Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

War And Inflation Worsen The Macroeconomic And Credit Outlooks

The confluence of headwinds afflicting the global economy are darkening the outlook for global growth and credit conditions this year.

A myriad of escalating risks that have been weighing on markets in the immediate-term—including Russia’s war on Ukraine and the consequential higher energy and commodity prices both prolonging; sooner and stronger monetary policy tightening from central banks around the world; and slower growth in China due to stringent COVID lockdowns—will more markedly burden economies’ growth prospects and companies’ credit this year, according to new forecasts from S&P Global Ratings.

Global economic expansion is set to slow more significantly than previously expected, with GDP in the U.S. likely to grow just 2.4% this year, 80 basis points (bps) less than S&P Global Economics’ previous forecast. For the eurozone, we’ve trimmed 60 bps from our full-year GDP forecast, to 2.7%, and in China by 70 bps, to 4.2%. Downside risks remain prevalent, with the potential for more economic turbulence if a significant trade rupture materializes between Russia and the German-centered industrial complex or if persistently high inflation prompts central banks to raise rates above market expectations.

Against this backdrop, credit ratings could confront additional pressure, and more defaults could occur if current conditions continue or worsen through the remainder of the year, according to S&P Global Ratings’ Global Credit Conditions Committee. Financing conditions have largely tightened as supply chain disruptions and inflationary pressures persist.

“The real question is: when do we expect this credit deterioration to occur, and which regions and sectors will be most exposed? In a nutshell, given a fair degree of resilience, if this situation persists for more than one or two quarters—or deteriorates further—this could translate into more negative rating actions and a gradual pick-up in defaults,” S&P Global Ratings Global Head of Research, Sustainable Finance, and Innovation Alexandra Dimitrijevic said in the special update. “That said, uncertainty is very high, and the global economy remains uniquely vulnerable to any further shocks, even in the near term.”

Today is Wednesday, May 18, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Listen: Street Talk | Episode 94: Recessionary Fears In '22 Overblown, Fed Could Overtighten

While recessionary fears have grown on the Street, S&P Global Ratings U.S. Chief Economist Beth Ann Bovino does not see a downturn developing this year. In the latest episode of Street Talk, the economist discussed her outlook for the U.S. economy and inflation, the possibility of a wage spiral, and the Federal Reserve's plans to wind down its nearly $9 trillion balance sheet. She also discussed how the Fed likely will tighten monetary policy too much in their effort to get inflation under control and the likelihood of a recession occurring as the central bank tries to initiate a soft landing.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition, and Recovery: The Global Corporate Default Tally Rises To 31 With The First Bankruptcy Of 2022

S&P Global Ratings' 2022 global corporate default tally has increased to 31 after three companies defaulted since its last report: Pennsylvania-based power generation and infrastructure company Talen Energy Supply LLC; Germany-based gaming company Safari Beteiligungs GmbH; and one confidential issuer. The default of Talen Energy marks the first nonconfidential bankruptcy of 2022—a historically low tally. So far in 2022, missed interest payments lead the tally with 12, followed by distressed exchanges with 11.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

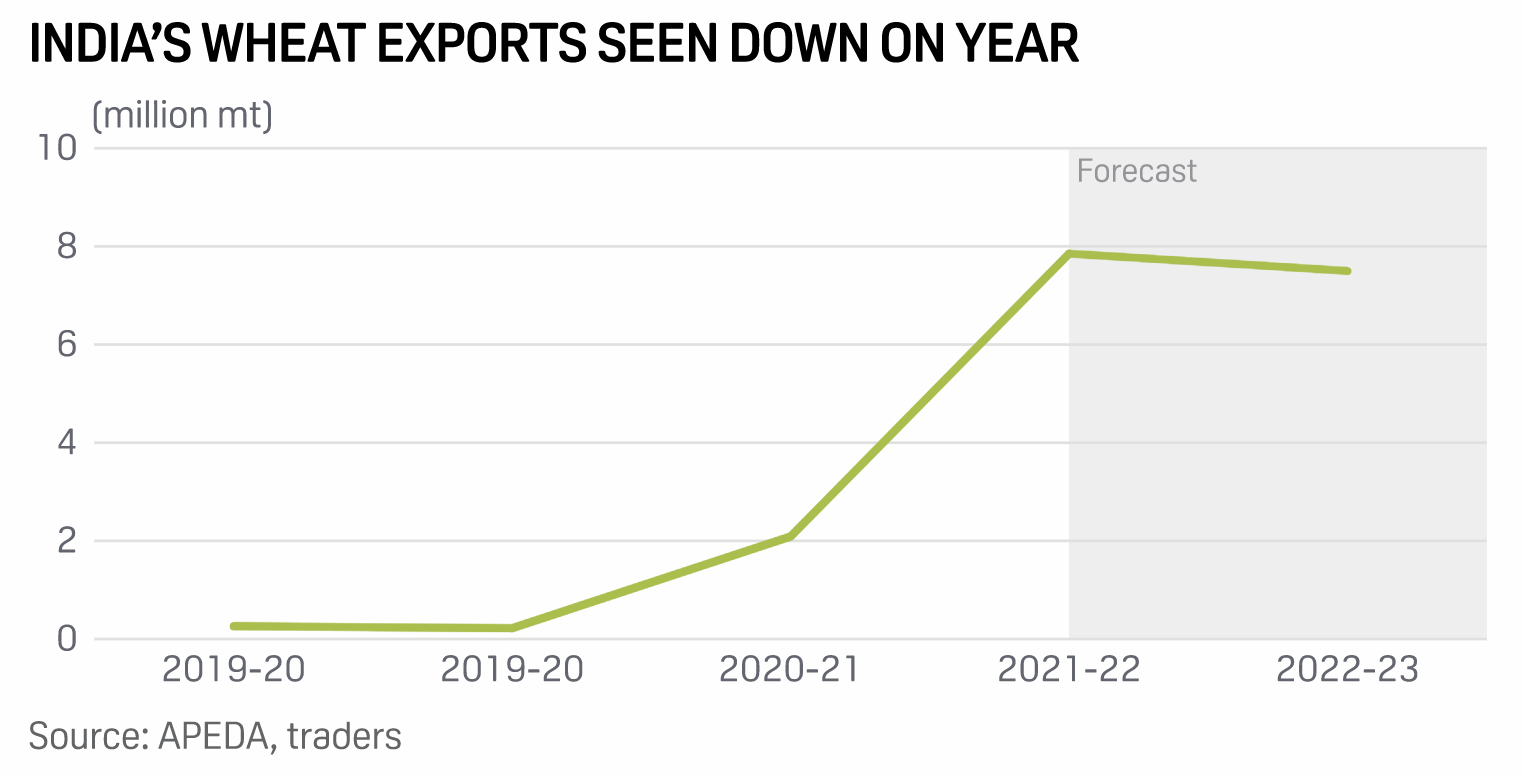

India's Wheat Export Ban Pushes Australian FOB Price To Record High

India's wheat export ban announced May 13 to ensure sufficient availability of wheat in domestic markets pushed the Australian wheat price to a record high May 17. Amid uncertainty around Indian exports, S&P Global Commodity Insights assessments for West Australia APW hit a record high of $458/mt on May 17, rallying $18/mt on the day, while ASW closed at $426/mt, $16/mt higher on the day. As a result of the ban, wheat and flour prices in Indonesia have increased, sources said.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Putin’s War In Ukraine Is Accelerating Hydrogen In Europe

When Putin invaded Ukraine in February, the industry wondered whether it would set back Europe's ambition to develop a low-carbon hydrogen market. Already, we have seen quite the opposite. The EU member states and other countries are doubling down on clean energy commitments, with hydrogen at their heart. S&P Global Commodity Insights' James Burgess discusses recent developments with pricing specialist Jeff McDonald and analyst Matthew Hodgkinson.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

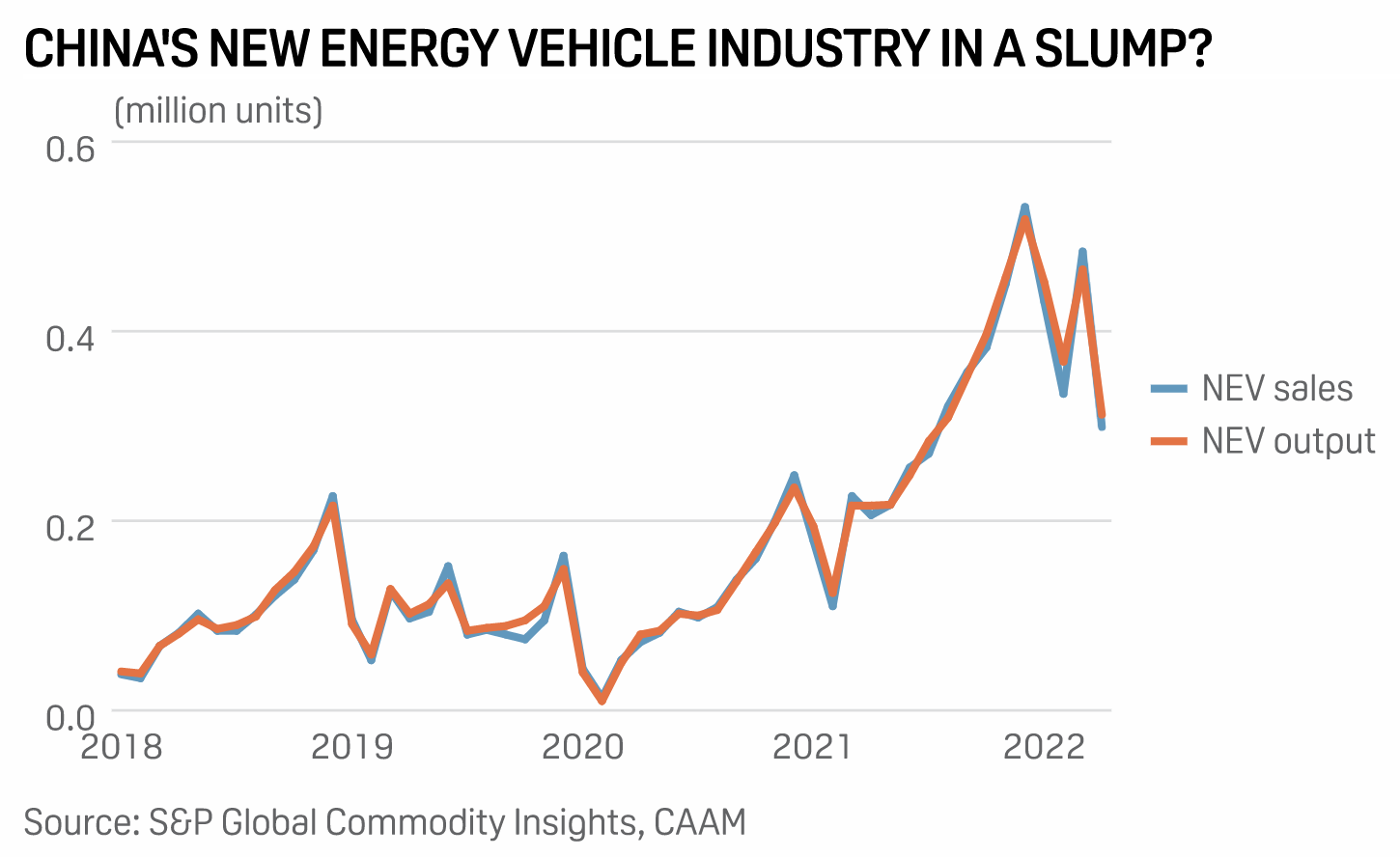

Feature: COVID-19 Outbreak In China Dents Battery Metals Demand

COVID-19 outbreaks in 29 Chinese provinces and cities, in particular Shanghai and Changchun, had a greater impact on downstream demand for battery metals than raw materials supply in April. China's demand for battery metals will continue to face challenges in May, as it might take some time for electric vehicle producers to resume production interrupted by COVID-19 resurgence, industry sources said. Industries in Shanghai and Changchun, contributing about 20% of the nation's total vehicle production, faced huge supply disruptions due to rising coronavirus cases since end-March.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

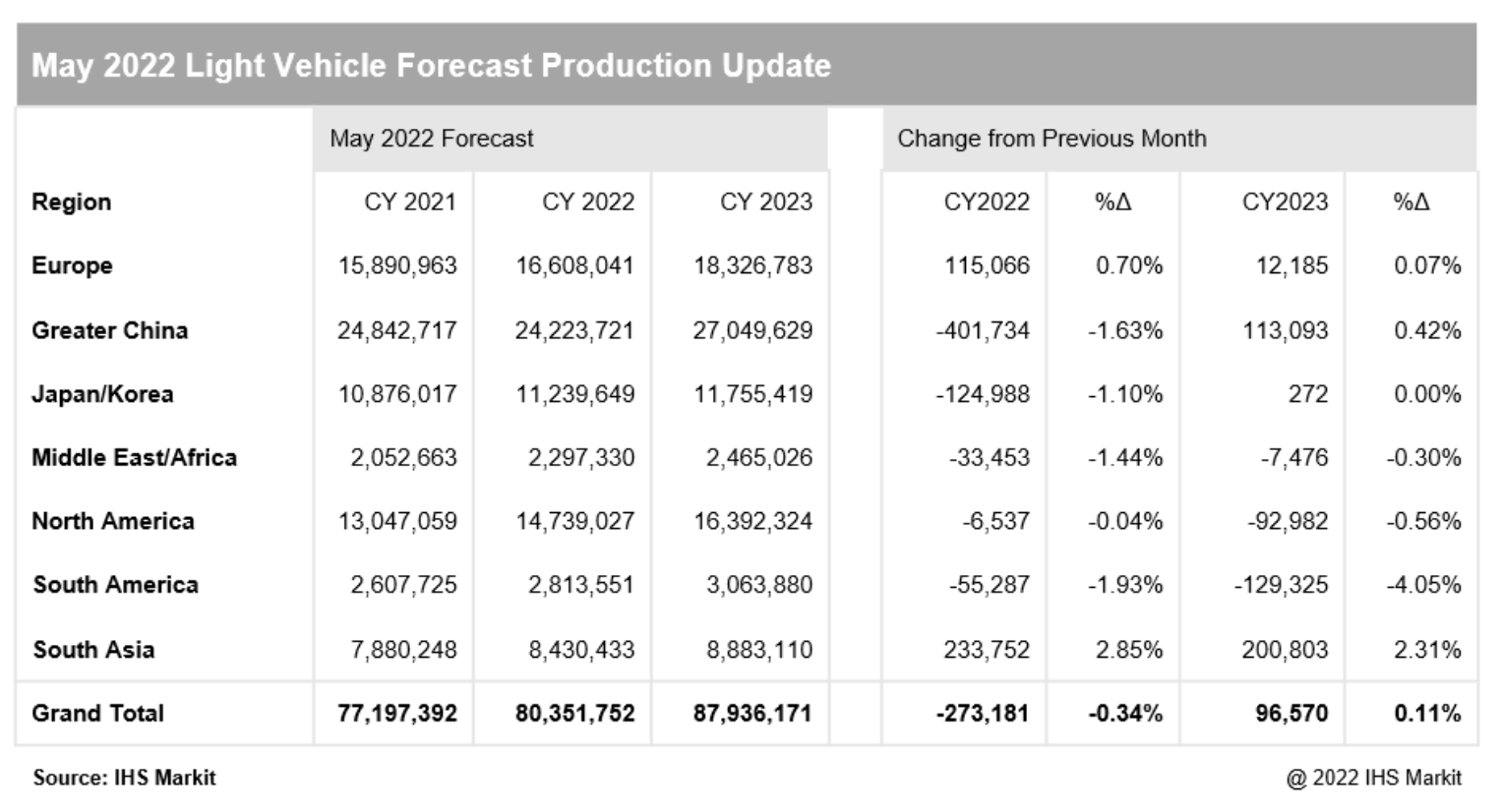

May 2022 Production Forecast Sees Variations From Region To Region

The global auto industry continues to navigate a challenging supply chain environment as well as lingering COVID-19 impacts. While ongoing COVID lockdowns in areas of mainland China are having a material impact on production within the country and some surrounding markets, S&P Global Mobility analysts are also seeing a measure of stability in other regions relative to some of the more meaningful downward revisions made in recent months.

—Read the article from S&P Global Mobility