Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 14 Apr, 2021

By Fiona Boal

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

As market participants increasingly incorporate ESG metrics into all aspects of investing, it is inevitable that commodities investing would collide with ESG. The search for low-carbon fuel feedstocks from renewable sources to meet the demand for green energy is one area where the commodity-ESG conundrum is already apparent. In part 1 of our blog, we introduced renewable diesel feedstock. In this edition, we’ll continue our discussion and how it relates to ESG.

Government mandates, incentives, and standards to lower the carbon intensity of fuel combined with consumer demands for meaningful action on climate change has accelerated the demand for renewable diesel feedstocks. Refiners can produce renewable diesel from animal fats, plant oils, and used cooking oil, but in North America renewable diesel producers will increasingly be relying on soybean and canola oil to run new plants. A renewable diesel boom may have a profound impact on the agricultural sector by swelling demand for oilseeds like soybeans and canola that compete with other crops for finite planting area and affecting food prices.

Rising food prices may be a concern if the predicted demand for crops to generate renewable diesel materializes. Some industry participants have suggested that U.S. renewable diesel production could generate an extra 500 million pounds of demand for soybean oil in 2021, which would represent a 2% year-over-year increase in total consumption.

The food versus fuel dilemma is not new. The corn industry went through a similar structural shift in 2005 with the introduction of the Renewable Fuel Standard (RFS), while sugar has been used as a feedstock for ethanol for decades in countries such as Brazil. While there is little academic evidence to suggest that corn demand from ethanol has structurally increased food prices (on average corn makes up a small percentage of final food expenses), the case with edible oils may be different given that they make up a larger percentage of final food expenses, especially in developing countries.

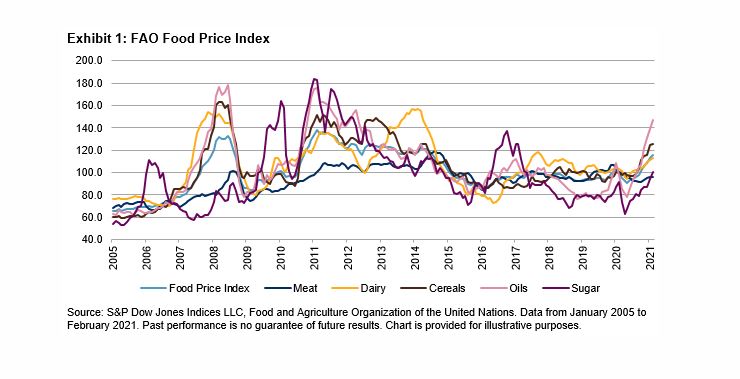

The FAO Food Price Index (FFPI) measures the monthly change in international prices of a basket of food commodities. Exhibit 1 illustrates the volatility of the basket and its sub-sectors over time. While the FAO Vegetable Oil Price Index reached its highest level since April 2012 in February 2021, this price appreciation should be viewed in the context of higher food prices across the board driven by a combination of disrupted supply chains in the wake of COVID-19, restocking demand, weather-driven supply issues, and higher energy prices.

While renewable diesel from recycled fuels may be a more sustainable and food-price friendly alternative, the transition to lower-carbon-intensity fuels will almost certainly involve increased demand for animal and vegetable oils.

For more information on SPDJI’s commodities indices, visit https://www.spglobal.com/spdji/ and be sure to check back as we celebrate the 30th anniversary of the S&P GSCI.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language