Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The escalating trade war between Australia and China appears to have its roots in diplomatic umbrage. After Australian Prime Minister Scott Morrison discussed an international investigation into the source of coronavirus with other foreign leaders in late April, relations between two longtime trading partners have degraded.

“The reasons for the difficult relationship between China and Australia are very clear,” Chinese Foreign Ministry spokesman Wang Wenbin said in a statement on Nov. 12. “For some time now, Australia has been blatantly violating usual diplomatic practices in international relations and has made inflammatory comments on China’s domestic matters relating to Hong Kong, Xinjiang, and Taiwan repeatedly.”

China is the largest consumer of Australian commodities. Australia also relies on China for both tourism and foreign students. However, the coronavirus pandemic and associated restrictions have limited both tourism and educational opportunities for Chinese citizens. China depends on Australia for the raw materials for its domestic steel industry, including iron ore and high quality coking coal and for thermal coal for energy producction.

In May during the early days of the diplomatic conflict, Beijing warned that it intended to replace Australian iron ore with African iron ore. In January-March, Africa supplied 16.1 million mt of iron ore to China, while Australia supplied 161.3 million mt. Chinese industry experts caution that it could take 4-5 years to substantially reverse that proportion.

China also appears to have instituted a “verbal ban” on Australian coal. China’s trade policy isn’t always communicated in a formal way. For example, a partial ban on Australian beef became widely known when Australian abattoirs were notified of paperwork errors by Chinese customs at the time of delivery.

The Chinese National Development & Reform Commission has indicated that it may look into "excessive coal imports" this year. Imported coking coal has been cheaper than Chinese domestically produced coking coal this year. During a year in which Chinese coal demand is expected to contract 5% according to the International Energy Agency, the combination of cheaper Australian coal and reduced demand has been challenging for the domestic coal industry.

But ANZ Research said in an Oct. 13 note that the apparent restrictions on Australian coal mask " a more confusing situation on the ground. While it appears some Chinese buyers have received the verbal ban, there have been others that have not heard a thing ... and it doesn't appear to be directed entirely at Australia, with other import sources also coming under the directive."

There are reasons to believe that the ban on Australian coal may have more to do with supporting Chinese producers than it does with Australian diplomatic policy. ANZ, in discussing the apparent ban, said “it appears to be directed at lower quality coking coals, such as [pulverized coal injection] and semi-soft. Demand for premium hard coking coal remains strong. This marries with China's own domestic coking coal industry, where lower quality coking coal is in plentiful supply, while hard coking coal is relatively limited."

Uncertainty driven by the Chinese bans on Australian materials has hurt some industries, while leaving others relatively unscathed. A challenging year for both economies and domestic considerations in China may be motivating the continued intransigence.

Today is Monday, November 16, 2020, and here is today’s essential intelligence.

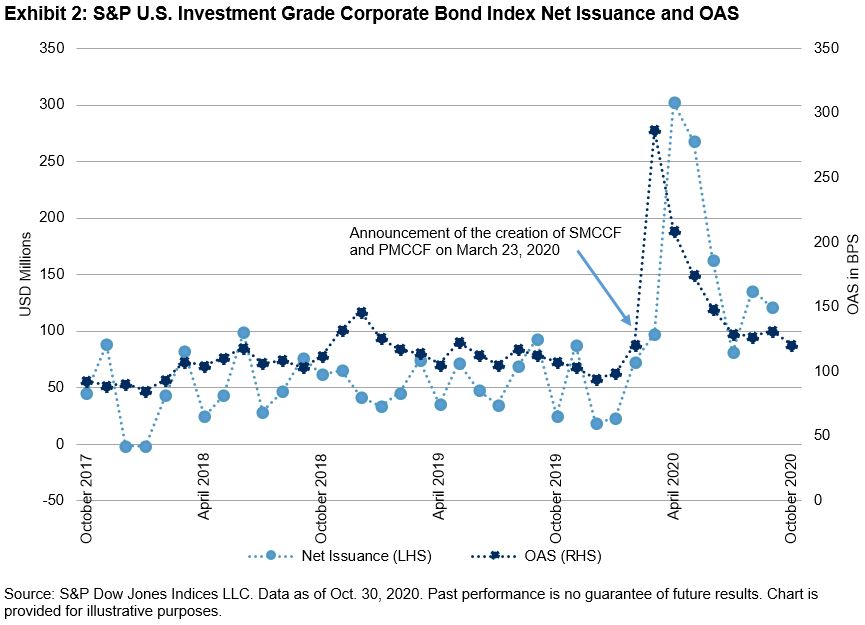

The Fed’s Corporate Bond Purchases and Their Impact on Corporate Bond Issuance

It is interesting to note that high-yield bond issuance rebounded, and investment-grade bonds further strengthened, as soon as the announcement of both credit facilities in March.

—Read the full blog post from S&P Dow Jones Indices

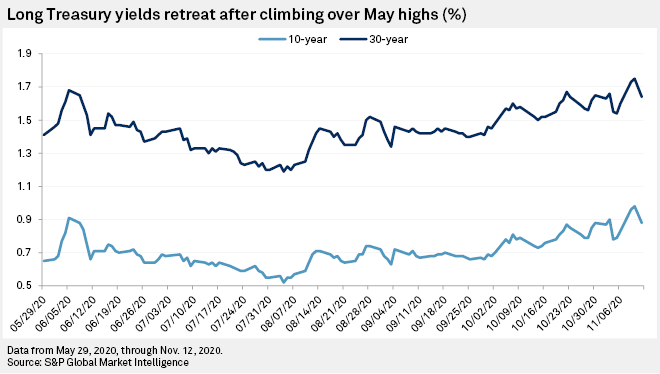

US stocks set for volatility cycles as virus surges compete with vaccine news

A wave of vaccine euphoria in the U.S. stock market may soon crash into the rocky reality of record-breaking coronavirus cases and social distancing restrictions.

—Read the full article from S&P Global Market Intelligence

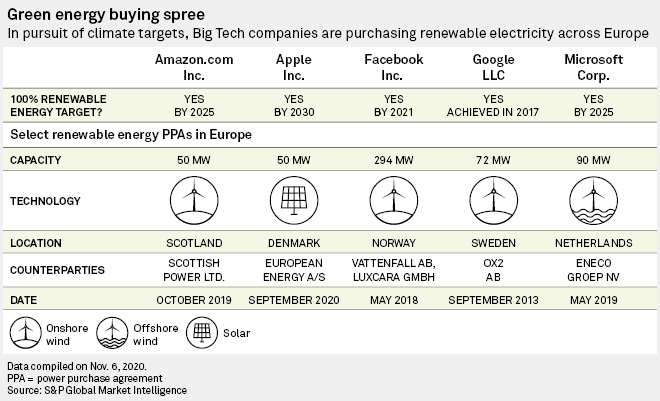

Big Tech in front as green power becomes 'must-have' for European data center

As square footage in Europe's data center industry rises steadily, so too does the sector's power demand. And against the backdrop of corporate sustainability targets, that means an increased focus on renewable electricity.

—Read the full article from S&P Global Market Intelligence

New FCC data shows growing number of Americans with access to quality broadband

New data released Nov. 12 by the Federal Communications Commission shows that the number of Americans with access to high-speed broadband is on the rise.

—Read the full article from S&P Global Market Intelligence

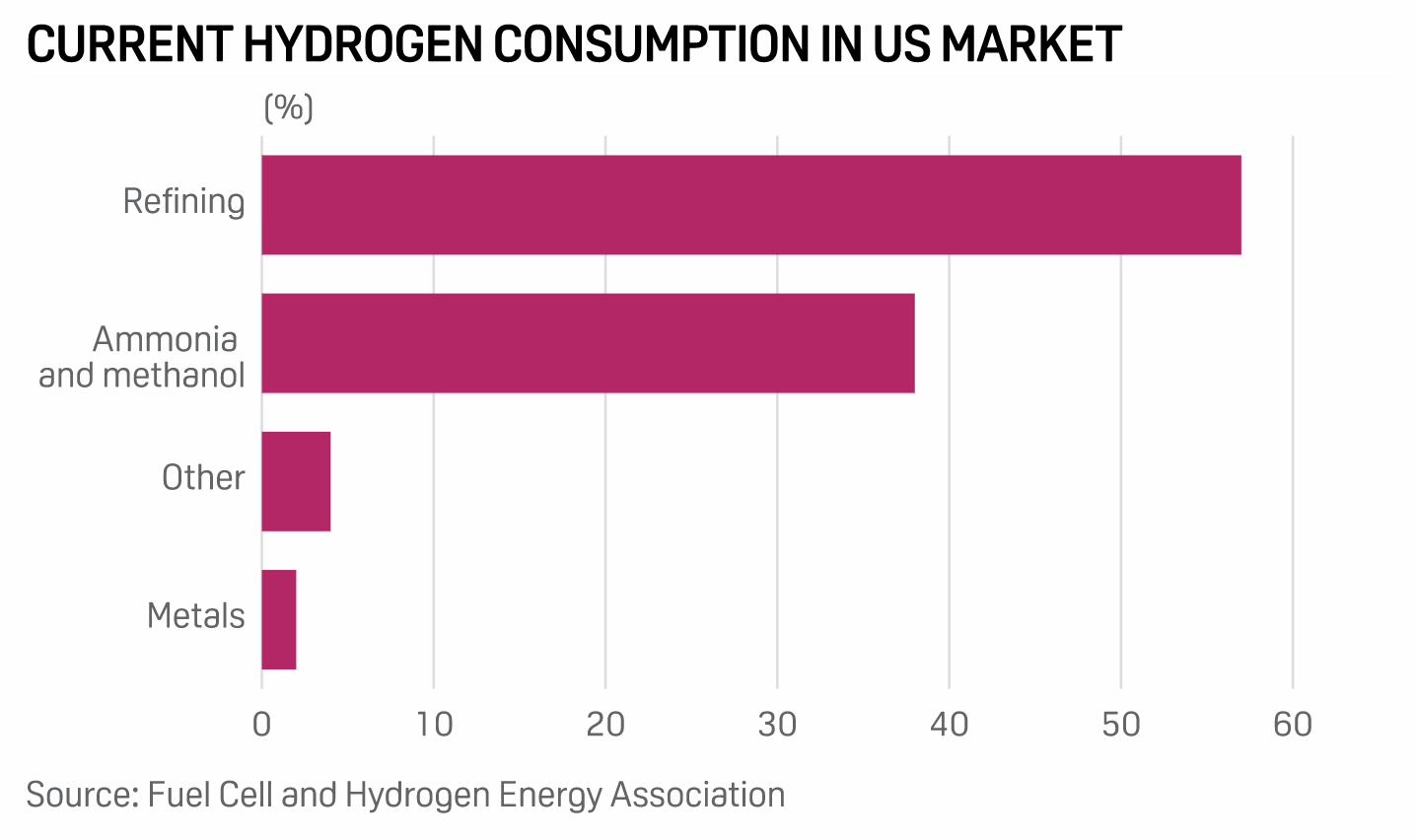

Hydrogen first used for energy storage then wider applications: Mitsubishi Power

Mitsubishi Power Americas is positioning itself as a decarbonization company based initially on hydrogen and lithium-ion battery storage technologies, with longer-term plans for hydrogen to be used in other applications like power generation

—Read the full article from S&P Global Platts

Feature: Maritime zero-carbon drive widens as 2 more companies build LPG duel-fuel VLGCs

The uptake of LPG-propelled Very Large Gas Carriers is expanding worldwide as two more LPG shipping and trading companies build duel-fuel vessels, hastening the drive towards zero-carbon fuels in the maritime sector.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language