Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 25 Jun, 2020

By Paul Hickin

Highlights

Oil markets are recovering quickly, but may have hit the buffers.

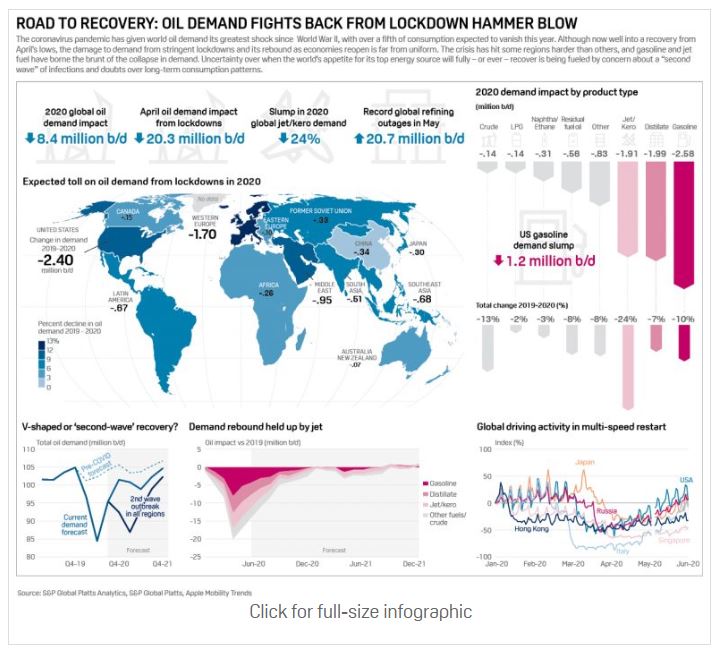

Deep production cuts from West Siberia to West Texas and resurgent gasoline demand have helped revive prices, however, a huge stock overhang and fears of further economic lockdowns to counter a second wave of the coronavirus pandemic remain significant risks to a full recovery.

“We see 4 million b/d of new demand coming on each month through to August as the world recovers from the lockdowns,” said Chris Midgley, global director of S&P Global Platts Analytics, at a media briefing June 18. “But in September, as you go to the lower traditional seasonal demand, it’s only 1 million b/d, and that’s maybe when you will see more oil coming on the market. So there is a danger that people get too confident.”

The next move on output levels by OPEC and its major ally Russia is critical. The so-called OPEC+ group of 23 producers has rolled over historic cuts close to 10 million b/d through July and toughened up its language on compliance by Iraq and Nigeria. Combined, these measures – including shut-ins mainly in the US and Canada – have removed 14.5 million b/d from the market.

However, some analysts continue to question the ability of Iraq and Nigeria to fully deliver on their side of the bargain.

Complicating matters further, US production declines have stabilized. The US oil and gas rig count fell by seven week on week to 292, rig data provider Enverus said June 18, as the bottom forecasted for weeks appears to be settling into the domestic drilling landscape.

“With oil prices testing $40/b that really does encourage some of the smaller US producers to increase their production,” Midgley said.

But Platts Analytics still expects 3.3 million b/d in lost US production by the end of next year, given the damage to operators caused by the collapse in oil prices.

The long-term recovery in prices depends on the restoration of stable market fundamentals. Dated Brent, the physical benchmark used to price two-thirds of the world’s oil, has tripled in value since hitting a 21-year low in April. The measure of high-quality North Sea crudes is now trading at around $40/b.

Platts Analytics forecasts oil prices could be stuck in a range between $35/b and $45/b in the near term. This is a level many producers will find unsustainable indefinitely, despite the industry cutting costs. Midgley describes this range as a “no man’s land,” not low enough to cut supply and not high enough to revive production.

Mercuria CEO Marco Dunand told S&P Global Platts in a recent interview OPEC+ was trying to put a $40/b floor to the market.

“We see a consensus between Saudis, US and non-OPEC members to get the market to $40/b,” Dunand said. “A sub-$40/b market creates a lot of pain for those countries … is there a consensus to get to $50/b? Is there a consensus to get it higher?”

The prospects for a so-called sustained V-shaped recovery could be dashed by a second wave of the pandemic taking hold. Markets are on edge after new breakouts have already started to emerge in Beijing and India. Midgley suggests a revival in the pandemic is “almost inevitable.”

New lockdowns and restrictions on demand will add to the problem of reducing global oil stocks. Around 1 billion barrels have built up in commercial storage, and refinery runs in key markets remain below seasonal averages. For the week ending June 12, Platts Analytics put overall global downtime at 18.5 million b/d amid outages in Africa, Japan and Europe.

Given the weak state of fundamentals, oil markets are right to remain nervous about the prospect of a second wave of COVID-19 hitting demand. As such, if the oil market remains in today’s no man’s land for a while longer, it may not be the worst outcome.

Fuel for Thought is a weekly column published first in S&P Global Platts Oilgram News

Content Type

Theme

Segment

Language