Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Quieter Conference of the Parties Confronts War and High Energy Prices

What a difference a year makes. The 27th Conference of the Parties to the United Nations Framework Convention on Climate Change, or COP27, begins Nov. 6 in Sharm el-Sheikh, Egypt. The lead up to COP27 has been notably subdued compared with last year’s meetings in Glasgow, Scotland. War in Ukraine, macroeconomic stress and high energy prices have dampened expectations for further agreements related to emissions reductions. Global leaders seem more concerned with how any commitments will play out for a home audience of cash-strapped consumers, who are already paying record-high prices for energy.

COP27 is intended to be an opportunity for countries to report on the progress of their goals under the Paris Agreement on climate change to limit global temperature rises to 2 degrees C above preindustrial levels, and ideally to 1.5 degrees. But very few countries have met the deadline to submit enhanced nationally determined contributions setting out how they intend to reduce emissions further.

Last year’s COP26 witnessed the signing of several major agreements, notably on coal, methane and deforestation. The conference nearly achieved a commitment to phase out coal, but it struggled to overcome opposition from India. One of the biggest questions for the conference this year will be whether countries agree to phase out coal. With high energy prices and growing demand, it seems unrealistic that delegates from India will agree to any sweeping agreements on the future of coal.

One notable change at COP26 was the increase in private sector participation. It will be interesting to see if the meetings in Sharm el-Sheikh attract such a sizable private sector audience. Regardless, the second week of meetings between country representatives will be critical for any additional commitments. Typically, agreements emerge as the time crunch toward the end of the second week accelerates the pace of negotiation. Voluntary carbon markets are looking for increased clarity and guidelines, and many participants would like to reach an agreement on carbon credit export bans.

As governments look to relieve the pressure of high energy prices for consumers, they may be paradoxically preserving the fossil fuel era. One might expect high prices to motivate consumers and companies to look to alternative energy sources. But a renewed focus on energy security seems to be shaping the conversation in a way that disfavors transition.

With so many geopolitical and macroeconomic headwinds, the question has moved from whether COP27 can achieve new commitments, to whether the conference is still relevant for the world.

“The need for major centralized decisions through institutions like COP seems to be decreasing as individual countries are now setting their own targets,” Roman Kramarchuk, S&P Global Commodity Insights’ head of future energy outlooks, said in a preview of COP27. “The recent U.S. Inflation Reduction Act is one example of this kind of national policy initiative.”

Today is Wednesday, October 19, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Flash PMI Data To Highlight Recession Risks And Varying Inflation Trends At Start Of Fourth Quarter

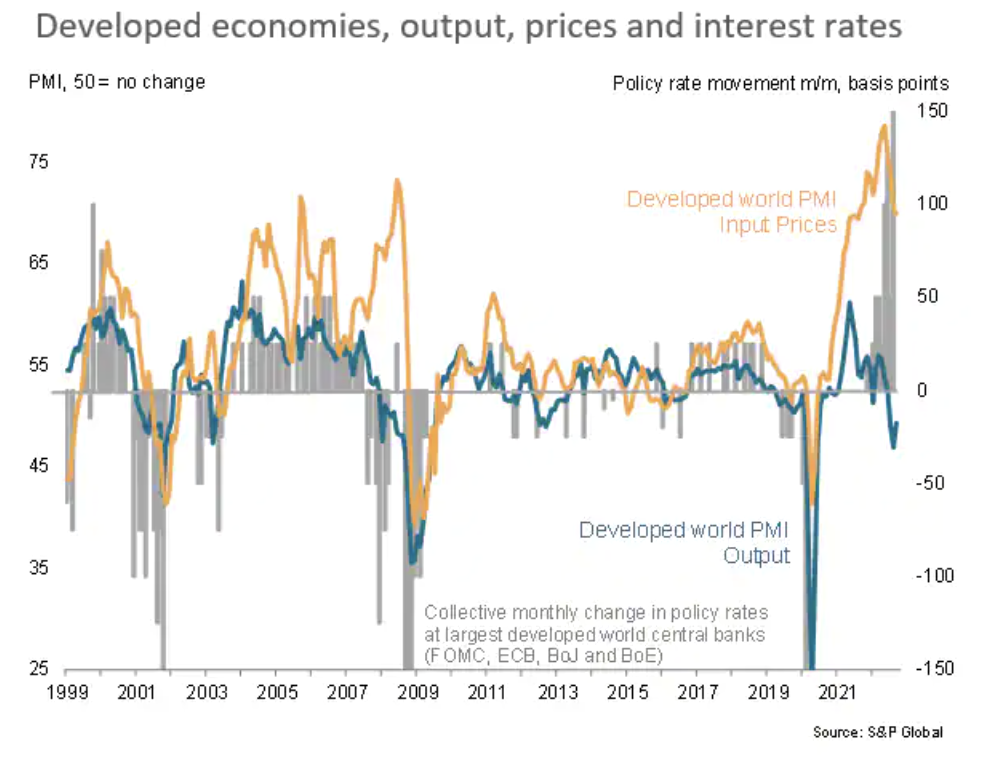

October flash PMI data will provide much needed insights into the risk of some of the world's major economies falling into recession. Prior data showed global output dropping for a second successive month in September amid worsening worldwide demand linked to the escalating cost of living, tightening financial conditions and rising risk aversion. However, this slowdown is also exerting downward pressure on many prices, which could in turn drive speculation about monetary policy needing to be tightened less than previously anticipated.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The Importance Of Being Indexed

One of the benefits of indexing is its low cost relative to active management. As indexing has grown, investors have benefited substantially by saving on fees and avoiding active underperformance. S&P Dow Jones Indices can estimate the fee savings each year by multiplying the difference between the average expense ratios of active and index equity mutual funds by the total value of indexed assets for the S&P 500, S&P 400 and S&P 600. When it aggregates the results of these annual computations, it observes that the cumulative savings in management fees over the past 26 years is USD 403 billion.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Commodity Tracker: 4 Charts To Watch This Week

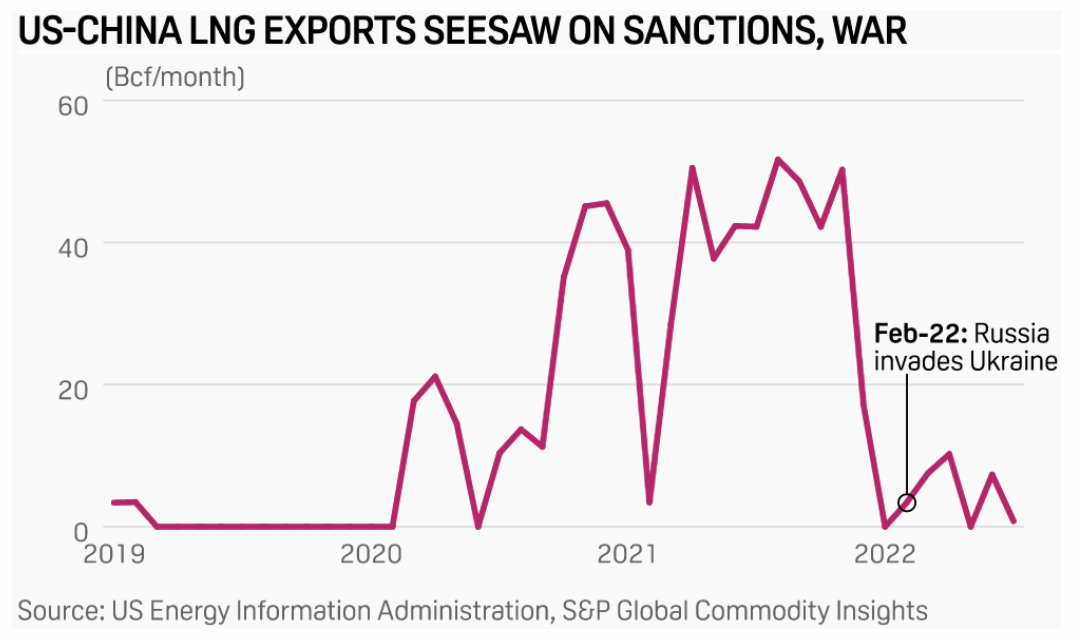

This week, S&P Global Commodity Insights editors and analysts examine China's interest in U.S. LNG, tanker freight rates amid changes in oil trade flows, France's nuclear output and U.S. power burn. New LNG developments in the U.S. have been gaining interest from international buyers, including a number of state-owned groups in China. Facilities owned by Cheniere, NextDecade and Energy Transfer signed separate deals this year with Chinese buyers comprising around 650 MMcf/d in future U.S. feedgas demand.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

What U.S. Banks And Their Supervisors Can Learn From Europe's Climate Stress Tests

Climate stress tests are playing a growing role in bank supervision as more regulators and prudential authorities embrace this tool to assess banks' resilience to environmental risks. The U.S. Federal Reserve announced last month that it would conduct a climate scenario analysis involving Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and Wells Fargo & Co.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

When Will European Gas Prices Come Back Down Again?

One question that we would all like to know the answer to is when will European gas prices come back down again? A forward curve is not always a reliable indicator of what will happen in the future, but it does give us some insight into how the market is viewing things today.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 87: The Future Of Payments At 451NEXUS

The payment world has transformed as it steps from the end of the customer experience journey to being integrated across customer relationships. Payments have expanded into many areas of finance. Jordan McKee, research director for Fintech, returns to talk with host Eric Hanselman about how enterprises can leverage this change and what he’ll be talking about at the 451NEXUS conference. You can also check out the detailed session at the 451NEXUS conference here.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence