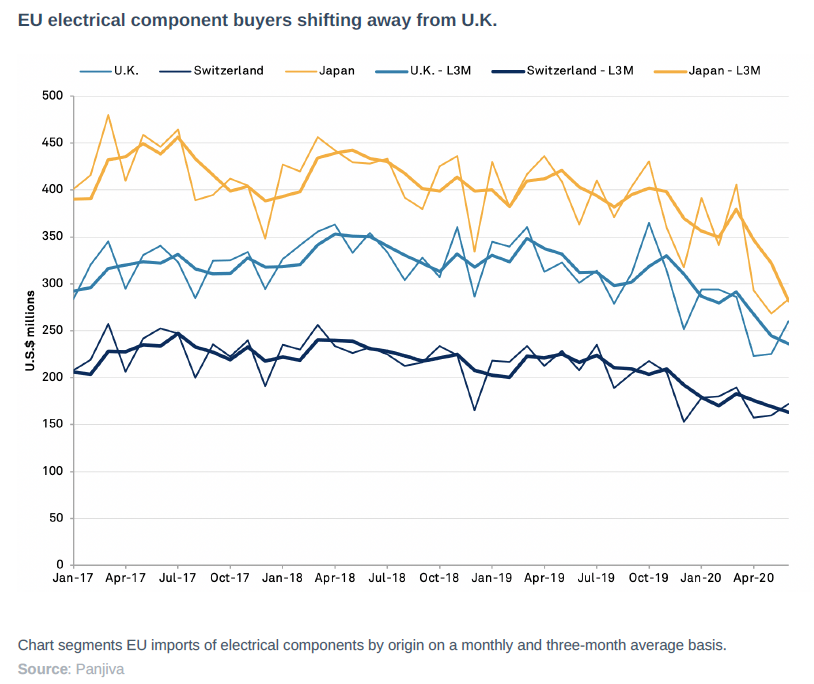

Data points to note: The new arrangements may leave enough uncertainties that EU importers of industrial components may seek to further reduce their exposure to imports from the U.K. in favor of other countries. Panjiva’s data shows that the share of EU electrical component imports from the U.K. has already declined to 6.1% of the total in the 12 months to June 2020 compared to 7.4% in 2015 while the share of imports from China has climbed to 42.6% from 38.5% at the expense of the U.K. as well as other major suppliers in Switzerland and Japan.

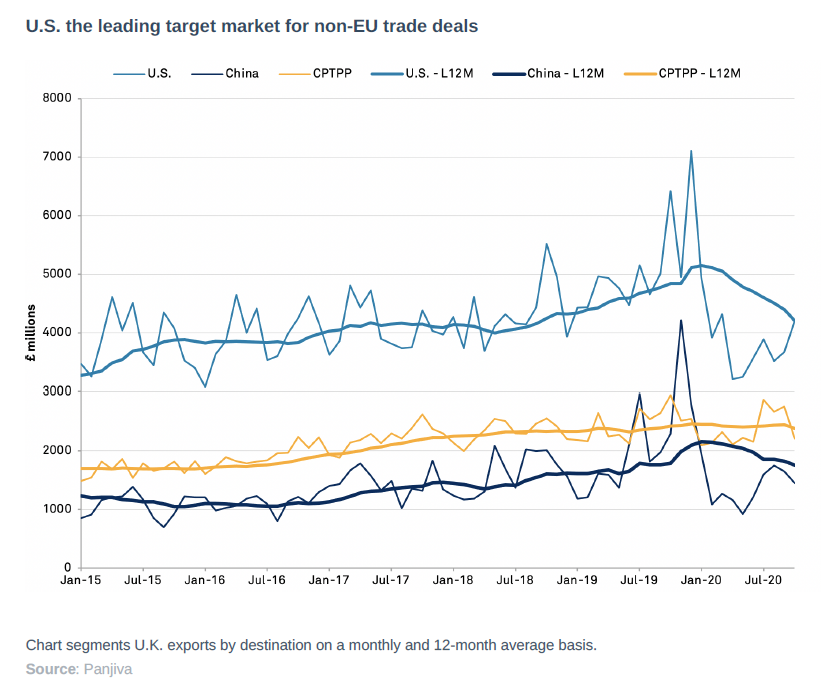

U.S. and China are the prizes in trade deals with the rest of the world

The issue: A major part of the reasoning behind Brexit from the U.K. side was to provide more flexibility in signing international trade deals. From the EU’s side having one less member state to consider in negotiating deals should also reduce the complications in signing new deals. Aside from the EU the U.K. has already reached and ratied (either fully or provisionally) continuity agreements with total trade worth £141 billion in 2019, or 17.8% of the total, while a deal with Canada is pending and that with Mexico underway which would bring the aggregate to 19.4% of total U.K. bilateral trade on top of the 49.4% already accounted for by the EU. Among the U.K.’s major trade partners that leaves only the U.S. and China as partners with whom a deal has yet to be signed.

Likely outcome: The potential for a deal with the U.S. under the incoming Biden administration has been improved by the implementation of the Brexit Withdrawal Agreement which ensures a soft border with Northern Ireland. Yet, a deal in the near term is unlikely given statements from President-elect Biden, including an emphasis on labor and environmental standards that were likely not so important to the talks held with the Trump administration. A deal with China will be complicated by ongoing relations linked to the telecoms sector, speciffcally Huawei, while the deterioration of relations between Australia – a U.K. intelligence ally – and China add a further layer of complications. The U.K. government is clearly committed to joining the CPTPP trade deal, though that would make it a deal-taker and only adds a handful of countries at the margin that the U.K. does not already have continuity deals with.

Data points to note: A deal with the U.S. could open up growth opportunities for exports which already represented 15.2% of the U.K. total in the 12 months to Oct. 31 while China accounts for a further 6.3% and the CPTPP group 8.6%. Trade with the three groups has also been more robust than that with the EU, though the pattern of trade for the U.K. has been distorted by the pandemic. The true picture of the impact of Brexit on U.K. and EU trade will take years rather than months to emerge as the changes wrought by the TCA and future trade deals take effect.

Content Type

Location

Language