Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Maximum Upheaval From a Mini-Budget

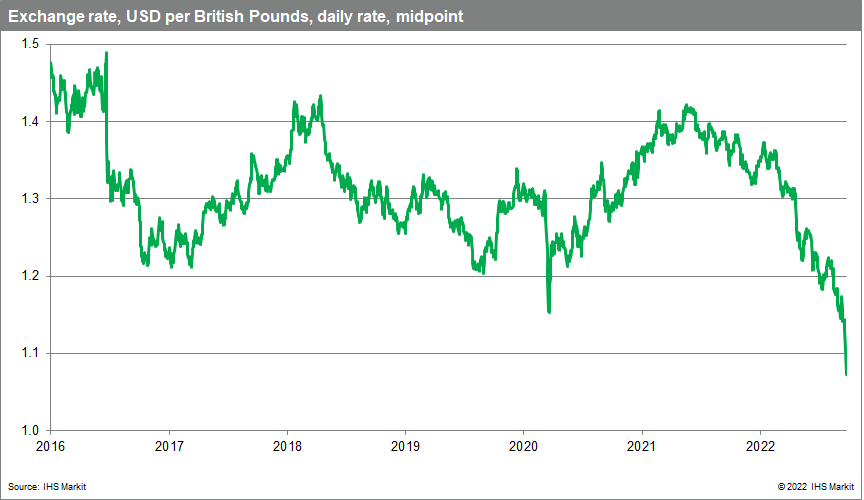

As the possibility of global recession looms, most countries are attempting to align their fiscal and monetary policies. Over the past week, the U.K. has been a notable exception. The Bank of England has been pursuing a policy of quantitative easing and higher interest rates for months. But new Chancellor of the Exchequer Kwasi Kwarteng has introduced a “mini-budget” that offers large tax cuts financed through increased government debt. This means His Majesty’s Treasury and the Bank of England may be working at cross-purposes.

With inflation in the U.K. running at approximately 10%, the Bank of England has adopted a relatively hawkish monetary policy. Its latest interest rate hike was 50 basis points. U.K. households are dealing with diminishing purchasing power due to inflation, which is expected to lead to a contraction in consumer spending over the winter, according to S&P Global Ratings. But some market observers have expressed concern that the higher interest rates needed to bring inflation expectations down are creating a drag on economic growth.

From that perspective, Kwarteng’s decision to share a budget with £45 billion in tax cuts might be interpreted as an attempt to ignite growth. Bond markets reacted badly. Interest rates on U.K. government bonds jumped sharply on the announcement, and the value of the pound plummeted against the U.S. dollar.

In a commentary published in early September, analysts at S&P Global Market Intelligence presciently suggested that “the incoming prime minister will not only be dealing with an economy that is facing a heightened risk of recession, but also a deteriorating labor market and persistent elevated price pressures linked to the soaring cost of energy.”

On Sept. 28, the Bank of England stepped in with an emergency commitment to buy £65 billion in long-dated bonds over the next 13 weekdays. Observers suggested that Kwarteng’s tax cut and the Bank of England’s response are potentially inflationary. The U.K.'s emergency fall budget, billed as "The Growth Plan," also included fiscal support measures for household energy bills and ambitious goals to accelerate the deployment of new energy projects.

Economic data from September suggests that the U.K. is already in recession, according to S&P Global Market Intelligence. The rising cost of living combined with higher energy prices is subduing demand and hitting output to an extent not seen since 2009. U.K. manufacturing output has dropped sharply, and the service sector appears to have stalled.

The weaker exchange rate for the pound will increase prices of imported goods, further diminishing consumers’ purchasing power.

The government of newly appointed Prime Minister Liz Truss has mostly reacted defensively to criticism of the budget by the International Monetary Fund, U.S. Federal Reserve, Bank of England and others.

Today is Thursday, September 29, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

U.K. Tax-Cut Plan Induces Short-Term Pain In Debt Market, Inflation Fight

Chancellor of the Exchequer (finance minister) Kwasi Kwarteng has delivered the biggest tax reduction since 1972, which amounts to GBP45 billion, or 1.5%, of GDP. U.K. Treasury must borrow an additional GBP72 billion between now and April 2023, or around 3% of nominal GDP. Such borrowing is getting more expensive as central bankers lift interest rates to tame the worst inflation in decades.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

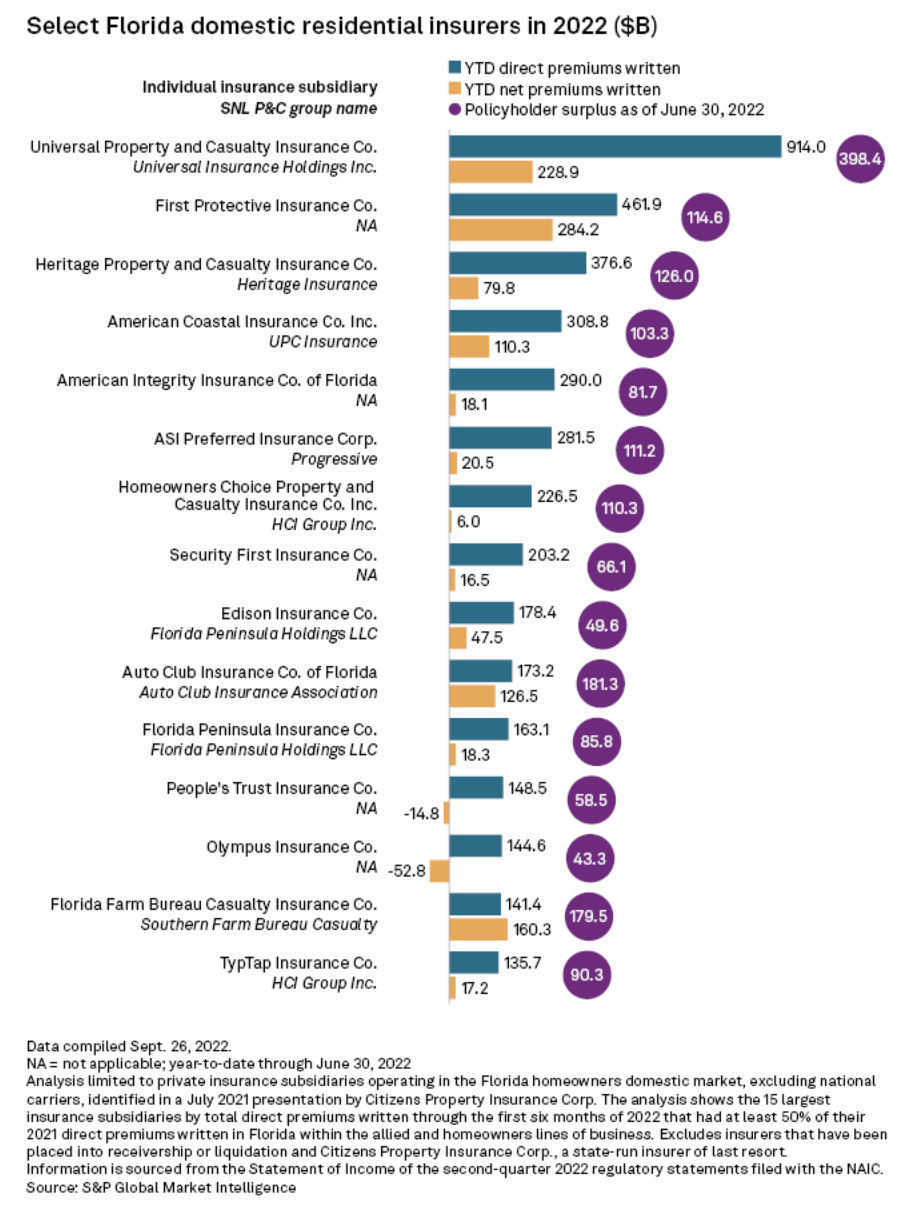

Florida's Citizens In The Eye Of Hurricane Ian After Rapid Growth On Gulf Coast

A sharp rise in policies in force along Florida's Gulf Coast leaves Citizens Property Insurance Corp. particularly exposed to the "1-in-100-year" wind and storm-surge damage expected from Hurricane Ian. State and local officials issued mandatory evacuation orders for at least a dozen counties in southwest Florida, including Charlotte, Citrus, Collier, Hernando, Hillsborough, Levy, Lee, Manatee, Pasco, Pinellas, Putnam and Sarasota. Highlands, Taylor and Glades counties were under voluntary evacuation orders. Even some portions of northeast Florida were ordered to evacuate due to the prospect of significant flooding.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

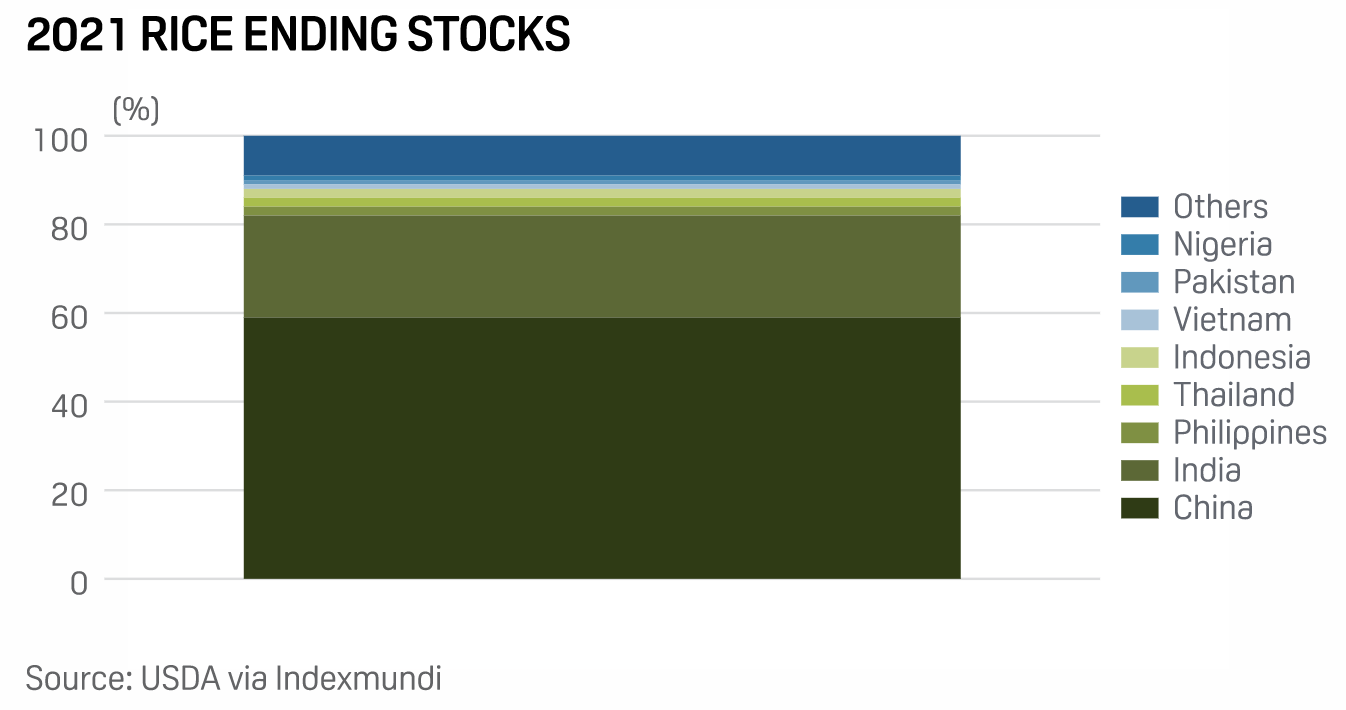

The Price Of Rice: A Beacon Of Stability In Agricultural Markets

In recent years, rice has emerged as an agricultural commodity with a reputation for relatively stable prices, when prices of most other agricultural products have been anything but. The main reason for this is the peculiar makeup of the rice market and how the international trade of the product is dominated by one actor in particular – India.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

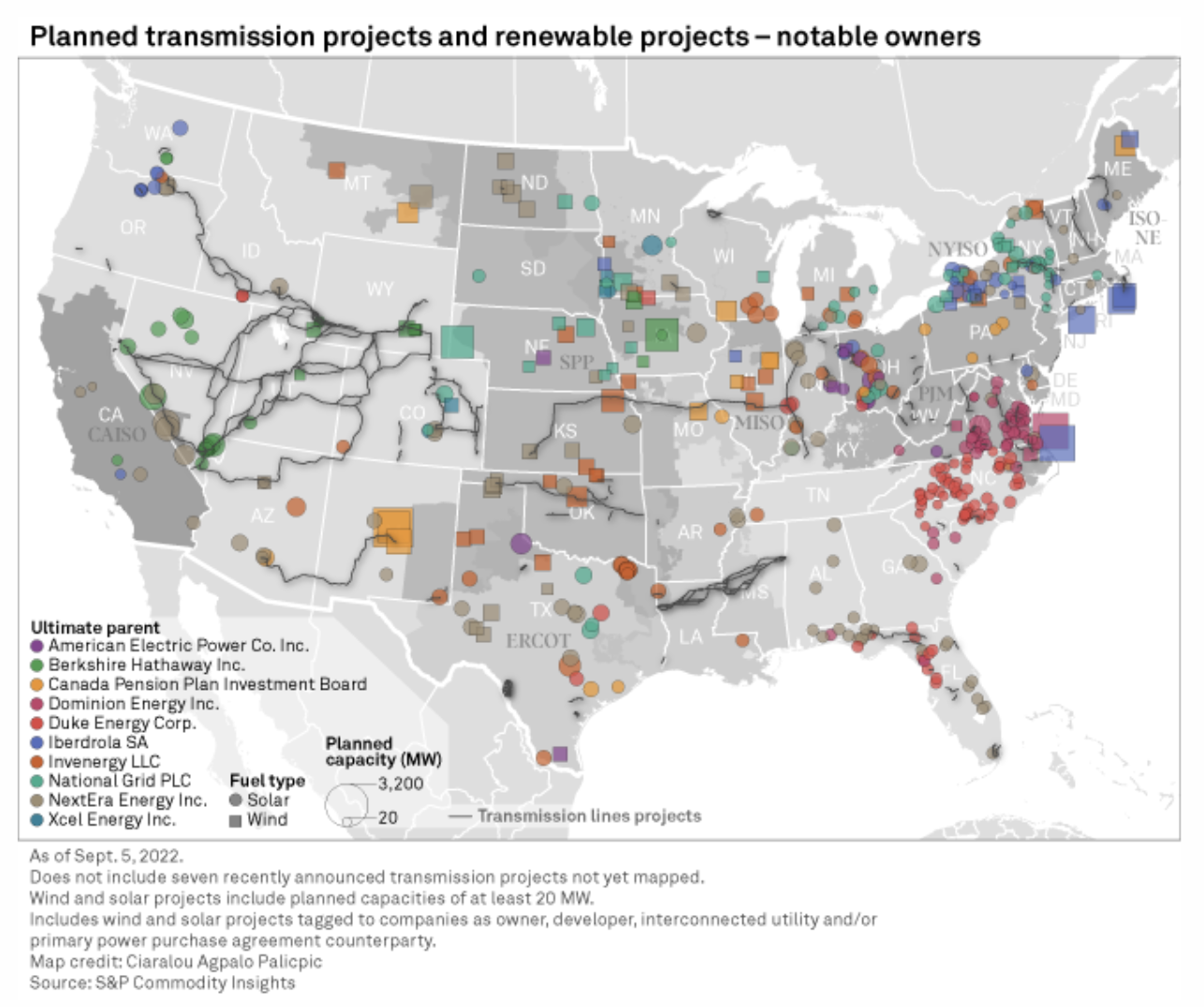

As IRA Drives Renewables Investment, Attention Turns To Transmission Upgrades

One of the most crucial and often overlooked segments of the clean energy transition is the upgrade and expansion of the electric transmission system across the U.S. Curtailment rates and grid congestion costs have risen for many independent system operators, or ISOs, as renewable penetration has continued to increase. The recently signed Inflation Reduction Act, or IRA, is expected to provide an additional jolt to already swelling pipelines for wind and solar, making the need for grid expansion and modernization all the more urgent.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

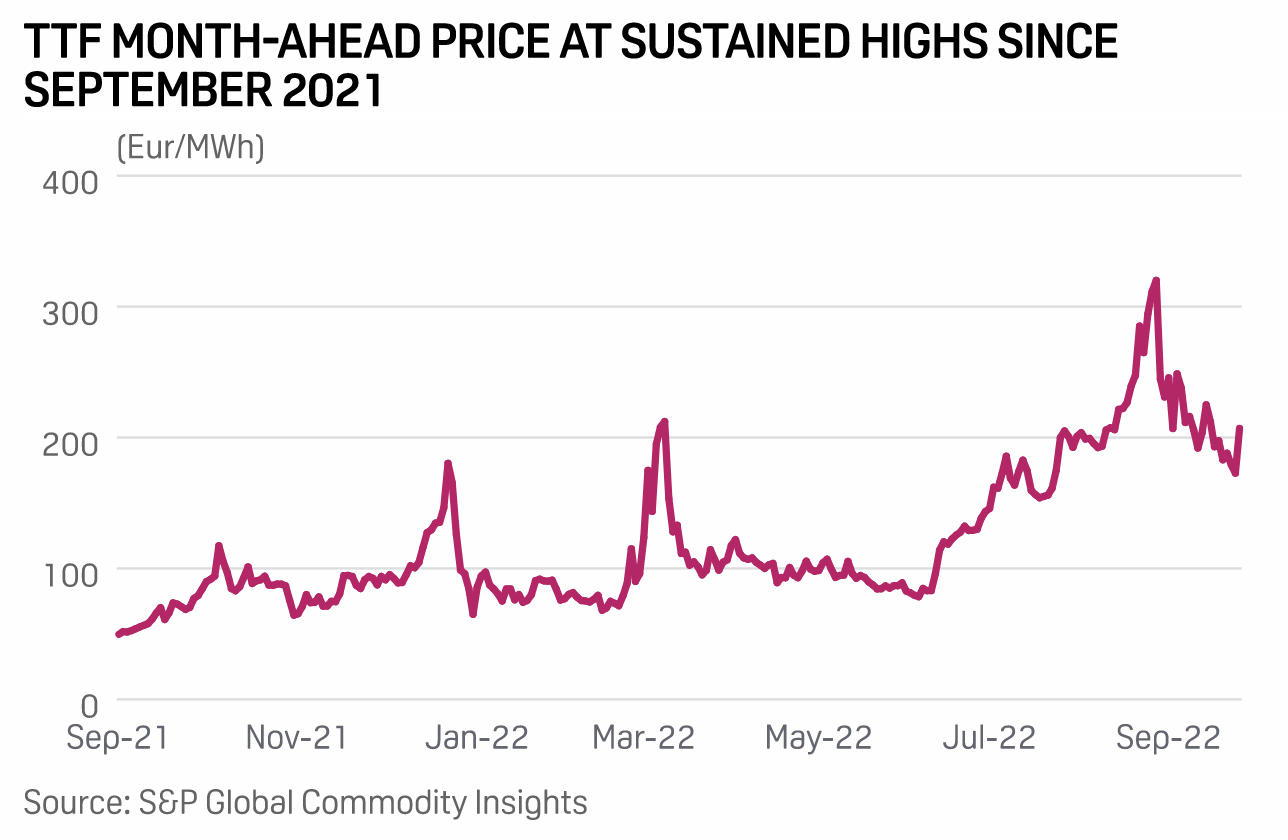

15 EU Member States Call For Price Cap On All Wholesale Gas Transactions

A total of 15 EU member states have called on the European Commission to present a proposal for a price cap on all wholesale gas transactions given the worsening European energy crisis. In a letter to the EC energy commissioner Kadri Simson, energy ministers from the 15 member states urged the EC to present a proposal for a wholesale gas price cap at a meeting of EU energy ministers on Sept. 30. "The energy crisis that started last fall has gotten worse over time and is now causing untenable inflationary pressures which are hitting our households and our businesses hard," the ministers said.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 84: The Bear Bites M&A

While tech had led the markets as it was running up, it’s also led on the way back down and that’s impacting merger and acquisition activity. M&A practice lead Brenon Daly is back with host Eric Hanselman to look at how the M&A environment has changed. The fuel that was heating dealmaking has been cut off and it’s also raising temperatures in the deal process.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence