Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 25 May, 2021

The S&P ESG Index Series is aimed toward those who are looking to incorporate environmental, social, and governance (ESG) considerations into their investment products. These indices seek to provide benchmark-like returns by having the same broad industry group exposure as the underlying index while simultaneously offering an enhanced ESG profile.

Within the European equities market, the S&P Europe 350 ESG Index is designed to measure the constituents that meet sustainability criteria from the headline S&P Europe 350®, which tracks 16 major European markets and covers approximately 70% of the region’s market capitalization. The S&P Europe 350 ESG Index is a unique strategy, designed for the ESG-conscious investor seeking broad market exposure in Europe through an index that is efficient to replicate.

How Is the S&P Europe 350 ESG Index Constructed?

The first step is to apply exclusions focused on business activities (controversial weapons, tobacco, thermal coal), ESG scores, and United National Global Compact (UNGC) scores. The remaining eligible companies are ordered by S&P DJI ESG Score within their GICS® industry groups, and constituents are selected targeting 75% of the market capitalisation in each S&P Europe 350 industry group.

Please see the index methodology for a full breakdown of the index construction rules.

Why Choose the S&P Europe 350 ESG Index?

Why Incorporate S&P DJI ESG Scores?

The results of the April 2021 index rebalance emphasize the importance of incorporating S&P DJI ESG Scores into the index methodology. Seven of the top 10 constituent exclusions were due to ESG scores (see Exhibit 1).

For instance, Novo Nordisk has had a deteriorating ESG score over the past few years, decreasing from 98 in 2018 down to a score of 69 in 2020. Notable areas of material weakness for the company are human capital development and innovation management.

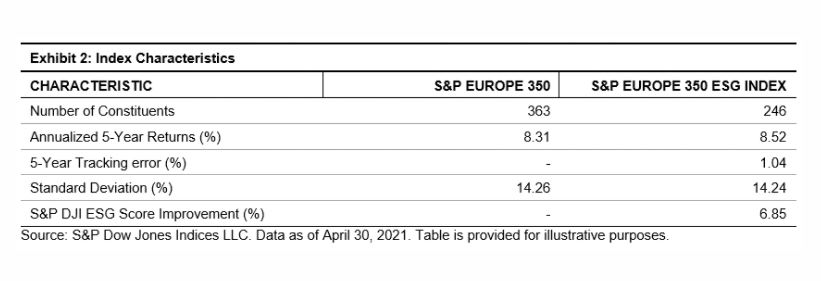

The S&P Europe 350 ESG Index had 246 constituents as of April 2021, as companies with low-ESG scores or those companies conducting business activities which are not consistent with ESG norms from the underlying index were excluded. The index offers an improved S&P DJI ESG Score of 6.85%* over the benchmark, as well as a low tracking error of 1.04%. The result is a broad European index that incorporates robust ESG objectives for sustainably conscious investors.

* ESG Score Improvement is calculated as the difference between the index-level ESG score of the ESG index and the index-level ESG score of its underlying index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language