Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The U.K. Confronts Economic and Social Instability

The U.K. is undergoing a period of transition. While the passing of Her Majesty Queen Elizabeth II has symbolic weight and importance for many residents of the country, the appointment of a new prime minister and the reverberations of Brexit will have material and financial implications for the U.K. These implications are coming into focus.

Newly appointed Prime Minister Liz Truss, having recently emerged from a bruising leadership contest with former Chancellor Rishi Sunak, entered 10 Downing Street at a moment of economic instability. While inflation across Europe has risen since the beginning of 2022, hitting 8.9% in July, inflation in the U.K. was 10.1% that same month. This inflation rate was the highest in more than 40 years. Real wages in the country are predicted to decline throughout 2022, creating a cost-of-living squeeze for households. Corporates are also feeling the pinch of persistent wage increases and higher core input costs from inflation.

According to Chris Williamson, chief business economist at S&P Global Market Intelligence, a severe downturn in U.K. manufacturing has coincided with a slowdown in the services sector. This contributed to August seeing the steepest fall in production since the height of the global financial crisis. Job growth, which was strong in the wake of lockdowns, has begun to weaken. S&P Global Ratings predicts late or nonpayment of mortgages will increase among U.K. borrowers as they struggle with the highest cost-of-living increase in decades.

On the positive side, compared with its former peers in Europe, the U.K. has a debt-to-gross domestic product ratio of 99.6%, which compares positively with those of France and Spain. The Bank of England has pursued a hawkish monetary policy, aggressively hiking interest rates to address inflation. The new prime minister has also been focusing on the cost-of-living crisis. One of her first official acts was to announce plans to subsidize energy bills this winter, capping average households’ costs at about £2,500 per year.

The financial sector remains an area of strength, despite predictions it would suffer post-Brexit. U.K. banks continue to compare favorably with European lenders for both investment and commercial banking. According to S&P Global Ratings, U.K. banks reported strong earnings in the first half of 2022, driven by sharp year-over-year growth in net interest income. The country’s banks have navigated this year’s cost-of-living increases, inflation and higher interest rates. Analysts believe that they are well-placed to manage an economic slowdown.

Today is Tuesday, September 13, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

The Russia-Ukraine War Is Reshaping The Fertilizer Industry

The effects of the Russia-Ukraine war may reverberate through the global fertilizer industry for years to come. Post-COVID supply-chain disruptions had already pushed fertilizer prices to cyclical highs in 2021. Russia's invasion of Ukraine in February, and the sanctions and trade supply disruptions that followed, then pushed prices even higher. Russia is a major producer of the three main types of fertilizers — nitrogen, phosphate and potash — and a major exporter of key raw materials for fertilizer production elsewhere in the world.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Inflation Risks Intensify For Corporate Australia

Corporate Australia faces a stern test. Balance sheets are strong. And they will need to be because in the next two years the ride could get rough. Interest rates are rising to combat stubborn inflation linked to the recovery from the pandemic, supply chain problems and booming commodity prices. This is likely to slow the economy and reshape the operating and capital market environment of the past few years. Wage and other cost inflation, rising interest rates, supply squeezes and softening demand will shackle earnings and credit measures.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Nowhere To Hide: Global Polymer Prices Plunging After Two Years Of Growth

It took a global pandemic's pent-up demand, supply disruptions on extreme weather, cheap borrowing costs and Russia's invasion of Ukraine to send worldwide polymer prices to all-time highs since mid-2020. But record-high inflation, rising interest rates, acute supply chain clogs and recession fears threw ice on that sizzling demand, prompting swift price declines and market uncertainty.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Climate Week Countdown How The Climate Landscape Is Evolving

In this episode of the ESG Insider podcast from S&P Global Sustainable1, hosts Lindsey Hall and Esther Whieldon preview what to expect during Climate Week NYC, which begins Sept. 19. Climate Week has run annually since 2009, convening leaders from business, government and the climate community through hundreds of events held across New York City. The goal is to drive climate action, and this year the tagline is “Getting it Done.”

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Skills Shortage Imperils Global Energy Transition

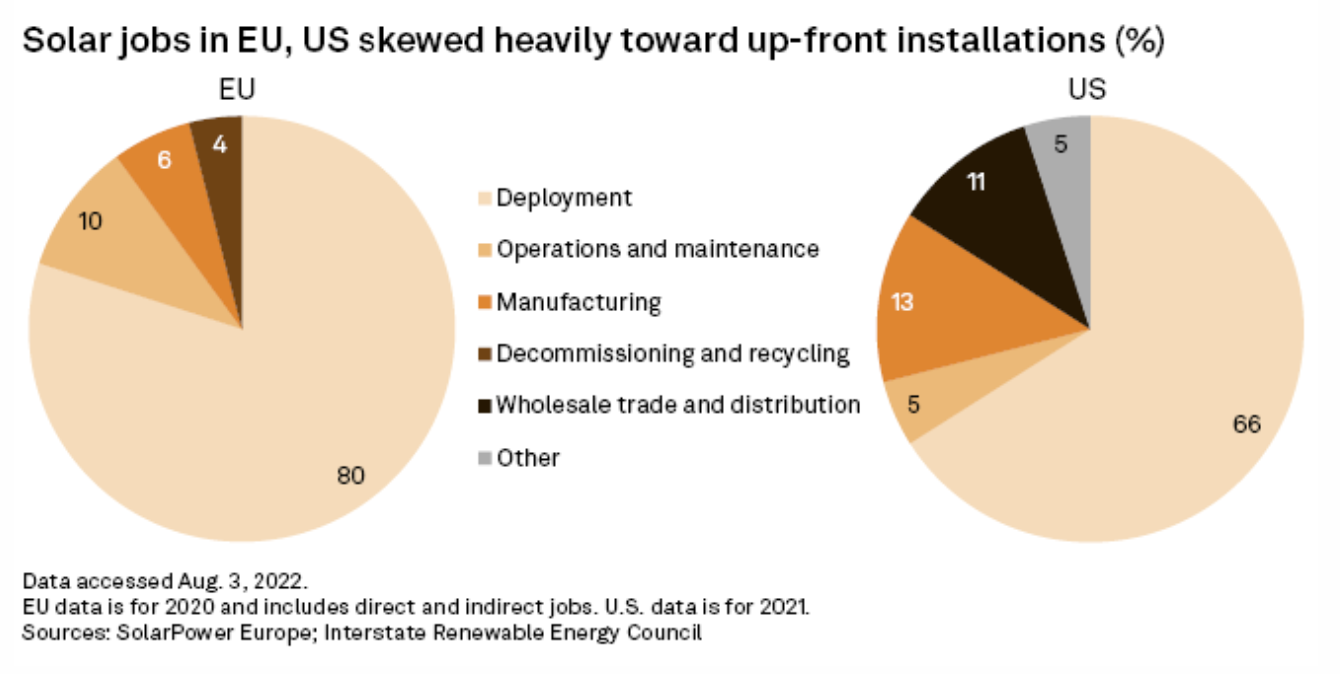

As renewable energy targets swell across the world, the availability of skilled workers risks becoming a bottleneck for deployment. In the EU, 650,000 people work in wind and solar energy. This figure is set to double in the next eight years, according to trade associations SolarPower Europe and WindEurope. The U.S. is seeing a similar growth pattern, with the country's new Inflation Reduction Act expected to generate nearly 1 million additional clean energy jobs each year in the coming decade.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Sales Forecasts Strong As Apple Skips US Price Hikes For New iPhone Lineup

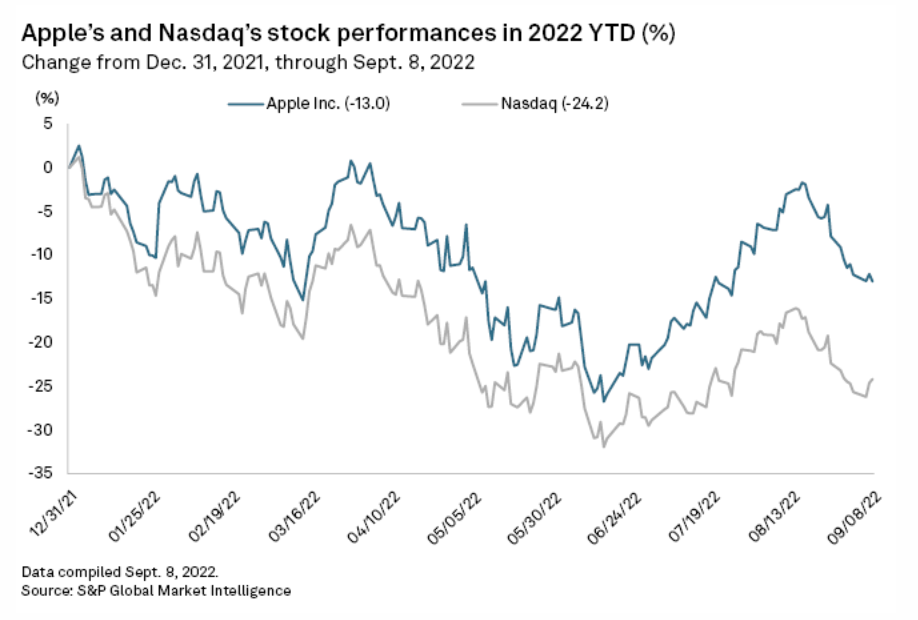

Apple Inc.'s new lineup of iPhones will have a lower price point than Wall Street expected, raising hopes for strong mainstream demand. The company on Sept. 7 unveiled its iPhone 14 lineup, including a base model that starts at $799, the same amount that it initially charged for last year's iPhone 13. The higher-priced iPhone 14 Pro Max starts at $1,099, the same as the iPhone 13 Pro Max.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >