Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 15 Apr, 2021

By Simeon Hyman

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

A CRITICAL DISTINCTION TO BE MADE

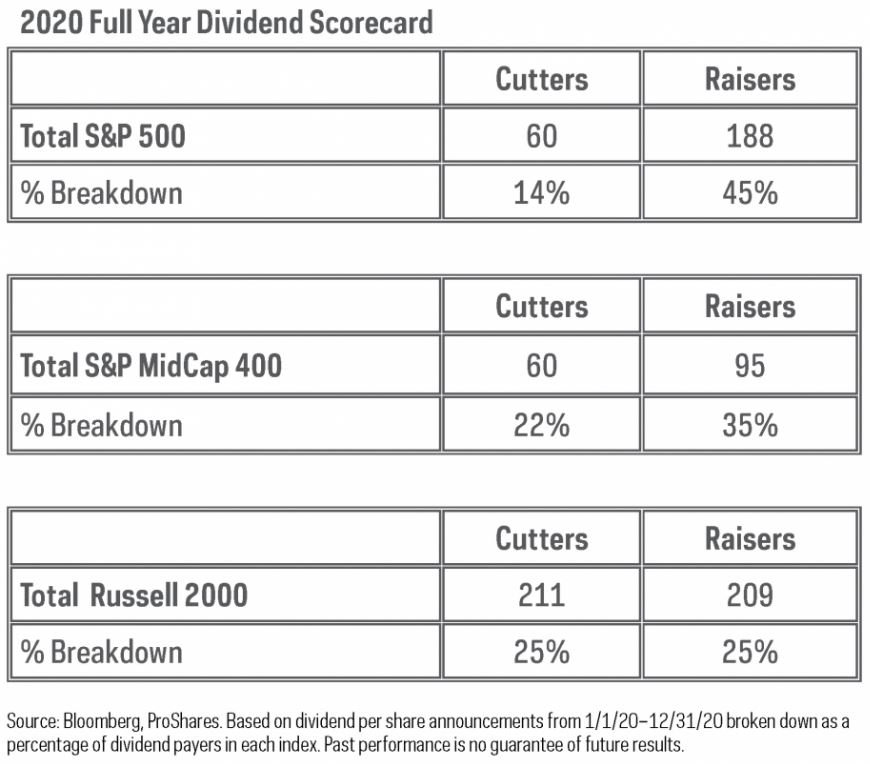

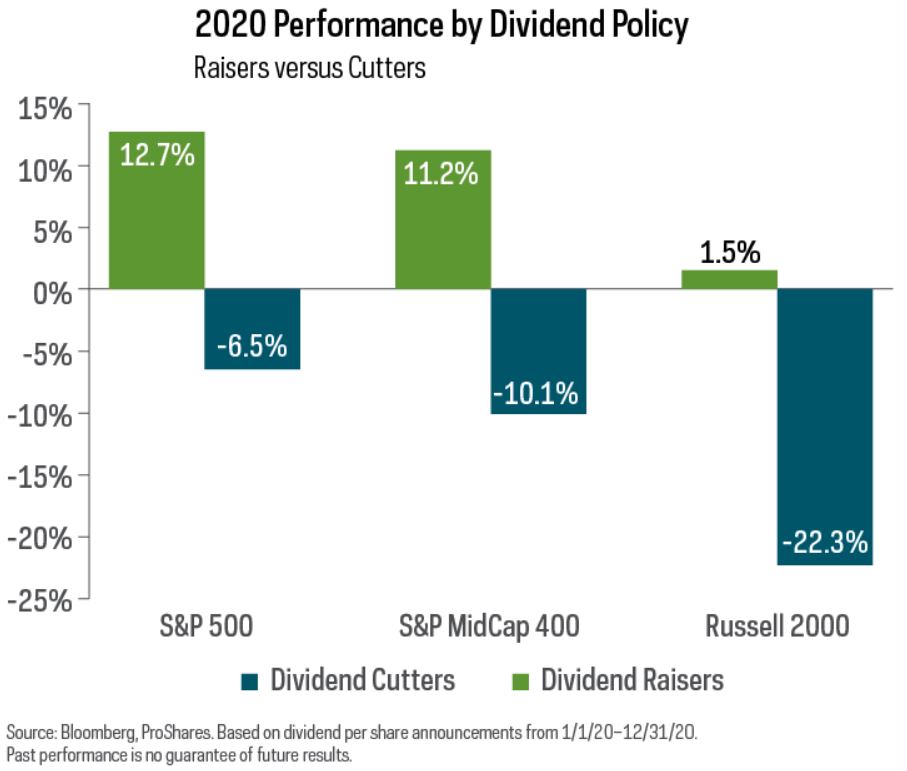

When the pandemic began, many investors feared widespread dividend cuts. However, while some companies did cut or suspended their dividends, the damage was largely confined to the pandemic’s early stages. Once the economy began to stabilize, so did dividends. By the end of 2020, approximately three times as many companies in the S&P 500 raised their dividends as cut them.

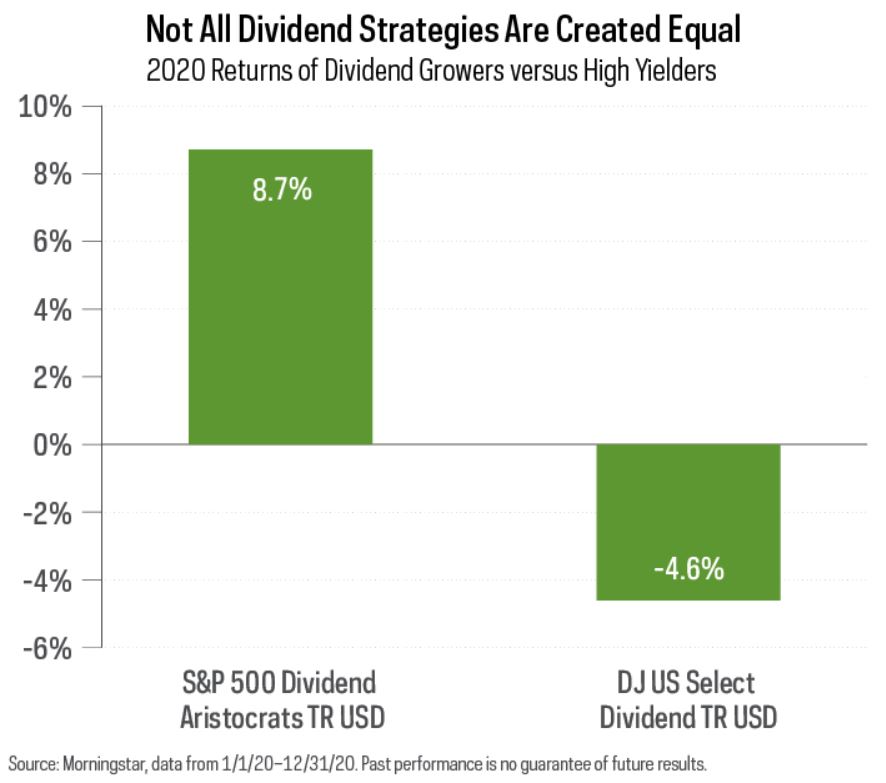

This distinction in dividend policy had a significant impact on performance. Across the market-cap spectrum, dividend growers outperformed dividend cutters by approximately 20%. Dividend strategies focused on high yield (represented by the Dow Jones U.S. Select Dividend Index) held proportionately more dividend cutters and saw their performance struggle. Dividend growth strategies (represented by the S&P 500 Dividend Aristocrats Index) fared much better.

WHERE IS THE DIVIDEND GROWTH?

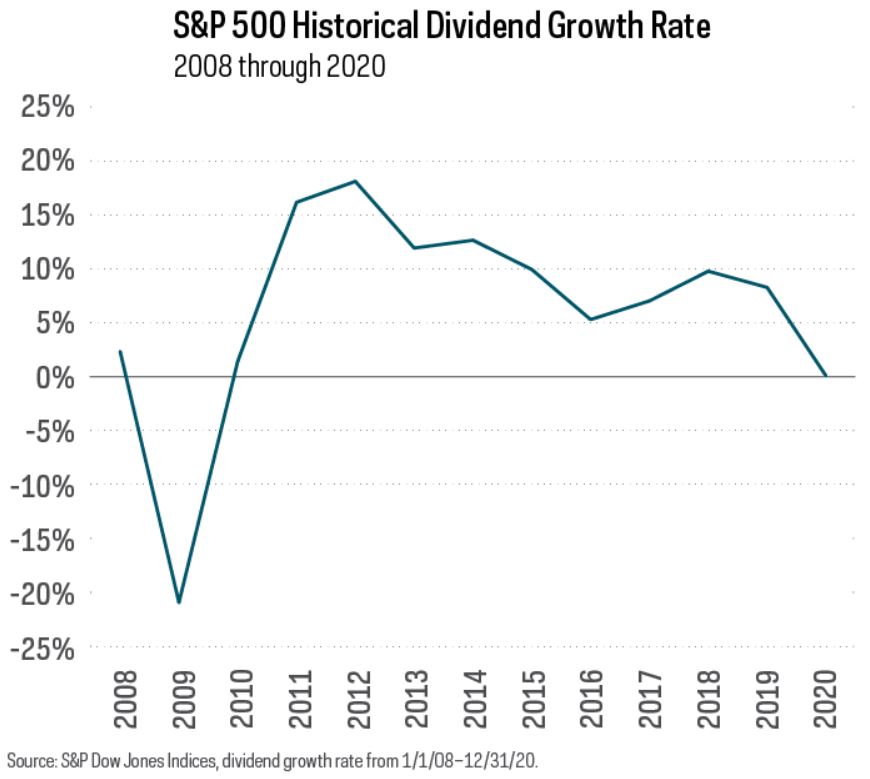

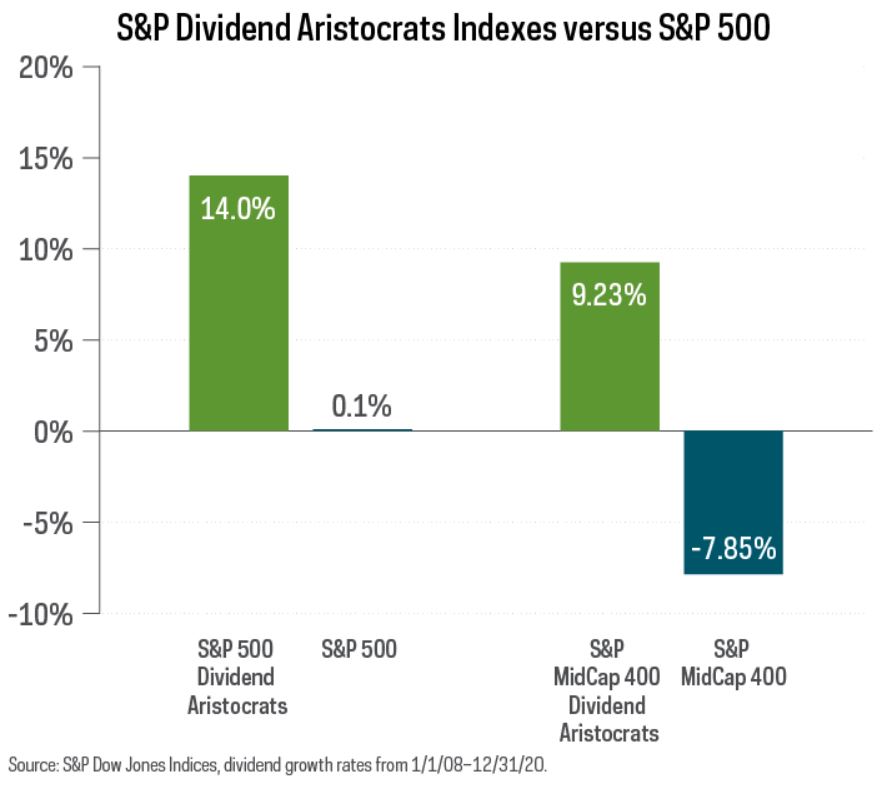

Although more companies grew their dividends than cut them in 2020, the rate of dividend growth among large-cap stocks has actually been trending lower for the last several years. And mid-cap stocks fared even worse, posting a dividend decline of roughly 8% for 2020.

Against this backdrop, one obvious place to look for sustainable and increasing income is dividend growth strategies. While dividends for the broad-market indexes were flat or down, S&P Dividend Aristocrat strategies delivered robust rates of dividend growth.

FINDING DURABLE DIVIDENDS IN 2021

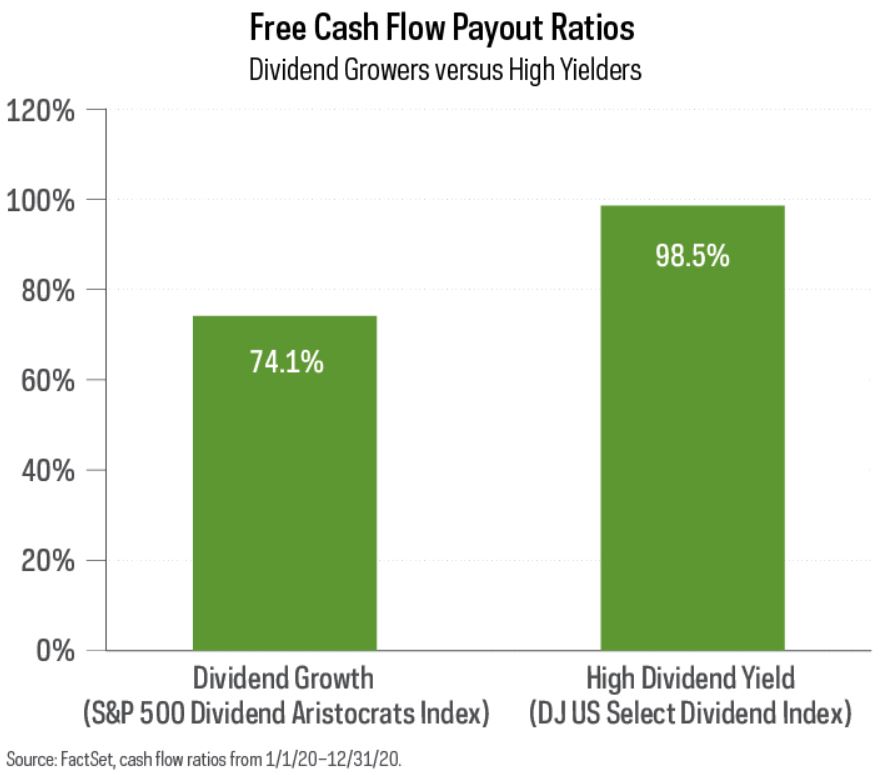

Analyzing cash flows can help identify companies capable of producing durable dividends. Over time, companies must create enough cash flow to pay expenses, invest in their business via capital expenditures, service their debt, and (sometimes) return money to shareholders via dividends and buybacks.

Free cash flow (“FCF”) measures the cash left over after a company pays its operating expenses and capital expenditures, and it represents the resources available to pay dividends.

Cash Flows from Operations (CFO) – Capital Expenditures = Free Cash Flow

Free cash flows can be turned into a payout ratio by calculating how much the company’s free cash flows it pays out in dividends.

Dividends / Free Cash Flow = Free Cash Flow Payout Ratio

A lower payout ratio gives companies the flexibility to continue paying and growing dividends, even if cash flows fluctuate. In contrast, companies with high payout ratios have very little flexibility and may have to cut or suspend dividends if earnings and cash flow falter. Dividend growth strategies generally appear better positioned, relative to high dividend yielding strategies, to sustain and grow their dividends.

While the worst of the pandemic’s impact on dividends appears to be behind us, we urge dividend investors to remain vigilant. Making a distinction between dividend growth and high yield strategies had important implications in 2020, and it will remain a key topic moving forward in 2021.

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

The “S&P 500® Dividend Aristocrats® Index” and “S&P MidCap 400® Dividend Aristocrats Index” are products of S&P Dow Jones Indices LLC and its affiliates. All have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on these indexes are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language