Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Labor Markets Remain Tight

When the coronavirus pandemic first hit, unemployment jumped as commercial activities dried up and companies cut back on payroll. Since lockdowns eased, labor markets have come roaring back. Job vacancies remain at historic highs and many industries around the world are struggling to find qualified applicants. This has pushed up salaries in many countries.

Across the world, strong labor markets and rising inflation expectations have led to wage increases. In the U.S., labor markets remained strong in August, even though unemployment rose to 3.7%. While the economy posted fewer new jobs than it did in June and July, the August numbers were more than sufficient to absorb new entrants into the labor force.

“Our takeaway from the August employment report and other recent data on labor markets, including near-record job openings, is that labor demand is still very strong and labor markets are extraordinarily tight,” the Economics & Country Risk team of S&P Global Market Intelligence wrote in a recent article.

Sophie Malin, senior economist of the pricing and purchasing service at S&P Global Market Intelligence, believes that the record high vacancy rates of global labor markets remain a key risk to rising labor costs.

“The last six months have been a story of record high vacancy rates globally as the skill, and labor unavailability, has been exposed as economic activity levels have been recovering,” Malin said in a recent webinar. “We're starting to see a decline in job vacancies as the weakness in economic growth flows through to softer demand for labor and sees job postings decline. Despite this weakness, there's still a huge gap between demand and supply for labor.”

Industries that depend on skilled labor have been particularly hard-hit. Due to the stresses of the pandemic, many nurses chose to leave the healthcare industry. This compounded existing shortages, driving up demand and bill rates for nurses. The construction sector has also faced a global labor shortage that is driving up costs.

In the wind and solar energy industry, labor shortages are especially acute. In the U.S. and the EU, more than 2 million additional clean energy jobs will be created in the coming decade. Already, 89% of solar companies reported difficulties finding qualified applicants last year, citing competition, a small applicant pool, and a lack of training, experience and technical skills, according to a recent industry survey.

While growing economic headwinds are predicted to cool labor markets and moderate wage levels, companies are currently struggling to attract skilled and qualified talent.

Today is Monday, September 19, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of Sept. 19, 2022

Three of the largest five economies will hold their central bank meetings this week, including the U.S., Japan and the U.K. Attention very much focuses on the Fed after last week's higher than anticipated inflation figure. Other scheduled central bank meetings include the Philippines, Indonesia, Hong Kong SAR, Switzerland, Brazil and Taiwan. The week will end with flash PMIs for the U.K., U.S., Japan, Eurozone and Australia, which will give a key indication into economic performance at the end of the third quarter.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

A Roll-Up-The-Sleeves Moment For PE; VC Funding Rounds Plummet In August

The message at SuperReturn North America was clear: If private equity wants to reach desired return targets, they have to get to work and add value to portfolio companies through operational improvements. Firms can no longer count on multiple expansions fueled by steady economic growth and a free-flowing supply of labor, said Patrick Severson, a senior managing director at Vista Equity Partners Management LLC. Uncertain times create opportunity, but seizing that opportunity requires a greater degree of collaboration between management teams and investors, Severson added.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

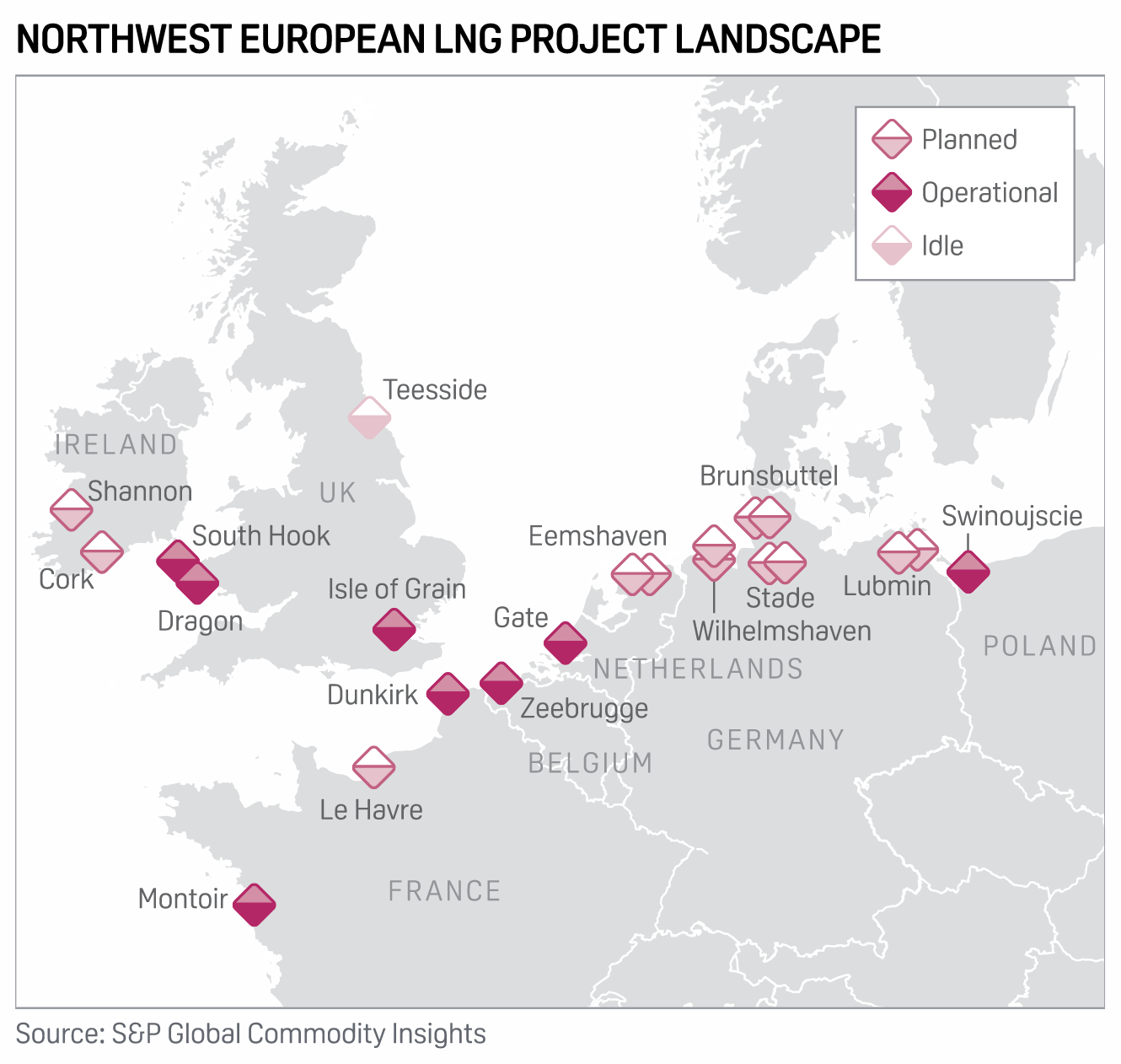

German Antitrust Authority Approves Coordinated Utility LNG Import Plans

Germany's antitrust authority has approved plans for three key German gas importers to coordinate LNG supplies to two floating LNG terminals, saying that the urgent need for new gas supply outweighed any competition concerns. In a statement Sept. 15, the Bundeskartellamt said it had no competition concerns about the way Uniper, RWE and EnBW/VNG were currently planning to work together at the Wilhelmshaven and Brunsbuttel FSRUs.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

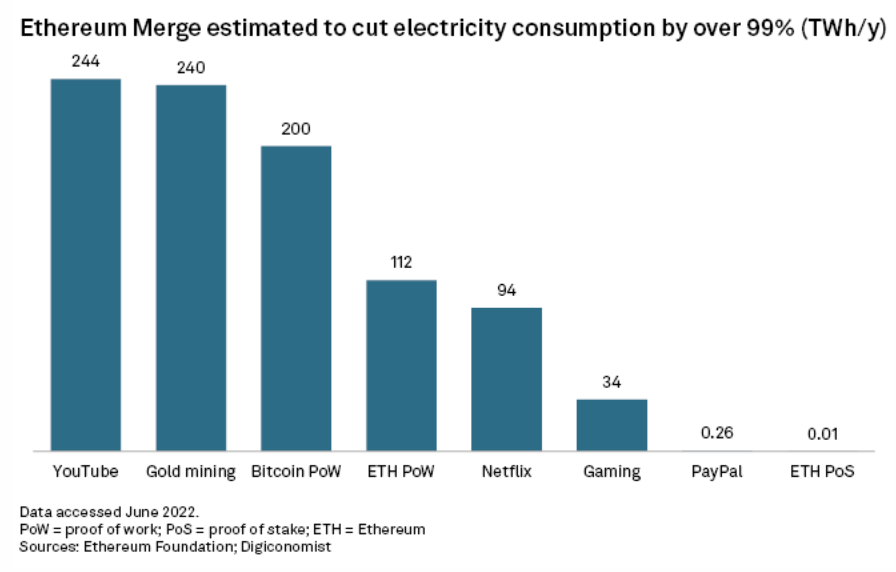

Ethereum's 99% Cut In Energy Use Will Curb Crypto's Climate Footprint

Ethereum, the world's second-largest cryptocurrency protocol by market capitalization, virtually eliminated its energy consumption overnight on Sept. 15 by successfully transitioning to a new consensus mechanism known as proof of stake. Although the long-awaited change did not result in a sudden price action for ether, the protocol's native crypto-asset, industry experts expect the shift to gradually alleviate concerns about how the use of blockchain technology is impacting the environment and demand for energy.

—Read the article from S&P Global Market Intelligence

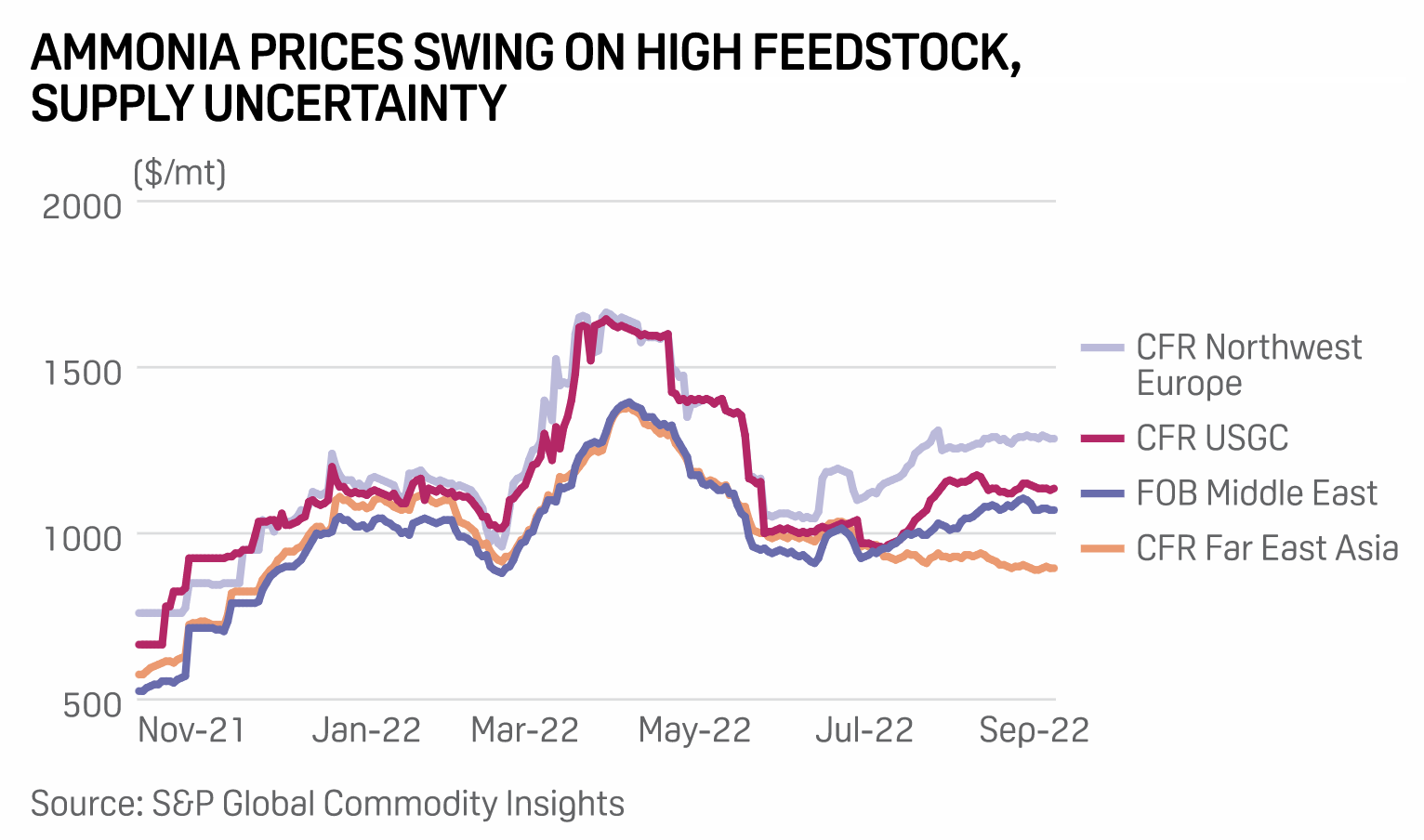

Unpacking Ammonia’s Market Landscape And Its Role In The Energy Transition

The surge in natural gas feedstocks costs in Europe in mid-2021 and the ongoing war between Russia and Ukraine boosted global ammonia spot prices to historic highs in April. For most of 2022, prices have been triple or quadruple the levels seen between 2016 and 2020. The abrupt stop of Russian and Ukrainian ammonia shipments out of the Black Sea after the Russian invasion of Ukraine in February slashed global supplies.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

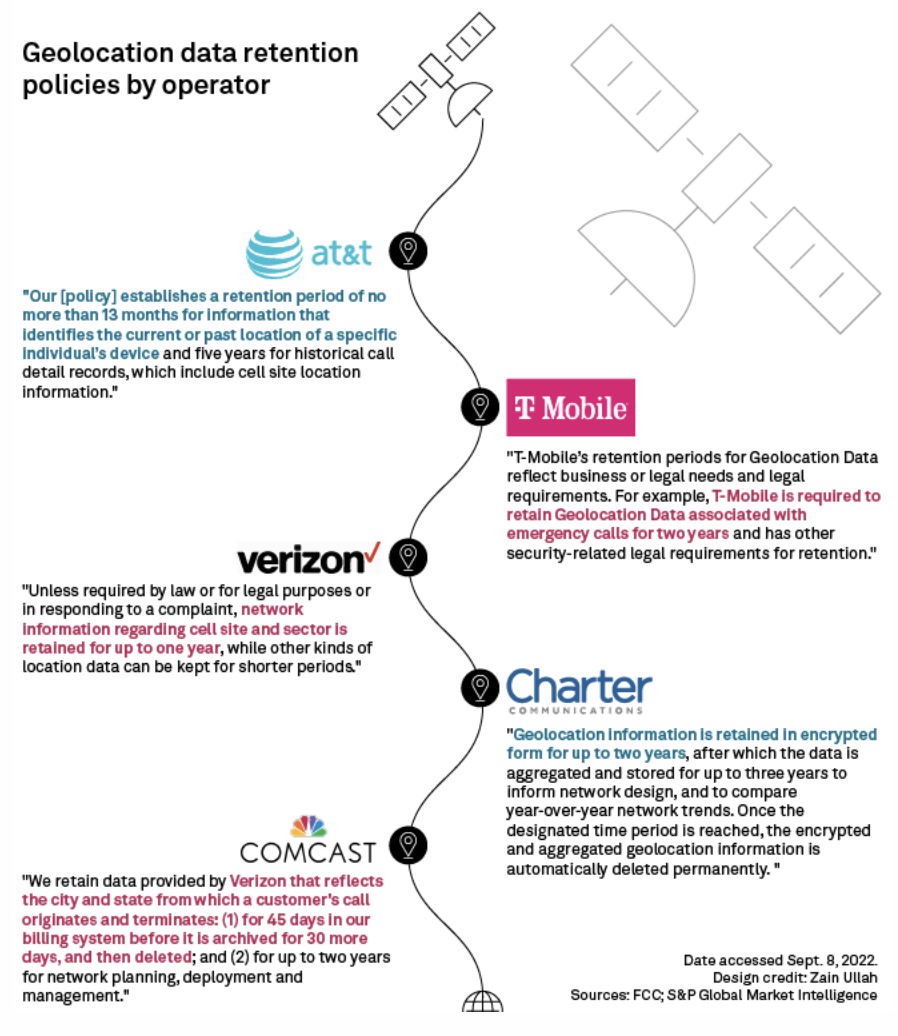

US Regulators Scrutinize Mobile Data Practices, Raising Enforcement Questions

The Federal Communications Commission is escalating an attempt to bring more regulatory oversight to mobile providers' data privacy practices. Chairwoman Jessica Rosenworcel recently called for an investigation into carriers' compliance with FCC rules that require mobile providers to fully disclose to consumers how they are using and sharing customer geolocation data. The investigation followed the FCC's receipt of responses to a data privacy probe commissioned by Rosenworcel that found inconsistent data privacy practices across the industry.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >