Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 27 May, 2020

Highlights

The shipping industry, skating on razor-thin margins, is drawing solace from cheaper bunker fuel prices caused by the coronavirus pandemic.

But the jury is still out on whether this will offset weaker shipping demand, which has infected key routes globally after decimating those in Asia.

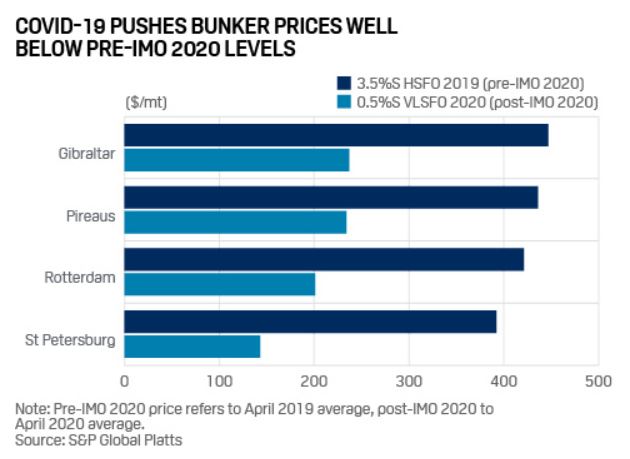

As the coronavirus pandemic takes the chair out from under global oil demand, marine fuel price surges from the IMO 2020 rules are a distant memory for the maritime industry – even though they only took effect from January 1. The crisis has dragged marine fuel prices below levels seen even before IMO 2020 became a driving force.

This year a large proportion of the marine industry shifted to more expensive, lower-sulfur fuel to comply with IMO 2020 rules, which cut the sulfur cap to 0.5% from 3.5%.

The marine fuel of choice for many shipowners, was very low sulfur fuel oil (0.5% sulfur). Its price averaged $201/mt in April on a delivered basis at Rotterdam, half what it was before IMO 2020, despite the main fuel one year ago containing more sulfur.

The prevalent marine fuel last year, high sulfur fuel oil (3.5% sulfur), averaged $421/mt in April 2019 at Rotterdam, S&P Global Platts data shows.

Spot prices of marine fuel are now the lowest in four years. Prices of VLSFO bunker fuel delivered-Rotterdam hit a record low of $154/mt on April 28, while the pre-IMO 2020 HSFO price was last below this in April 2016.

The current coronavirus-driven dynamics of the marine fuel market are a far cry from the fears of price spikes post IMO 2020 when the sector rushed to stockpile compliant fuels, and this has caught some companies out.

Prior to IMO 2020, chartering companies were advised to take ships from owners that had secured bunker contracts to mitigate IMO 2020-induced price volatility on the spot market, which starkly contrasts with conditions now.

Crude oil tanker giant, Euronav, purchased the equivalent of 420,000 mt of compliant fuel oil and marine gasoil, paying an average of $447/mt for 0.5% sulfur fuel oil in September, the company said.

The VLSFO was purchased “in anticipation of IMO 2020 price volatility” and the fuel that has not been consumed yet “will lead to a write-down as the current market value is significantly below the acquisition cost,” Euronav said in its 2019 results in late March.

While usually the true winners of lower marine fuel prices are the downstream end users – the shipowners and charterers – the reduction in fuel costs is providing little solace in an otherwise gloomy macro-economic picture.

“From a shipowner’s or charterer’s perspective, the lower bunker prices provide a glimmer of hope in bleak times,” Chief Shipping Analyst at BIMCO, Peter Sand, said.

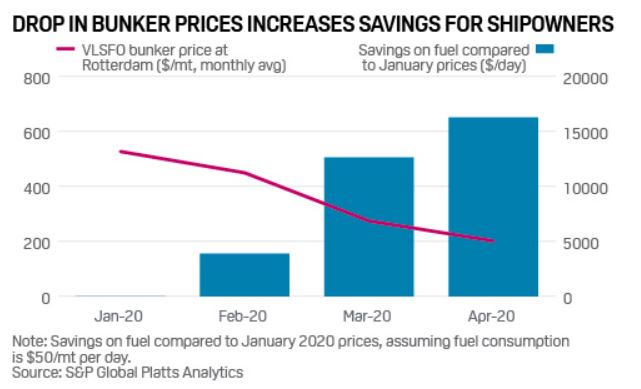

“The lower bunker fuel prices are partly buoying earnings amidst challenging markets conditions,” he noted, adding that VLSFO prices in April were a “massive cost saving” from prices in January.

The precipitous drop in bunker prices has led to increased savings for shipowners. Platts data shows the average drop in VLSFO prices of $325/mt between January and April means that shipowners were set to save $16,266 a day during April, assuming a vessel consumes 50 mt/day of fuel.

Low bunker prices have also altered some shipping routes, Sand said. “With the lower cost of sailing, some companies have started to sail around the Cape of Good Hope on the Asia-Europe backhaul instead of paying steep toll dues to transit the Suez Canal.”

However, S&P Global Ratings said lower bunker prices would only provide moderate relief. “We forecast that global [freight] trade volumes will plunge by up to 15% in 2020 compared with 2019, and that this will be only partly offset by blank sailings – a measure implemented by container liners to reduce running capacity — and a lower bunker price.”

Looking further ahead, bunker fuel demand is expected to fall 5% this year, the International Energy Association (IEA) said in its most recent report. The IEA previously attributed the fall in demand from some shipping segments, notably container ships, to reduced trade to and from Asia.

Danish shipping giant, Maersk, reiterated the view in its first quarter earnings report saying: “we expect container liners’ bunker bills to be much lower than in 2019, also because of reduced transported volumes.”

Weakened demand for the bunker fuels, and in turn, cheaper fuel prices mirrors that of reduced shipping volumes in the maritime sector, acting as a double-edged sword for shipowners.

However, the significance of shipping to the world economy has been highlighted during the pandemic so far, as marine fuel has seen relative support compared to other transport fuels such as gasoline and jet fuel, due to freight exemptions to widespread lockdowns.

As 90% of global trade is seaborne, “bunker fuel’s immune system [is] stronger than other fuels,” the IEA said.

Overall, the maritime industry has been kept on its toes so far this year. As the industry sails through choppy waters, only time will tell what is in store, but signs of a revival in demand will certainly be the main focus in the near term.

Content Type

Location

Language