Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Reinsurance, A Lynchpin Under Pressure

Insurance is a nice business. Collect premiums, invest the capital and pay out claims based upon reliable actuarial models. Unfortunately, sometimes unexpected occurrences such as natural disasters and global pandemics cause those models to become temporarily less accurate. That’s where reinsurance comes in. This insurance for insurers is a way to spread the risk and reduce the financial exposure for individual insurance companies.

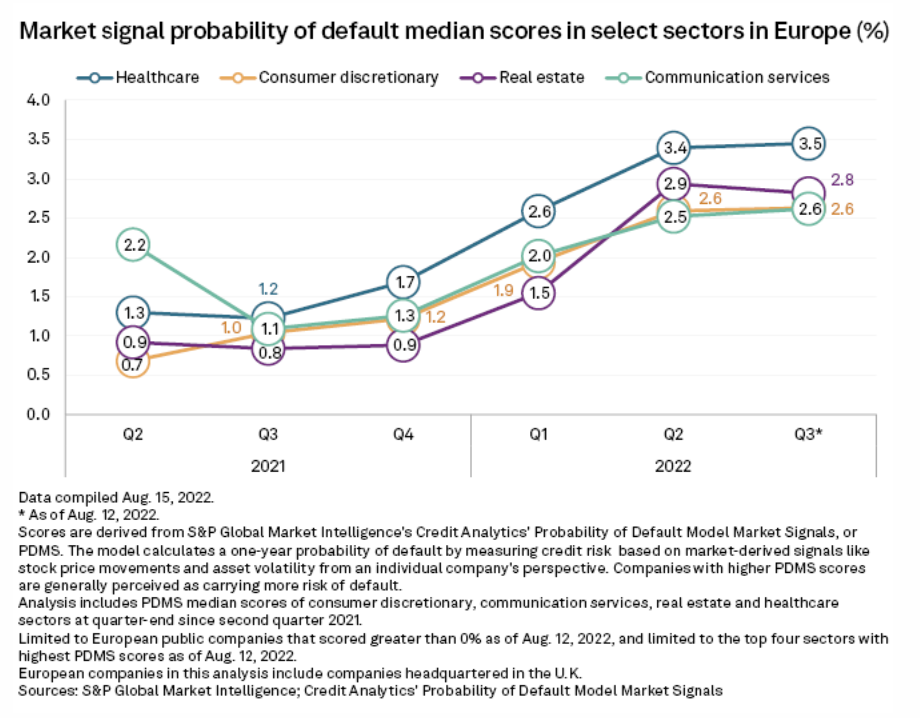

Reinsurance is a very large and important industry, but the current outlook for the global reinsurance sector remains negative, according to S&P Global Ratings, which covers the industry extensively. Natural disasters, COVID-19 pandemic losses and the war in Ukraine have negatively impacted performance over the past five years. As a result, large reinsurance companies have steadily increased their prices, a trend that is expected to continue in 2023. Scor SE, one of Europe's four biggest reinsurers, recorded a loss in the first half of 2022 due to capital markets turmoil as well as natural disasters, war and the pandemic.

Reinsurance companies have struggled to earn more than their cost of capital due to high inflation and rising interest rates. Inflation is challenging because it can elevate the cost of paying out claims. If new cars are more expensive due to inflation, then insurance may be responsible for the higher cost of replacement.

Rising interest rates increase the cost of capital for everyone. But the reinsurance industry has been weak in covering the cost of capital for years. Since reinsurance companies invest the premiums they receive from insurance companies, mark-to-market losses on those investments have eroded capital buffers in 2022. Treasurys and equities are down this year, but bond yields are up. So, prudent capital management and careful risk management should allow the industry to meet its capital needs. At the same time, reinsurance companies need to improve underwriting earnings and increase investment income.

Cyber insurance is a potential bright spot for reinsurance companies. The demand for cyber insurance, and for reinsurers willing to underwrite it, greatly exceeds the supply, leading to significant rate rises.

Reinsurance is particularly sensitive to the effects of climate change. Some carriers have reduced their exposure to homeowners insurance in the areas most exposed to hurricanes. Many reinsurance companies, particularly after the hurricane seasons of 2004 and 2005, have recalculated their models regarding the frequency and severity of tropical storms. While about half of the top reinsurance companies see an opportunity in growing their natural catastrophe net exposure, the other half is reducing their exposure.

One of the challenges of evaluating global reinsurance has been to separate reinsurance from the primary insurance business, especially when the reinsurance operation is a division within a company. Reinsurance tends to be a more volatile industry than insurance. Many Bermudian reinsurers have adopted a hybrid model to manage that volatility through diversification.

Due to a favorable regulatory and tax environment, established infrastructure and proximity to the U.S., Bermuda has become the location of choice for reinsurance startups, according to S&P Global Ratings. However, like the industry, Bermudian reinsurers' underwriting profitability has been lackluster over the past five years. During that period, Bermudian reinsurers have posted $21 billion in natural catastrophe losses and $3 billion in COVID-19-related claims. While it is tempting to hope that the number of claims related to natural disasters and global pandemics will revert to the mean, the trends are concerning.

Today is Monday, September 12, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

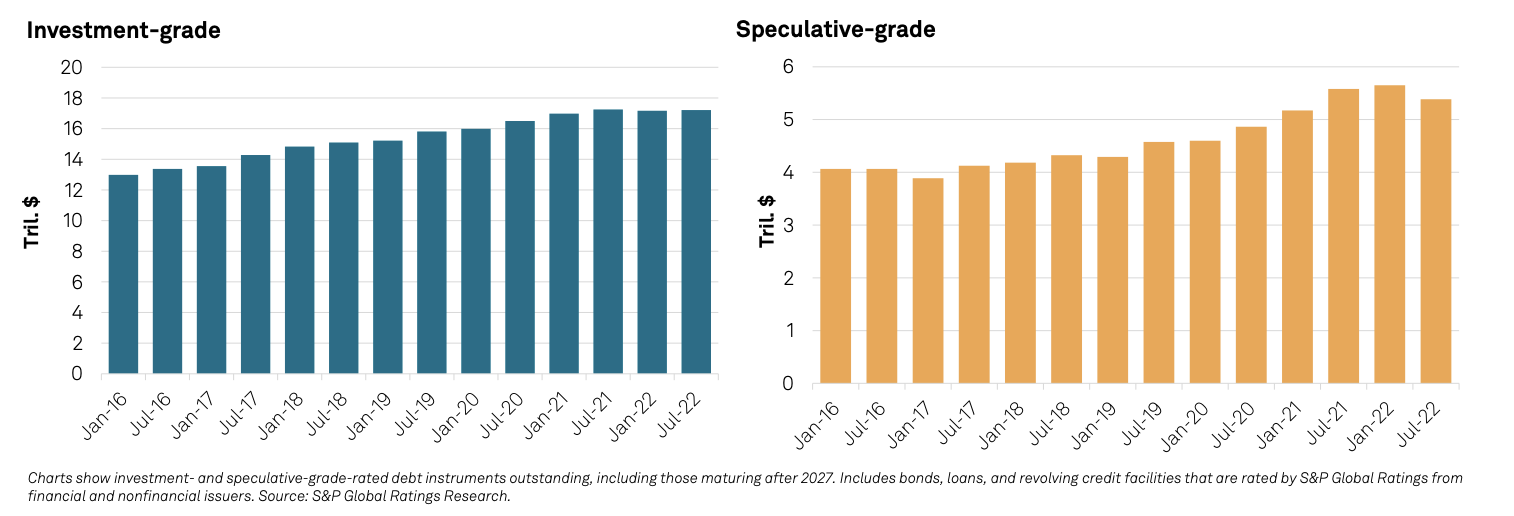

Credit Trends: Regional Refinancing: Rising Interest Rates And Strengthening Dollar Present Headwinds

Despite falling issuance volumes this year, U.S. corporate issuers remain broadly well positioned after stretching maturities into later years. S&P Global Ratings rates $11.6 trillion in U.S. corporate debt: 9% is scheduled to mature over the next 18 months (through Dec. 31, 2023) and 43% over the next five years (through June 30, 2027). While speculative-grade debt is more vulnerable to refinancing risk, it represents a relatively small share (19%) of U.S. corporate debt maturing through 2023.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

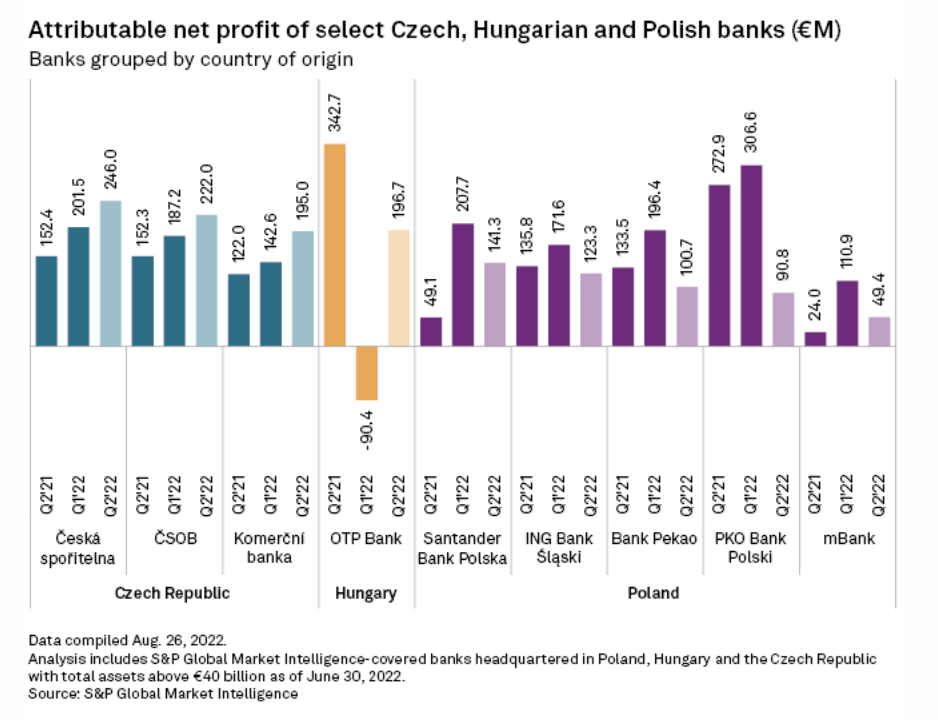

Polish Banks' Fortunes Dip As Regulatory Burden Bites

Poland's biggest banks all reported quarter-over-quarter net profit declines in their latest results as higher regulatory costs offset the benefits of rising rates. Among a sample of Poland's five biggest banks, state-owned PKO Bank Polski SA suffered the biggest quarterly net profit decline for the period ending June 30 at 70.4%. It was followed by Commerzbank AG-owned mBank SA with a 55.5% drop and Bank Polska Kasa Opieki SA, or Bank Pekao, which saw its profit fall 48.8%.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

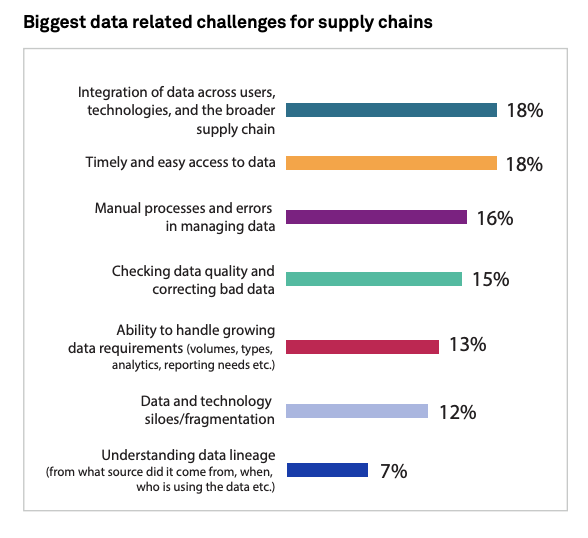

2022 Supply Chain Survey Report

With the 2022 Supply Chain Survey Report, learn the key priorities of supply chain practitioners, and whether these alone will deliver the resilience they seek. Understand how companies rate their current capabilities across supply chain functions and areas where there is room for improvement, and investigate immediate challenges of supply chain resilience, economic fragility and global security concerns.

—Read the report from S&P Global Market Intelligence

Access more insights on global trade >

Credits Entice Renewables Investment In U.S.; Hunting Discounts In Europe

Private equity investment in North America's renewable energy sector is on the rise, a trend that is likely to gain momentum with the recent passage of landmark climate legislation in the U.S. The Inflation Reduction Act, or IRA, signed into law Aug. 16 by President Joe Biden contains $369 billion for domestic clean energy and climate priorities over the next decade. But the real game-changer for private equity is how the law handles the tax credits that entice investment in renewable power and other technologies intended to cut planet-warming carbon emissions.

—Read the article from S&P Global Market Intelligence

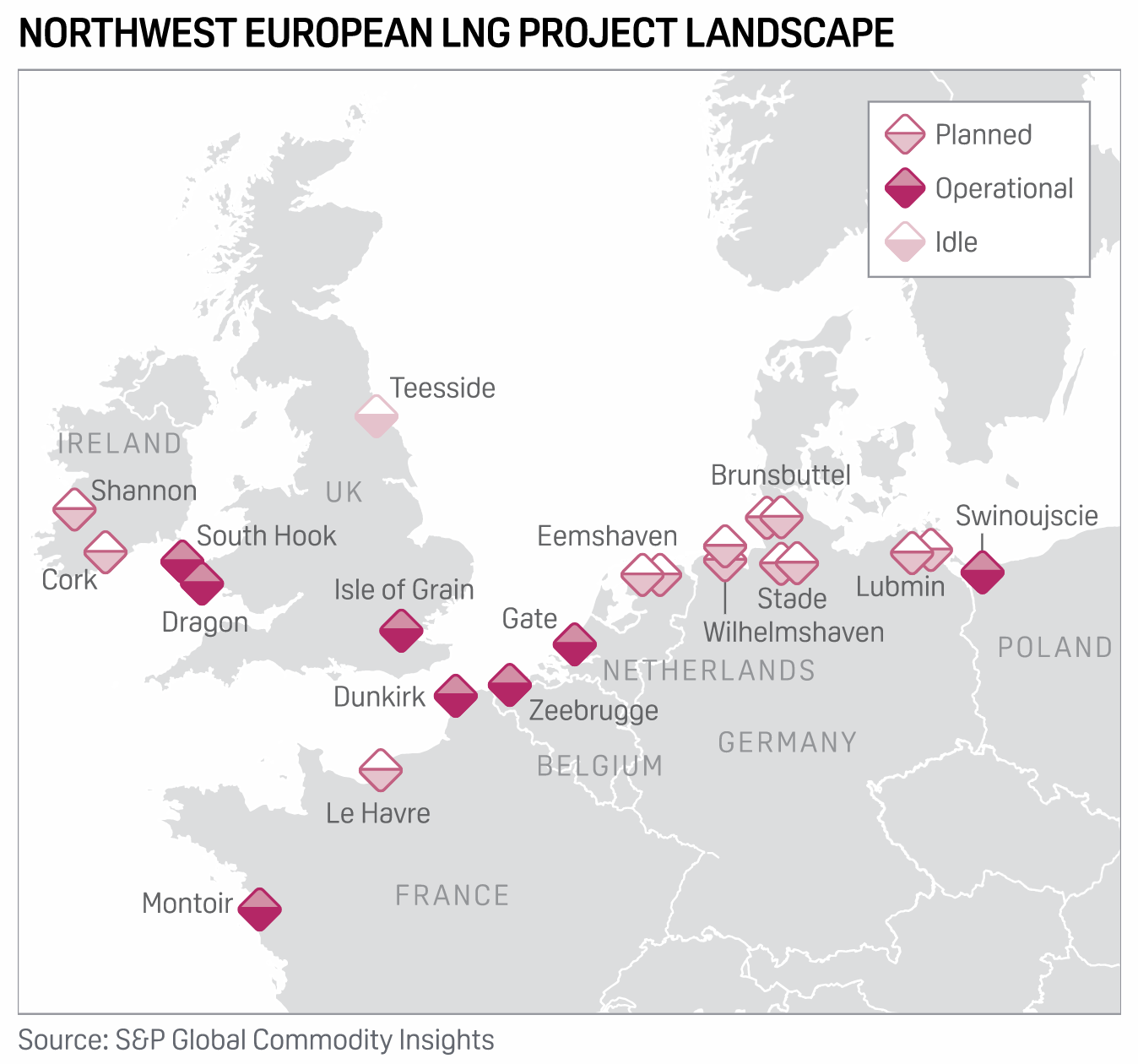

Dutch LNG Terminal At Eemshaven To Reach Full Capacity By End-Nov Or Early Dec: Gasunie

The new Dutch LNG import terminal at Eemshaven is set to operate at full capacity by the end of November or early December, operator Gasunie said Sept. 9. The first LNG tanker arrived at Eemshaven from the U.S.' Sabine Pass facility on Sept. 8, and the first regasified LNG is set to flow into the Gasunie grid in mid-September.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

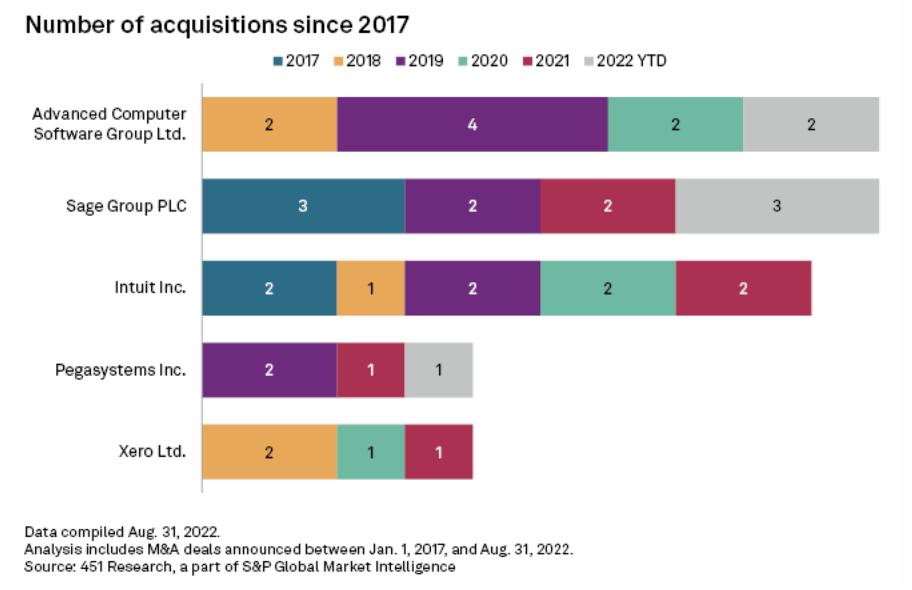

U.K. Software Provider Sage Group's Appetite For M&A Grows

U.K.-based software provider The Sage Group PLC has stepped up its M&A activity in the past 20 months, overtaking its peers with the number of deals done. Sage, which sells payroll, accounting and enterprise resource planning solutions to small and medium-sized companies, closed its acquisition of Lockstep Network Inc. at the end of August.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >