Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Remote Work and the Office Real Estate Market

Real estate has long been considered a hedge against inflation. However, low office utilization due to the global pandemic has affected some real estate investment trusts, or REITs. A REIT is a company that owns, operates or finances real estate, and many specialize in areas such as offices, hospitality or datacenters. While real estate is still considered a relatively stable asset in an inflationary period, the pandemic and its aftermath have introduced new challenges for some office REITs.

Globally, office utilization — the amount of office space occupied by workers — remains low. In Tokyo, office utilization is a relatively healthy 60% of pre-pandemic levels. In the U.S., office utilization was about 44% for a 10-city average in July, with 16.9% of office space in the country currently vacant. This is the highest vacancy rate seen since the global financial crisis of 2008. In addition, 3.9% of tenants are attempting to sublease unutilized office space. On the positive side, the 30-plus day delinquency rate for office loans was less than 1.5% as of the end of August 2021, compared with 1.3% before the pandemic.

Analysts at S&P Global Ratings believe that overall office occupancy levels are likely to remain well below pre-pandemic levels for the next few years due to slowing economic growth. Some market observers have suggested that increased unemployment could be a boon for the office real estate market since employers would have additional leverage to force more employees back to the office. But so far in this economic cycle, unemployment rates in the U.S. have stayed low.

REITs with extensive office holdings will remain relatively resilient due to the long-term nature of their leases and a stable tenant base, but this may change as leases expire. The leasing volume for office spaces is 15%-20% below pre-pandemic levels in the U.S. In the overall U.S. real estate market, net lease transaction volumes improved in the first half of 2022 compared with the same period of 2021.

According to S&P Global Market Intelligence, U.S. public pension funds are increasing their real estate allocations to hedge against volatile market conditions. Real asset prices tend to rise as inflation increases since landlords can set rents higher to offset inflationary pressures. According to S&P Global Market Intelligence, eight U.S.-based publicly traded REITs raised their regular dividend payments in August.

S&P Global Ratings expects that the office real estate market will bifurcate between class A and class B properties over the next year, with class A properties able to command higher rents and occupancy rates. Depending on their mix of properties, some REITs that specialize in office spaces will remain strong, while others may be cursing the large pool of remote workers that refuse to revisit their commute.

Today is Friday, September 16, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Listen: The Essential Podcast, Episode 67: Pyramid Of Lies — Reporting On Greensill Capital

Duncan Mavin of Dow Jones joins the Essential Podcast to talk about his new book, "The Pyramid of Lies: Lex Greensill and the Billion Dollar Scandal." Duncan discusses Greensill Capital and its collapse, which damaged the reputations of a former U.K. Prime Minister, prominent venture capitalists and Credit Suisse. He also talks about the bizarre experience of reporting on a company where the red flags were obvious, and yet thoroughly ignored by investors.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on the global economy >

Transaction Banking Revenues Hit Highest Level Since Global Financial Crisis

Transaction banking revenues have reached their highest level since the global financial crisis, as the industry benefits from rising interest rates and huge corporate demand for financing. The world's 10 largest transaction banks posted a combined revenue of $15.6 billion from cash management and trade finance in the first six months of 2022, according to new data by Coalition Greenwich. That represents a 22% rise from $12.8 billion in the same period last year.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Potential U.S. Rail Strike Threatens Coal Supply Logistics, Gas Demand Forecasts

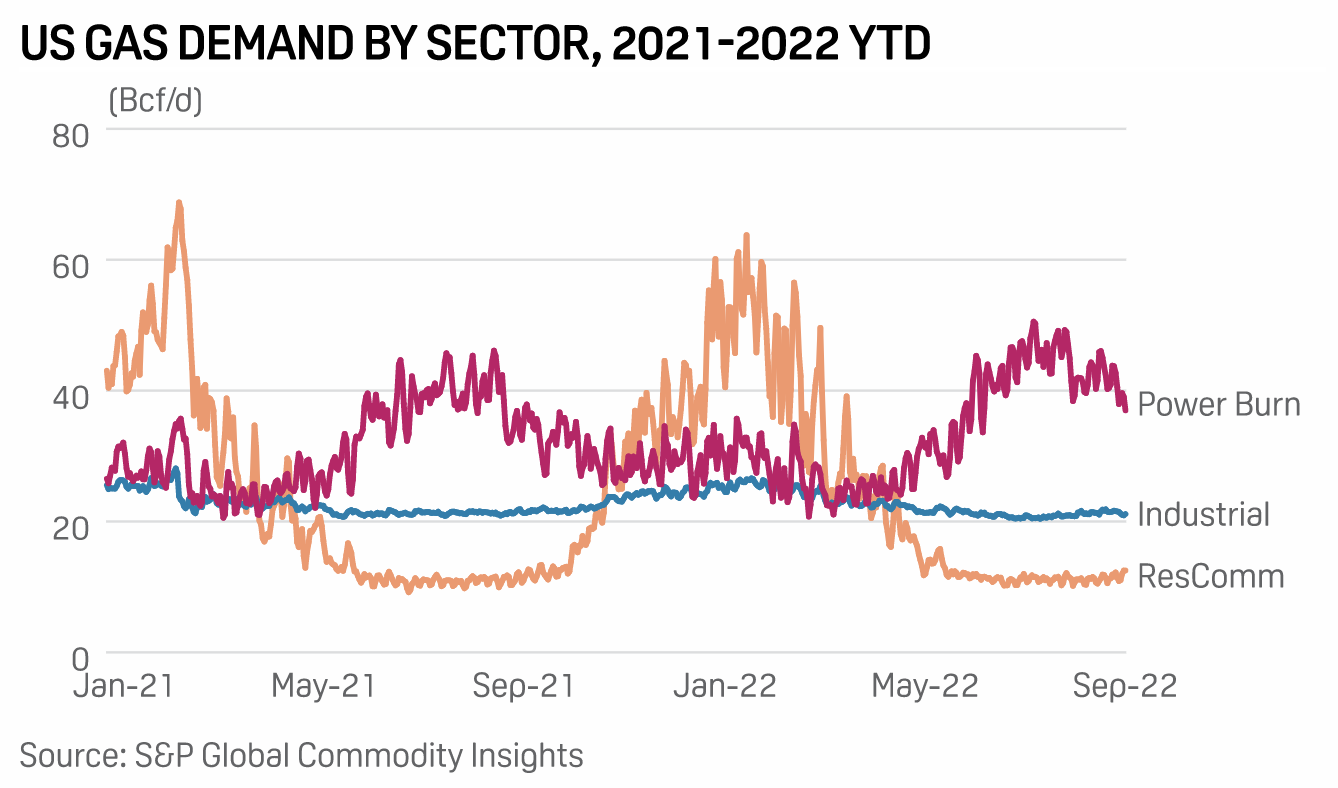

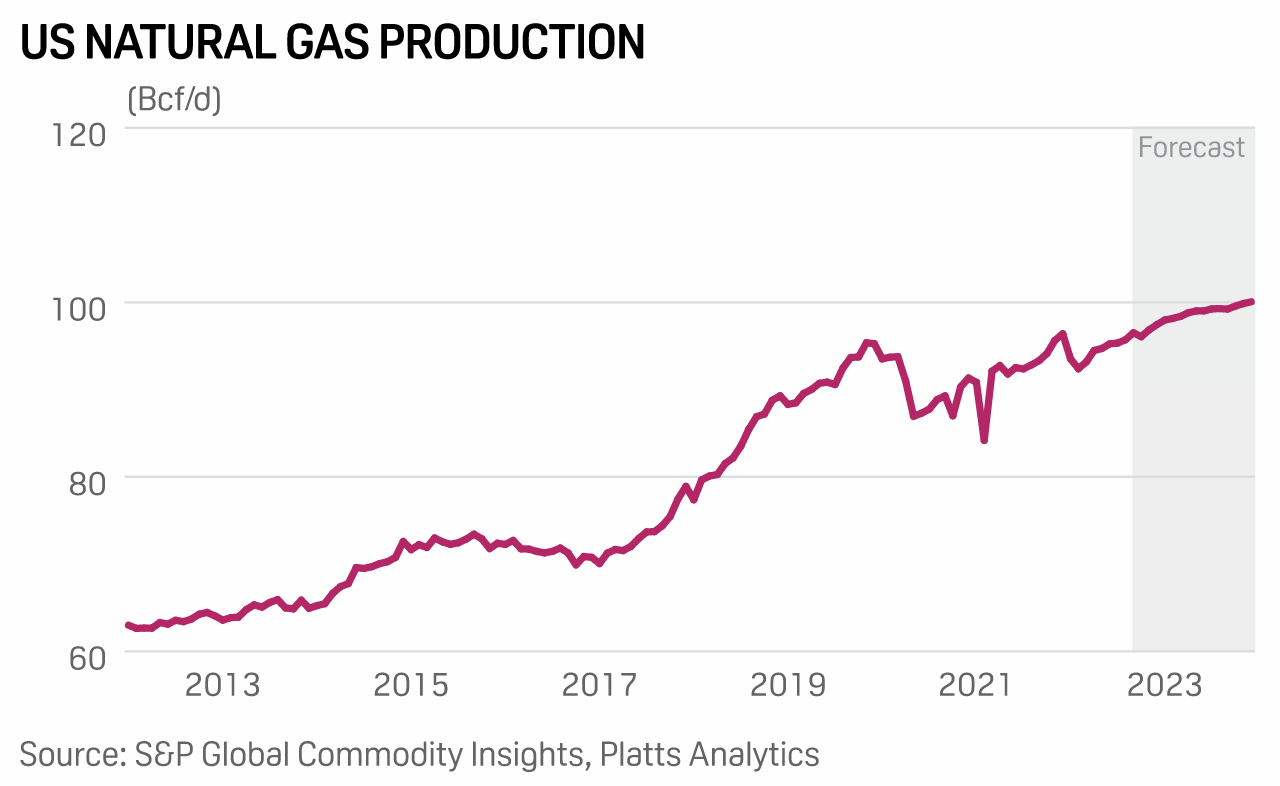

Growing demand for natural gas in the U.S. power sector is supporting record-high forecasts for year-long gas consumption, but a looming rail strike could drive up demand even further than previously expected if coal-by-rail supplies are interrupted. The U.S. Energy Information Administration forecast in its latest Short-Term Energy Outlook that U.S. end users would consume 86.6 Bcf/d in gas across 2022, a record-high, with gas power burns up this year due in part to retirements of coal-fired plants once crucial to the U.S. energy mix.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Changes In U.S. Wind Speeds Since 2000 Point To A Dynamic Landscape

With the passage of the Inflation Reduction Act, which will solidify renewable energy tax credits for the next 10-plus years, prospects for land-based wind farms are rosier. This is a much-applauded boost to a wind energy sector that has seen a decrease in wind additions over the past year due to pandemic-related supply chain disruptions. The performance of a wind turbine is highly correlated with local climatology, with a turbine’s power output proportional to the cube of the local wind speed.

—Read the article from S&P Global Market Intelligence

U.S. Midterms 2022: IRA Bill Could Be Top Target Of Republican Oversight Agenda

Should Republicans reach a majority in the U.S. Congress in the November midterm elections, the party could put Democrats' energy and climate policies under intense scrutiny — even as obstacles remain to advancing major Republican goals in that space. Although Democratic President Joe Biden could veto any Republican-sponsored bills that threaten his agenda, tough oversight from a Republican majority could target implementation of the Inflation Reduction Act, with its billions in energy and climate spending.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 82: Flexible Infrastructure

Enterprises are working hard to meet the needs of developers and lines of business, but it’s a much more challenging task with the polyglot resources they’re pulling together. Senior analyst Jean Atelsek and research director William Fellows are back on the podcast with host Eric Hanselman to explore this shift and look at data that point to how it will be addressed. They revisit the question of whether the cloud should be treated as a special case. Can we manage a market with 1,000 aisles?

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence