S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

The U.K. left the European Union on Jan. 31, 2020 and entered a set of transitional arrangements for trade and customs that applied through Dec. 31, 2020. On Dec. 24 the two sides signed a provisional “ EU-U.K. Trade and Cooperation Agreement Agreement” (TCA) that will provide a framework for relations going forward.

S&P Global has written extensively extensively about the United Kingdom’s exit from the European Union over the past four years. This report provides a brief overview of the newly signed trade deal, the issues to watch in 2021 with potential outcomes and data points to watch.

From Financials to Fish, What the Brexit Trade Deal Means

The Brexit negotiations may appear to be over, but it is merely the end of the beginning.

Read the Full ArticleAltogether, Apart – 2021 Global Trade Policy Outlook

While it's tempting to focus on the early moves of the Biden administration or the fallout from Brexit, global trade policy developments in 2021 will yield just as many threats and opportunities as developments in the Atlantic basin.

Read the Full ArticleLife After the Elections: Quick Deal, No Deal or a Small Deal – U.K.-U.S. Relations

Trade negotiations between the U.K. and U.S. had made significant progress under the Trump administration, including completion of “much of the legal text” according to HM Trade Secretary Liz Truss.

Read the Full Article

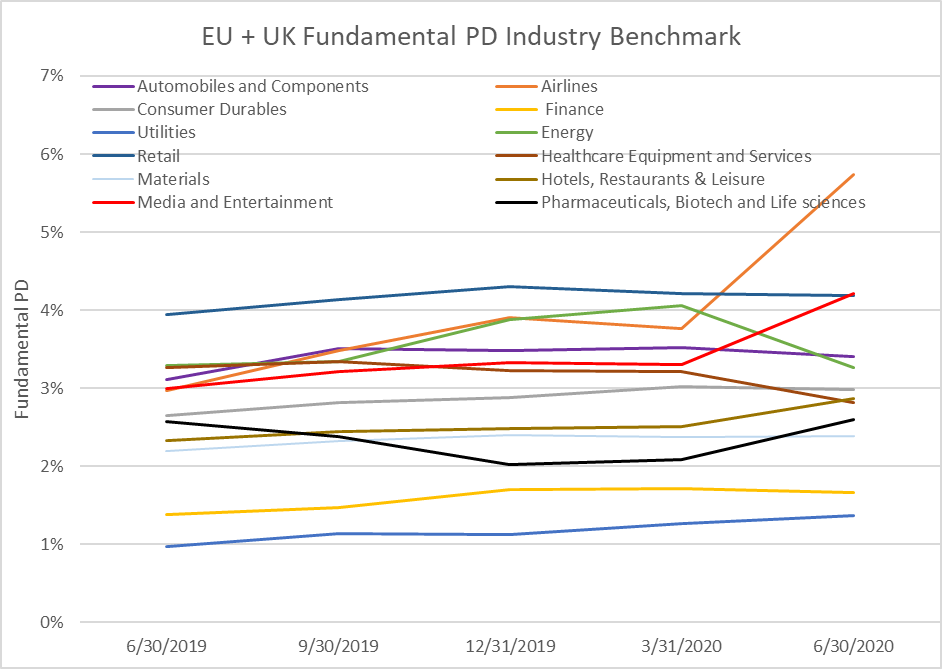

Companies within the European Union (EU) have experienced significant turbulence over the past year with the COVID-19 pandemic and are braced for more with the finalisation of the UK’s exit from the EU. Figure 1 shows historical speculative default rates provided in CreditPro®, an S&P Global Market Intelligence offering that provides rating transition, default and recovery rate analytics.

For the EU including the UK (EU+UK), S&P Global Market Intelligence saw spikes for speculative grade companies in 2002 with the tech bubble and in 2009 following the global financial crisis.

Key Takeaways

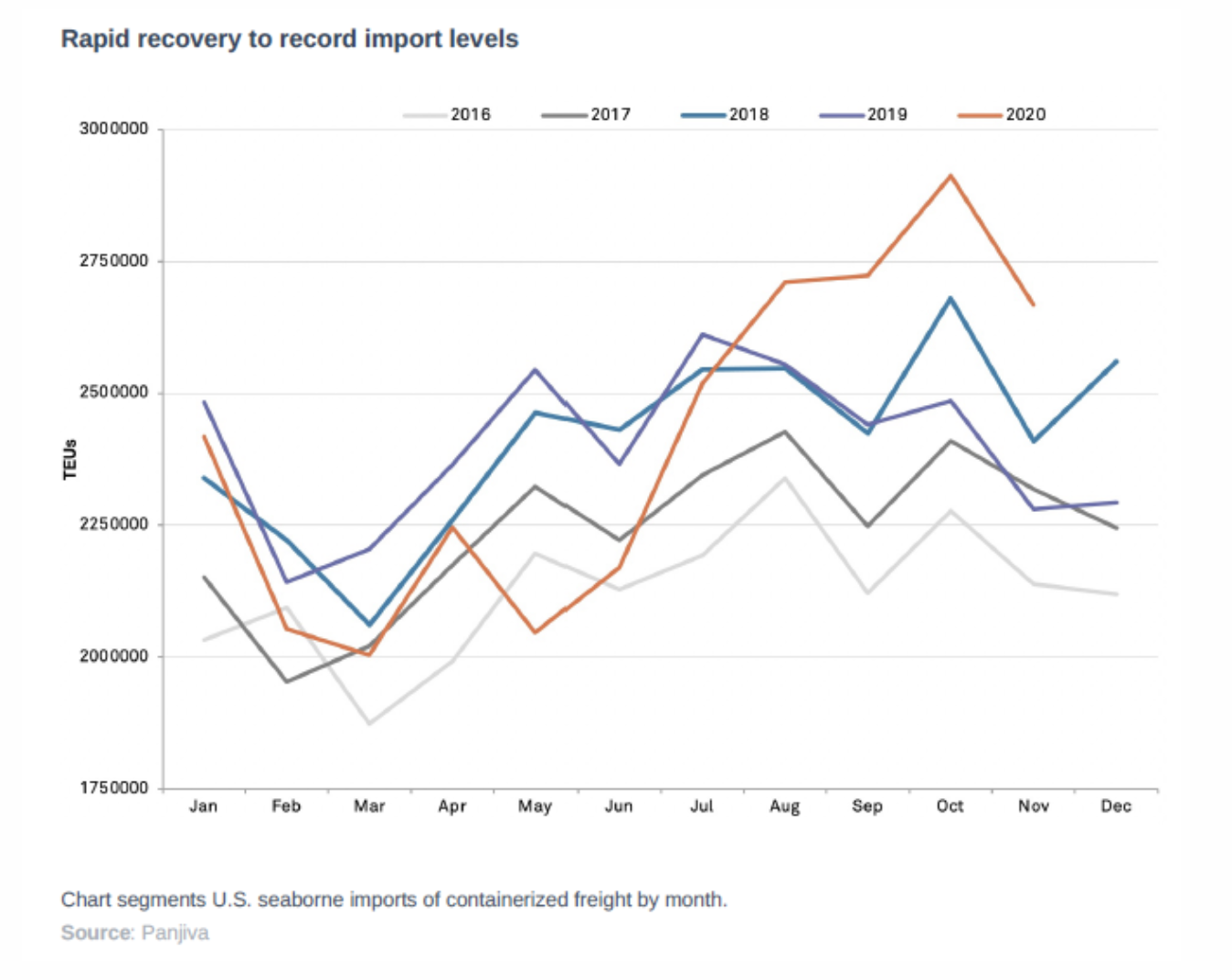

This report reviews the events that were emblematic of the changes in trade policy, logistics sector and industrial supply chain operations in 2020, based on Panjiva’s monthly most-read research review and the 1,200 reports published by Panjiva research in 2020. For each report we outline what it covered, why it mattered and what the data told us, with charts updated for the most recent data available.

UK Private Sector Activity Expands Less Than Expected in December 2020

The Composite Output Index, which takes into account both manufacturing and services sector activity, rose to 50.4 in December from 49.0 in November.

Read the Full ArticleUK Banks' Recovery Set to Be 'Bumpy'

S&P Global Ratings said its outlook on the U.K. banking sector is negative as banks' road to recovery will be a tumultuous one amid a new variant of the COVID-19 virus, renewed lockdown restrictions and dwindling fiscal and monetary support from the state.

Read the Full ArticleEconomic Research: The Second Wave And Brexit Will Test The U.K. Recovery

Despite the promising start, many hurdles are ahead on the path to recovery, and S&P Global Ratings now sees the economy slightly worse off over the next three years, compared with their previous forecast.

Read the Full Article

The U.K. will strive to boost investment in its car industry, with battery cell manufacturing a top priority, now that a Brexit free trade deal has assuaged uncertainty over its prospects, the head of the British automotive industry association said Jan. 27.

The trade deal, agreed upon on Dec. 24, 2020, removed the threat of tariffs on exports of U.K.-made cars from manufacturers including Nissan Motor Co. Ltd., Tata Motors Ltd. subsidiary Jaguar Land Rover, Toyota Motor Corp., Stellantis NV subsidiary Vauxhall and Bayerische Motoren Werke AG's MINI brand. Honda Motor Co. Ltd. is ending U.K. production this year.

UK Requires EV Battery Taskforce to Retain Auto Industry: Ex-Aston CEO

The UK government needs to step up its efforts to create homegrown electric vehicle battery production, and establish a sector taskforce, or face the possible consequences of losing its auto industry, according to the former Aston Martin CEO, Andy Palmer.

Read the Full ArticleAuto Industry Welcomes Brexit Trade Deal but Awaits Specifics

Automakers in the U.K. and Europe welcomed the announcement of a Brexit trade deal on Dec. 24 that will avoid import tariffs they say would have been catastrophic for the industry.

Read the Full Article

EU sugar production in the 2020-21 campaign (October-September) is set to fall for the third consecutive year due to unfavorable weather, a high incidence of virus yellows due to the ban on neonicotinoid pesticides and a smaller acreage.

As far as trade flows go, Brexit and the rollout of COVID-19 vaccinations will continue to be in focus in 2021. Looking further ahead, S&P Global Platts Analytics expects EU+UK production in 2021-22 to increase on the year.

Poor EU crop prospects are likely to cause the EU to remain a net importer in 2020-21. One trader said that there could be a sugar deficit of 2 million mt and that "it will be hard to find [this volume] to make up for the deficit." The trader also said that, "although the EU can't supply [regionally], it still has to export due to its long-term obligations." Platts Analytics estimates the 2020-21 EU sugar deficit at 1.585 million mt, almost five times the 343,000 mt in 2019-20.

UK Steel Safeguards to Remain with New Trade Accords: HMRC

The UK's steel import safeguards system – published Sept. 30 for use from Jan 1, 2021 – will still be applicable to some trade between the EU and the UK, and between Turkey and the UK.

Safeguards are non-preferential measures, along with measures including anti-dumping duties and countervailing duties. Preferential agreements – such as the ones negotiated by the UK with both the EU and with Turkey – do not impact on the application of steel safeguards, an HMRC officer told S&P Global Platts.

Solvency II equivalence continues to be a goal for U.K. insurers despite the mechanisms companies have set up to ensure continued trade after the U.K. left the European Union. But they should not expect it to be granted any time soon.

Clare Lebecq, CEO of the London Market Group, recently met with the U.K.'s economic secretary to the Treasury. Following that meeting, Lebecq in an interview said "everything is on hold at the moment."

The transition period for the U.K.'s exit from the EU ended Dec., 31, 2020, cutting the automatic access EU and U.K. insurers had enjoyed to each other's markets. The trade deal struck the day before Brexit went into effect was silent on financial services, but most insurers had ensured trade could continue by setting up EU subsidiaries, or making more use of existing ones, and transferring relevant business to them.

UK Clearing Houses Can Cope with EU/U.S. Equivalence Deal, Market Participants Say

The U.K.'s clearing industry does not expect to lose out to U.S. firms now that the European Union has granted equivalence status to more U.S. clearing houses, according to market participants.

Read the Full ArticleShare Trading that Switched to EU from UK Unlikely to Return, Say Exchanges

Share trading that switched out of London and into the European Union because of Brexit is unlikely to return, even though the EU may now be keener to grant equivalence status to the U.K., according to market participants.

Read the Full Article

Key Takeaways:

UK Prime Minister Boris Johnson has appointed former business and energy secretary Alok Sharma as full-time president of the United Nations Climate Change Conference in November. The conference, known as COP26, is to be held in Glasgow.

The move comes as Energy Minister Kwasi Kwarteng was appointed to take over from Sharma as UK secretary of state for business, energy and industrial strategy, the prime minister's office said.

"To meet the high ambitions for the summit in the year of COP26, Alok Sharma will solely focus on driving forward coordinated global action to tackle climate change," the PM's office said in a statement. "A successful summit in November will be critical if we want to meet the objectives set out by the Paris Agreement and reduce global emissions."

'It's just harder work': Wind-Turbine Makers Adapt to UK's Post-Brexit Realities

In the final weeks of 2020, a wind turbine blade factory on the Isle of Wight, off the south coast of England, did what many other manufacturing facilities in the country were doing as the U.K. prepared to exit the EU's single market.

Read the Full ArticleUK Emissions Trading System to Be Ready for Exit from EU: Government Whitepaper

The system underpinning a UK Emissions Trading System is on track to be ready for the country's exit Jan. 1, 2021, from the EU's own ETS, the UK government said Dec. 14 on publication of an Energy White Paper.

Read the Full Article

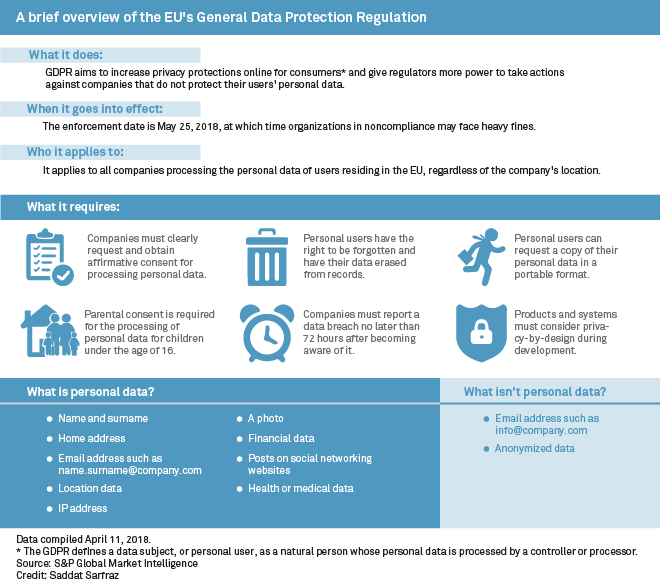

A Brexit deal struck at the 11th hour has thrust the U.K. in the middle of a politically turbulent tussle over data privacy between its two leading trade partners, the U.S. and the EU.

In the U.K.'s recent deal with the EU finalizing their post-Brexit relationship, an entire chapter was devoted to digital trade. But the biggest decision on data transfers — allowing data to move freely between the two regions without the need for cumbersome safeguards such as individual corporate contracts — has been delayed by the bloc until April, with the ability to extend the deadline by an additional two months. In the interim, the U.K. will continue to get all the perks of an EU member state, including on data, as part of a temporary data adequacy agreement.

After Brexit, Freedom to Set Own Rules Fintech, Crypto Could Benefit UK

Brexit has created disruption and uncertainty for the U.K.'s fintech sector, but industry insiders say that there is a silver lining.

Read the Full ArticleOutlook for UK Fintech Hiring After Brexit More Positive than Experts Feared

U.K. fintech industry insiders and recruiters had initially predicted that Brexit could lead to severe hiring difficulties due to the loss of freedom of movement within the EU.

Read the Full ArticleBrexit Complicates Data Privacy Politics Between U.S., E.U. and U.K. – Legal Experts

A Brexit deal struck at the 11th hour has thrust the U.K. in the middle of a politically turbulent tussle over data privacy between its two leading trade partners, the U.S. and the EU.

Read the Full Article