Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 18 Jun, 2020

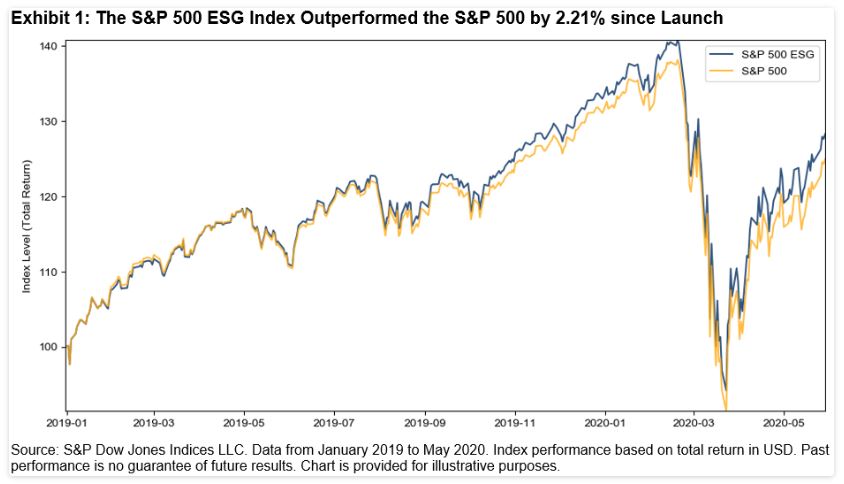

Since launching the S&P ESG Index Series, we have been continuously asked the same question: Can environmental, social, and governance (ESG) be considered a factor that outperforms? In short, since its launch in January 2019, the S&P 500® ESG Index has outperformed (see Exhibit 1).

We further analyzed the performance characteristics of the S&P 500 ESG Index against our suite of S&P Factor and Style Indices (see Exhibit 2).

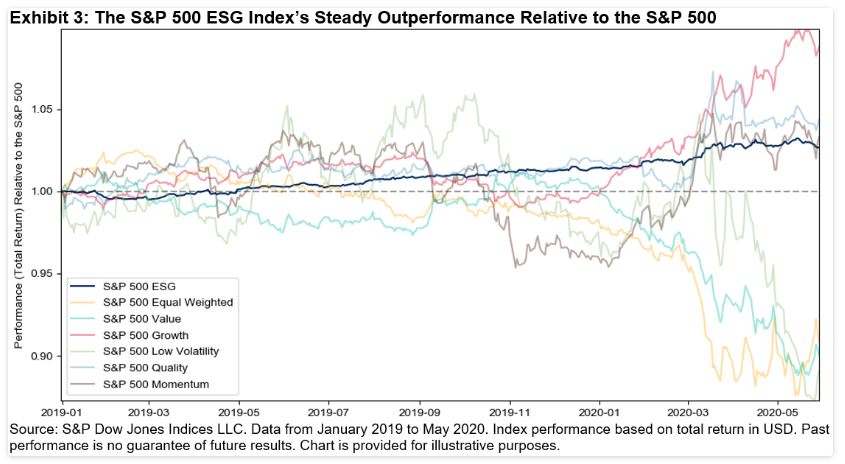

While growth, quality, and momentum fluctuated their way to a position of strong relative outperformance, ESG showed slow, steady outpeformance over the S&P 500. Size, low volatility, and value performed relatively worse over the period (see Exhibit 3). This distinction in behavior may be explained by the construction and objective of each index. While the S&P 500 ESG Index aims to deliver core-like returns with low tracking error to the S&P 500, the S&P Factor and Style Indices are designed to target differentiated and less correlated returns to the benchmark.

However, it is unsurprising to note that the excess return of the S&P 500 ESG Index was negatively correlated to the S&P 500 Equal Weight Index, which was likely attributable to the large-cap bias present in the S&P 500 ESG Index.

Given the variation of active risk of each index versus the S&P 500, we normalized the relative performance (excess returns/tracking error) to understand the consistency of outperformance observed. These form information ratios (see Exhibit 4).

What drove this outperformance and can we expect it to continue? The drivers of ESG outperformance require further analysis than this blog provides. The S&P 500 ESG Index’s outperformance may be attributed to a successful mix of factors during the period, uncorrelated ESG alpha, inflows into ESG strategies, a combination of these, or something else.

Factors such as value, momentum, and size have been studied in both industry and academia for many decades, whereas ESG score-based indices are a relatively recent phenomenon. In ESG’s shorter lifespan, there have been large-scale shifts to integrating sustainability-based criteria into the investment process. At S&P Dow Jones Indices, we are fortunate that S&P Global (our parent company) acquired SAM, who has been integrating ESG scores into the investment process for over 20 years. In this time, company disclosure has improved and methodologies have evolved with sustainability-based norms. When considering this, having the same degree of confidence in the future outperformance of ESG may be naive.

How has ESG performed in other regions? With the exception of Japan, which showed a small underperformance, each region outperformed, including Europe, the U.S., Latin America, and other global variants (see Exhibit 5).

Overall, since its launch, the S&P 500 ESG Index has seen slow, gradual outperformance over the S&P 500, with compelling information ratios compared with S&P Factor and Style Indices. Similar outperformance has been observed in other regions, too. Will this continue? We’ll need more time to gain reasonable confidence, but it does make an attractive graph for now.

Content Type

Location

Segment

Language