Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Days after advocating for aggressive climate action at COP26, the Biden Administration opened the largest oil and gas land lease sale in U.S. history.

Originally planned by the Trump Administration, Lease Sale 257 occurred on Nov. 17 under the leadership of the lease sale sponsor U.S. Bureau of Ocean Energy Management, auctioning more than 80 million acres in the Gulf of Mexico as the first in event in the area after the President Joe Biden paused federal and offshore land leasing by executive order in January. A district court decided in June that the Biden Administration’s federal leasing and auction moratorium could decrease economic output and revenue in oil-producing states, and ultimately allowed for Lease Sale 257 to move forward despite the administration’s continuing appeals to reinstate the rule.

"The previous halt by the Biden Administration may incentivize some operators to snag more blocks while they can, in case another regulatory hurdle is thrown at them,” Sami Yahya, senior supply and production energy analyst for S&P Global Platts Analytics, told S&P Global Platts. “I think we'll see the usual suspects coming back to the game.”

Sales of deep-water acreage generated healthy, measured bids that appeared to be the most popular in the sale—while energy giant Exxon Mobil scooped up a majority of shallow-water acreage. Bidders may have been more drawn to this sale due to the U.S. Gulf’s relatively low emissions intensities and the opportunity to create profitable low-carbon businesses, according to S&P Global Platts.

"The deep-water Gulf of Mexico on a global stage is considered to offer some of the lowest carbon-intensity metrics, making it pretty attractive," Mr. Yahya told S&P Global Platts.

"It's a clear indication of the [company's intention to use the blocks for its] carbon capture and storage project," Justin Rostant, a principal analyst on Gulf of Mexico research for the energy consultancy Wood Mackenzie, told S&P Global Platts of Exxon’s bid for roughly 100 Continental Shelf blocks along the Texas coast. "I anticipate they'll use the area for direct capture of carbon and put it in the reservoirs of the blocks they acquire."

The auction comes less than one week after President Biden told COP26 attendees on the international climate stage that the U.S. is "planning for both a short-term sprint to 2030 that will keep 1.5 degrees Celsius in reach and for a marathon that will take us to the finish line and transition the largest economy in the world into a thriving, innovative, equitable and just clean-energy engine,” according to S&P Global Market Intelligence.

The U.S. Interior Department has made clear its strong desire to “flip the script” on public land usage and leasing away from the oil and gas industry’s dominating interests and on a path toward "a fair return" for taxpayers "for a shared resource that they own,” Interior Deputy Secretary Tommy Beaudreau said at an event hosted by the Energy Policy Institute at the University of Chicago this week, according to S&P Global Platts. "It creates a complex issue when your purpose is to reform that system and to unwind 40 years of administrative practice to align the programs with the realities facing the United States and the world, particularly around climate.”

Today is Thursday, November 18, 2021, and here is today’s essential intelligence.

More COVID-19 Life Claims To Come For Europe's Big 4 Reinsurers

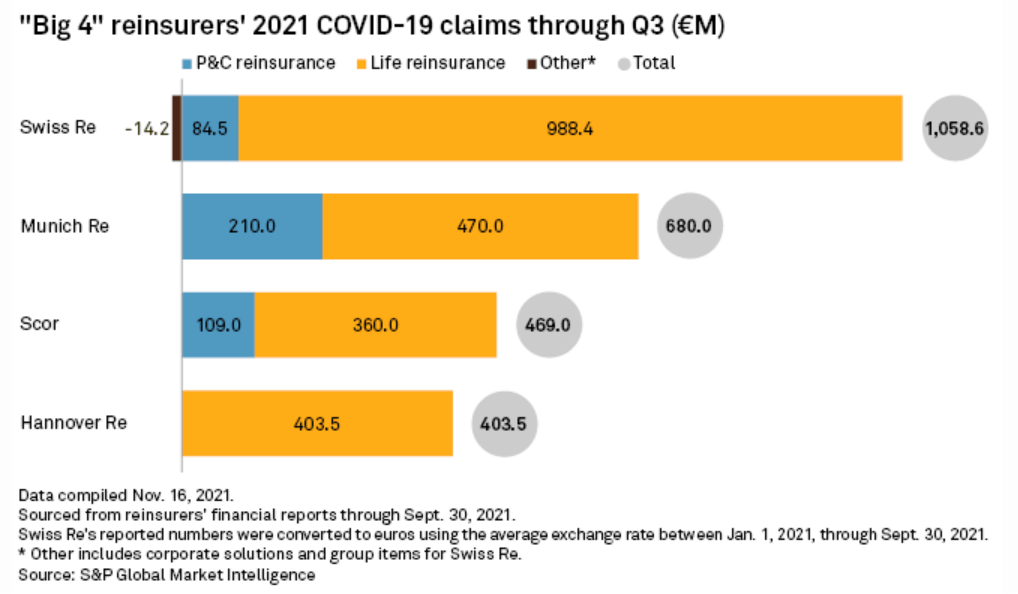

After racking up a larger-than-expected COVID-19 life claims bill in the third quarter, Europe's four largest reinsurers expect additional claims through the rest of 2021 and a lingering virus impact in 2022. Munich Re, Swiss Re AG, Hannover Re, and Scor SE collectively booked just under €740 million in COVID-19 claims and reserves in the third quarter, taking their collective year-to-date total to €2.61 billion.

—Read the full article from S&P Global Market Intelligence

Sustainable Covered Bonds: A Primer

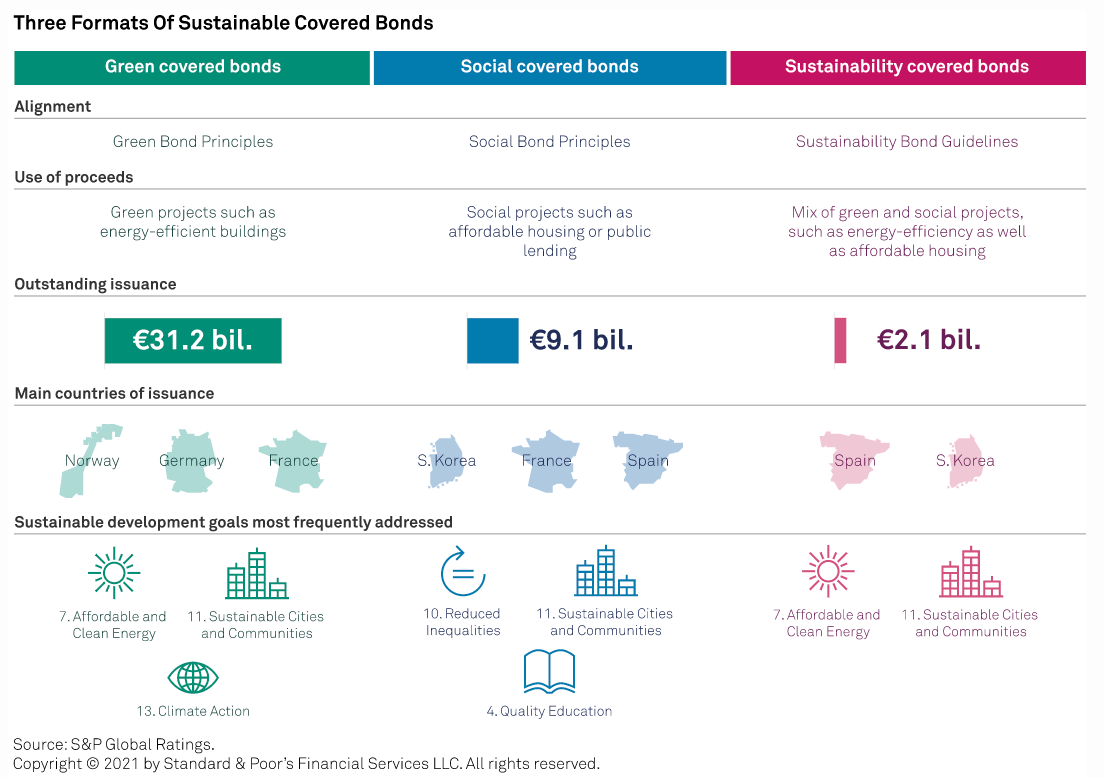

Issuers want to get more of them into the market. Investors can't get enough of them. Policymakers want to facilitate their growth. We have entered the era of the sustainable covered bond. These bonds raise funds to finance new and existing assets that meet certain sustainability criteria.

—Read the full report from S&P Global Ratings

EMEA Insurance Outlook 2022 Sector: Fighting Fit For 2022

S&P Global Ratings considers EMEA insurers to be well prepared for the challenges of 2022. Their capital surplus has largely recovered and now stands at 92% of its pre-pandemic level. For the EMEA insurance sector in aggregate, capitalization is 9% above the 'AA' category, which supports S&P Global Ratings’ current ratings.

—Read the full report from S&P Global Ratings

Inflation To Play Role In Biden's Fed Chair Selection, Analysts Say

The ongoing rise in inflation may give Federal Reserve Chairman Jerome Powell a slight edge over other candidates as President Joe Biden mulls who he will pick to lead the central bank, analysts say. The consumer price index rose 6.2% year over year in October, the largest 12-month increase since the period ending November 1990.

—Read the full article from S&P Global Market Intelligence

Bond Investors Unfazed, So Far, By Alarming Inflation Numbers

While inflation has surged to levels not seen in more than three decades, the government bond market seems to be buying the Federal Reserve's argument that inflation will not stick around. Since April, the Consumer Price Index, the market's preferred inflation metric, has seen an average year-over-year increase of 5.3%. In October, the index jumped 6.2%, the highest year-over-year increase since November 1990.

—Read the full article from S&P Global Market Intelligence

Listen: Fixed Income In 15 – Episode 22

Nicole Connolly, Global Head of ESG at Fidelity Investments and Lauren Smart, Chief Commercial Officer S&P Global Sustainble1, joined Joe Cass on this edition of Fixed Income in 15. Discussion focused on S&P Global’s new Sustainble1 division, ESG investing trends and how investors are increasingly playing a part in investment stewardship.

—Listen and subscribe to Fixed Income In 15, a podcast from S&P Global Ratings

No Time To Thrive

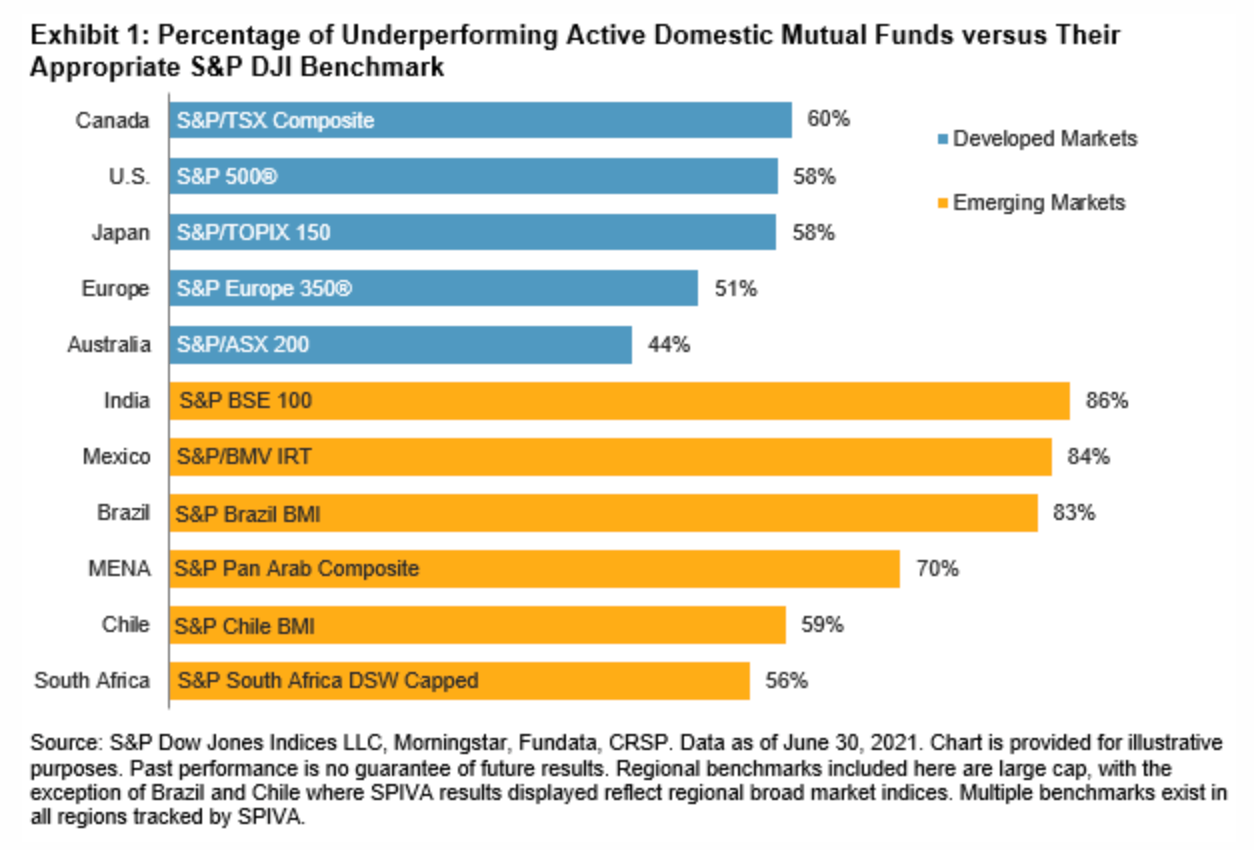

S&P DJI has just released the final regional edition of its S&P Index Versus Active Mid-Year 2021 Scorecards. The semiannual reports cover the performance of actively managed funds in the U.S., Canada, Latin America, Europe, South Africa, India, Japan, Australia, and S&P DJI’s newest regional addition, the Middle East and North Africa (MENA).

—Read the full article from S&P Dow Jones Indices

New SEC Guidance Emboldens Shareholder Activists As 2022 Proxy Season Ramps Up

With the 2022 proxy season ramping up, a recent decision by U.S. Securities and Exchange Commission staff to return more influence to investors has already yielded some early shareholder successes. The SEC issued a legal bulletin Nov. 3 that rescinded restrictions the Trump administration imposed on shareholder resolutions.

—Read the full article from S&P Global Market Intelligence

French Banks Outperform European, U.S. Peers In Q3 Equities Revenue Growth

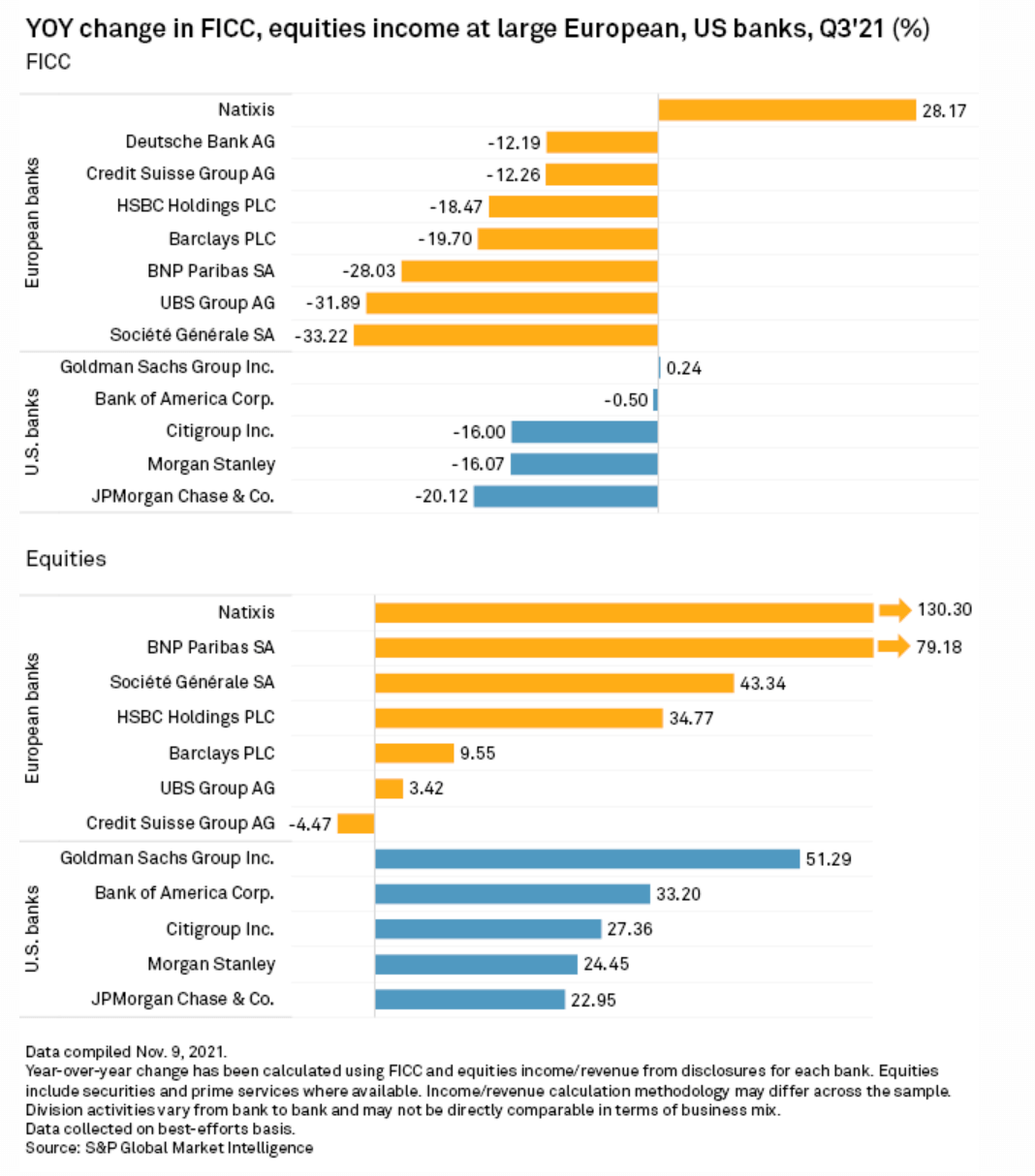

France's Natixis SA, BNP Paribas SA, and Société Générale SA outperformed almost all of their European and U.S. investment banking competitors in equities income growth in the third quarter, S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

Quotes Of The Quarter: APAC Lenders Bank On Digitalization For Post-COVID Growth

Banks in the Asia-Pacific region are investing in digital technology as the pandemic, by forcing people to stay indoors, has accelerated the trend toward digitalization. During conference calls after reporting results for the July-to-September quarter, top bank executives spoke about their plans and outlook, with many underscoring efforts to increase digitalization following the pandemic as well as to tackle emerging competition from new digital-only lenders.

—Read the full article from S&P Global Market Intelligence

Strong Interest Income Tips The Scale For Digital Banks In Europe, Asia

Digital banking, at its core, remains a balance sheet-driven business, and profitability hinges on the entity's ability to operate a sustainably profitable lending franchise. Maintaining high user engagement will be key in driving further growth.

—Read the full article from S&P Global Market Intelligence

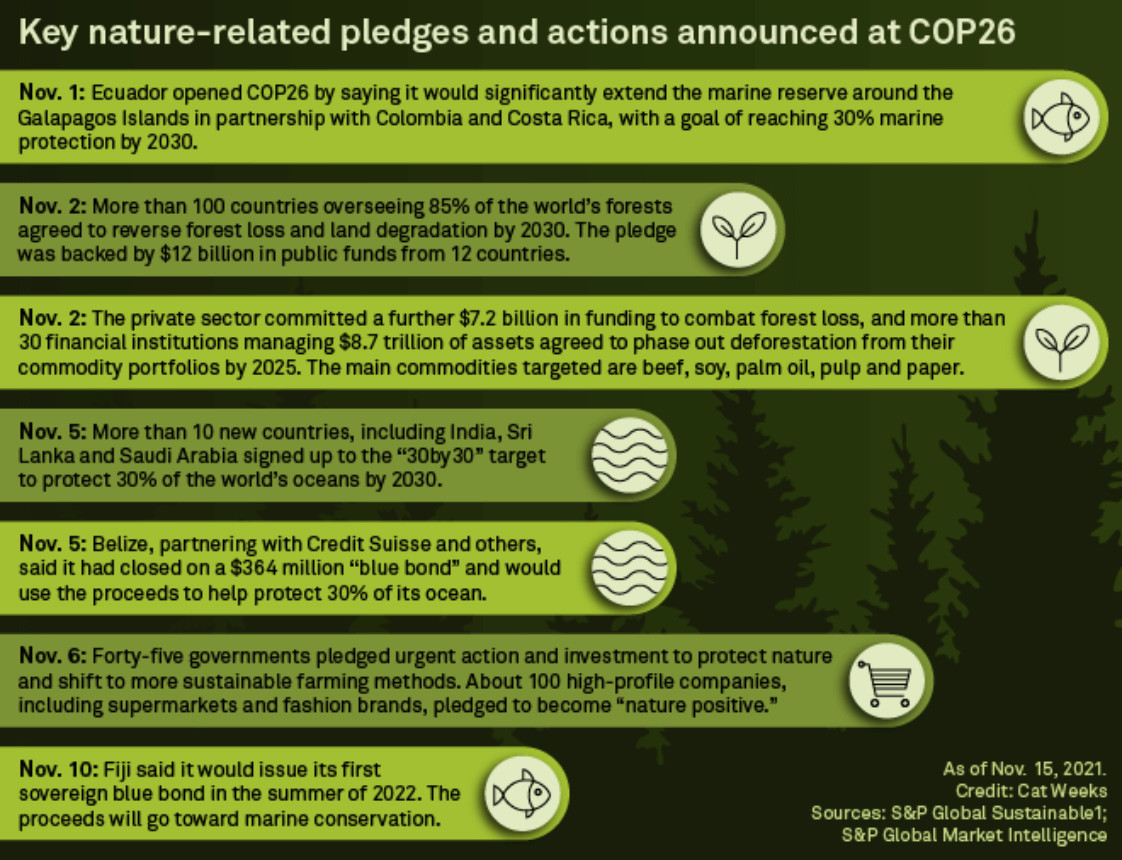

At COP26, Governments And Businesses Turned A New Leaf On Protecting Nature To Halt Climate Change

Calls to slash energy-related greenhouse gas emissions have been a common refrain at the U.N.’s annual climate summits, and COP26 was no different. At this year’s meeting in Glasgow, however, many asset managers, corporations, and policymakers embraced a much broader theme: Preserving and harnessing nature to fight climate change.

—Read the full report from S&P Global Sustainable1

Analysis: COP26 Offers Small Wins On Coal, Carbon Trading But Misses 1.5 Degree Target

The 26th UN Climate Change Conference, or COP26, failed to achieve goals like mobilizing sufficient climate funds for developing countries or dial down projections of fossil fuel demand in emerging markets, but pledges against coal and methane, and agreements on cross-border carbon trading, are being viewed as small wins in a bigger battle.

—Read the full article from S&P Global Platts

Wyden: U.S. Senate Will Not Be 'Potted Plant' On Build Back Better Negotiations

The U.S. Senate could tweak the clean energy tax provisions of a massive social spending and climate change package that the U.S. House of Representatives could vote on in the coming days, the head of the Senate tax-writing committee said Nov. 16.

—Read the full article from S&P Global Market Intelligence

FERC/NERC Staff Detail 28 Actions To Avoid Repeat Of Mid-February Blackouts

A report on the deadly mid-February electric grid outages in the U.S. Southwest underscored the need to safeguard natural gas-fired power plants and related pipeline infrastructure against extreme cold weather. The Nov. 16 report, produced by staff at the Federal Energy Regulatory Commission and North American Electric Reliability Corp., confirmed that the nearly weeklong event represented "the largest controlled firm load shed event in U.S. history."

—Read the full article from S&P Global Market Intelligence

Emirates Prepares For Test Flight Using 100% Sustainable Aviation Fuel

Emirates has joined a list of airlines that are forging ahead with plans to explore sustainable aviation fuel, or SAF, as decarbonization and climate change action looms in the international transport sector. The carrier in a statement on Nov. 16 said it had inked a memorandum of understanding with GE Aviation to develop a program that will see an Emirates Boeing 777-300ER, powered by GE90 engines, conduct a test flight using 100% SAF by the end of 2022.

—Read the full article from S&P Global Platts

Southwestern Energy Issues ESG Goals But No Net-Zero Emissions Pledge

A Southwestern Energy Co. corporate responsibility report promised that the pure-play shale gas producer will continue to reduce methane leakage, but it did not set net-zero or any other emissions targets. Southwestern's greenhouse gas emissions are already approaching a global climate change target of less than 2 degrees C outlined in the Paris Agreement on climate change, according to projections by S&P Global's Trucost climate risk unit.

—Read the full article from S&P Global Market Intelligence

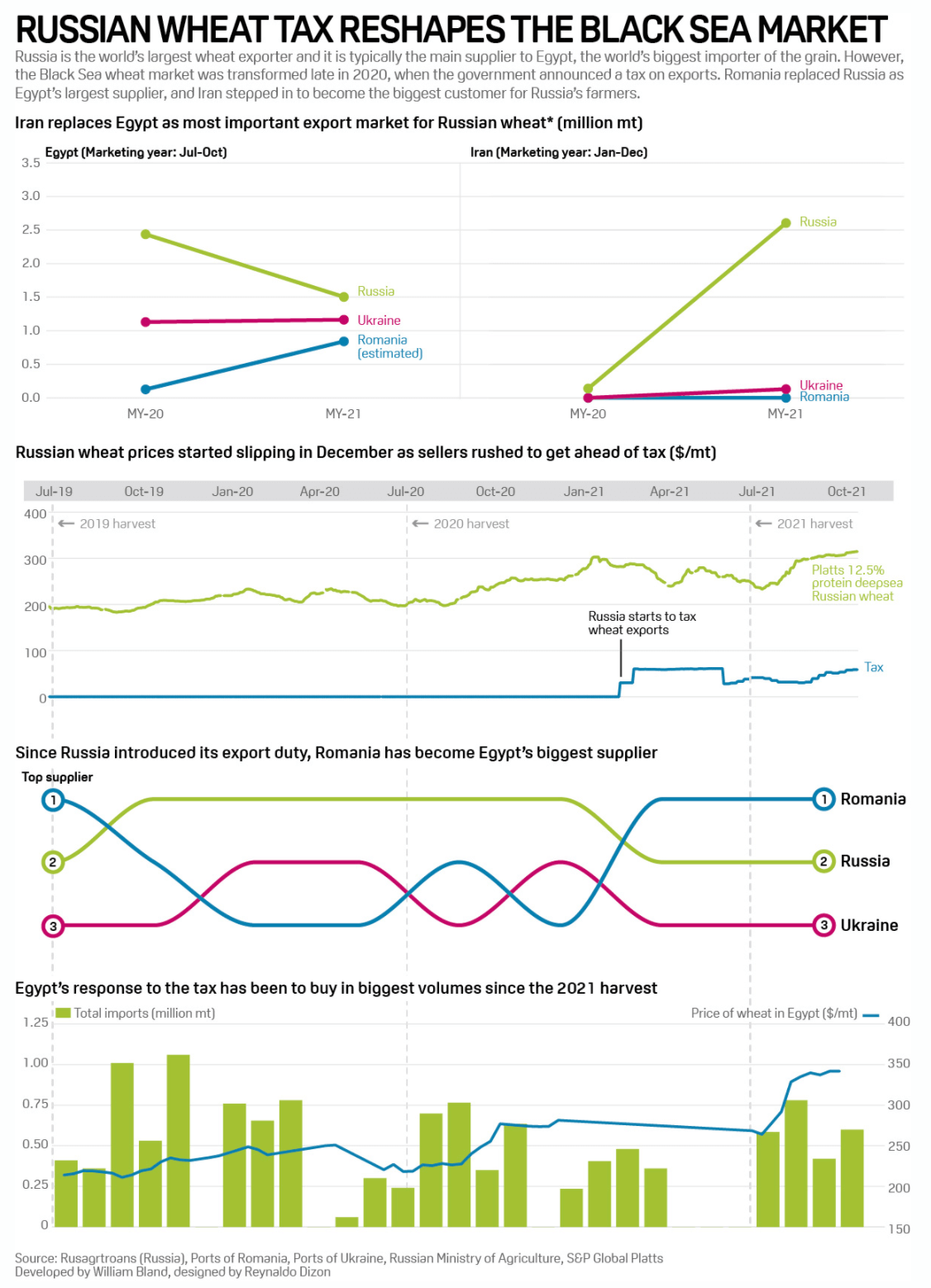

Infographic: Russian Wheat Tax Reshapes The Black Sea Market

Russia is the world's largest wheat exporter, and it is typically the main supplier to Egypt, the world's biggest importer of the grain. However, the Black Sea wheat market was transformed late in 2020, when the government announced a tax on exports. Romania replaced Russia as Egypt's largest supplier, and Iran stepped in to become the biggest customer for Russia's farmers.

—Read the full article from S&P Global Platts

Biden Asks FTC To Investigate Oil, Gas Companies' Role In High Prices At The Pump

U.S. President Joe Biden has called on the Federal Trade Commission to take immediate action to determine whether oil and gas companies have engaged in "illegal conduct" aimed at keeping prices at the pump high. "I do not accept hard-working Americans paying more for gas because of anti-competitive or otherwise potentially illegal conduct," Biden said in a Nov. 17 letter to FTC Chair Lina Khan.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language