Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Food Price Shocks Are Raising Risks Of Social Instability

As the Russia-Ukraine war continues to push food and energy prices higher, risks of food insecurity and social unrest are intensifying for developing economies.

After the United Nations Food and Agriculture Organization’s Food Price Index in March reached the highest level seen since its inception in 1990, the inflationary stresses on food prices and disruptions to supply chains have disproportionally hurt emerging market economies that already suffer from food shortages—particularly in the Middle East and North Africa. Such rising international food prices have historically been associated with higher risks of sociopolitical instability, especially in lower-income economies.

Egypt, Jordan, Lebanon, Morocco, and Tunisia are likely to significantly suffer from the Russia-Ukraine conflict’s economic implications due to their dependence on imports of food and/or energy—which may exacerbate existing inequalities and raise risks of social instability, according to new S&P Global Ratings research.

“Surging commodity prices on the back of the Russia-Ukraine conflict are pushing up food price inflation in Middle East and North African (MENA) economies and could pose risks to existing sociopolitical dynamics,” S&P Global Ratings said in research published today. “We believe rising food and energy prices and supply insecurities, alongside high youth unemployment in these countries, could lead to higher income inequality and pose risks to existing sociopolitical dynamics. Fiscal measures to soften the blow to consumers and producers and prevent social discontent will put pressure on post-pandemic fiscal consolidation. A protracted Russia-Ukraine conflict risks worsening the fiscal dynamics of MENA commodity importers.”

Because both Russia and Ukraine produce and export substantial supplies of the world’s wheat, corn, sunflower and vegetable oils, and fertilizer, supply and price shocks have hit key agricultural commodities with extraordinary volatility since the invasion began on Feb. 24. The conflict is dragging on as unfavorable weather conditions hurt production in other major agriculture producing economies, notably darkening the outlook and further straining stressed supply chains, according to S&P Global Commodity Insights.

“There is a possibility of unrest driven by this inflationary pressure. It's a combination of everything—the burden of recovering from the pandemic, the macroeconomic environment, issues like unemployment—but high food prices could be the straw that breaks the camel's back," Monika Tothova, a United Nations FAO economist, told S&P Global Commodity Insights in an interview. “It is very likely that food prices are going to stay elevated, given by the supply and demand shock but also by the higher cost of agriculture inputs.”

Today is Thursday, May 26, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

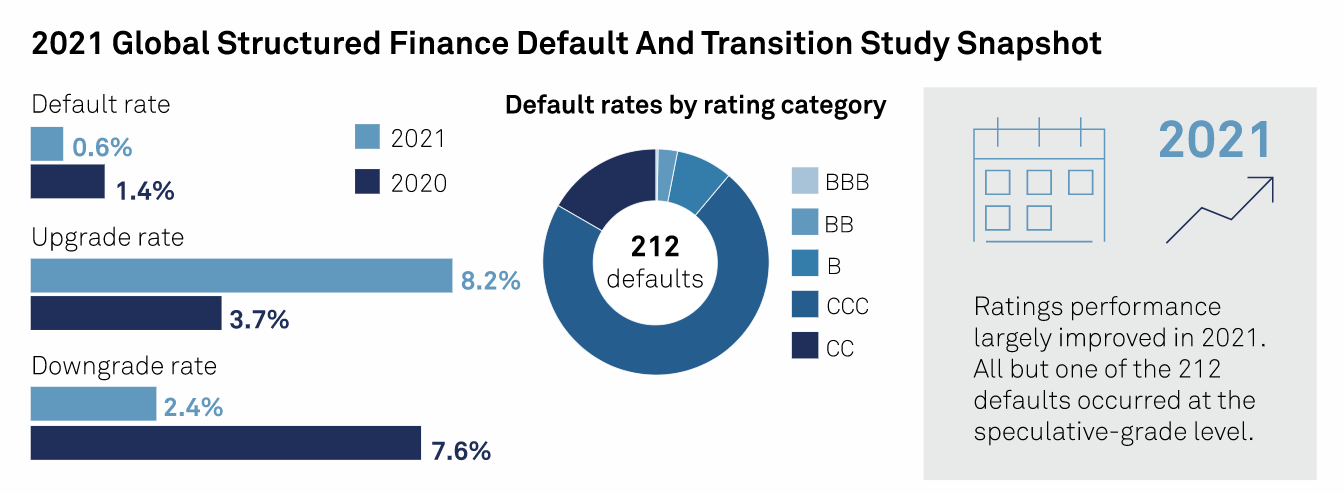

Default, Transition, and Recovery: 2021 Annual Global Structured Finance Default And Rating Transition Study

The global structured finance default rate dropped to 0.6% in 2021, well below the one-year average of 3.7%, after overall credit performance started the year in the red but picked up in the last two quarters to reach its highest since February 2019. There were 212 global structured finance defaults last year: 203 in the U.S., seven in Europe, and two in Latin America. Of the 32,861 global structured finance ratings outstanding at the start of 2021, we lowered 2.4% (down from 7.6% in 2020) and raised 8.2% (up from 3.7%).

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Ukrainian Banks Evaluate Impact Of Russia War As Provisions Surge, Profits Sink

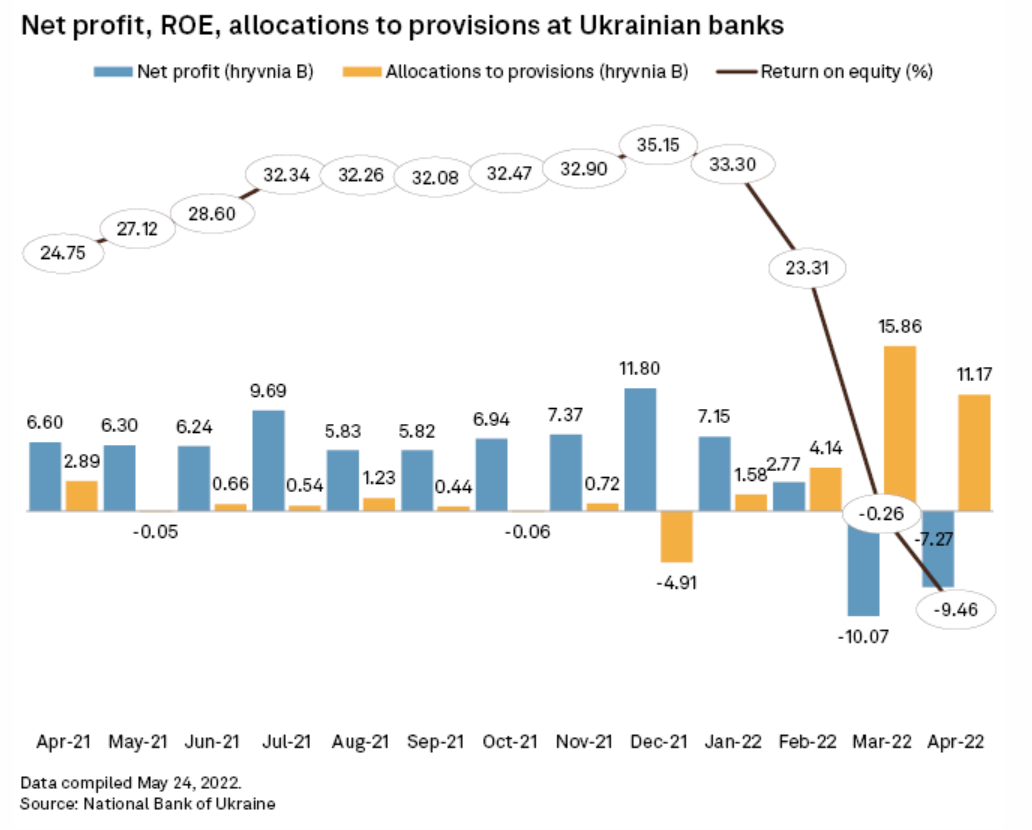

Ukraine's banking sector recorded consecutive months of deep losses and elevated provisions for bad loans as the impact of Russia's invasion on the country's lenders becomes increasingly clear. Aggregate profitability in the sector fell to a loss of 7.27 billion hryvnia in April from a profit of 7.15 billion hryvnia in January, the latest data from the Ukrainian central bank shows. Return on equity fell to negative 9.46% from 33.3% over the same period, while loan loss provisions rose to 15.86 billion hryvnia in March from 1.58 billion hryvnia in January, with a further 11.17 billion hryvnia added in April.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

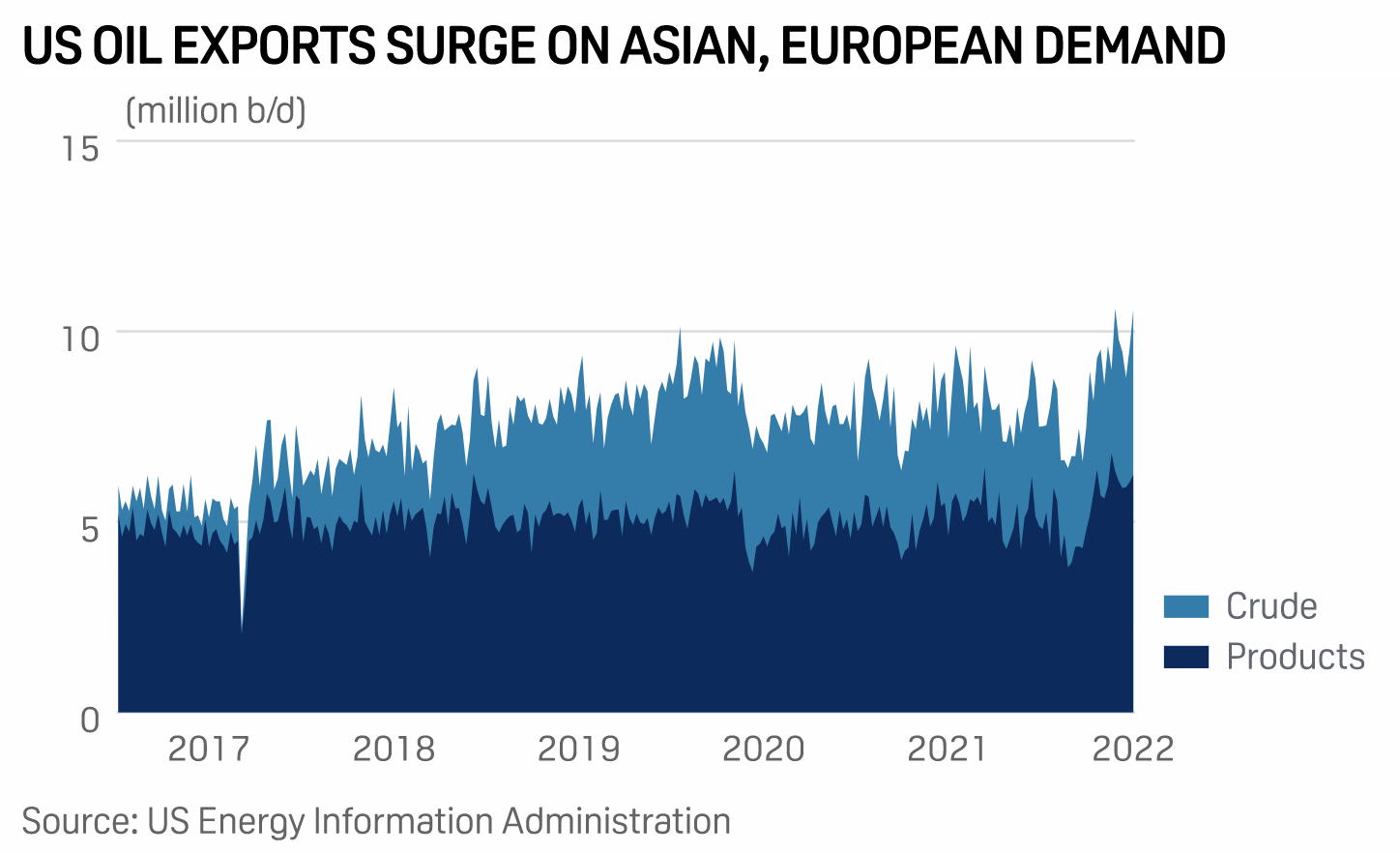

Biden Administration Weighs U.S. Oil Export Limits Again, But Analysts So Far Doubt Action

While the Biden administration signaled that it was again considering limits to U.S. oil exports to curb high fuel prices, analysts do not think it will make any policy changes as long as the Russian energy crisis looms. U.S. Energy Secretary Jennifer Granholm told reporters May 24 during a tour of the Strategic Petroleum Reserve's Bayou Choctaw site in Louisiana that President Joe Biden was "not taking any tools off the table," when asked about U.S. oil export limits, according to Reuters.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

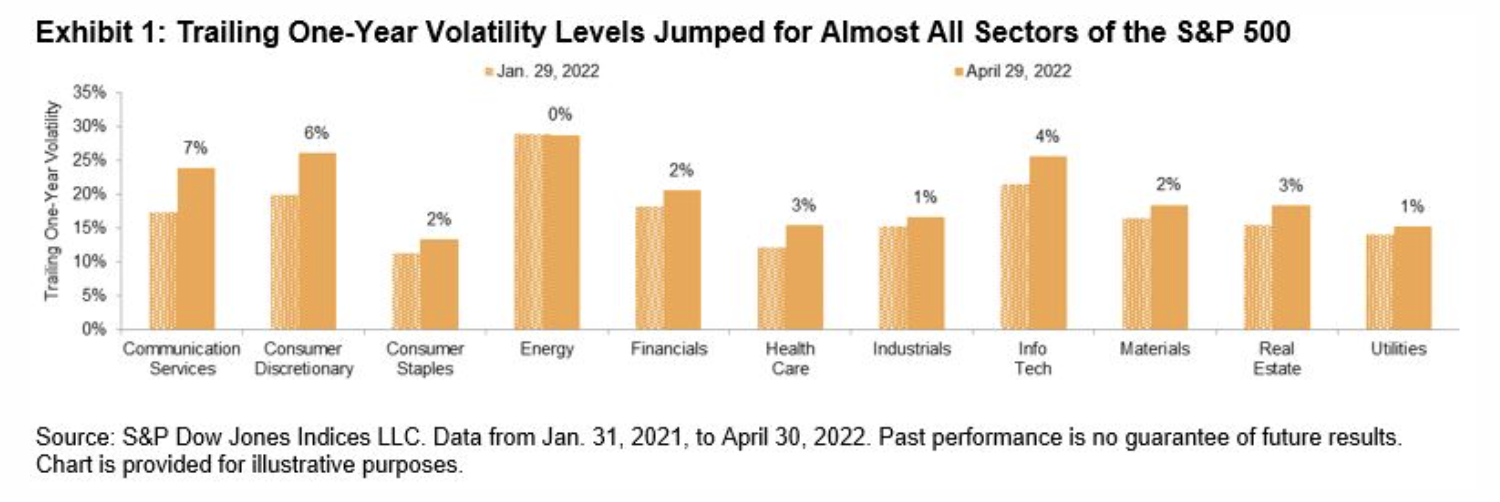

A Reliable Strategy In Unreliable Times

Try as one might, it is hard not to notice the woes of equities this year. Through May 19, 2022, the S&P 500® has declined 18%, losing 9% in the last three months alone. This pain was felt across most sectors of the index, with only Consumer Staples, Energy, and Utilities in positive territory for the year.

—Read the article from S&P Dow Jones Indices

Listen: How Has The War In Ukraine, China’s 'Zero-COVID' Strategy Impacted Sulphuric Acid, Copper?

Sulphuric acid prices have been rising strongly since the start of COVID-19. Copper prices are also showing a similar trend. What are the factors behind the strong uptrend in demand? What is the impact on copper and sulphuric acid from the ongoing Russia-Ukraine war and China's "zero-COVID" strategy? S&P Global Commodity Insights experts Mok Yuen Cheng and Han Lu from the Platts pricing team and Hui Min Lee from Fertecon discuss in the latest episode of Commodities Focus.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Plan To Open-Source Twitter Algorithm Raises Transparency, Revenue Questions

Elon Musk's plan to open-source Twitter Inc.'s algorithm may not do much to increase transparency, but it could prove a lucrative business opportunity if enough people can understand it. As part of his larger plan to take Twitter private, Musk has suggested open sourcing its algorithm as a means of reducing manipulation and mistrust on the platform. "Open source is the way to go to solve both trust and efficacy," Musk said in a May 15 tweet.

—Read the article from S&P Global Market Intelligence