Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

4 Feb, 2020

H&M Hennes & Mauritz reported strong results for the first quarter, Barron’s reports, with attribution to technology changes mentioned by the CEO. On the Jan 30 earnings call, CEO Karl-Johan Persson noted that “The supply chain is a key area as well for our transformation, where focus is on speed, flexibility and efficiency to create an even better customer experience. And the work spans the entire product flow and — where logistic centers and logistic systems are important parts. We have, for example, opened a new high-tech logistic center in Milton Keynes in the U.K. that will replace several existing centers and serve both stores and online.”

H&M’s focus on transforming their supply chain was noted in Panjiva’s 2020 technology outlook on Jan 27, outlining how H & M focuses on analytics. Panjiva data shows that H&M has increased imports by 12.7% year over year in 2019, including the period of supply chain streamlining.

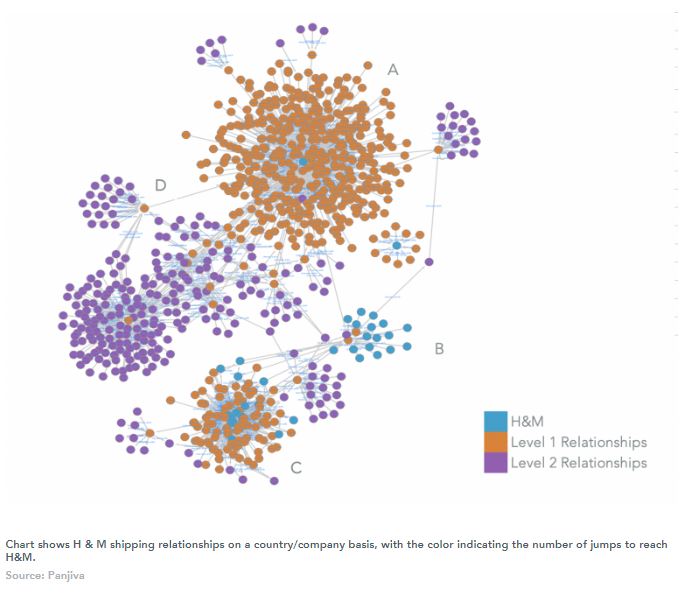

Looking at H & M’s supply chain network using graph theory methods can shed some light on their structure, with each company-combination being a separate node in the network. This allows relationships within the same company across different countries to be shown. Label A on the network chart below shows a large number of suppliers from multiple countries supplying H&M India. H&M nodes are blue, while direct suppliers and customers are orange, and second tier suppliers and customers are purple.

Label B shows H&M shipping to its local subsidiary in Colombia. This may be an indication that H&M uses Colombia as a consolidation point in South America. Label C shows Indian suppliers shipping to H&M’s operations in Europe and South Korea among others.

Finally, Label D shows a large number of second tier suppliers including those that use more than one direct supplier in turn. The latter, known as supply chain diamonds, could be a potential source of risk for H&M.

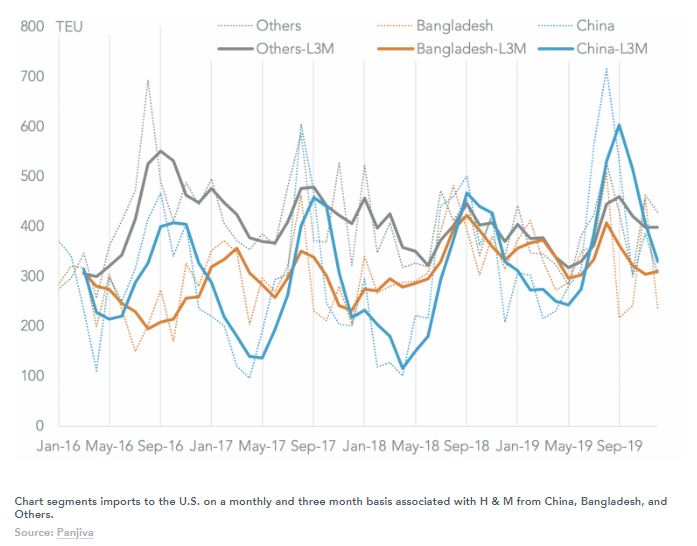

Panjiva data shows U.S. seaborne imports associated with H&M come from two main sources, Bangladesh and China, which accounted for 30.7% and 33.7% of shipments in 2019. H&M appears to be investing in China despite the increase in tariffs imposed in Sept. 2019, with imports to the U.S. rising by 28.2.% year over year in 2019.

The increase in imports from China came as shipments from Bangladesh where shipments increased by just 0.2% year over year. That may indicate a pause in previous plans, flagged in Panjiva’s June 18 research, potentially relating to worker safety concerns and union action in Bangladesh.