Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Recent actions by the U.S. Federal Communications Commission could disrupt precedent for both the agency and telecommunications providers.

President Biden’s nominees for the telecommunications regulatory board are different from its predecessors in a number of ways. On Oct. 26, the White House nominated acting FCC Chairwoman Jessica Rosenworcel to become permanent chair of the agency. The appointment would mark the first time a woman would lead the FCC. The Biden Administration also named Gigi Sohn, a senior fellow at the Benton Institute for Broadband and Society and previously a counselor to former FCC Chairman Tom Wheeler and co-founder of the communications advocacy agency Public Knowledge, to fill the third Democratic commissioner position, which has been empty for 10 months. If confirmed, she would the first openly LGBTIQ+ commissioner in the FCC’s history.

Market participants expect the confirmation to be handled with urgency. That could be "untidy,” but result in both FCC picks being approved, Blair Levin of New Street Research said in an Oct. 26 note, according to S&P Global Market Intelligence.

The FCC is slated to confront a laundry list of pivotal issues, including net neutrality, market monopolies, and regulating broadband prices and internet service providers.

"While we don't think it likely, it is possible, given the small margin, that a single Democratic senator could upset the plan by deciding to delay or oppose Sohn as a commissioner, thereby further delaying the time at which there would be a Democratic majority … Ultimately, however, the most likely scenario is that by sometime in [the first quarter of next year], there will be a Democratic majority,” Mr. Levin said. "We expect the issue [of net neutrality and setting broadband prices] to be brought up during the confirmation hearings and believe ... that either nominee saying that they think price regulation should be on the table could lead to significant problems in obtaining confirmation.”

Recently, the agency advanced its deployment and support of telehealth services. But the future of some pandemic-era FCC projects—including the agency’s Emergency Broadband Benefit Program that helped families access internet services during the coronavirus crisis—remains in question in a post-pandemic world.

"It would be nice for acting Chairwoman [Jessica] Rosenworcel to tether this to the other conversations going on around the expiration of other services," Nicol Turner Lee, a senior fellow for governance at the Brookings Institution, said of the FCC's leader in an S&P Global Market Intelligence interview.

Today is Wednesday, October 27, 2021, and here is today’s essential intelligence.

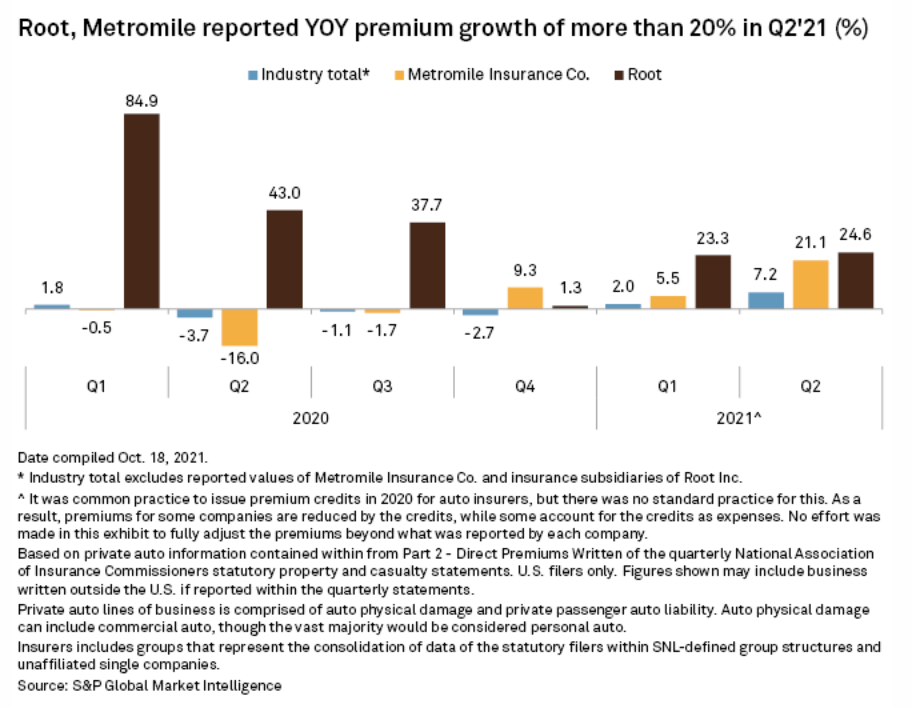

Metromile, Root Further Encroaching On Traditional Auto Underwriters' Turf

The two publicly traded full-stack personal auto insurance companies recently disclosed plans to further expand their distribution networks into the independent agent channel. The independent agent space represents more than 30% of the industry's total auto insurance sales, Metromile Inc. said in its announcement.

—Read the full article from S&P Global Market Intelligence

Around The Tracks: Vehicle Makers Lower Annual Forecasts Amid Parts Shortage

A global semiconductor shortage affected vehicle makers over Q3 as they struggled to maintain production to meet firm demand. Makers such as Japan's Toyota Motor lowered its output by 400,000 vehicles over September and October, thereby also reducing its production forecast for the fiscal year ending March 31, 2022, to 9 million vehicles from 9.30 million vehicles.

—Read the full article from S&P Global Platts

Listen: The Upgrade Episode 16: Why CCC Category Ratings Have Risen But Default Rates Have Not

The latest episode of The Upgrade podcast discusses why the default rate is so low — and expected to remain so well into next year — even as the CCC ratings cohort is so large. Also discussed is the past and present CLO exposure to the CCC category.

—Listen and subscribe to The Upgrade, a podcast from S&P Global Ratings

European Commission Proposes New Tools For Insurance Regulators

On Sept. 22, 2021, the European Commission proposed amending the EU's Solvency II directive and increasing harmonization of recovery and resolution regimes for insurers in the European Economic Area.

—Read the full report from S&P Global Ratings

Watch: Measuring The Impact Of Generosity

How do the philanthropic efforts of public companies impact returns? S&P DJI’s Michael Mell explores a custom index designed to track the 50 most generous companies with Earl Bridges, CEO of Uncommon Giving and Claire Gaudiani, Board Member at Uncommon Investment Funds Trust and author of The Greater Good: How Philanthropy Drives the American Economy and Can Save Capitalism.

—Watch and share the full video from S&P Dow Jones Indices

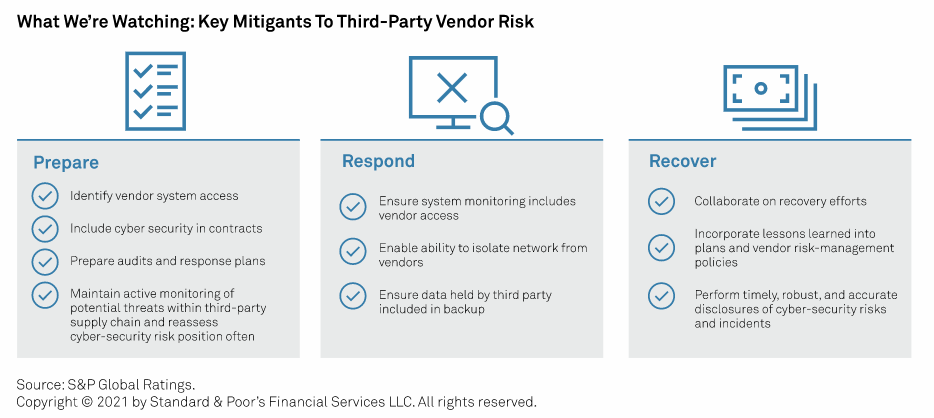

Cyber Risk In A New Era: Are Third-Party Vendors Unwitting Cyber Trojan Horses For U.S. Public Finance?

Digitalization in operations and IT services can increase risks of cyber-attacks for U.S. public finance issuers if proper vendor risk management is not in place. Integration of third-party vendor risks into a comprehensive cyber-defense strategy is an important aspect for an issuer to help reduce the frequency and mitigate the effects of a cyber-attack.

—Read the full report from S&P Global Ratings

Weighing Challenges, Opportunities Behind Ad-Supported Streaming Boom

The evolution of streaming video has taken many turns, from single subscription services to advertising-based platforms that resemble linear TV networks to free ad-supported TV services, or FASTs, that aggregate networks and resemble entire pay TV packages.

—Read the full article from S&P Global Market Intelligence

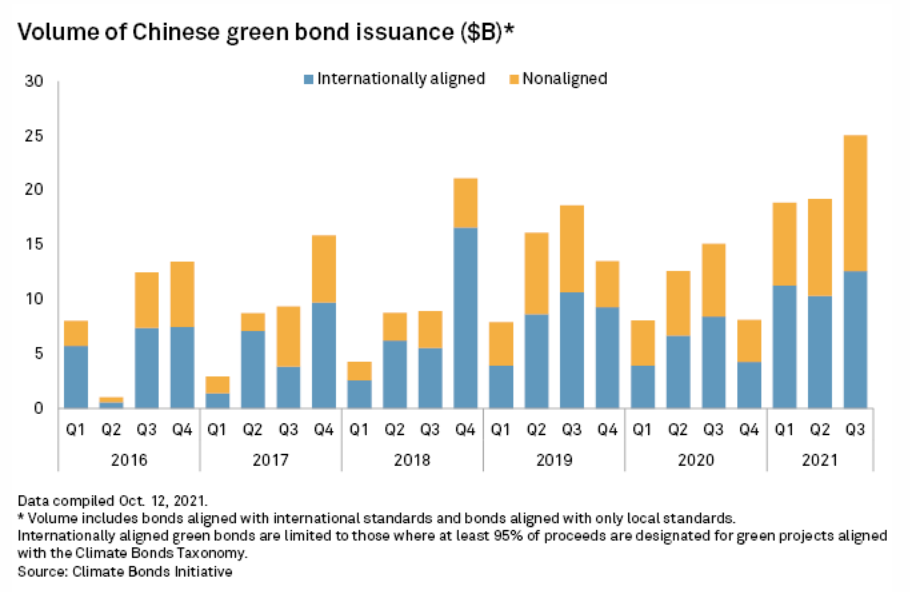

China Green Bond Market Breaks Record With Policy Push, Offshore Interest

China's green bond market is headed for its busiest year ever amid a national push for net-zero emissions and the growing appetite of international investors. The issuance of Chinese green notes will reach a new high in 2021, surpassing its previous record of US$56.18 billion in 2019, analysts said.

—Read the full article from S&P Global Market Intelligence

Net-Zero Transition Gains Momentum In Real Estate As Commitments Grow

Commercial real estate companies in the U.S. and Canada are increasingly joining the race to net-zero carbon emissions amid mounting pressure from various stakeholders in the aftermath of the COVID-19 pandemic, industry insiders say.

—Read the full article from S&P Global Market Intelligence

Listen: Mechanical Vs Chemical Recycling For Plastics: Competing Or Complementing To Drive Sustainable Growth?

Recycled plastics has become a hot topic recently with soaring demand driven by legislation, corporate commitments, and increasing consumer awareness across the globe. There are raising questions on how the current recycling mechanisms could cope with such rapid-changing market dynamics to drive the sustainable growth of recycled plastics industry.

—Listen and subscribe to Future Energy, a podcast from S&P Global Platts

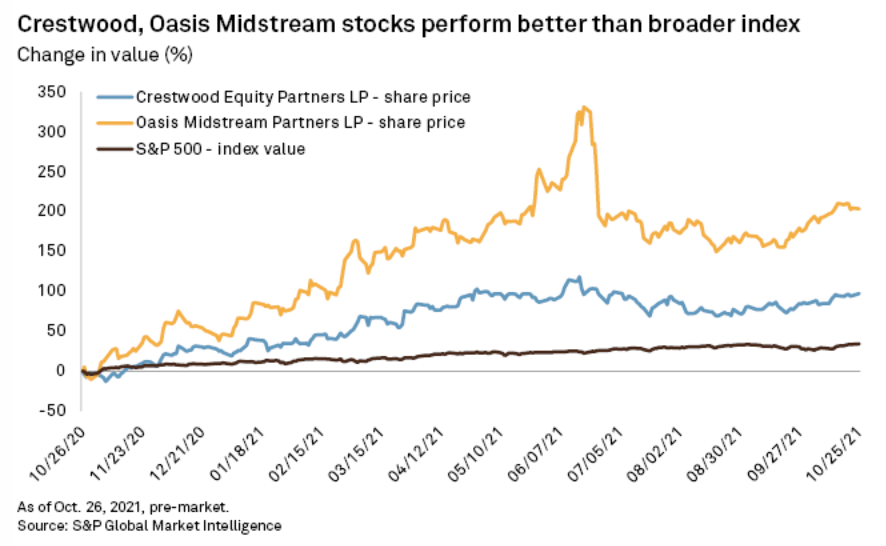

Crestwood To Merge With Oasis Midstream, Creating Top Williston Basin Operator

Crestwood Equity Partners LP has agreed to acquire Oasis Midstream Partners LP in a $1.8 billion equity and cash deal that is expected to create one of the top three midstream operators in the Williston Basin with a pro forma enterprise value of roughly $7 billion.

—Read the full article from S&P Global Market Intelligence

Interview: Energy Crunch Shows Need For More Oil, Gas Investment: IEF Secretary General

The oil and gas industry is emerging from the depths of the coronavirus pandemic into the teeth of an energy crisis. Two straight years of massive capex cuts are leading to a supply shortage that could destabilize the global economy.

—Read the full article from S&P Global Platts

South African Sibanye-Stillwater To Buy Nickel, Copper Mines In Brazil For $1 Billion

Sibanye-Stillwater — one of the world's largest platinum group metal producers — said it had signed definitive purchase and sale agreements with affiliates of funds advised by Appian Capital Advisory to purchase both mines for a cash consideration of $1.0 billion and a 5% net smelter return royalty over potential future underground production at Santa Rita.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language