Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Landmark Legislation Supercharges U.S. Clean Energy Effort

Thirteen years is a long time in the climate policy world. But that is how long advocates of climate action have been waiting for another chance at implementing sweeping federal legislation to address U.S. greenhouse gas emissions. Back in 2008-2009, negotiators worked to replace the expiring Kyoto Protocol; Europe adopted a major climate and energy package to achieve emissions, renewable and energy efficiency targets; and Barack Obama was elected president with expectations of climate action. In June 2009, the Waxman Markey Bill passed the U.S. House of Representatives by a very slim margin and included a framework to drive change through subsidies, renewable electricity standards and an economywide carbon cap and trade system. The framework never made it further.

By the end of 2009, many major economies, including the U.S., agreed to the Copenhagen Accord and essentially the entire world has since agreed to the Paris Agreement on climate change. Recognizing the challenges of passing climate legislation, the Obama administration tried to make progress via a regulatory approach. But those regulations needed to withstand legal challenges. In 2016, the Supreme Court stayed the Obama administration’s ambitious Clean Power Plan to decarbonize the power sector. In July 2022, the U.S. Supreme Court’s West Virginia v. EPA decision closed that door further, limiting regulatory options to set climate policy absent “clear congressional authorization” or legislative intent. S&P Global Commodities Insights forecasts indicate that the U.S. is falling far short of its aggressive 2030 Paris Agreement targets.

Since the Russian invasion of Ukraine, the EU has sought to meld its ambitious “Fit for 55” 2030 decarbonization goals with the need to address near-term concerns around energy security and a lasting cutback of Russian fossil fuel imports. S&P Global Commodity Insights forecasts indicate that China’s plans and directives will achieve their goal of peaking country-level greenhouse gas emissions by 2030. Meanwhile, the U.S. offered another reminder of how a divided electorate and the checks and balances of government can lead to policy paralysis.

One month after the West Virginia v. EPA decision — after intense public and private negotiations and compromises, and by the slimmest of margins — Congress passed and President Joe Biden signed the Inflation Reduction Act. The bill provides $369 billion in meaningful incentives for clean technologies such as wind, solar, storage, hydrogen, nuclear, carbon capture and biofuels that will drive energy sector transformation and emissions reduction. Instead of a structure built on carbon trading and pricing, the Inflation Reduction Act looks to leverage federal funding and tax policy to drive private sector clean energy investment, building on the successful track record of tax credits for wind and solar. Instead of trading carbon allowances, project developers and financiers will need to be engaged in markets for tax equity, which will need to scale up.

Instead of a carbon bill, the Inflation Reduction Act offers comprehensive industrial policy which, through implementation, will bring about emissions reductions. Concerns about budget deficits would be, in part, offset by increased corporate taxes. Concerns about jobs and the disadvantaged would be addressed by apprenticeship and locational project requirements. The bill looks to ensure reliable clean energy supply chains by tying the full value of tax benefits to materials sourcing and manufacturing requirements. For those concerned about an overly rapid transition, the bill reopens some leasing for fossil fuels and facilitates long-stalled pipelines — although a methane fee will help ensure cleaner upstream supply.

The Inflation Reduction Act benefits a full spectrum of clean energy, extending long-running programs for electric vehicles, wind and solar. It also bolsters programs for carbon capture and creates new programs for low-carbon hydrogen, stand-alone energy storage and existing nuclear. The incentives will not only ensure that new capacity is clean, but replace existing emitting capital stock, including accelerating coal plant retirements.

The new law did leave other clean energy issues unresolved. Direct incentives for transmission buildout, which is critical for moving power from areas of cheap clean energy to demand centers, did not make the final bill. Without a carbon price, investments may not be fully “carbon-efficient.” It is unclear whether some of the hurdles for the qualification of credits, including domestic sourcing and employment considerations, are achievable. It is also uncertain whether clean energy supply chains are ready to meet the expected additional demand. There is no funding provided for international climate financing efforts, nor is it clear how U.S. efforts would fit into considerations of border carbon adjustments or the Paris Agreement’s Article 6, which allows countries to voluntarily cooperate with each other on their emissions reduction targets. But after 13 years, the U.S. can, for the first time, begin relying on a comprehensive, federally driven policy to channel investments, transform the sector and drive down emissions — all while bringing aspirational Paris Agreement targets more firmly into the realm of the achievable.

Today is Friday, October 14, 2022, and here is today’s essential intelligence.

Written by Roman Kramarchuk.

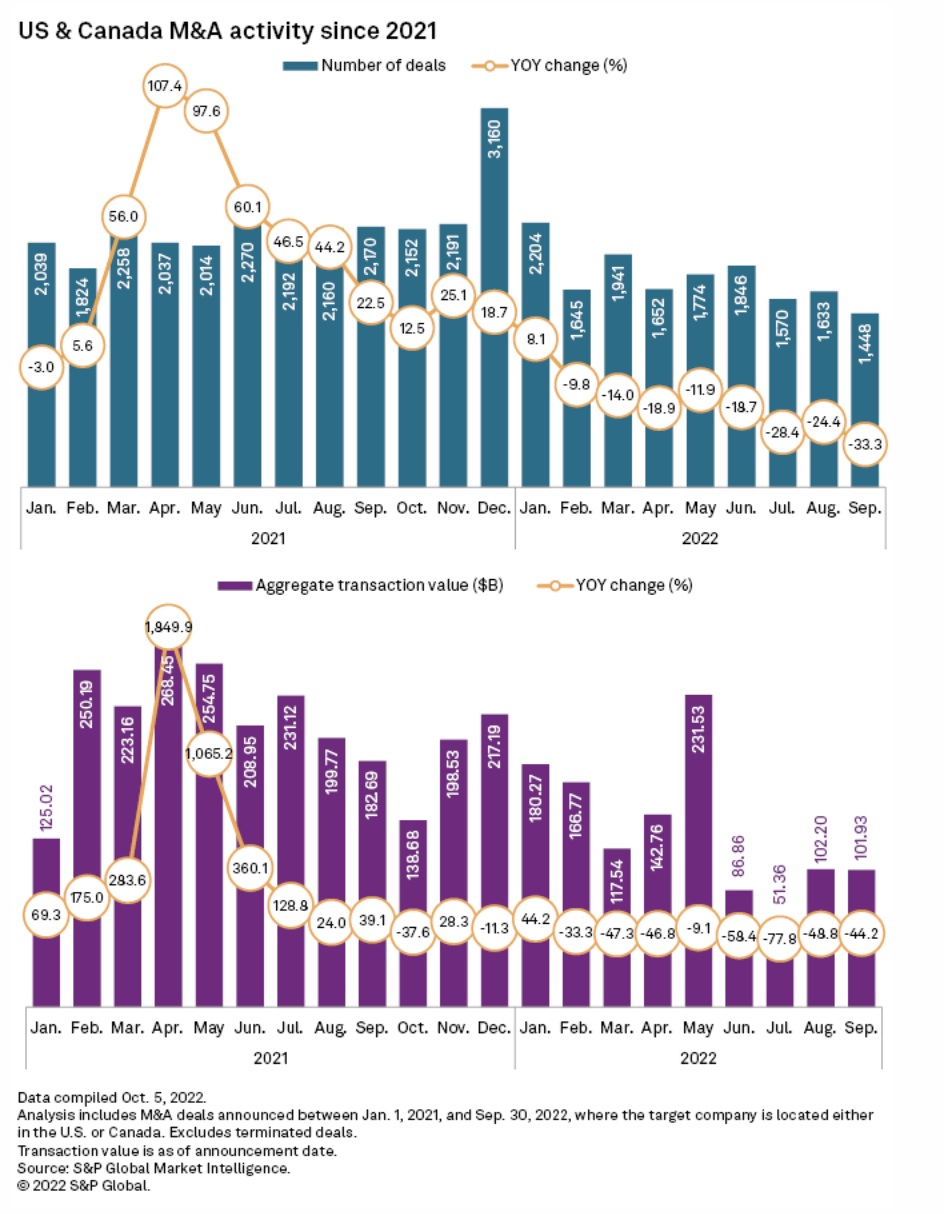

M&A Activity In U.S., Canada Slumps To Worst Quarter Since COVID-19 Low

M&A activity slumped further in the third quarter of 2022 as business leaders put corporate checkbooks away amid rising interest rates and a slowing economy. Fewer than 4,700 deals were announced in the U.S. and Canada between July and September, according to data from S&P Global Market Intelligence, the lowest number since the second quarter of 2020 when COVID-19 sparked a collapse in activity.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

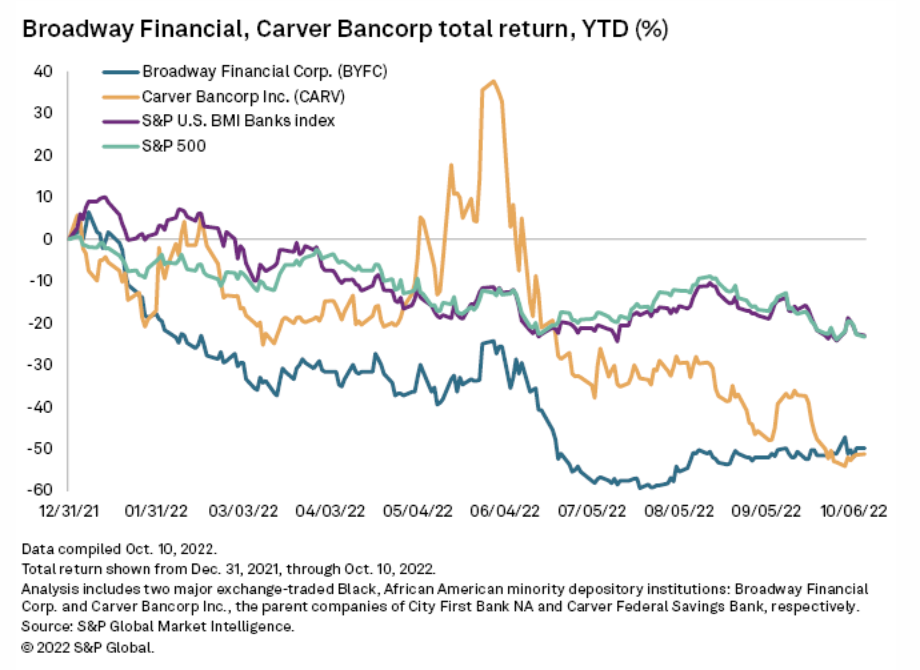

Broadway Eyes $1.5B In Loan Growth With Government Investment, Deposits In Tow

Los Angeles-based Broadway Financial Corp. is aiming to fund $1.5 billion in loans to low- and moderate-income clients across its bi-coastal footprint with a recent government investment and its better-than-peers deposit growth. The company's Washington, D.C.-based banking subsidiary City First Bank NA, which is the largest African American minority depository institution, or MDI, in the U.S., recently received a $150 million grant from the U.S. Treasury as part of the Emergency Capital Investment Program.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

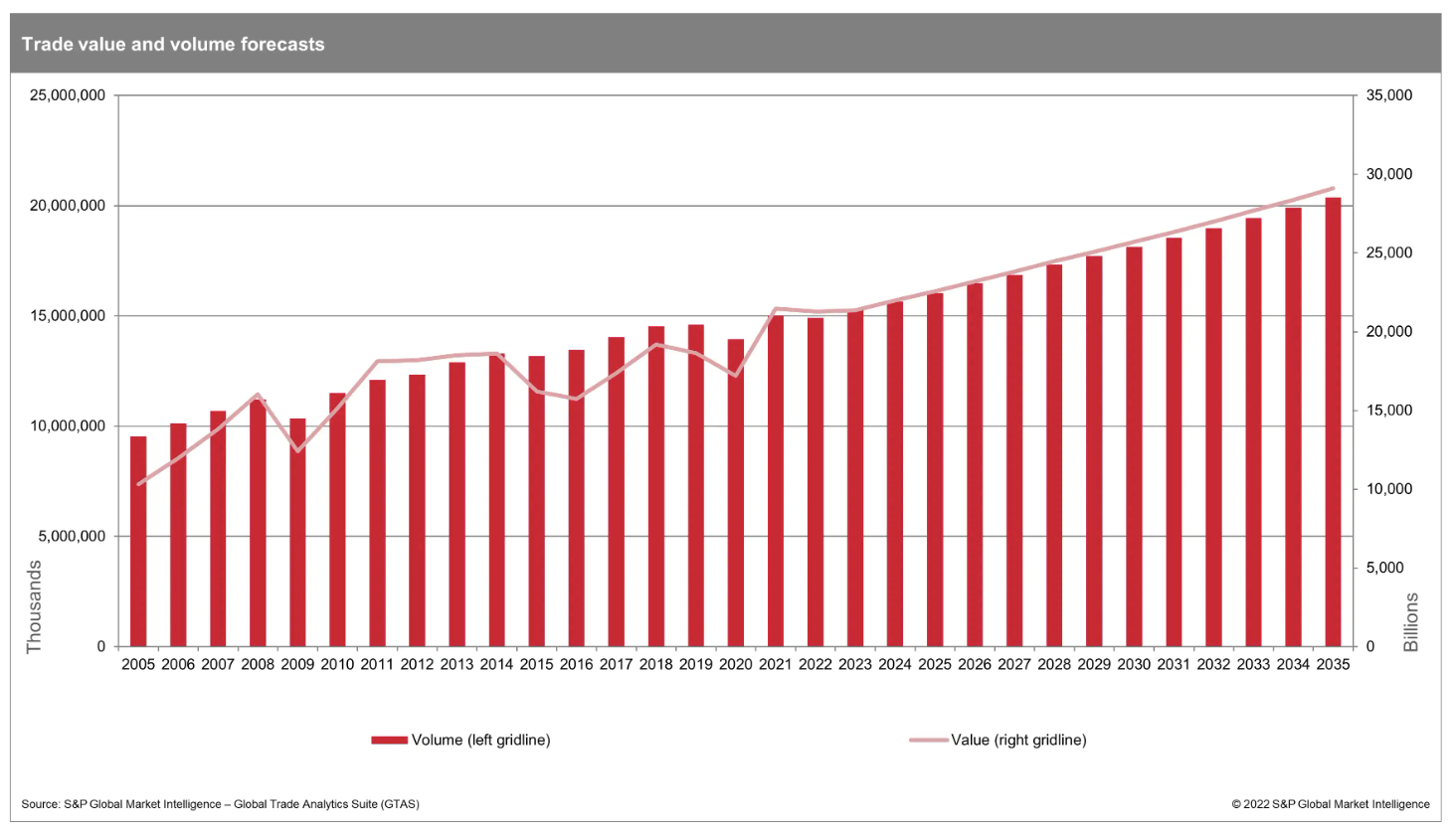

Maritime And Trade Talk - Trade Outlook: Response To Geopolitical Events

In this episode, Dr. Jakub M. Kwiatkowski, a senior economist within the Global Trade Analytics Suite Forecasting team of S&P Global Market Intelligence, talks about the trends in trade shaped by current geopolitical changes and anticipated shifts in trade following international policies and agreements.

—Listen and subscribe to the Maritime and Trade Talk, a podcast from S&P Global Market Intelligence

Access more insights on global trade >

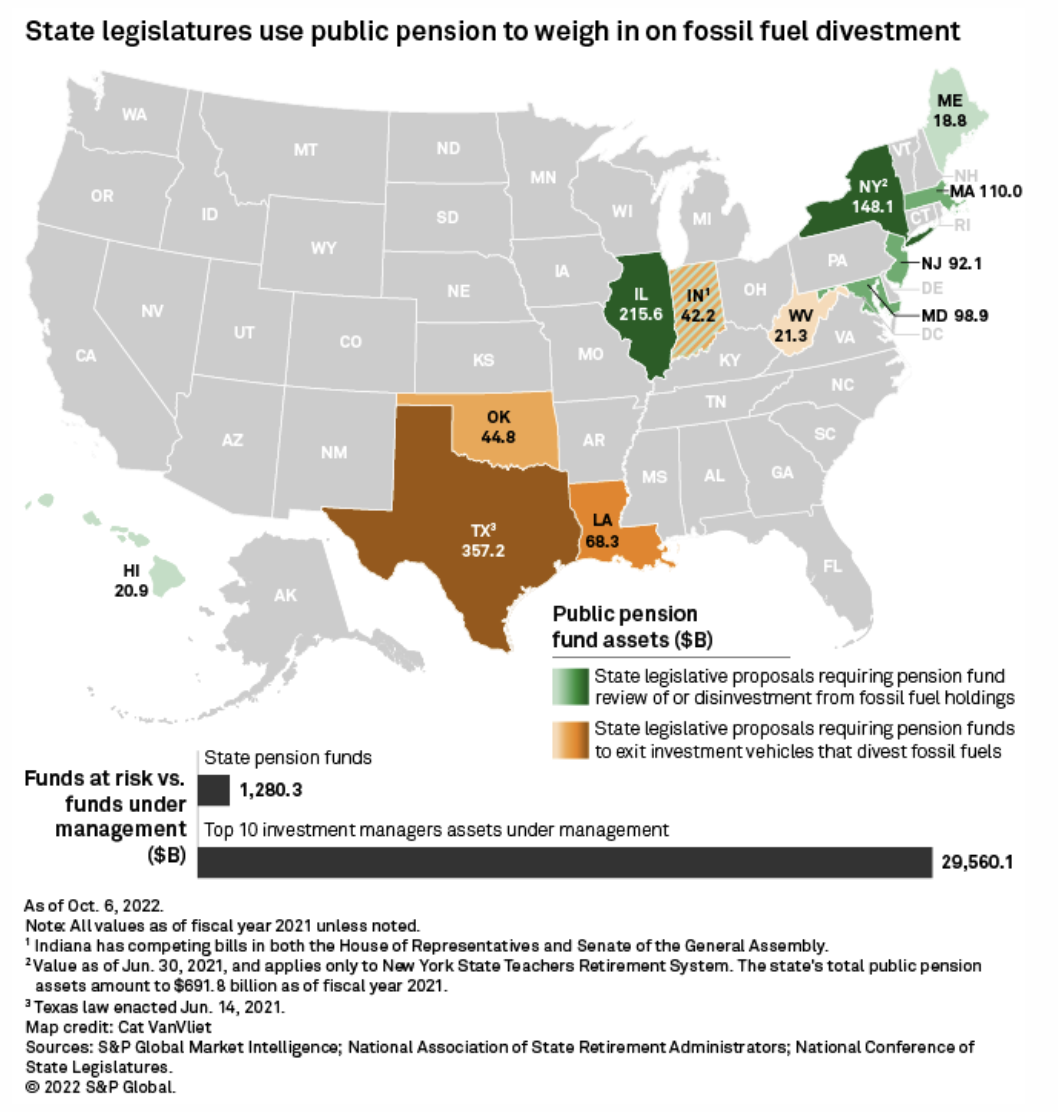

State Pension Funds Remain Insulated From GOP Crackdown On ESG

As more GOP-led states join the movement to divest from banks over their environmental, social and governance policies, some critical investment assets remain conspicuously untouched: state pension funds. Even states that pledged to bar their retirement funds from ESG-focused investment firms have thus far not put that policy into practice. Nor have their initiatives had much of an overall impact on the banks and investment firms that manage such funds, data from S&P Global Market Intelligence show.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Asian LNG Procurement Heating Up As Winter Approaches

LNG markets are in the spotlight after the Russia-Ukraine war, with Asia and Europe competing for limited cargoes. A harsher than expected winter may trigger unprecedented changes in LNG trade flows and force many Asian governments to implement contingency measures to tackle power outages. In a discussion ahead of the Asia LNG & Hydrogen Gas Markets Conference, S&P Global Commodity Insights' experts Surabhi Sahu, Kenneth Foo and Jeffrey Moore talk about Asia's LNG winter procurement, benchmark market activity and strategies like fuel switching to mitigate shortages.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

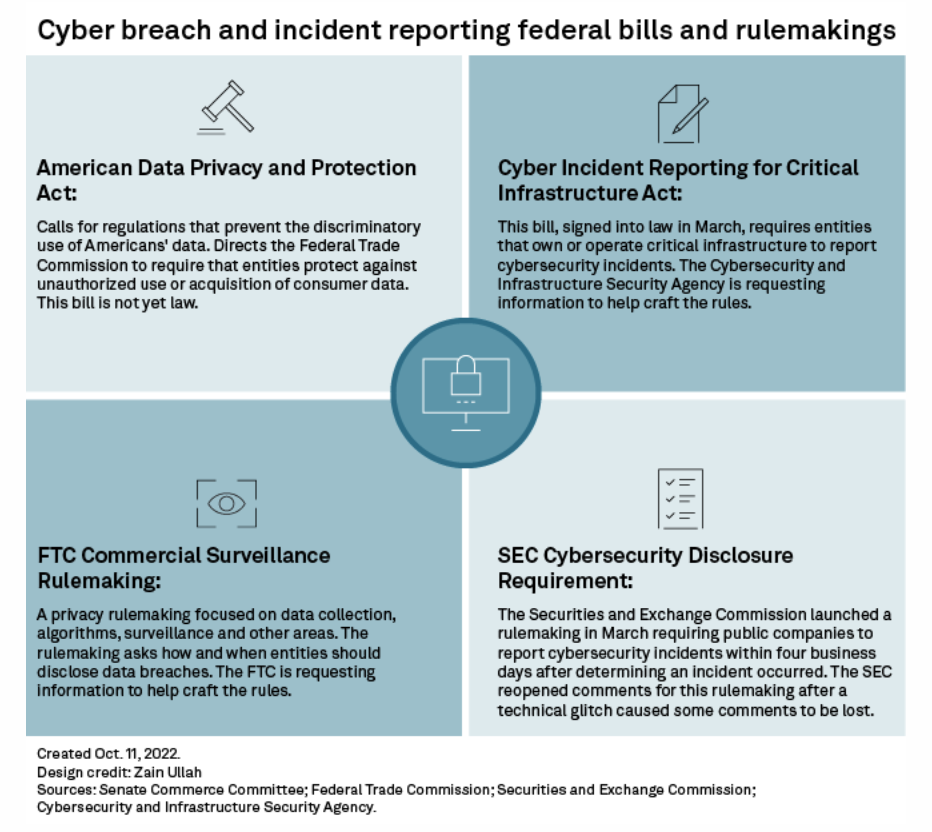

Incomplete Data Breach Records Up As US Debates Cybersecurity Authority

Heightened cybercrime and incomplete reporting records are concerning cybersecurity researchers at a time when it remains unclear which U.S. federal agency should take the lead on crafting comprehensive cyber breach and incident disclosure rules. There were 1,291 publicly reported U.S. data compromises in the first nine months of this year, according to the Identity Theft Resource Center, a nonprofit that supports victims of identity crime. At that pace, the 2022 numbers are unlikely to surpass the record 1,862 data breaches reported last year.

—Read the article from S&P Global Market Intelligence