Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 May, 2022

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

More Shocks For Global Oil Markets

By year-end, the Group of Seven nations are prepared to end financing for most overseas fossil fuel projects and the European Union plans to prohibit nearly all Russian crude imports. How will OPEC+ and global oil markets respond?

Since the coronavirus pandemic began in 2020 and the Russia-Ukraine war started in February of this year, disruptions to supply and prices have sent shocks throughout global oil markets. Conditions have ricocheted from the dramatic drops in global petroleum demand caused by the coronavirus crisis to the scramble for energy security as economies establish supply separate from Russia. On April 20, the NYMEX WTI oil price plunged into negative territory for the first time in history. On March 7, the ICE Brent crude futures price roared to a 14-year high above $130 per barrel as international sanctions took effect targeting Russian energy. Now, new variables have the potential to permanently change global oil markets.

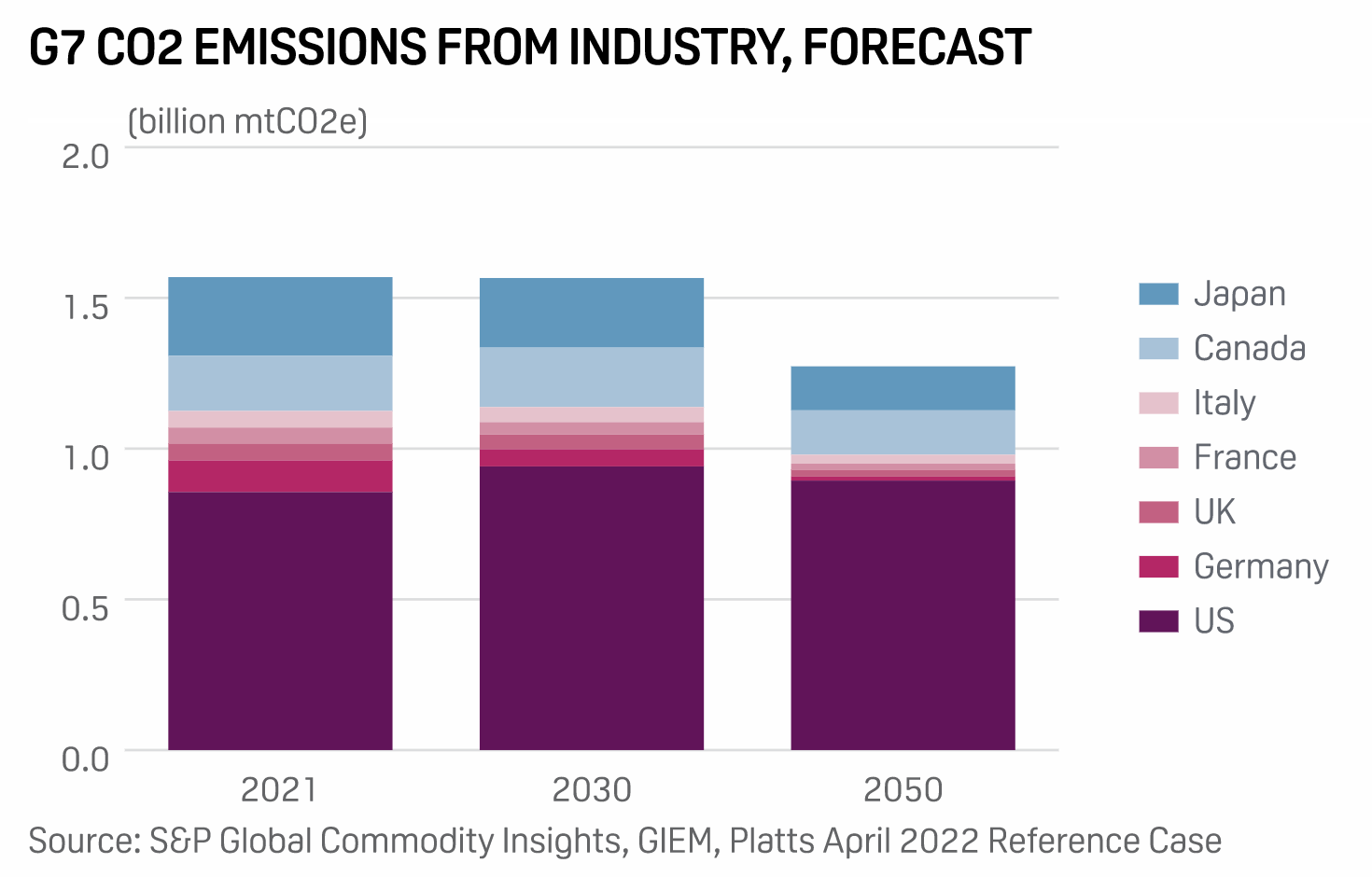

On May 27, G7 countries pledged to end their support for the international fossil fuel industry by the end of this year and affirmed their climate and decarbonization commitments despite the challenges to the global energy landscape from the Russia-Ukraine war. Leaders from Canada, France, Germany, Italy, Japan, the U.K., U.S., and EU also advocated for “oil and gas producing countries to act in a responsible manner and to respond to tightening international markets, noting that OPEC has a key role to play” in filling the current and future gaps in the market.

Three days later, in its sixth sanctions package since Ukraine came under attack, European leaders agreed on May 30 to ban Russian oil imports by sea before the end of this year. The move will phase out almost 90% of the former Soviet superpower’s oil imports into the bloc. Market participants expect that the change will further disrupt global energy supplies and flows and exacerbate price pressures as buyers seek alternative partners, according to S&P Global Commodity Insights.

Markets will be closely watching how OPEC+, the coalition of major oil producing economies and their allies, reacts to these shifting dynamics—especially as the production cuts that the group implemented at the peak of the pandemic end in September.

"We're looking at the physical market," one OPEC delegate told S&P Global Commodity Insights about how the producer group is likely to wait and see how the new EU measures directly affect Russian flows. “This talk [of banning Russian oil] has been going on for a long time. We have our tools to judge the physical market. We know the customers; we know the demand. We'll see if there's an impact."

"Market conditions continue to scream out for additional supplies," Edward Bell, senior director of market economics at the Dubai-based bank Emirates NBD, told S&P Global Commodity Insights. “But so long as OPEC+ keeps its focus on 'fundamentals' we expect oil prices will continue to price in considerable tightness, meaning high and volatile prices will persist.”

"OPEC+ is not reliable and is not fulfilling its commitment to oil market supply," Kamil al-Harami, an independent Kuwait-based oil analyst, told S&P Global Commodity Insights. "They are promising an increase on a monthly basis, but they have been missing their targets for the past year. Where is their dedication to oil market stability?"

Today is Tuesday, May 31, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

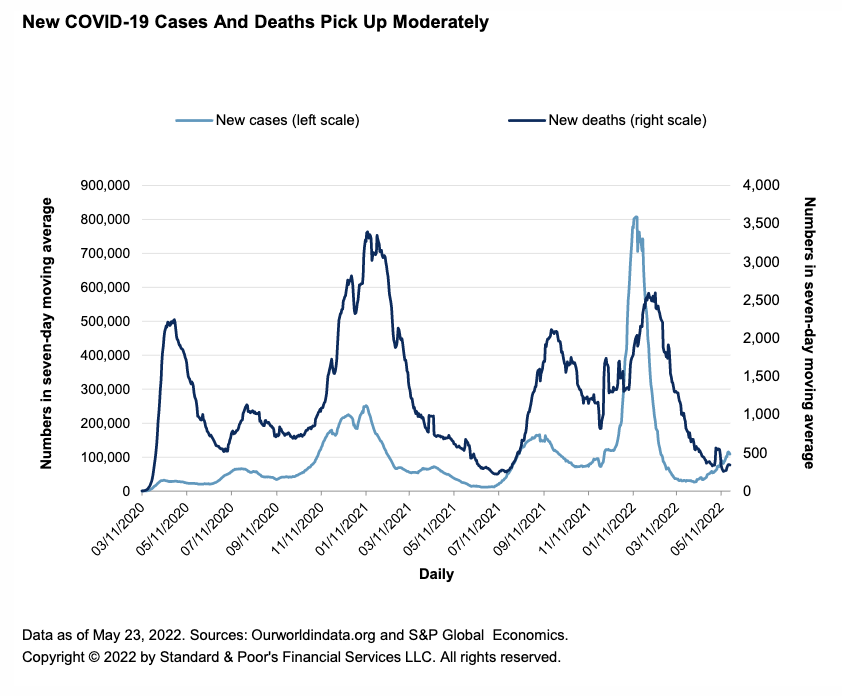

Economic Research: U.S. Real-Time Data: Higher Prices And Interest Rates Dampen Activity As COVID-19 Cases Rise

Average new daily COVID-19 cases reached 108,582 as of May 23, almost double the number at the beginning of the month. Recurrence of COVID-19 has kept some milder restrictions in place, preventing mobility from recovering fully. The number of seated diners slipped back into negative territory, and as of May 20, travelers passing through airport security checkpoints were near 12% below the pre-pandemic level. On prices, lumber futures prices fell to a new low this Monday due to a slowdown in the market for new homes, but other commodity prices (gasoline and metal) remain extremely high. Inflation expectations remain elevated. The jobs market remains healthy. For the week ended May 21, initial jobless claims declined by 8,000 to 210,000, beating estimates of 215,000.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

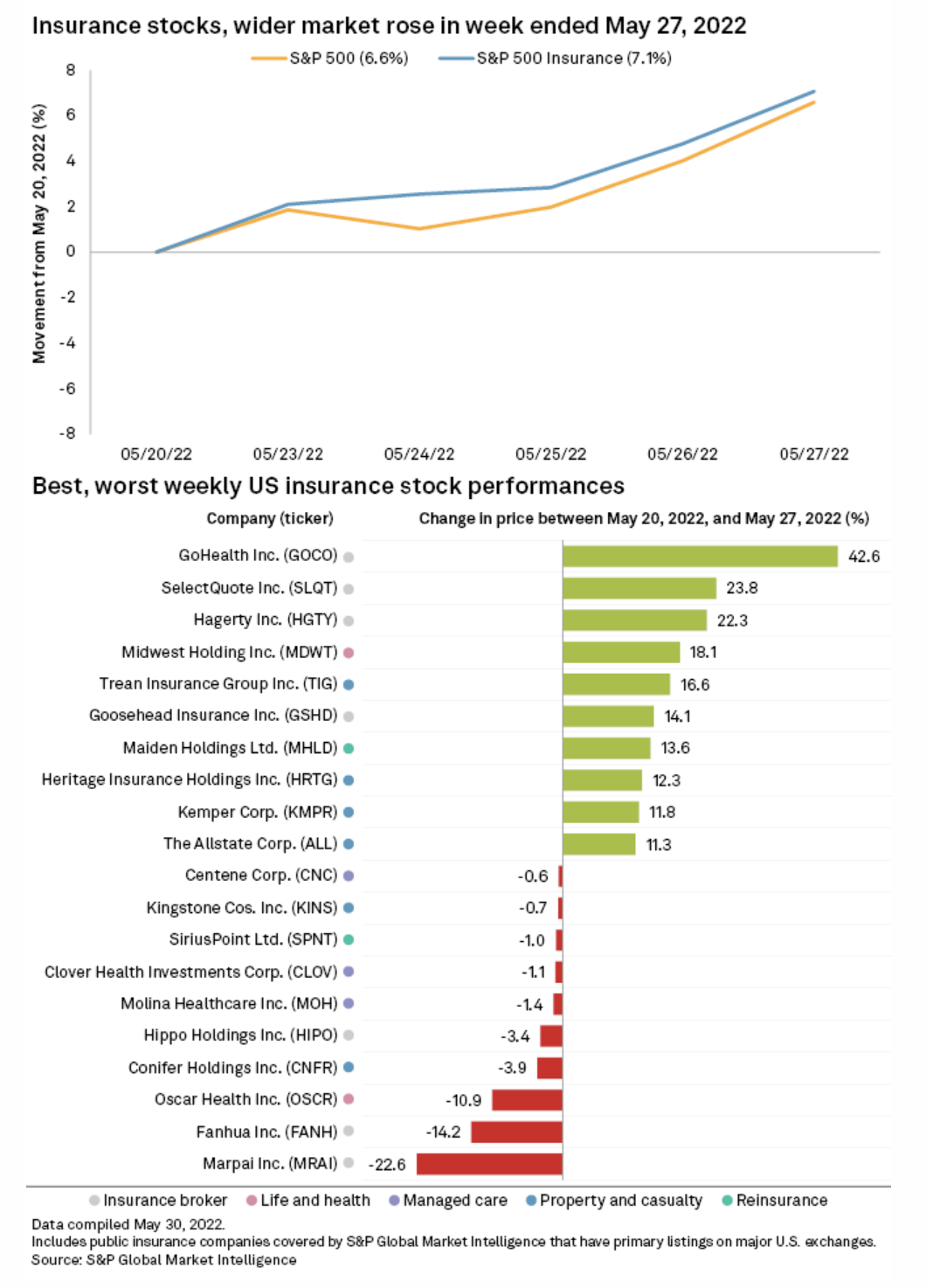

Stocks Shake Losing Streak; Fla. Insurers Up As Legislature Passes Property Bill

U.S. equities broke its losing streak in a big way, carrying the insurance sector along for the ride, with stocks experiencing broad-based gains during the week ending May 27. The S&P 500 Insurance index jumped 7.06% to 570.93, while the S&P 500 soared 6.58% to 4,158.24. While the broader market had suffered a string of losses, insurance stocks, particularly in the property and casualty sector, have bucked some of the negative trends that have affected the rest of the market.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

G7 To Stop Fossil Fuel Funding, Calls On OPEC To Pump More Oil

The G7 on May 27 called on OPEC to pump more crude and committed the group of major industrialized consumer countries to end financing for most overseas fossil fuel projects by the end of 2022, in a joint statement. "We call on oil and gas producing countries to act in a responsible manner and to respond to tightening international markets, noting that OPEC has a key role to play," the G7 energy and climate ministers said in a joint communique following their ministerial meeting in Berlin. "We will work with them and all partners to ensure stable and sustainable global energy supplies."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

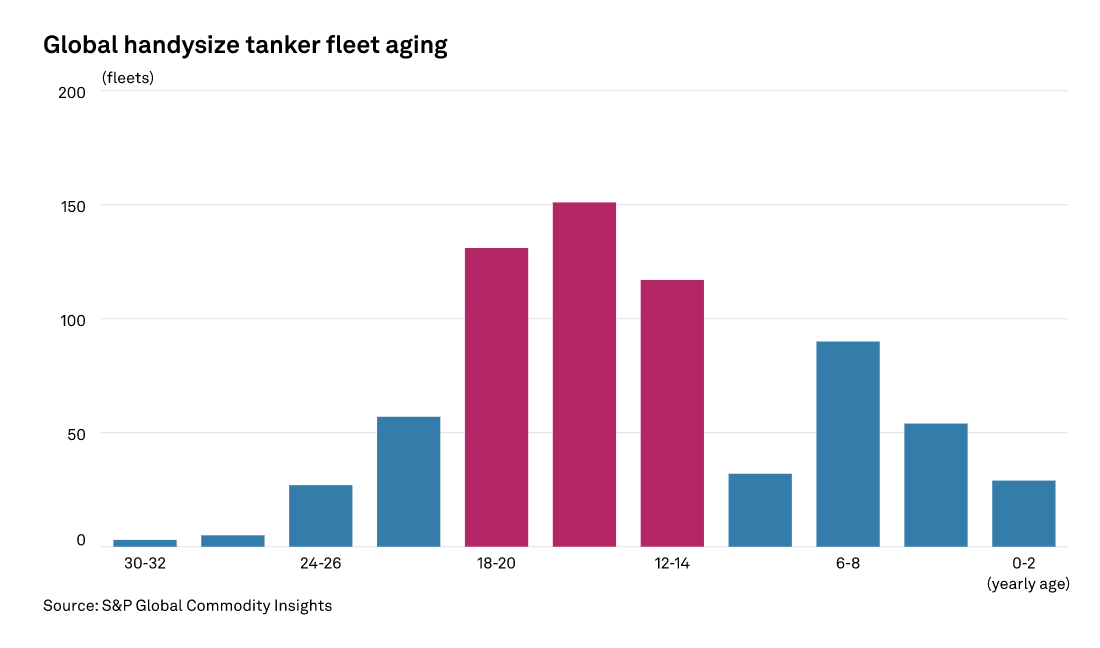

Carbon Neutral Cargo

Emissions trading is not a new concept. One of the earliest examples emerged in 1990, when the sulfur dioxide trading system was launched under the framework of the Acid Rain Program of the Clean Air Act in the United States. It was only a matter of time before the maritime industry would be expected to address its own emissions and some shipbrokers first started to look at this around twenty years ago.

—Read the article from S&P Global Commodity Insights

Fuel For Thought: Tax Cuts, Subsidies Reflect Asia’s Belief Expensive Oil Is Here To Stay

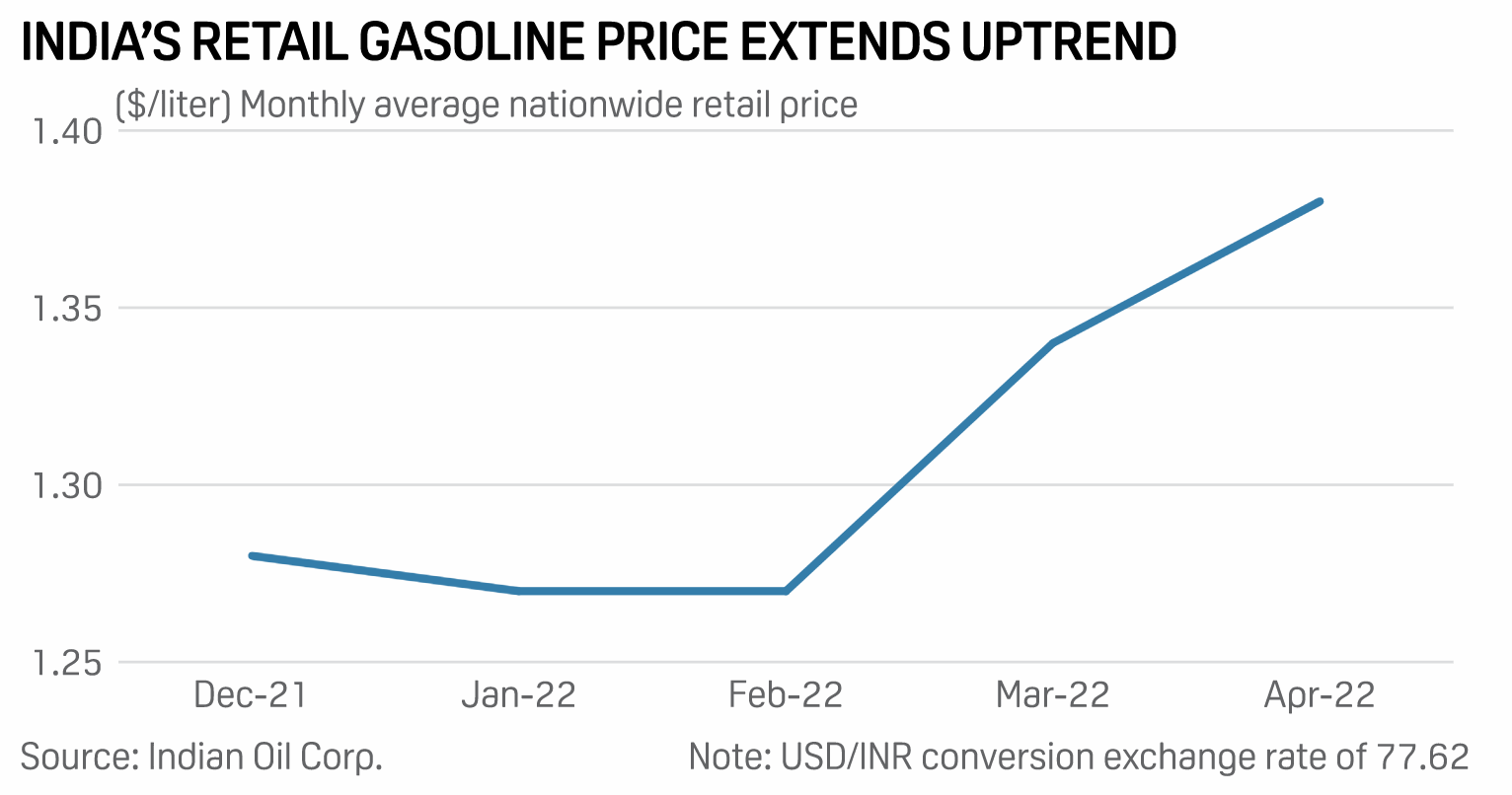

Desperate times call for desperate measures, and for Asian governments it's time to act rather than wait for oil prices to cool. After shelling out more than $100/b for months, Asia's leading oil importing nations are running out of patience and are either slashing taxes or providing subsidies on fuels to ensure consumption does not suffer yet again. Asian governments had hoped the sharp rise in crude prices following the start of the Russia-Ukraine conflict in March would be short-lived, but now they are convinced the price surge was not just a knee-jerk reaction.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Heavy Cybersecurity M&A Spending May Be Here To Stay

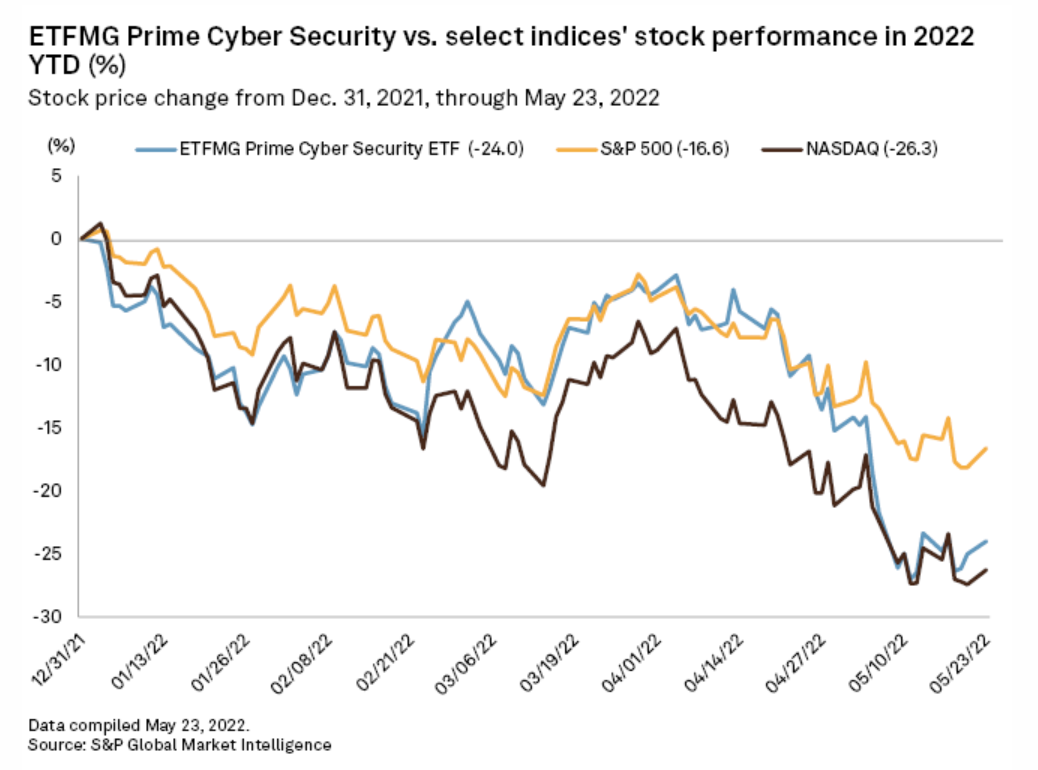

Cybersecurity M&A will likely remain hot, even as investor interest in tech more broadly continues to cool. Investors in recent years have piled into cybersecurity, paying high valuations for equity stakes in a range of companies that have yet to produce a profit. That thesis expanded into M&A, where both strategic and financial investors struck deals at record paces and prices throughout the pandemic and into 2022.

—Read the article from S&P Global Market Intelligence