S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Activist shareholders and environmental campaigners notched a string of high-profile victories over oil and gas majors in May, illustrating how climate-change pressure on the companies is rising in both Europe and the U.S.

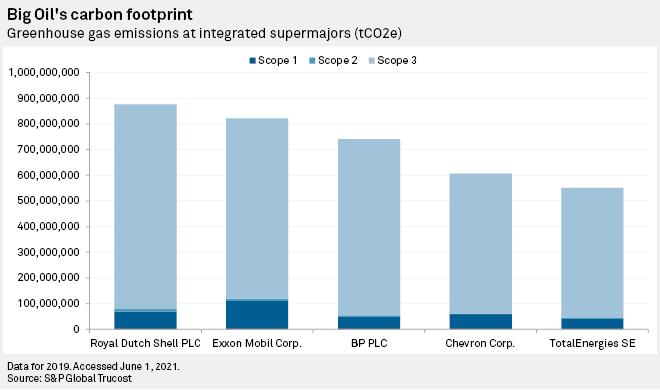

At Exxon Mobil Corp., activist hedge fund Engine No. 1 added three of its own nominees to the company's board after a contentious campaign. On the same day, Chevron Corp. investors defied management to vote in favor of stringent targets to cut emissions from the company's products, known as Scope 3 emissions, for the first time. And in the Netherlands, Royal Dutch Shell PLC lost a landmark court case that means it will have to cut its emissions much more steeply than planned.

Although the proxy battle at Exxon was only in part about managing climate risk, the victories were hailed as a significant step forward for the environmental, social and governance investors who have sought to tie Big Oil to higher climate targets. But some campaigners caution that getting companies to set goals, like at Chevron, is only the first step. Holding them accountable over the longer term and making sure they raise their low-carbon ambitions will be much harder tasks.

How Will Increasing Investor Focus on ESG Factors Affect North American Energy Companies?

S&P Global Ratings research indicates investors' growing focus on environmental, social, and governance (ESG) factors and credit risk could be affecting demand and pricing for oil and gas companies' new debt issuance, although these companies continue to have ample market access.

Read the Full ReportBig Oil, Stung by Activist Campaigning, Not Yet Out for the Count

Global oil and gas producers, facing a pummeling from environmental activists and shareholders, can rely at least for a while on persistent oil demand and a need for their expertize and scale, even as pressure increases for them to diversify.

Read the Full ArticleClimate-Focused Investors Push Top Oil Drillers to 'Start Facing the Future'

ExxonMobil and Chevron at annual meetings May 26 faced their strongest pushback yet from climate-focused investors urging the oil and gas drillers to "start facing the future" by shifting to lower-carbon technologies and preparing for sharply lower fossil fuel demand.

Read the Full Article

Enbridge Inc.'s sustainability-linked bond framework could represent the next frontier in pipeline sector finance as investors look for management teams to deliver on environmental, social and governance commitments, industry observers and credit rating experts said.

The Canadian pipeline giant on June 17 enumerated the performance indicators affecting borrowing costs it would use when issuing those bonds, like progress on reducing the intensity of its Scope 1 and Scope 2 greenhouse gas emissions by 35% by 2030, as well as progress on achieving 28% representation of racial and ethnic groups in its workforce, 40% gender diversity across the company and 40% representation of women on its board of directors by 2025.

Better Credit Available to Low-Carbon Oil, Gas Companies

The transition to low-carbon and zero-carbon energy in North America has gained momentum among investors and is likely influencing oil and gas companies' access to capital and its cost.

Read the Full ArticleCommodity Traders Eye Growing Oil, Gas Asset Opportunities but Rising ESG Scrutiny

Independent commodity traders see a growing role as owners of producing oil and gas assets but are feeling rising pressure from banks to align their investments with environment targets, the financial heads of some of world biggest trading houses said June 16.

Read the Full ArticleESG Concerns Are Starting to Present Capital Market Challenges to North American Energy Companies

S&P Global Ratings has recently observed contracting bond tenors and widening spreads for North American oil and gas debt issuers, relative to those of European peers and the broader corporate fixed income universe, suggesting that investors' growing focus on ESG and credit risk may be affecting demand for new issuance from oil and gas companies.

Read the Full Report

The world's largest oil and natural gas companies face an existential crisis. As pressure from climate and investor activism escalates, legal challenges arise and investment patterns transform, they must square the circle of profits and emissions pledges. The shift from rebranding their identities to reassessing their business models is fraught with challenges for the oil and energy outlook.

The industry last month felt the force of climate activism in two areas where it hurts most: in the boardroom and in the courtroom. Chevron's shareholders voted May 26 to approve new reduction targets, while ExxonMobil's shareholders approved directors aimed at forcing the company to take more aggressive steps to combat climate change.

ESG Momentum May Influence Oil, Gas Funding, Midstream Valuations

Since around 2017 and especially in the past year, the energy transition to low-to-zero-carbon fuels has gained momentum among investors and likely will influence their actions on future project funding availability and costs

Read the Full ArticleRisk of Majors Underinvesting in Oil and Gas is Real

Underinvestment by the major global oil and gas companies risks leaving markets undersupplied and also damaging parts of OPEC that rely on the majors for financing and the ability to meet spare capacity expectations.

Read the Full ArticleThe ESG Winds of Change Could Become A Tempest for Global Oil and Gas Producers

If the latest news reports about the effects of environmental, social, and governance (ESG) trends and climate change on the oil and gas sector is any indication of what may be in store, some companies may be in for a rough ride.

Read the Full Report

Oil producers with plans to boost their output capacities need to implement plans to reduce CO2 emissions over the current decade despite few current options to capture carbon, the US Special Presidential Envoy for Climate said July 1.

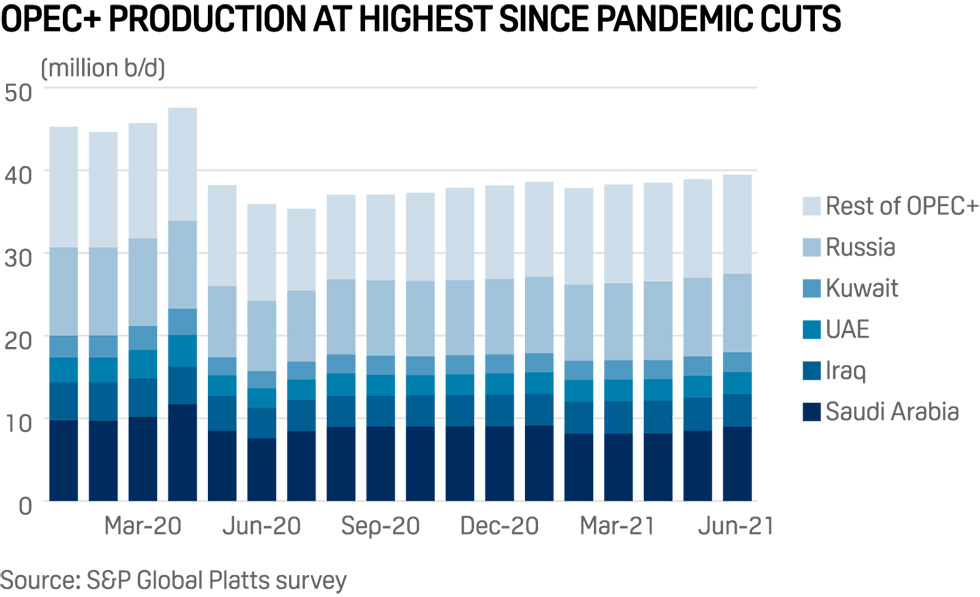

Several oil producing countries, including members of OPEC+, plan to boost their production capacities in the current decade before they become stranded assets. Saudi Arabia -- the world's biggest oil exporter -- aims to boost its production capacity by 1 million b/d to 13 million b/d, while the UAE's Abu Dhabi National Oil Co. is on course to hit a 5 million b/d production capacity by 2030, up from 4 million b/d now.

"There is an incumbent responsibility on any country if it says it is going to have a new project to make sure that there are no emissions coming out of that because you cannot have policies which are adding emissions," John Kerry said in a media briefing.

Smaller Oil, Gas Producers Have Outsized Methane Emissions Impact

As the Biden administration develops new methane regulations for the oil and gas industry, a recent report revealed that some smaller producers emit disproportionally more methane, though larger companies are still responsible for the bulk of emissions.

Read the Full ArticleJPMorgan Vows to Help Oil and Gas Clients Reduce Their Carbon Intensity

Global investment bank JPMorgan Chase, which is one of the largest financiers to the fossil fuel industry, has pledged to help its oil and gas clients cut their carbon intensity by 35% by 2030, it said May 13.

Read the Full Article

Asian carbon cutting will be critical to the effort to reduce global warming. The region releases more carbon than the rest of the world combined. Given Asia is the most populous continent, and most countries within are developing, it is hard for this region to achieve zero carbon emissions. The region does have one big policy advantage: its governments typically control at least one national oil company (NOC). S&P Global Ratings expects the NOCs will set the pace in Asia in slashing carbon emissions, even if this undermines their profits and credit standing.

Oil and Gas Company Net-Zero Targets Face Scrutiny, Skepticism from Researchers

Net-zero emissions targets put forward by oil and gas companies offer a chance to hold major emitters to account but continue to face skepticism from researchers examining the robustness of the mounting pledges by countries, states, cities and companies around the world.

Read the Full ArticleBP's Looney Says Investors Warming to New Strategy as Green Pledges Grow

Investors are warming to BP's radical shift of strategy away from oil and gas with a growing acceptance that the energy major can deliver on its plans to profitably scale up its renewable energy businesses, BP's CEO Bernard Looney said May 19.

Europe's number two oil company unveiled its major pivot to low carbon energy in August 2020, announcing that spending on renewables and bioenergy would jump tenfold to around $5 billion/year by 2030.

Read the Full Article

The International Energy Agency issued a stark warning to the global oil industry last month that the time for new oil and gas projects has passed. If the world wants to achieve net-zero emissions by 2050, all new upstream developments are effectively surplus to requirements, and the only spending needed is to keep oil and gas flowing from existing fields, the IEA said in its Net Zero 2050 (NZE2050) report.

UK Stands by Offshore Oil, Gas Licensing Despite Rising Tensions Over Net-Zero Targets

The UK will still consider offering new offshore oil and gas licenses in the future, energy minister Anne-Marie Trevelyan said June 23, despite rising pressure on the country to ban new exploration in the wake of a landmark report on global carbon emissions by the International Energy Agency.

The UK suspended North Sea licensing in September 2020 to align the process with the country's long-term climate goals as it also prepares to host United Nations COP 26 climate talks in November.

Read the Full Article

OPEC's latest rift between estranged oil allies Saudi Arabia and the UAE has dominated market headlines, but even bigger cracks within the organization are looming. As the world continues to look to the bloc and its partners for more volumes of crude, gaps between its haves and have-nots are widening.

Even setting aside the UAE's insistence on a higher output target, plans by the OPEC+ group to lift production could run into many members' practical limits on how much crude they are able to pump.

Oil, Gas CEOs Concur on Supply Tightness, Energy Transition Goals

The CEOs of of ExxonMobil, Shell and TotalEnergies all see a lack of investment in upstream oil and gas contributing to coming supply tightness following the pandemic, they told the Qatar Economic Forum on June 22, stressing, however, the importance of investment in low-carbon energy projects.

Read the Full ArticleVitol Boss Warns of Oil Supply 'Gap' in 2025-2035 as Upstream Spending Ebbs

The world faces a potential global oil supply shortage over the coming decade as the pullback from fossil fuels project by parts of the industry creates a gap with expected demand.

Read the Full Article

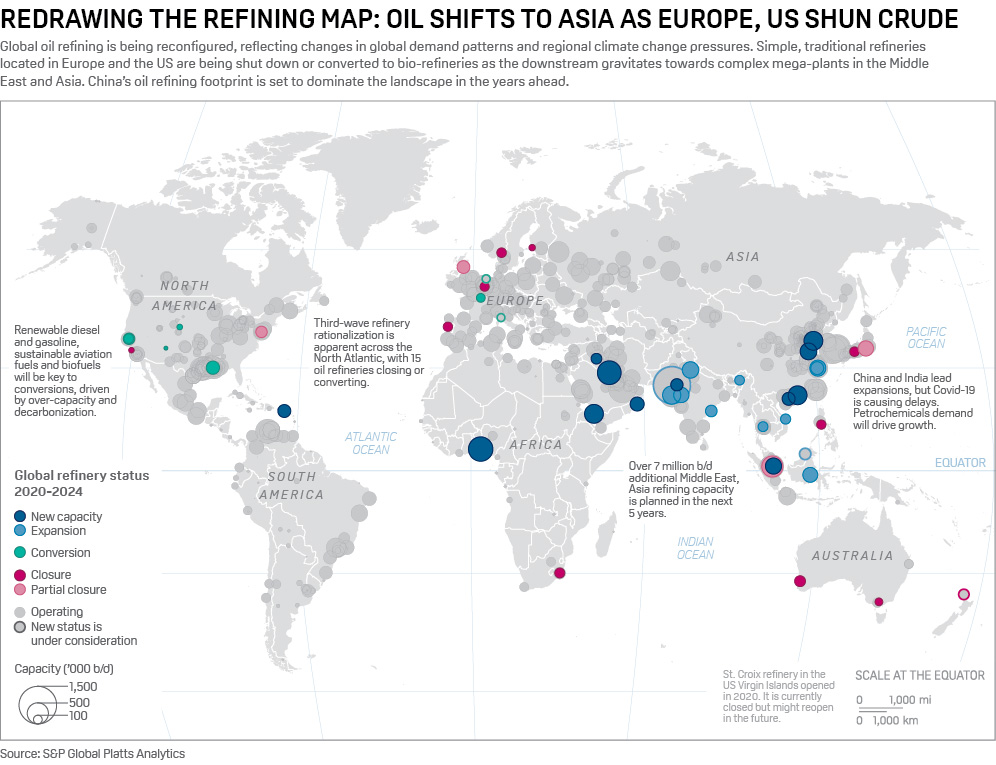

The oil refining industry could struggle to return to full health in the next couple of years as analysts predict that the oil demand recovery enables new plants to start outpacing closures bringing extra capacity to the beleaguered sector.

India's Recovery Road Map Prompts Oil Majors to Accelerate Energy Transition Plans

India's road to recovery from the pandemic's deadly second wave may help fast track oil majors' ambitions to expand their portfolio in Asia's fastest-growing energy market while at the same time reducing their carbon footprint.

With plentiful funds expected to support an economic recovery from the COVID-19 crisis, CEOs of leading global companies are hopeful a large part of that relief will flow into the energy sector, creating opportunities in both fossil fuels and in clean energy.

"Perhaps a post-pandemic economic recovery anchored around sustainability and climate action could well be the prudent way," Nitin Prasad, chairman of Shell Companies in India, said in an exclusive interview with S&P Global Platts.

Read the Full Article