Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 May, 2024

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Weather Creates Disruption in Global Rice Markets

In years when warm weather builds along the equator in the Pacific, the Pacific jet stream moves south and farther east, triggering a series of weather changes that bring rain to dry regions and drought to traditionally wet regions. This pattern is known as El Niño. These changes have a particular impact on global rice markets that depend on predictable and consistent levels of rainfall. When El Niño hit this year, it triggered many changes in the rice trade — some traditional exporters became importers, and some exporters, such as India, banned exports altogether.

Historically, India has been the stabilizing actor in the global rice market. Indian rice comprises about 40% of the global rice trade, even though only 15% of Indian domestically produced rice is exported. The Indian rice harvest and rice prices are tightly controlled by the Food Corp. of India (FCI), a statutory body of the Indian government. Traditionally, the FCI has set minimum prices for rice to accommodate the cost of production, including fertilizers and labor for rice farmers. The power of the FCI to influence global prices has been due to India’s unrivaled position as the world's rice basket.

However, in 2023, the Indian government imposed curbs on rice exports that sent rice prices to multiyear highs around the world. Indian rice production declined last year due to unusually dry conditions caused by El Niño. Rice production fell from 135.5 million metric tons for the 2022–2023 growing season to 128 million metric tons in 2023–2024. Despite the curbs on rice exports, prices for Indian rice have climbed for domestic consumers. The ban on exports is expected to last until at least October, according to S&P Global Commodity Insights.

India was not the only rice-producing economy affected by El Niño this year. Indonesia moved from a rice exporter to a rice importer as dry conditions impacted its harvest. Meanwhile, rice producers in Pakistan, Vietnam and Thailand have tried to take advantage of higher prices and India’s absence to gain market share. A recent episode of S&P Global’s "Commodities Focus" podcast focused on the weather-related impacts on global rice markets.

“India’s export ban helped Pakistan reach new milestones in rice exports,” Elvis John, an associate editor for agricultural markets, said on the podcast. “In the past year, we have seen the rate of export volume has increased significantly. During the current fiscal year 2023–2024, Pakistan’s foreign exchange earnings from rice exports have nearly doubled, and the quantity of rice exported has increased by at least 50%.”

Asia is not the only place where unusual weather has disrupted global rice markets. In the Brazilian rice-growing state of Rio Grande do Sul, catastrophic flooding has caused extensive damage to rice fields. Unusually damp conditions in Brazil have delayed the rice harvest, and the damage from flooding is expected to be worse as a result.

Today is Friday, May 17, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

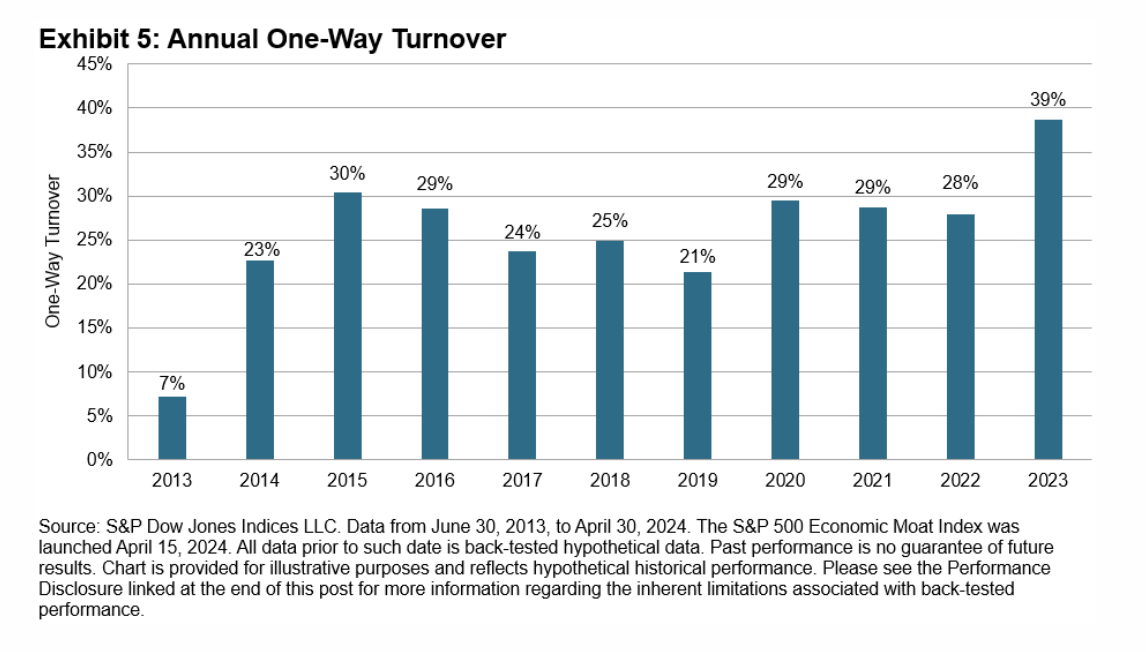

Identifying Economic Moats Using a Quantitative Lens: The S&P 500 Economic Moat Index

Popularized by Warren Buffett, the term economic moat refers to a company’s sustainable competitive advantage that allows it to preserve market share and generate high profits over the long term. In this analogy, companies are compared to medieval castles surrounded by deep and wide moats, which protected the castles from attack. In the same way, economic moats protect companies from competitors and other external threats by making it difficult for the competition to replicate or challenge their position in the market. There are several potential sources of an economic moat including network effects, economies of scale, strong brand recognition and high switching costs.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Resilient Growth, Resilient Yields, And Resilient Defaults To Bring The US Speculative-Grade Corporate Default Rate To 4.5% By March 2025

S&P Global Ratings Credit Research & Insights expects the US trailing-12-month speculative-grade corporate default rate to fall slightly to 4.5% by March 2025, from 4.8% in March 2024. This assumes defaults will peak either later in the second quarter or, more likely, the third quarter of this year. Interest rates will likely remain higher for longer given stubborn inflation. S&P Global Ratings still expects rates to ease, but now much later in the year than it previously expected. Positively, economic growth and corporate profits remain broadly healthy, and many issuers recently refinanced upcoming maturities, easing near-term pressure. Market sentiment has also been supportive, providing liquidity where needed.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

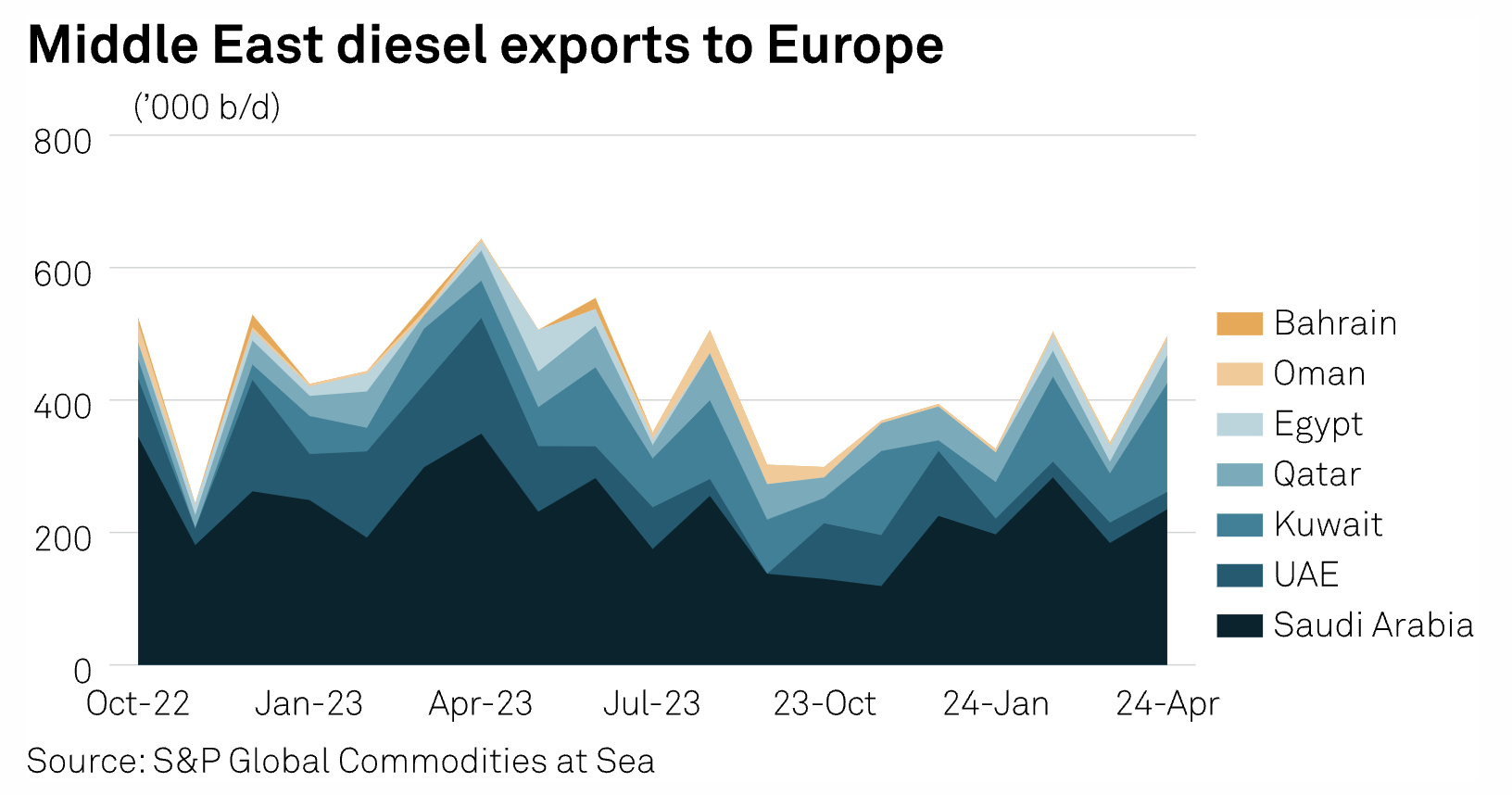

Middle East Diesel Exports To Europe Rise To 10-Month High As Russia Mostly Stays Away

Middle East diesel exports to Europe rose to a 10-month high in April with Russian product mostly heading to Turkey, Brazil and Africa, according to latest ship tracking data. Diesel shipments from the Middle East to Europe averaged 531,000 b/d in April, the most since June 2023 and up from 320,000 b/d in March, according to S&P Global Commodities at Sea data. Saudi Arabia was again the largest supplier, at 260,000 b/d.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

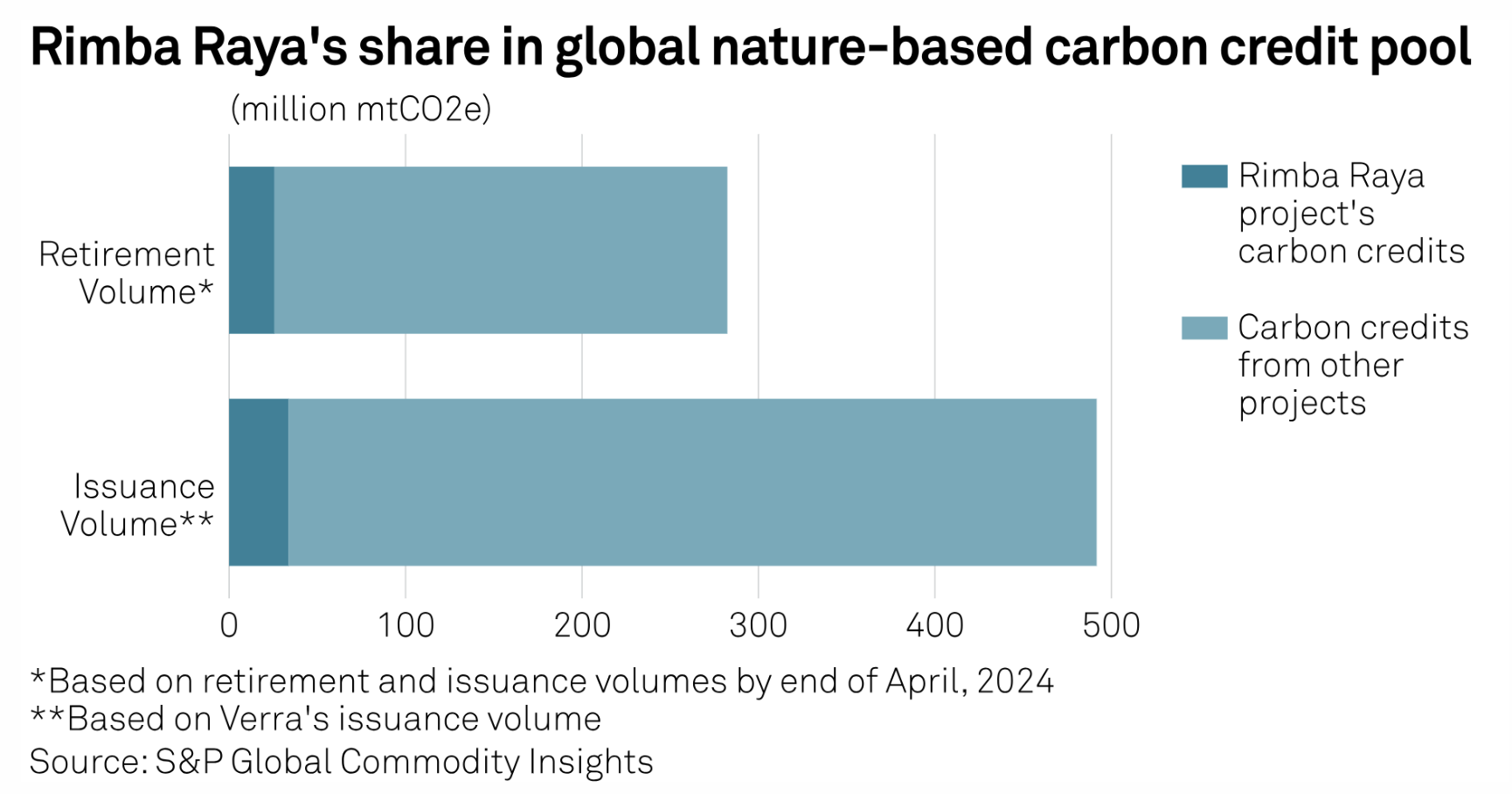

Indonesian Nature-Based Carbon Project Rimba Raya Hits Regulatory Wall

S&P Global Commodity Insights editors and analysts bring you the biggest stories from the industry this week, from renewables to storage to carbon prices. The Indonesian government recently revoked the license of Rimba Raya Biodiversity Reserve Project, one of the world’s largest nature-based carbon projects, located in Central Kalimantan on the island of Borneo. From June 2013 to April 2024, carbon credits from Rimba Raya accounted for about 6.84% of total nature-based avoidance credits issued by Verra, and 9.1% of the total retired volume of nature-based avoidance credits, according to data from S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

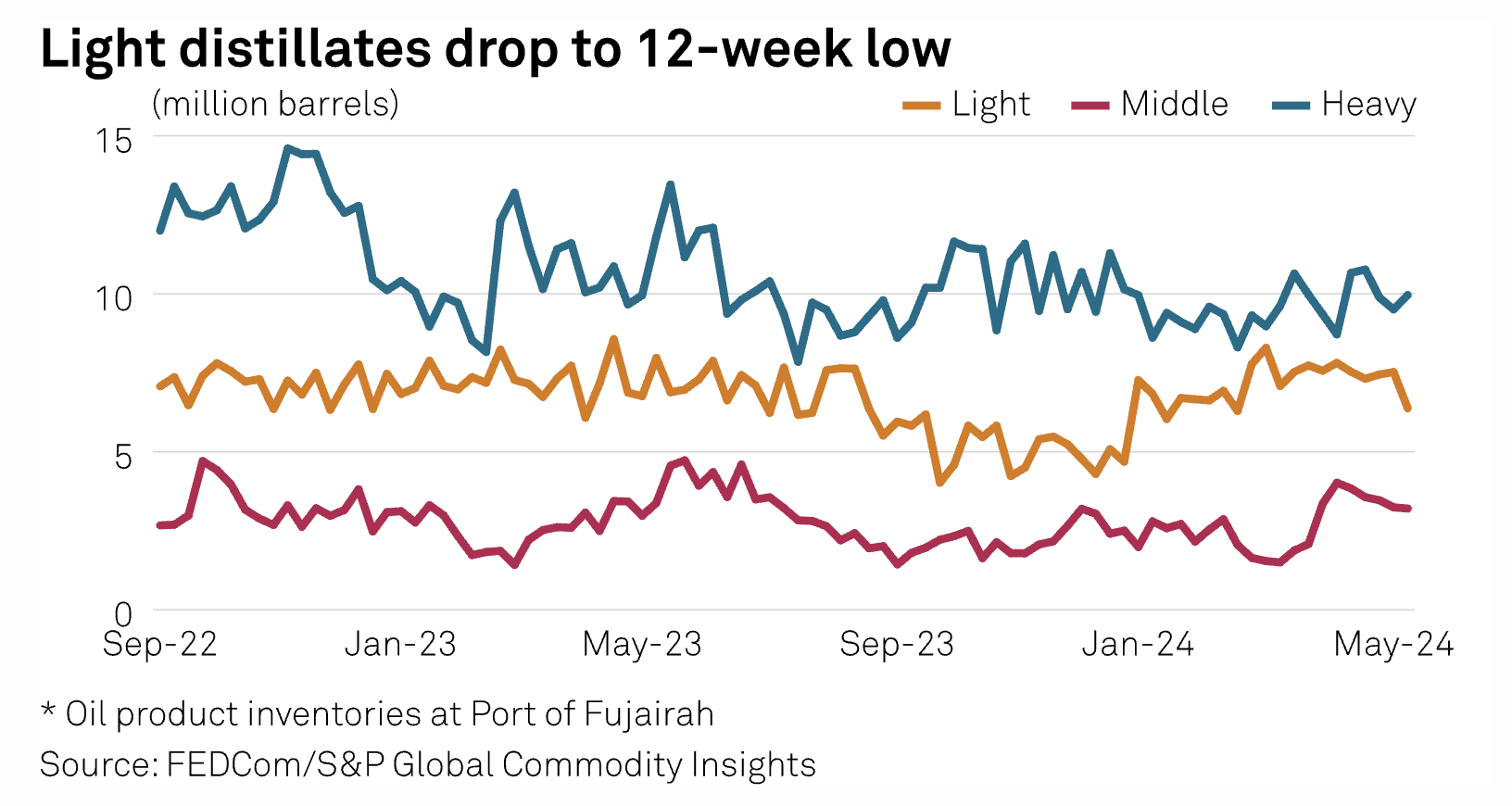

Oil Product Stockpiles Fall To Two-Month Low

Stockpiles of oil products at the UAE's Port of Fujairah dropped to a two-month low on May 13, led by declines in light and middle distillates, according to data from the Fujairah Oil Industry Zone. Total inventories fell 3.6% to 19.541 million barrels in the week ended May 13, the lowest since March 11, the FOIZ data published May 15 showed. However, stockpiles have increased 13% since the end of 2023.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Cyber Risk Insights: Hackers Are Knocking On The Door Of US Affordable Housing Issuers

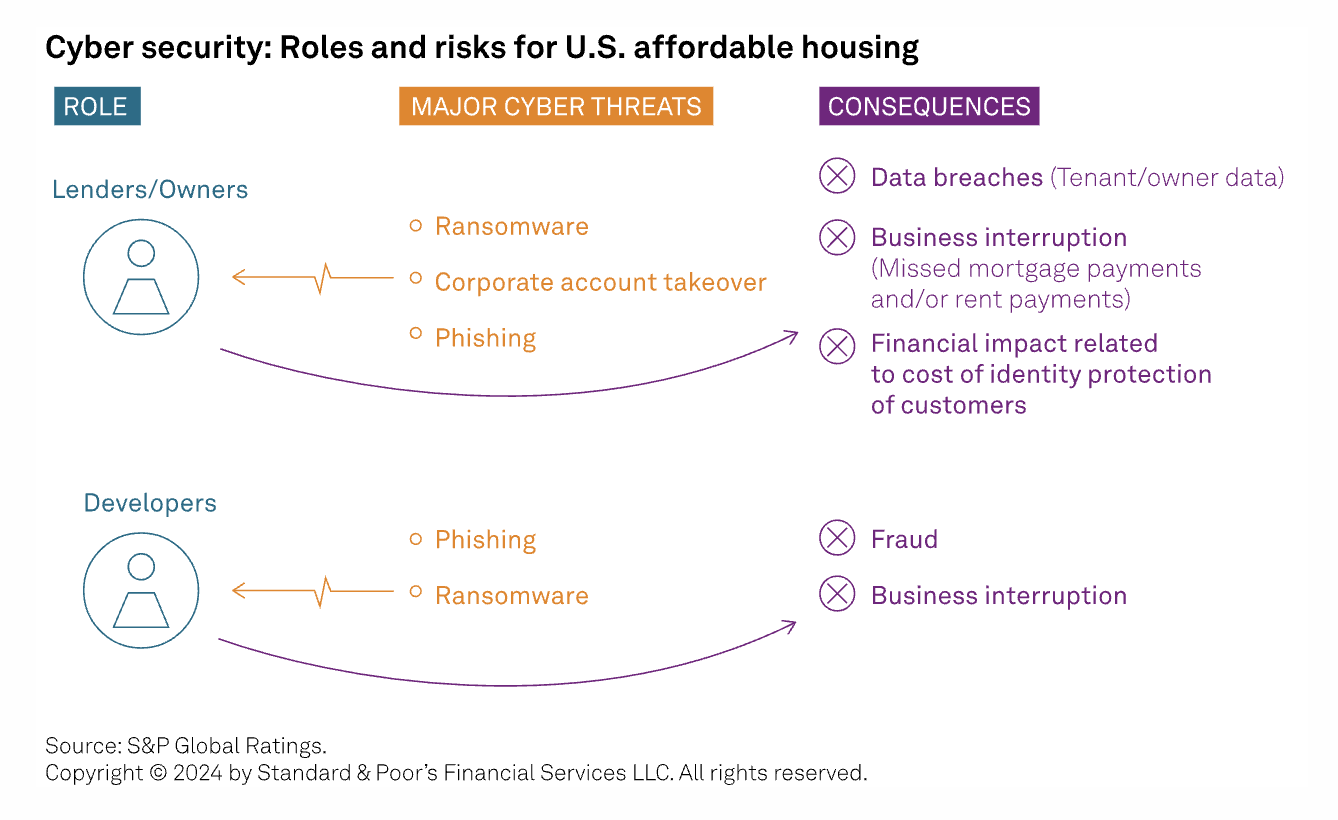

Issuers, such as social housing providers and public housing authorities (PHAs), that own and operate affordable housing have access to tenants' confidential information while lenders' risks for housing finance agencies (HFAs) are related to homeowners' confidential information. US HFAs, PHAs and social housing providers could also be exposed to heightened cyber risk from aging technology and data storage systems, with some issuers using on-site servers, rather than cloud storage, to manage critical data.

—Read the article from S&P Global Ratings