Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Concerns Over Bond Market Reversal Rise Alongside Fed Meeting

Increasingly risk-averse investors are watching the U.S. bond market as persistent inflation, the war in Ukraine, sooner-and-stronger interest rate hikes, and the COVID situation in China contribute to ongoing market volatility.

The U.S. Federal Reserve is at a juncture—aiming to control roaring price pressures without pushing the world’s largest economy into a recession. Market participants are awaiting the central bank’s next move. The Fed is expected to announce its next interest rate hike, with a 50 basis point (bps) increase as soon as this week, and plans to reduce its balance sheet following the end of its two-day Federal Open Market Committee meeting on Wednesday. S&P Global Economics expects the Fed to raise interest rates a total of seven times, including March’s 25 bps hike, followed by four additional increases next year.

As the Fed raises rates and offloads its Treasury holdings accumulated during the pandemic, the Fed’s hawkish policy is exposing the bond market’s structural cracks—and leaving traditional buyers to fill the gaps despite insufficient demand, according to S&P Global Market Intelligence.

"As the Fed pulls that liquidity away, we should not be surprised to see the return of volatility as other market makers have to now absorb that supply and absorb all that market-making activity," Patrick Leary, a senior trader at Loop Capital Markets, told S&P Global Market Intelligence.

"Treasury market liquidity is currently rather low compared to the amount of supply coming to market in the coming years ... It's not facing any sort of acute liquidity crisis like it did in March 2020, but the conditions for a problem are there,” investment strategy researcher Lyn Alden told S&P Global Market Intelligence. "The lack of liquidity is not at acute levels but it's clearly on their radar … The Fed is historically a reactive organization rather than a proactive one, so they would likely need to be told by the market when to pivot rather than anticipate in advance where the pivot point may be.”

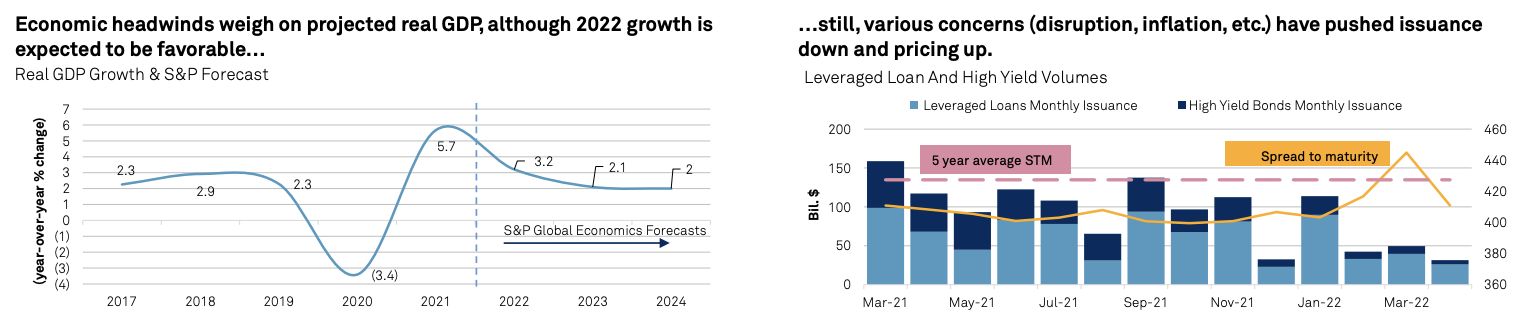

U.S. corporate credit generally remains weaker now than prior to the pandemic, and leveraged loan and speculative-grade bond issuance volumes plunged 60% year-over-year in February and March following a brisk start to the year, according to S&P Global Ratings. Leveraged debt investors have reallocated from bonds to loans to protect their portfolios from rising inflation and interest rates, according to S&P Global Market Intelligence. Now, S&P Global Ratings expects global bond issuance to contract nearly 5% this year, with higher rates, volatility, and event risk pushing issuance below 2021 levels across most asset classes. This includes the global green bond market, which showcased a drag in issuance in the first quarter as rising interest rates sidelined investors.

Whether rising inflation coupled with higher nominal interest rates will help or hurt the economy is unclear, according to S&P Global Market Intelligence. In the immediate term, market participants’ concerns are evident. The ICE BofAML Move Index, which is the bond market’s equivalent to the equities market’s so-called VIX "fear gauge,” has recently climbed to highs not seen since March 2020.

“Is it a bond picker's market?” Martin Fridson, chief investment officer of Lehmann Livian Fridson Advisors and a contributing analyst to Leveraged Commentary & Data, said in a recent commentary. “At first glance, recent market behavior appears highly irrational, with the riskiest credits providing the most price protection as credit risk mounts. Upon closer examination, however, the traditional relationship between risk and return has not been scrapped, notwithstanding the current market turmoil. As in more ordinary times, successful bond-picking will require rigorous analysis of issuers’ business prospects.”

Today is Tuesday, May 3, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

U.S. CLO And Leveraged Finance Quarterly Key Themes: An Early Spring Chill In The Credit Markets

The S&P Global Ratings GDP growth forecast at 3.2% for 2022 remains favorable, but growth is slowing (down from 5.7% in 2021 and its prior 2022 forecast of 3.9%). Healthy consumer savings, low unemployment levels, and good corporate liquidity remain bright spots. Business headwinds will likely stall, or reverse, the net positive rating momentum seen over the last 16 months. Risks, including persistently high inflation, tightening financial conditions, ongoing supply chain disruptions and staffing challenges, and escalating geopolitical conflicts and tensions, have contributed to the increase in its 12-month recession estimate to the 20%-30% range.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

PE Managers Face 'Crowded' Fundraising Environment; Medtech Buyouts Pace Slower

EQT AB (publ) COO Caspar Callerström described a "crowded and competitive" fundraising environment on the Swedish private equity firm's first-quarter earnings call. That is translating into a "little bit of slowness" as EQT raises capital for a new slate of investment strategies, added CEO Christian Sinding, who still expressed confidence in the firm's ability to hit fundraising targets. Its flagship funds are still seeing a "quite healthy demand" from investors, Sinding said. The comments delivered April 26 gave a from-the-trenches perspective on the hyperactive pace of fundraising in private equity, with an estimated 15 buyout fund managers all attempting to raise $15 billion or more for their strategies this year, according to the 2022 Market Overview report from Hamilton Lane Inc.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

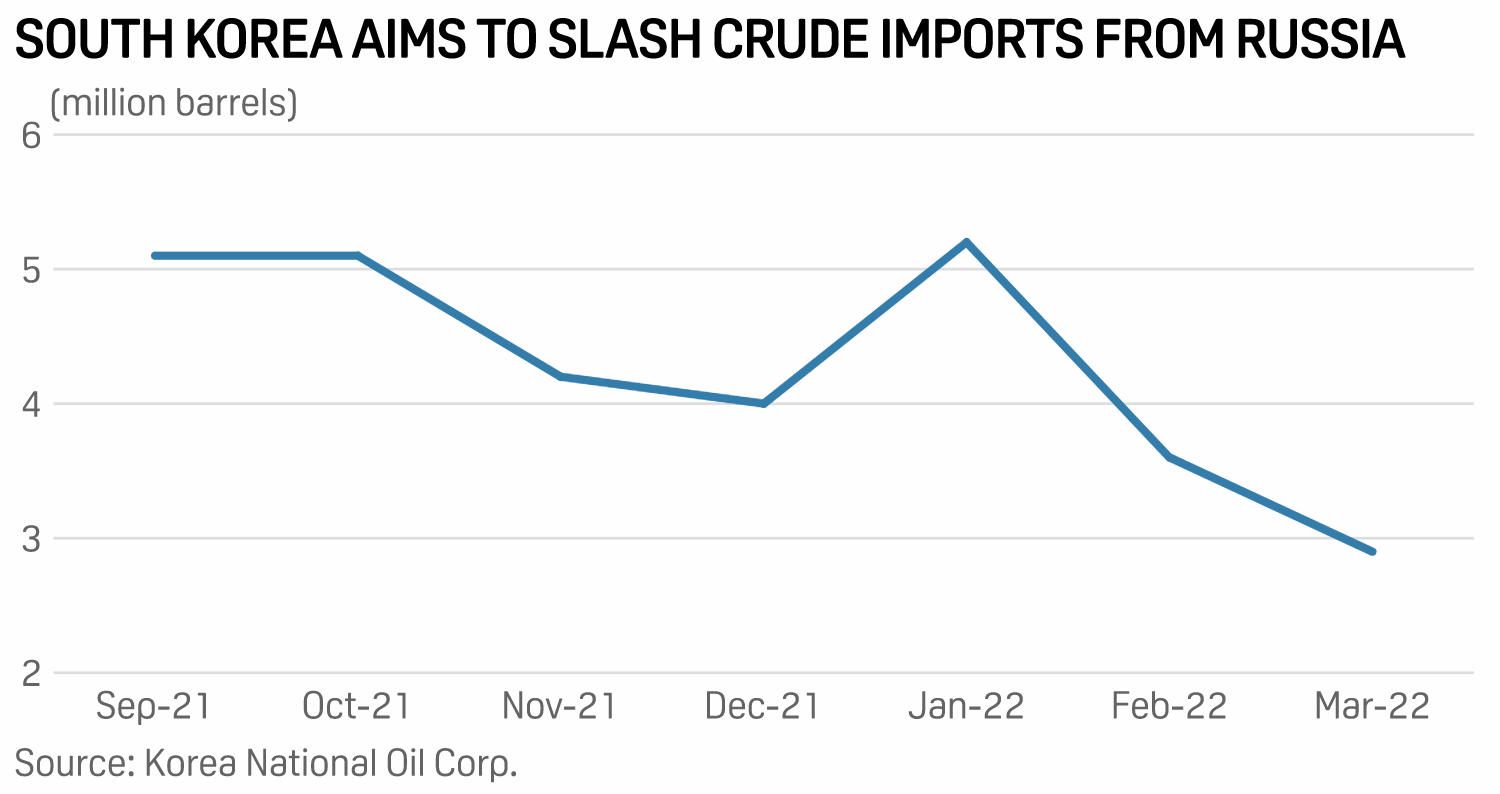

South Korea On Course To Slash Russian Crude Imports, Takes Ample U.S. Cargoes As Alternative

South Korea is on course to sharply reduce crude imports from Russia with shipments from the OPEC+ producer tumbling by more than 40% year on year in March, as refiners aim to avoid trade, logistics, and financial complications, while light sweet U.S. crude is considered the country's best option to fill any Russian supply gaps. South Korea imported 2.98 million barrels of crude oil from Russia in March, down 44% from 5.29 million barrels received a year earlier and marking the lowest monthly shipments in eight months, latest data from state-run Korea National Oil Corp showed. The monthly shipments also fell 18% from February, while Russian crude imports in the first quarter dropped 4% from the same period a year earlier to 11.86 million barrels, the KNOC data showed.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Can The Los Angeles-Shanghai Green Shipping Corridor Save The Sector And The Planet?

The shipping sector faces a massive challenge in decarbonizing to meet global climate goals. To accelerate those efforts, leaders at the COP26 climate change conference in Glasgow last year agreed to develop at least six green shipping corridors by 2025 and many more by 2030. The Biden administration has fully supported the plan and is urging private industry to also get on board. One of the more significant corridors to emerge is between the Port of Los Angeles, the busiest container port in the Western Hemisphere, and the Port of Shanghai, the world's largest port. Christopher Cannon, chief sustainability officer at the Port of Los Angeles, spoke with senior editor Meghan Gordon about how plans for the Los Angeles-Shanghai green shipping corridor are shaping up.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

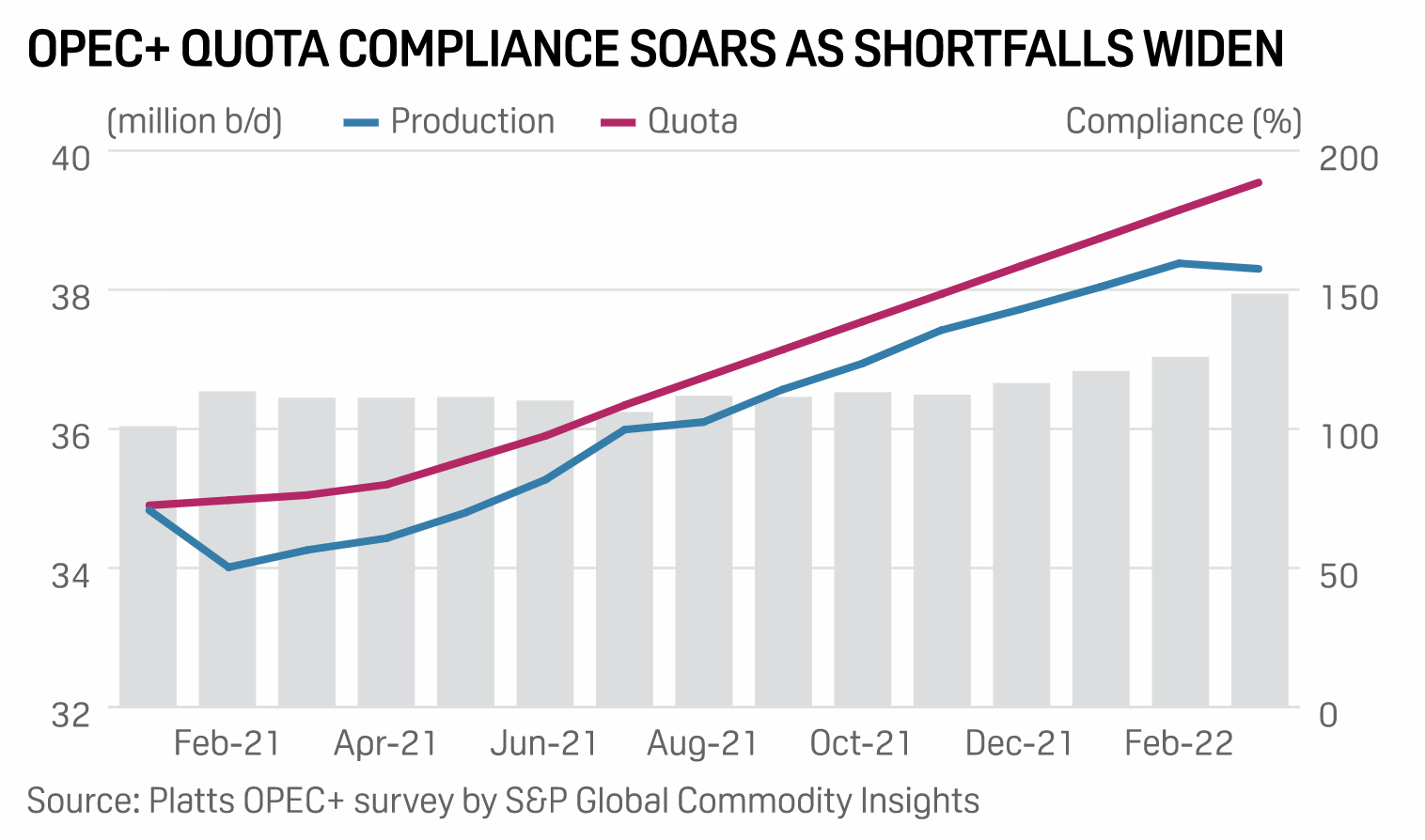

OPEC+ Set To Stay The Course As It Awaits Clarity On Russia Shut-Ins, China Lockdowns

Dated Brent prices in April vacillated between $98/b-$108/b as traders struggled to weigh the evolving western sanctions on Russia against weakening oil demand in China, where the coronavirus is resurgent. For OPEC and its Russia-led allies, however, there is no wavering in their conviction on how to manage crude supply. Several delegates say the OPEC+ coalition is likely to rubber stamp another modest 432,000 b/d increase in production quotas for June, when ministers meet May 5, sticking with a plan agreed last summer.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Customer Experience As A Catalyst: Data-Driven Digital Economy

2022 will be a year of IT execution as companies establish a new ‘business as usual’ with fresh approaches to improving the customer experience, once-aspirational views of innovative and immersive digital experiences have quickly transitioned into requirements for employees, customers, and partners. As businesses face mounting pressure to meet the speed and scale demanded of the digital experience economy, they need to decrease complexity in the technologies and processes used to deliver on their customer experience initiatives along the customer journey. Becoming data-driven is more than implementing a strategy, however; it entails an organizational and cultural shift. Overall, the state of adoption for a data-first model remains in the earlier stages. So, how are customer experience data drivers and digitally driven businesses boosting company performance?

—Register for the webinar from S&P Global Market Intelligence