Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 6 Mar, 2021

By Jason Ye

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

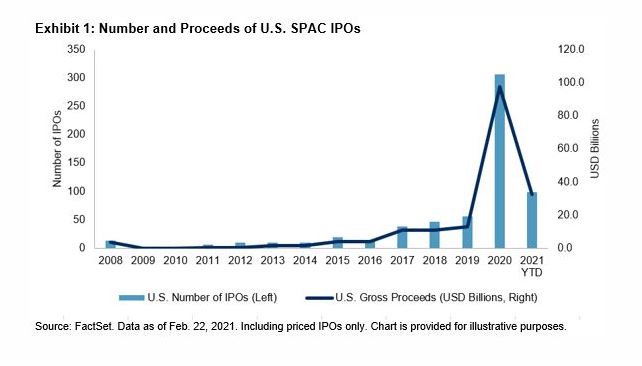

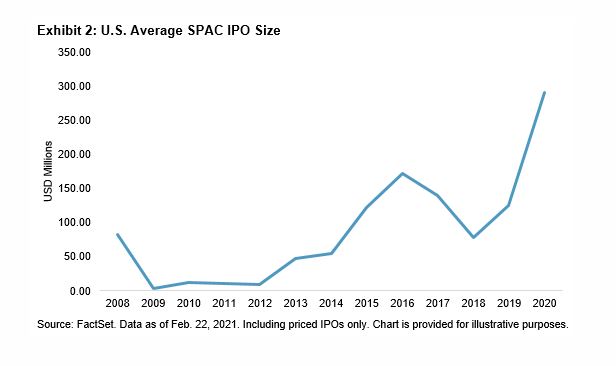

SPACs have been raising funds faster than ever before. In 2020, SPACs raised close to USD 100 billion in public offerings, which is more than in the prior 10 years combined (see Exhibit 1); the average IPO size also doubled from 2019 (see Exhibit 2). On July 22, 2020, Bill Ackman’s Pershing Square Capital Management raised USD 4 billion in the IPO of Pershing Square Tontine Holdings Ltd., recording the largest SPAC IPO to date.

Given this uptick in interest, we are going to publish a series of three blogs on SPACs investing. In this first blog, we will introduce the concept of SPACs and discuss market trends. Then, we will discuss a SPAC’s lifecycle and the potential benefits and risks of investing in SPACs. In the last blog, we will analyze SPACs’ liquidity and performance characteristics.

What Is a SPAC?

A SPAC is created specifically to pool funds in order to finance an acquisition opportunity within a set timeframe.1 The SEC’s Electronic Data Gathering, Analysis, and Retrieval database for public companies assigns SPACs a standard industrial code of 6770, classifying it as a subgroup of blank check companies.

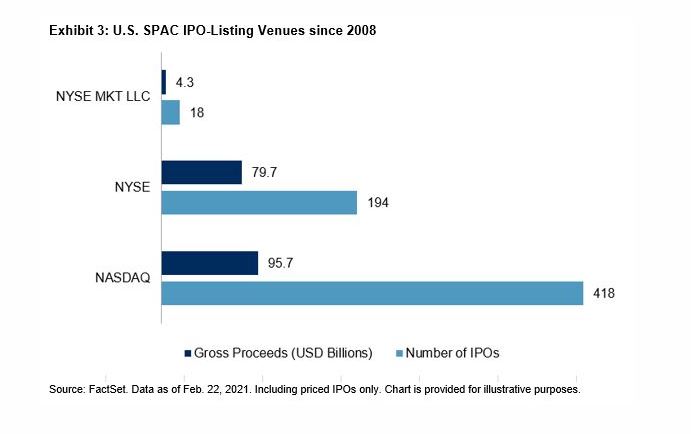

Before 2005, SPACs were traded in the over-the-counter (OTC) market. In 2005, the AMEX (now NYSE MKT LLC) started to list SPACs. In 2008, both NASDAQ and NYSE started to list SPACs. Currently, NASDAQ is the primary listing venue for SPACs (see Exhibit 3).

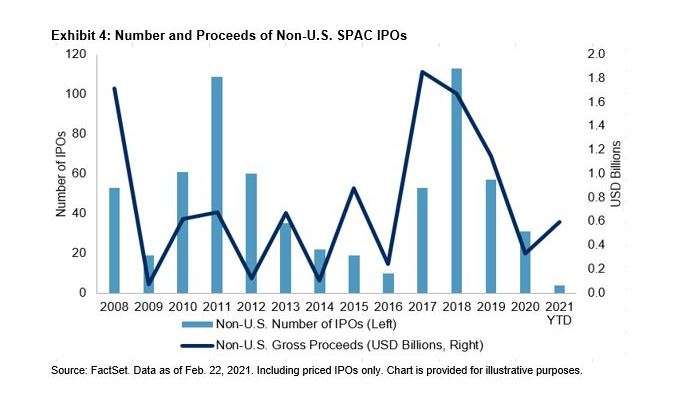

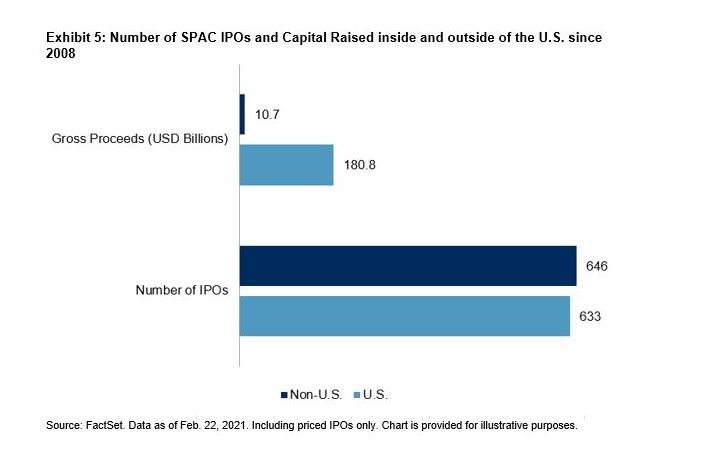

SPACs are not exclusive to U.S.-based exchanges. Some countries such as Canada, Italy, and South Korea allow SPAC listings in local exchanges as well. Currently, both Hong Kong and London are considering allowing SPAC listings.2 However, the overseas SPACs IPO markets were quieter in 2020 compared to the ones in the U.S. (see Exhibit 4); Canada was the most active SPAC market outside of the U.S by number of SPAC IPOs. Although the historical number of SPAC IPOs outside the U.S. was slightly greater than the number in the U.S., investors in the U.S. raised over 15 times more capital in SPAC IPOs than non-U.S.-based investors (see Exhibit 5).

1 https://www.sec.gov/fast-answers/answers-blankcheckhtm.html

2 https://www.reuters.com/article/hong-kong-spac/hong-kong-considering-allowing-spac-listings-idUSL2N2L009P; https://www.ft.com/content/2079bd8e-79b7-4820-9be8-c20020f48aee

The posts on this blog are opinions, not advice. Please read our Disclaimers.