Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Race to Contain Cyberrisk

When it comes to cyberrisk, preparation matters. An attack is rarely a single event, but rather a series of events with increasingly serious consequences, as noted in a recent cyberrisk report by S&P Global Ratings. As the cost of attacks soars, executives and regulators around the globe are focused on best practices for attack prevention and response.

For instance, IT asset management — the process of logging, tracking and managing hardware, connected devices, software and networks — is critical to enterprise cybersecurity, S&P Global Ratings credit analyst Paul Alvarez said.

A 2017 breach at US credit reporting agency Equifax is estimated to have cost the company over $1.4 billion, including the cost of various settlements and security improvements, Alvarez said. In the incident, poor device tracking contributed to a data breach involving 147 million people, according to Equifax’s settlement agreement with the Federal Trade Commission.

Companies also face emerging financial risks as governments around the world draft stricter cyber-related disclosure policies and minimum preparedness standards, according to S&P Global Ratings credit analyst Vishal Merani. The additional disclosures regarding cyber incidents and cyberrisk preparedness that are demanded by regulators may ultimately contribute to S&P Global Ratings’ issuer credit ratings, the report said.

A July cyberattack that affected several major German banks highlights the risks associated with outsourcing certain services using third-party software and IT, S&P Global Ratings credit analyst Claudio Hantzsche wrote. While outsourcing some IT allows companies to keep up with technological developments at reduced costs, the practice could introduce vulnerabilities, the report said.

Third-party vendor risk is also noted in a June S&P Global Ratings report by credit analyst Li Yang. The report highlighted several potential increases in cyberrisk for institutions that may look to extract cost savings in IT departments if the economy falls into a recession. Other concerns include the rising cost of cybersecurity insurance premiums, which could lead some companies to reduce their insurance coverage amid a difficult economic environment.

Beyond banks, electric utilities are among the most attractive targets for malicious actors. Notably, the highly regulated nature of the utility industry has resulted in a higher baseline for cyber protection, S&P Global Ratings credit analyst Nicole Shen said. Nonetheless, utility management teams must continuously update their cyber practices to meet evolving threats, Shen wrote.

“Organizations are coming to accept that it is a matter of when, not if, they will be targeted by cybercriminals,” S&P Global Ratings credit analyst Martin Whitworth said. “That realization is changing the dynamic of cyberrisk management, pushing damage limitation to the forefront and, as a result, turning the spotlight on attack detection.”

Today is Friday, September 29, 2023, and here is today’s essential intelligence.

Written by Christina Mitchell.

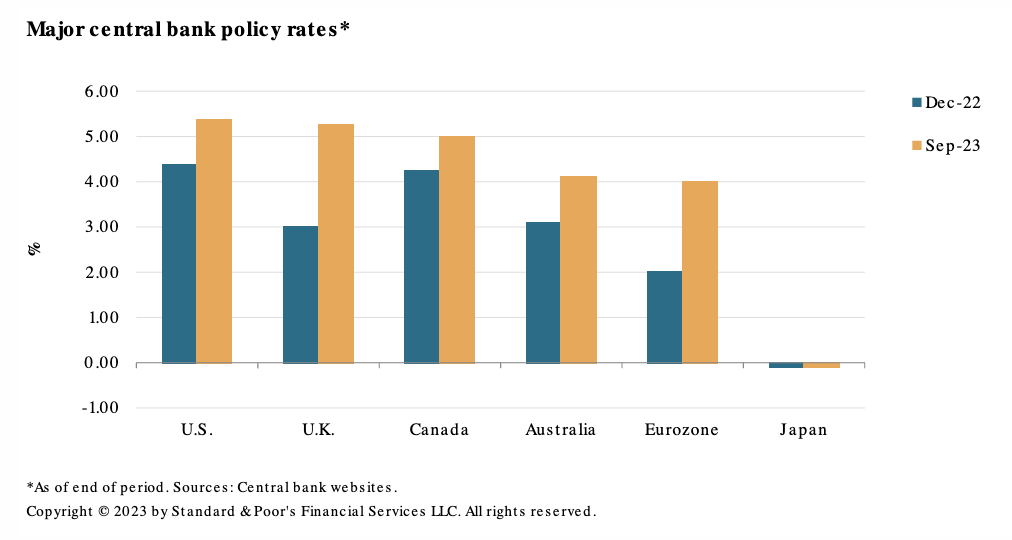

Global Economic Outlook Q4 2023: Nearing The Rate Plateau

Global economies have mixed macro narratives but a common short list of key issues. Inflation concerns still dominate in the West, fueled by strong services demand and tight labor markets. That being said, policy rates appear to have peaked and are likely to stay elevated into 2024. Weaker-than-expected Chinese growth reflects flailing confidence related to the debt-laden property market and has emerged as both a domestic risk and a global growth drag. The authorities continue to fine tune their response, and this slowdown will have uneven effects across countries.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

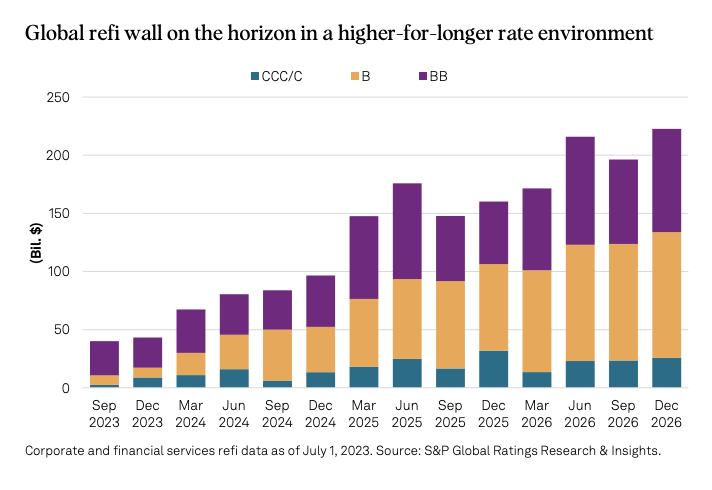

Global Credit Conditions Q4 2023: Resilience Under Pressure

Economies have avoided major pitfalls since the pandemic, helping borrowers partly offset, or at least postpone, the major headwinds from rising rates. Defaults have picked up in 2023 and will increase into next year among weaker borrowers. Investment-grade ratings can better absorb higher borrowing costs and are expected to see relatively muted credit deterioration ahead, though real estate could see some downgrades. Persistent core inflation, a drawn-out period of high rates and slower growth will challenge weaker-rated corporates and emerging markets. A more severe economic downturn, a longer-than-expected period of high rates, geopolitical events and challenges for China could derail S&P Global Ratings’ base case and lead to weaker business activity and market liquidity when large 2025 maturities loom.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

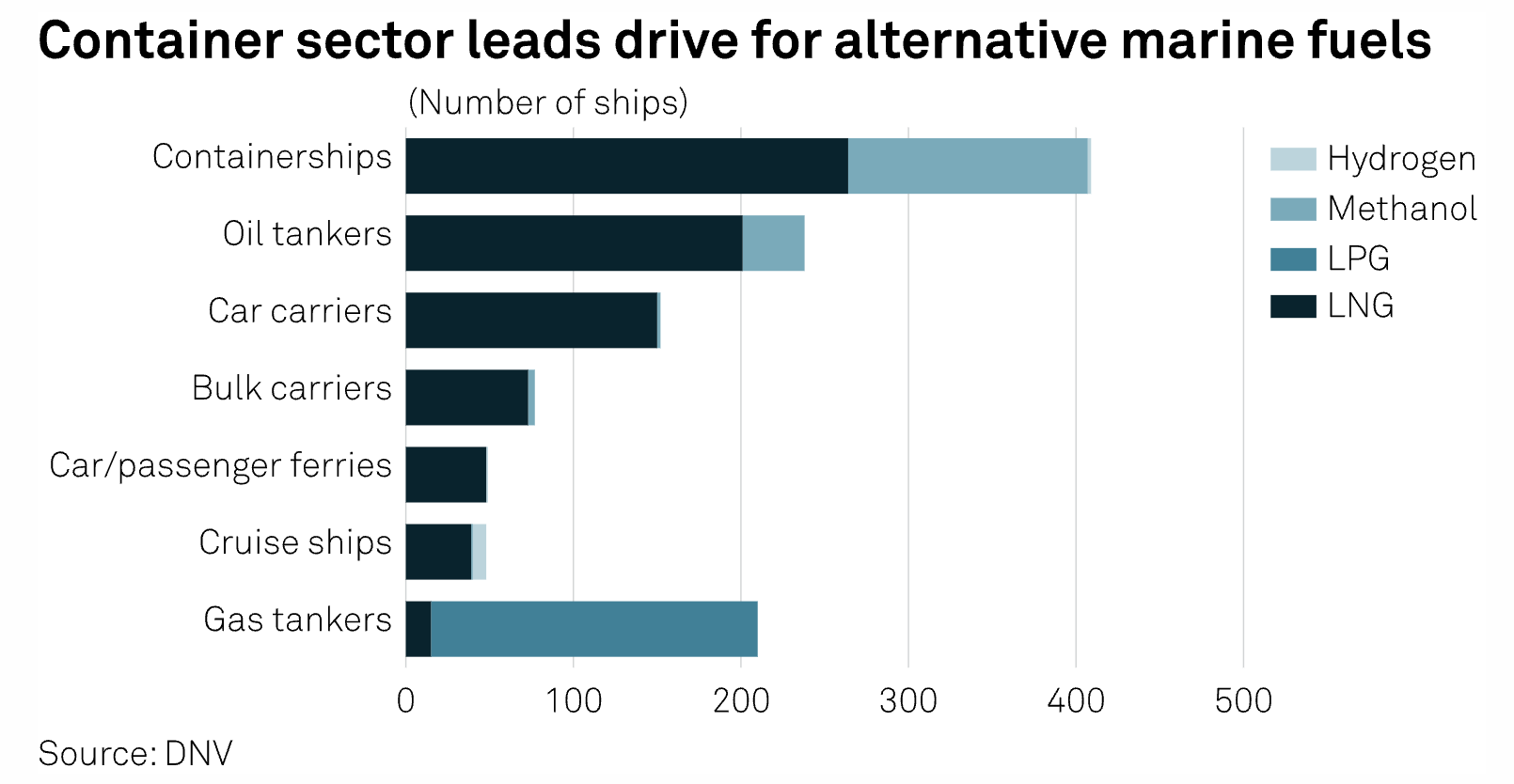

Alternative Marine Fuels: Monthly Market Indicators

Global seaborne trade will return to growth in 2023 as the shipping industry emerges from post-pandemic supply chain issues and adapts to changing cargo flows in the wake of Russia's invasion of Ukraine, the UN Conference on Trade and Development said Sept. 27. In its annual Review of Maritime Transport report, UNCTAD said maritime trade volume will expand by 2.4% this year after contracting by 0.4% in 2022 as "the industry remains resilient."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Unpacking Government’s Role In Catalyzing Low-Carbon Solutions

Last week, the ESG Insider podcast was on the ground at Climate Week NYC for a special series of interviews. In this episode, ESG Insider sits down on the sidelines of The Nest Climate Campus with Christopher Creed, chief investment officer of the US Department of Energy's Loan Programs Office. Christopher tells us that the loan programs office is working on deploying $350 billion worth of lending authority created under the US Inflation Reduction Act "to help catalyze energy projects" in the US.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

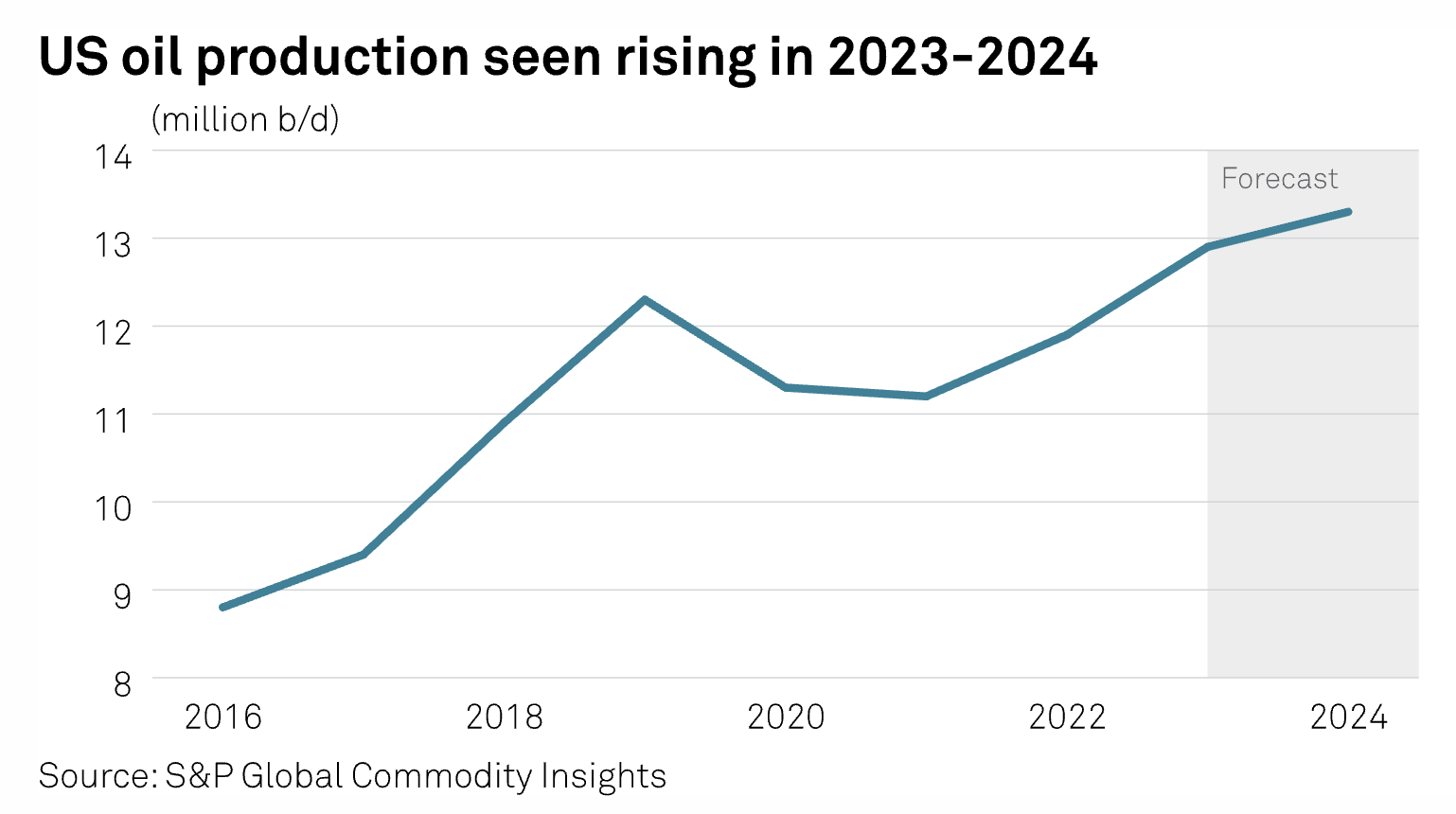

Well Drilling, Completion Costs To Rise In 2024: Dallas Fed Survey

A majority of oil and natural gas operators expect well drilling and completion costs to rise in 2024 versus 2023, even as inflation has moderated from peak levels seen a year ago and some service costs have dropped, the most recent Dallas Federal Reserve Bank energy survey found Sept. 27.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Fuel For Thought: Too Many Toys On The Shelf

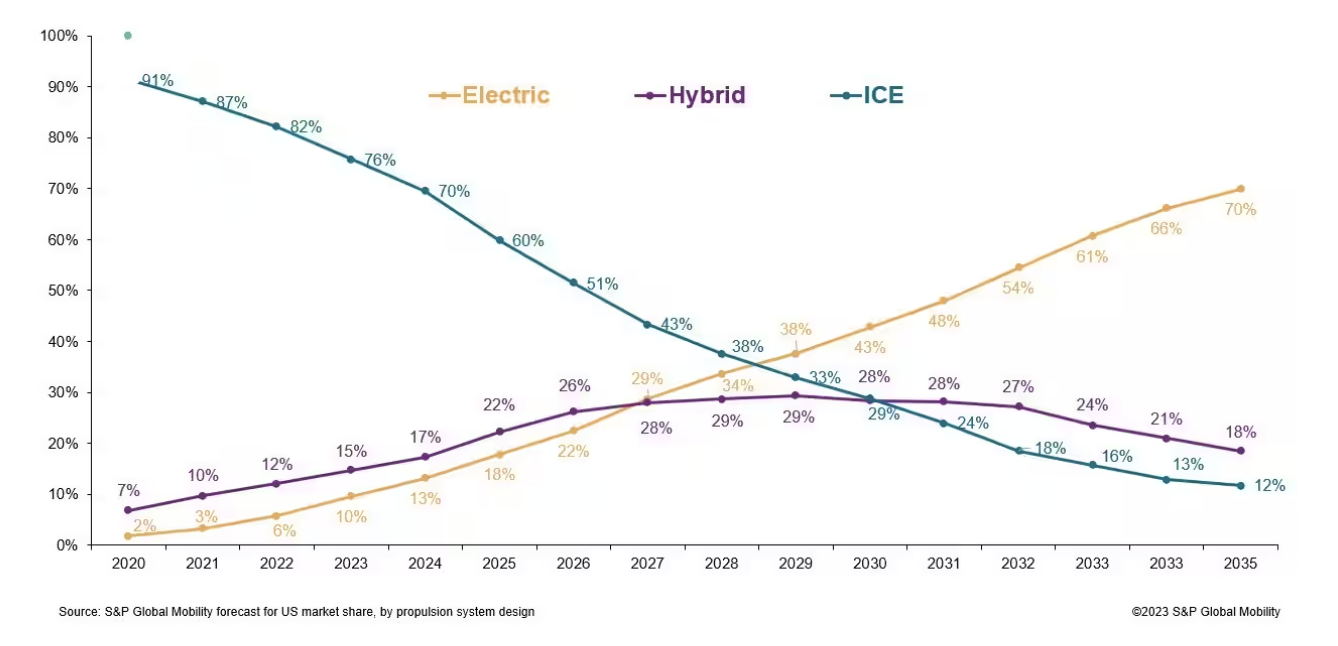

Today, US auto shoppers have nearly 450 vehicle nameplates to consider. Within five years, that number will grow considerably. With the arrival of electric vehicles across every mainstream and luxury brand, approximately 650 models will be competing for showroom space, lot space, digital space, marketing budget and, most importantly, customer attention. This isn't just a US phenomenon; a similar equation will happen in the European market — perhaps more so, as mainland Chinese automakers are already launching their EV-minded brands there as well.

—Read the article from S&P Global Mobility