Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 May, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

China’s Property Developers Squeezed by a Changing Market

The orderly deconstruction of a market bubble is a hard thing to manage. For a long time, China’s property market was reliably profitable. A growing and urbanizing population was willing to pay property developers in advance of construction for the opportunity to own units. Escalating values encouraged ordinary investors to pre-buy additional units. Banks wanted exposure to the fast-growing market, and local governments introduced policies to facilitate more development. More investment drove higher valuations, and higher valuations drove more investment. Eventually, a few highly leveraged developers found themselves unable to finish construction on some prepaid units, and the logic of a deflating bubble took over. However, China’s property market correction has been more orderly than many expected, due in part to targeted government programs.

Property developers in China are being squeezed by two structural shifts in the market. First, the secondary market in property has grown 17% and will comprise an estimated 40% of total sales in 2024, while primary residential sales have fallen 12%, according to S&P Global Ratings. This means that people buying units in new buildings has fallen in favor of people buying units from other owners in existing buildings. This shift has hit property developers at the top end of the market where wealthy buyers prefer the certainty of a finished building to the speculative risk of pre-buying a unit the property developer may not be able to afford to finish.

The other structural change in Chinese property markets has been an increase in social housing units for sale. As part of Beijing’s Three Major Projects initiative, China will provide an estimated 2 million social housing units for sale at subsidized rates during 2021–2025. This will raise the percentage of social housing for sale in tier-one and tier-two cities to an estimated 20% of the total market, according to S&P Global Ratings. More social housing for sale squeezes property developers at the lower end of the market as well. While some of these social housing units may come from existing rated developers, the benefit of destocking these units will be temporary.

The Three Major Projects initiative provides a low cost-income ratio (e.g., 8% for China Development Bank in 2022) for policy banks that allows those banks the flexibility to provide loans to property-related projects. Beyond these types of initiatives, local governments have shown little sign of broader policy support for property developers.

The Ministry of Housing and Urban-Rural Development (MOHURD) and the National Financial Regulatory Administration (NFRA), China's housing and financial regulators, have introduced a joint program to identify property projects eligible for fast-track funding and related support. This program, which creates a “white list” of approved projects, does not represent direct government support of property developers. The program is designed to boost homebuyer confidence that development projects will be completed so they are comfortable pre-buying units. Local governments are not backing bank loans to projects on the white list, but they are working at the local level to coordinate approvals across different government bodies.

According to S&P Global Ratings, the property market may begin to stabilize when it reaches about 10 trillion renminbi in annual sales. The strength of the secondary market, particularly in tier-one cities, indicates that demand exists, albeit at more modest levels than during the run-up. While the property downturn has proven resilient and may still surprise on the downside, an anticipated 10 trillion renminbi in annual sales represents a discount to current prices of 15%-20%, adjusting for the tier of city.

Today is Thursday, May 16, 2024,, and here is today’s essential intelligence.

- Written by Nathan Hunt.

European Airports Trundle Along

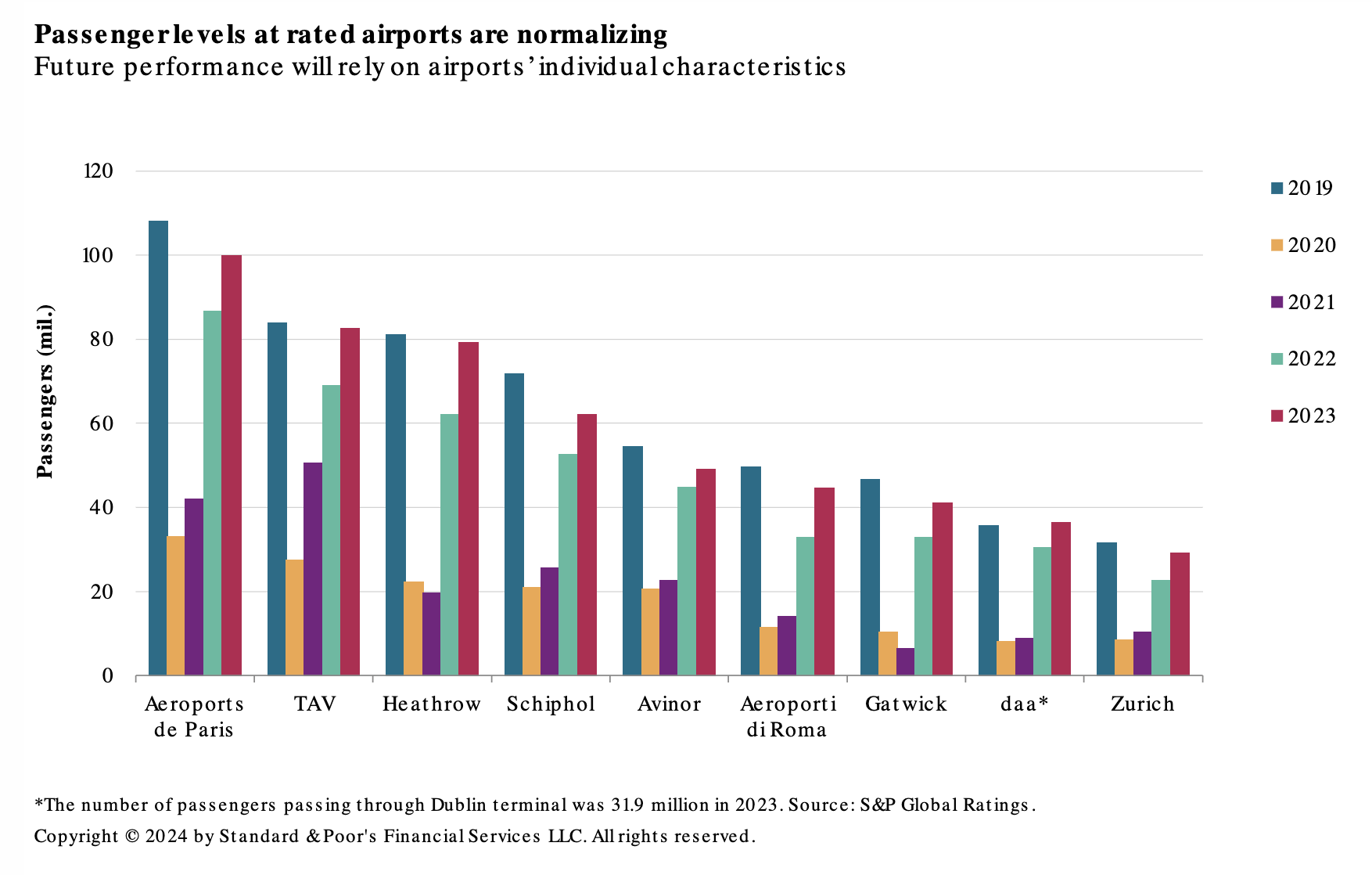

The ratings on the airports in S&P Global Ratings’ portfolio are mostly investment-grade, but still below pre-pandemic levels. Despite the post-COVID-19 recovery in air traffic, the ratings on European airports remain below pre-pandemic levels, with mostly stable outlooks. Most European airports are struggling to restore their financial metrics. In the first quarter of 2024, European airports' debt exceeded 2019 level by an average of 20%, while all rated airports' total capex increased by about 25%.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Your Three Minutes In Digital Assets: Tokenized Treasuries Offer A Path To On-Chain Financial Markets

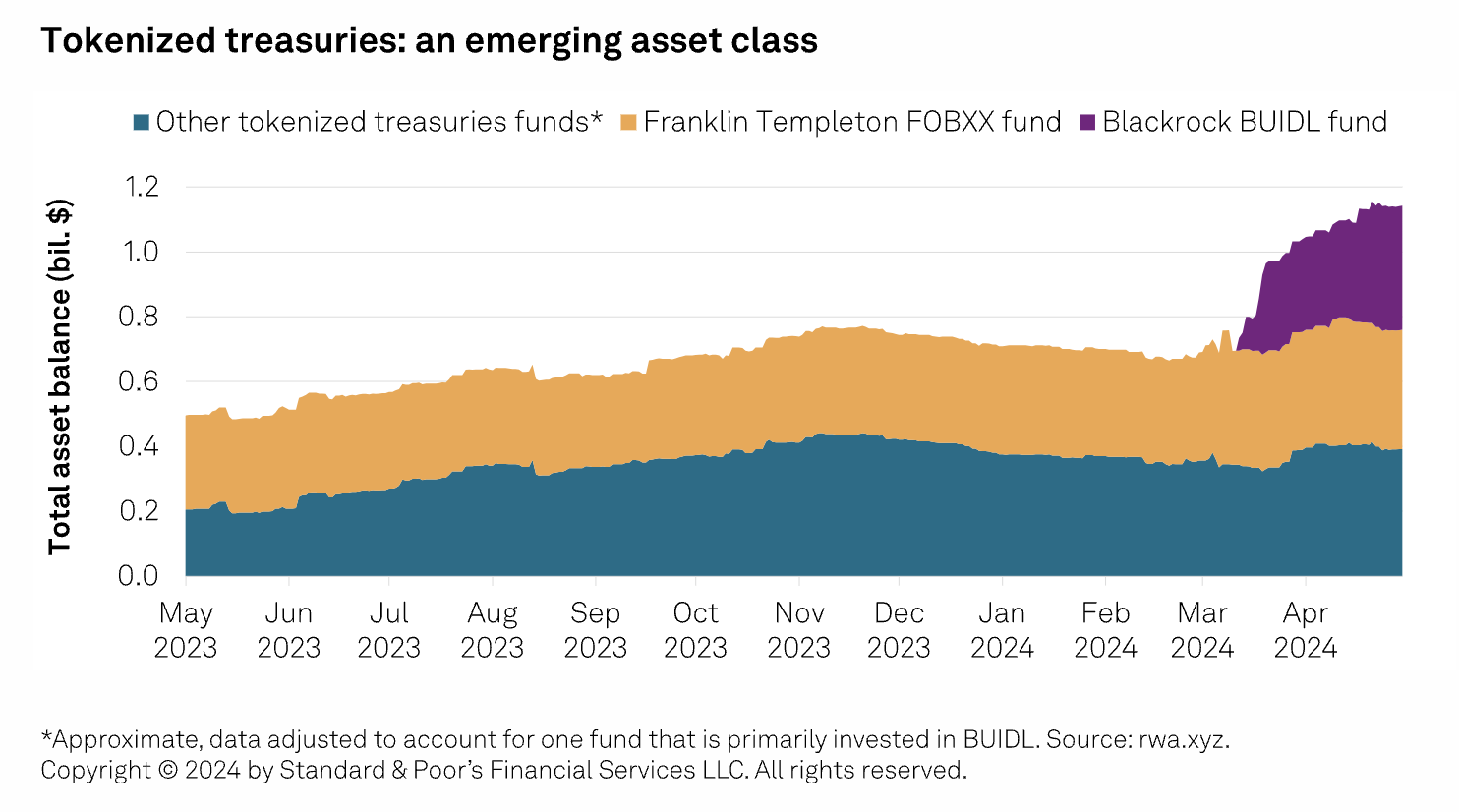

Tokenized Treasuries offer several benefits for money market fund issuers and investors, such as managing liquidity and allowing on-chain businesses to access real-world yields. They may also support broader innovation in asset management. With more than $1 billion outstanding on public blockchains (primarily Ethereum), the Tokenized Treasuries market is picking up. The recent launch of Blackrock's BUIDL fund has accelerated this trend. Tokenized Treasuries are digital tokens created on a blockchain that are backed by a portfolio of US government obligations. They are issued both by blockchain-native firms and traditional institutions, including Franklin Templeton and Blackrock.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

Brazilian Soybean Oil Export Values Firm Further

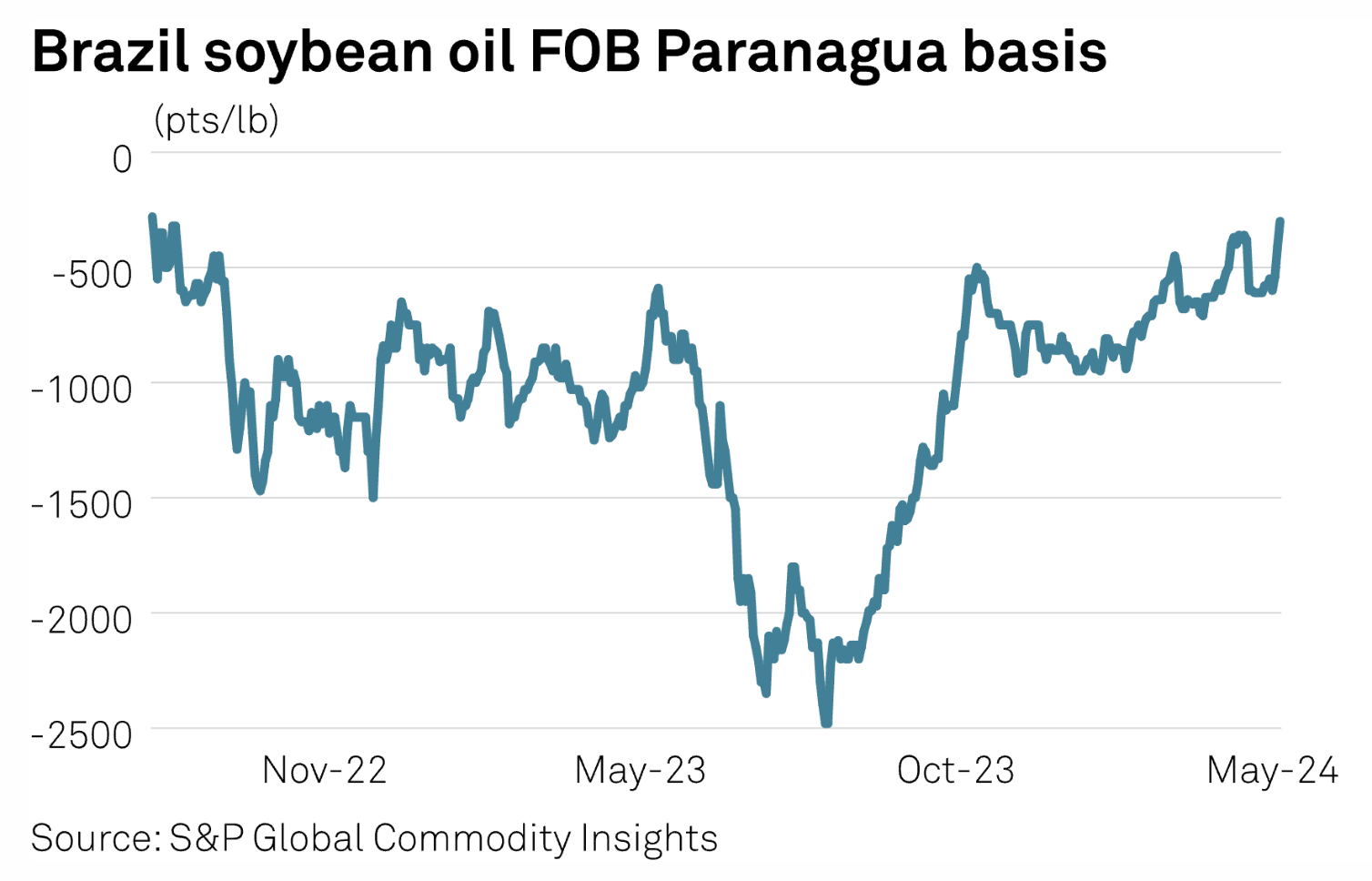

Soybean oil export values in the Brazilian market have strengthened to nearly two-year highs amid a combination of supportive factors, from improving destination demand to concerns over crop losses from floods in the southern state of Rio Grande do Sul. Platts assessed the soybean oil FOB Paranaguá basis for June dates at minus 300 points to the Chicago Board of Trade July (N) contract, the highest for a front-month loading since July 27, 2022, when marked at minus 280 points.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Demand For CORSIA Carbon Credits Unlikely To Match Supply Until 2030: Abatable

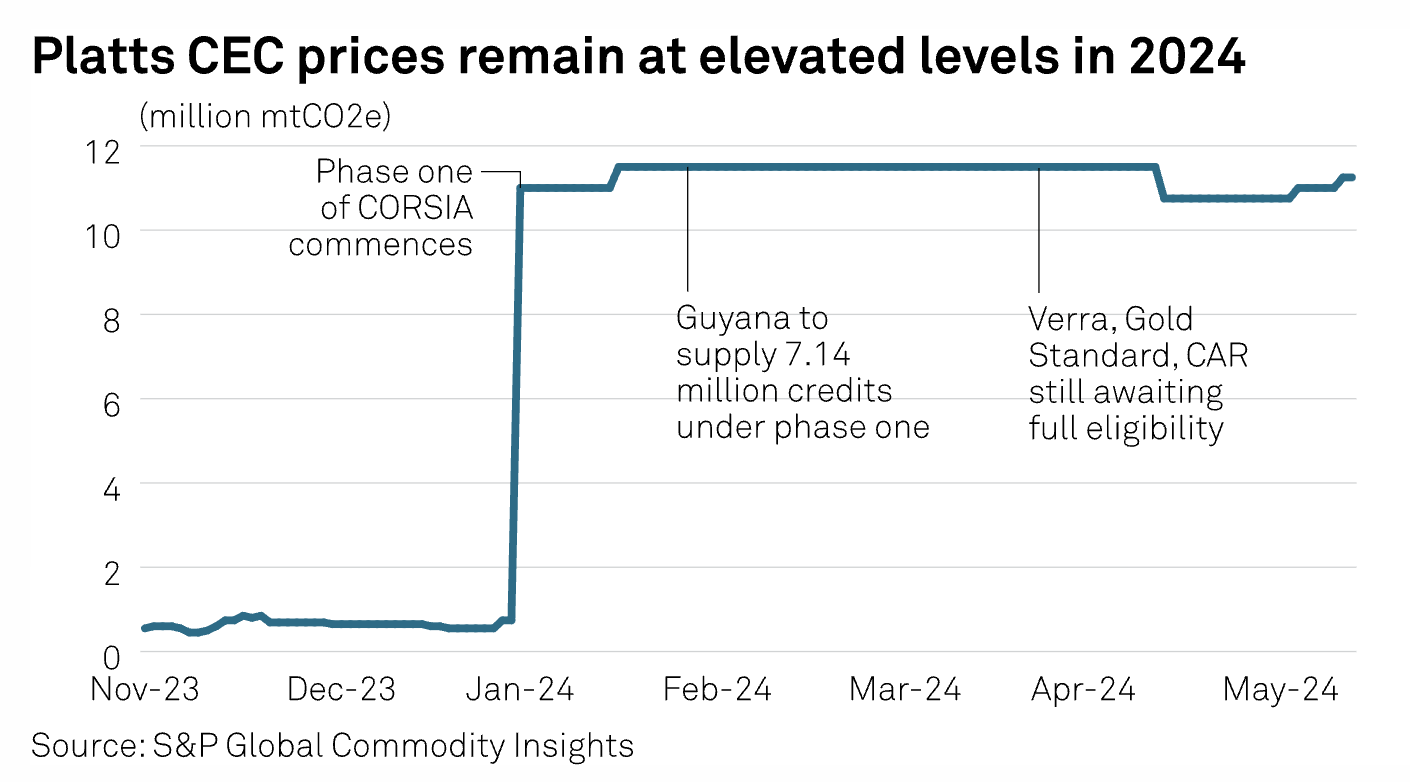

The first phase of the Carbon Offsetting and Reduction Scheme for International Aviation scheme has got off to a "turbulent" start but demand for carbon credits could outstrip supply by 2030, carbon markets-focused consultancy Abatable said May 14. In a report, Abatable modeled two scenarios for CORSIA credits, with a conservative estimate showing that demand will not surpass 100 million credits until after 2034. However, the supply of CORSIA-eligible credits will peak in 2025, with the cumulative supply only able to meet demand until 2029.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

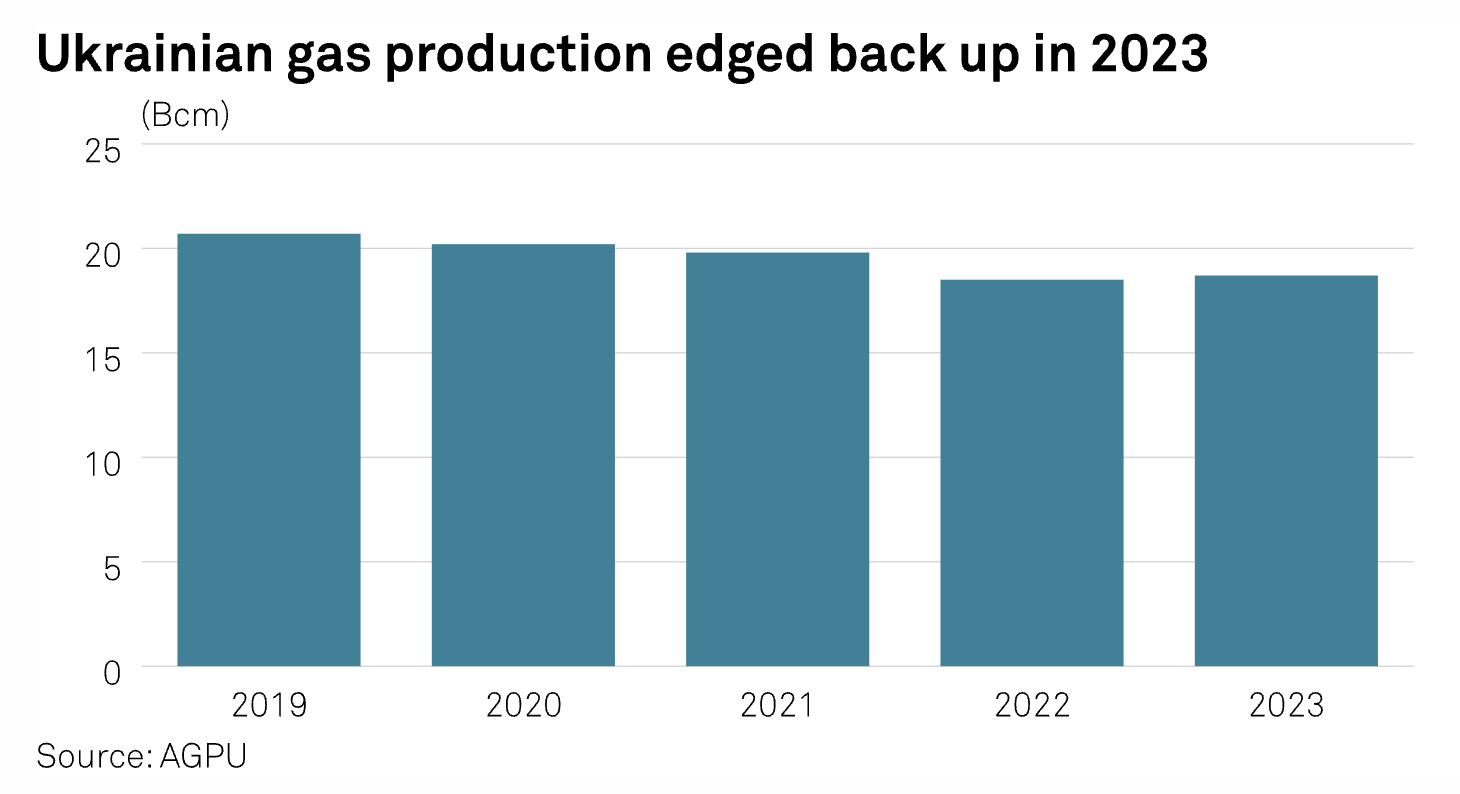

Ukraine Boosts Number Of Operational Drilling Rigs In Q1 In Gas Push: AGPU

Ukrainian upstream companies increased their drilling activity in the first quarter of 2024, with an average of 46 rigs operating in Ukraine in the period, higher than pre-war levels, industry group AGPU said May 13. In a statement, AGPU said the number of operational rigs in Q1 was well up on the pre-war average of 30 and also higher compared with Q1 2023 when 37 rigs were operating. Ukraine has made it a priority in 2024 to further increase domestic gas production to eliminate the need for costly European imports.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 167: FinOps And Battle For Cloud Costs

The flexibility and adaptability of cloud-based infrastructure brings great value to enterprises, but most have been wrestling with managing cloud costs. Melanie Posey, Jean Atelsek and William Fellows join host Eric Hanselman to look at FinOps, the cost management initiative that is looking to regain control of infrastructure costs in this new model. Hyperscalers are expanding their tooling and a bevy of startups are angling to optimize both operations and deployment. It’s not a simple path.

—Listen and subscribe to the podcast from S&P Global Market Intelligence