Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Thirty years is an eternity in market terms—particularly if the market in question involves commodities. And yet, in the past three decades the S&P GSCI has cemented itself as the most precise benchmark for global commodities.

When the Goldman Sachs Commodities Index launched on April 11, 1991, the S&P 500 equities benchmark closed at 380, and the price of barrel of crude oil was $21, according to S&P Dow Jones Indices, which purchased the commodities index subsequently known as the S&P GSCI in 2007. Since the creation of the S&P GSCI, the world has undergone significant geopolitical disruption, and markets have swung to extremes—with the S&P 500 closing at 4,129 and crude at $59 on April 9. The S&P GSCI index itself finished the first quarter of this year up 13.5%, marking one of its better quarterly performances in its history.

“Over that 30 years, [the S&P GSCI has] really paved the way in terms of index innovation in the commodity market. Today, just as it was when it launched in April 1991, it's the most widely recognized commodity index benchmark. It's broad-based and it's production weighted, and that means it really is a true global representation of commodity market beta,” Fiona Boal, global head of commodities and real assets for S&P Dow Jones Indices, told S&P Global’s Essential Podcast in celebration of the index’s anniversary. “It reflects the importance of each commodity in the real world … It really does represent the size and the weights of the most vital commodities traded today, just like the S&P 500 is market cap weighted and represents the true size and weights of the 500 largest companies in the U.S.”

Considering the complexities of the commodities market, the first major investable commoditiy index is primarily used as the foundation of financial products, ranging from exchange traded funds to structured products to swaps.

For example, “a pension fund might be looking to allocate a small percentage of its portfolio to commodities in order to benefit from the diversification or maybe the inflation protection qualities that have traditionally been associated with commodities. The way they could do that would be to buy an ETF that is based on the S&P GSCI, or enter into an over-the-counter swap on the S&P GSCI with a counterparty such as a bank,” Ms. Boal said. “What these products allow investors and other market participants to do is to take a position in the commodity market without having to go out and buy a truck load of live cattle.”

The last 30 years of the commodities benchmark focused in part on its ability to provide market participants with direct access to individual commodities’ performance as demand and supply surged around significant events. Now, the index is likely to stay in the spotlight due to the conditions unfolding from the economic recovery from the coronavirus crisis.

“One of the most common justifications for having an allocation to commodities in a diversified portfolio is that commodities have traditionally proved to be a relatively reliable hedge against inflation. They've demonstrated what we call a high inflation beta. And I think today among market participants, the risk of inflation centers around whether the post-COVID-19 recovery will be truly inflationary,” Ms. Boal told the Essential Podcast. “I think this is all related to what we're seeing in terms of the price action in the commodity markets.”

The disruptions that may shape the next 30 years of commodities index investing are still developing. The collision between commodities investing and environmental, social, and governance (ESG) principles is inevitable, according to S&P Dow Jones Indices. So, too, is the eventual integration of non-traditional data and decentralized digital assets like cryptocurrency.

“While 30 years is a lifetime in commodities investing,” Ms. Boal and Jim Wiederhold, associate director of commodities and real assets at S&P Dow Jones Indices, asked in a report marking the S&P GSCI’s 30th anniversary, “what more can we expect in the next three decades?”

Today is Monday, April 12, 2021 and here is today’s essential intelligence.

The Essential Podcast, Episode 35: Building Blocks of the Real Economy — Thirty Years of the GSCI

Thirty years is an eternity in market terms, particularly if the market in question is the commodities market. Fiona Boal, Global Head of Commodities and Real Assets for S&P Dow Jones Indices, joins the Essential Podcast to talk about the 30th anniversary of the GSCI, supercycles, the energy transition, and the idiosyncratic nature of commodities markets in general. Tune in to this podcast on Apple Podcasts, Spotify, Google Podcasts, and Deezer.

—Listen and subscribe to the Essential Podcast from S&P Global

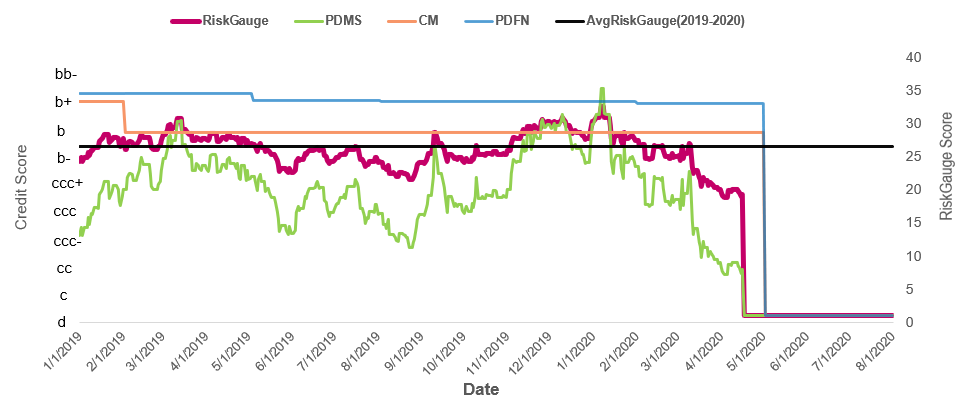

Tracking Credit Risk at a Major U.S. Retailer

JCP is an American department store chain with 840 locations in 49 U.S. states, plus Puerto Rico. Like many U.S retailers, JCP was seriously impacted as soon as the COVID-19 pandemic spread in the U.S. in early 2020. With a significant decline in sales and increasing operating expenses, JCP had already struggled in prior years, trying to adapt its business model to the competitive U.S. retail space. However, the situation only got worse with the COVID-19 shock and severe economic recession. In this blog, S&P Global Market Intelligence discusses how the S&P Global RiskGauge model could have been applied to help track JCP’s credit risk before and during the COVID-19 pandemic, and act as an early-warning signal of a bankruptcy event.

—Read the full article from S&P Global Market Intelligence

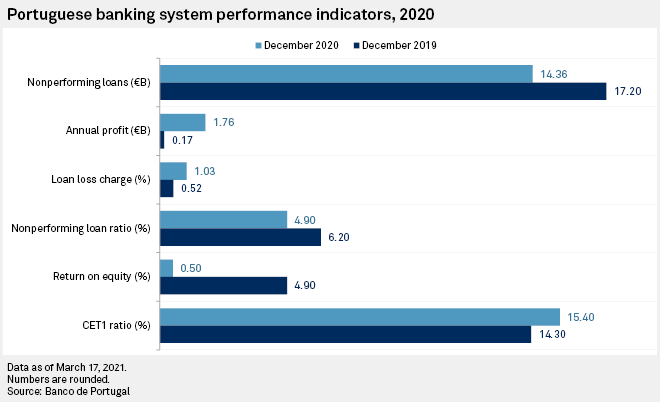

Portuguese Banks Brace for Worsening Asset Quality in 2021 as Loan Moratoria End

Loan moratoria and other policy measures have protected Portuguese banks' asset quality so far during the COVID-19 pandemic, but this may change in 2021 as many programs are unwound, DBRS Morningstar said in a report April 8.

—Read the full article from S&P Global Market Intelligence

2021 U.S. Bank Market Report Sees Reserve Releases Offering Banks a Shot in the Arm

Bank returns should rebound dramatically in 2021 as reserve releases and net interest margin expansion should drive earnings significantly higher.

—Read the full article from S&P Global Market Intelligence

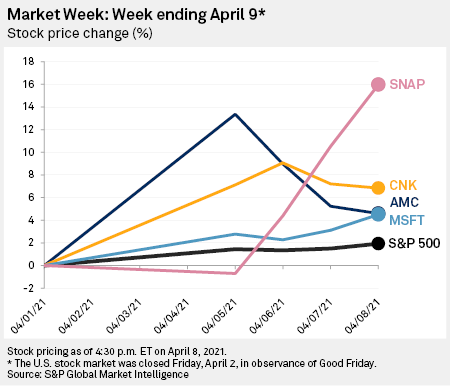

'Godzilla Vs. Kong' Claws Through Pandemic Fog; Microsoft Tops Earnings Pick

The blockbuster launch of "Godzilla vs. Kong" boosted shares in AMC Entertainment Holdings Inc. and Cinemark Holdings Inc. this week as investors grew optimistic that better days are ahead for the theater industry.

—Read the full article from S&P Global Market Intelligence

Global Console, Mobile and PC Gaming Drives $175B in Content Revenue in 2020

Global gaming software and services revenue grew 21.6% to an estimated $174.53 billion. Mobile led the way, with nearly $100 billion in annual revenue accounting for 57.2% of the market.

—Read the full article from S&P Global Market Intelligence

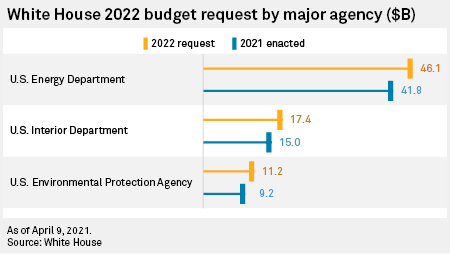

Biden Proposes Surge In Climate Spending In 1st Budget Request

U.S. President Joe Biden called for a more than $14 billion increase in climate change investments in fiscal year 2022, including a 10% increase in the Department of Energy's budget, as he seeks to decarbonize the U.S. power sector and broader economy. The request includes major investments to address climate change and boost federal research and development of clean energy technologies, priorities Biden has woven into his recent infrastructure proposal and efforts to reinvigorate the U.S. economy amid the coronavirus pandemic.

—Read the full article from S&P Global Market Intelligence

Exxon Mulls Closure of Norway's Slagen Refinery as Region's Clean Fuel Shift Continues

ExxonMobil is considering closing its 116,000 b/d Slagen refinery in Norway to convert the site into a fuel import terminal, the company said April 8, marking a potential further casualty of Europe's surplus refining capacity as the region's fuel demand shrinks and competition from new markets continues to grow.

—Read the full article from S&P Global Platts

EU Review Of ETS An Opportunity for Aviation Decarbonization

The EU's review of its Emissions Trading System in June presents a chance for the bloc to look at the aviation sector, with environmentalists saying long-haul flights and pricing were key issues to address.

—Read the full article from S&P Global Platts

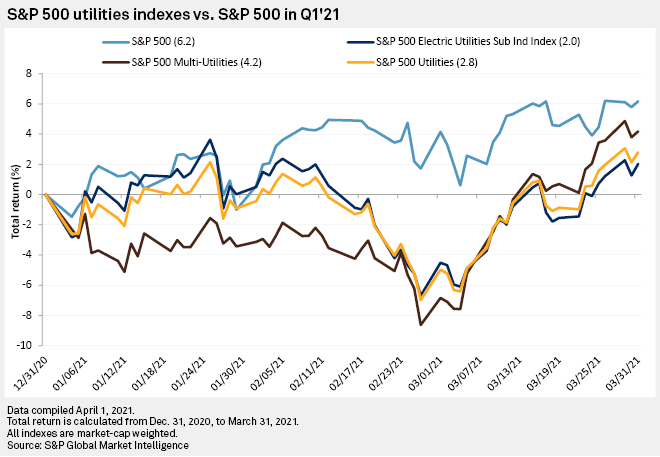

Nextera, Duke, Southern Retain Top 3 Slots in Q1 Market Cap Ranking

NextEra Energy Inc., Duke Energy Corp. and Southern Co. retained their first-, second- and third-place spots on the list of the top 20 S&P Global Market Intelligence-covered U.S. electric and multi-utilities by market capitalization at the end of the first quarter.

—Read the full article from S&P Global Market Intelligence

OPEC+ Bolsters Output By 450,000 B/D In March Despite Strong Compliance: Platts Survey

Crude oil production from OPEC and its allies rose by 450,000 b/d in March, the latest S&P Global Platts survey found, as Russia and Iraq pumped well above their agreed caps, while quota-exempt members Iran and Libya also boosted output. In Libya's case, its production hit an almost eight-year high.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language