Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 9 Apr, 2021

By Fiona Boal

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Renewable diesel1 is one of the newer clean energy fuels on the market. It has become popular because it reduces emissions and has up to 85% less sulfur than ultra-low sulfur diesel. As clean air regulations and sustainability goals become more common, renewable diesel could continue growing in popularity. Renewable diesel can power conventional auto engines without being blended with diesel derived from crude oil, making it attractive for refiners aiming to produce low-pollution options.

According to the U.S. Department of Energy, the U.S. Energy Information Administration does not report renewable diesel production, but data from the U.S. Environmental Protection Agency indicates that the U.S. consumed over 900 million gallons in 2019. Nearly all domestically produced and imported renewable diesel is used in California due to economic benefits under the Low Carbon Fuel Standard. S&P Global Platts forecasts that the global renewable diesel supply will exceed 3 billion gallons by 2023 and 5 billion gallons by 2025.

Refiners can produce renewable diesel from animal fats and plant oils, in addition to used cooking oil. Several plant oils are widely traded via commodities derivatives, and for those market participants seeking exposure to green fuels, these commodities may offer an alternative avenue of investment.

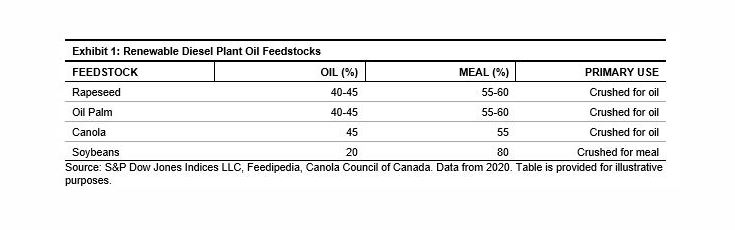

The proportion of oil produced by crushing these so-called feedstocks varies, but apart from soybeans, they are all crushed for their oil, i.e., oil is the most valuable product from the crushing process and is the primary driver of demand (see Exhibit 1).

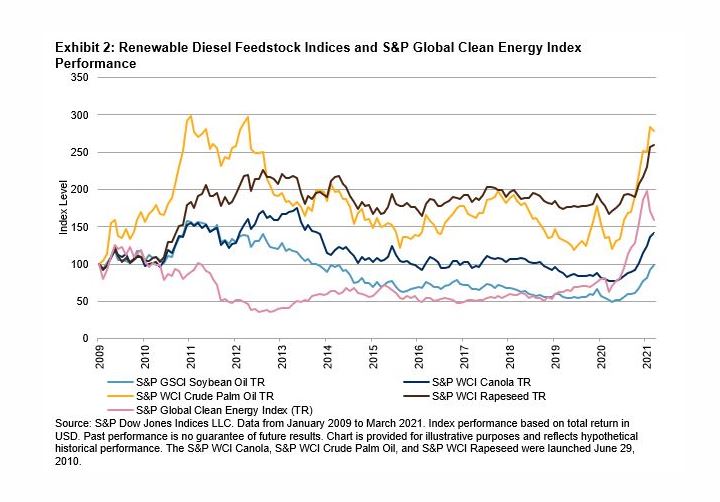

The performance of renewable diesel feedstocks was strong over the past 12-month period (see Exhibit 2), reflecting robust restocking demand from existing refiners, as well as expectations that production capacity would expand significantly over the coming years. The Biden Administration’s promise of a clean energy revolution may prove instrumental in cementing this new demand driver for plant and animal oils. However, more traditional food demand has also been strong for edible oil and meal. The U.S. Agriculture Department has forecasted record-high soybean demand from domestic processors and exporters in 2021, largely because of expanding global demand for livestock and poultry feed.

Over the long term, the adoption of electric passenger vehicles may limit the increased use of edible oil for renewable diesel, but it will still be required for heavy transport, such as trucks and trains.

For more information on S&P DJI’s renewable diesel feedstock indices, please visit https://www.spglobal.com/spdji/ and be sure to check back as we celebrate the 30th anniversary of the S&P GSCI.

1 In Europe, renewable diesel is known as hydrotreated vegetable oil

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language