Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 March, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Resurgent UK Economy All the Way from the City to Canary Wharf

At some point this year, UK Prime Minister Rishi Sunak will call for new elections to be held no later than Jan. 28, 2025. When Sunak inherited the premiership after the brief interregnum of Liz Truss, the UK economy was in woeful straits. By most measures, the economy is trending in a more positive direction today. According to a recent analysis by S&P Global Market Intelligence, Purchasing Managers’ Index data indicates an economy returning to growth, with a surge in optimism and sustained hiring. However, the news is not all good for Sunak heading into a general election.

“The upturn is being driven to a large extent by resurgent demand for financial services, in turn predicated on hopes of an imminent pivot to rate cutting by the Bank of England,” wrote Chris Williamson, chief business economist at S&P Global Market Intelligence. “In contrast, manufacturing remained mired in contraction. The drop in factory jobs was one of the steepest on record, and the largest since the global financial crisis barring only the initial pandemic lockdown months.”

Within the City and Canary Wharf, London’s financial districts, the resurgent UK economy is driving strong margins, solid earnings and increased dividends. According to S&P Global Ratings, the major UK banks, including HSBC Holdings, Barclays, Lloyds Banking Group, NatWest Group and Standard Chartered, had strong results in 2023.

Looking at 2024, some degree of margin compression is expected for the eight largest UK banks, which will cause earnings to dip slightly compared with last year. Higher interest rates may create credit losses and weigh on asset quality, but those losses are anticipated to remain within historical averages. The Bank of England is still pursuing quantitative tightening, meaning that even if the central bank reduces interest rates later in the year, the easy money era will not return in force. However, UK banks began 2024 in relatively good shape due to prudent underwriting, low unemployment, falling inflation and the solid growth of wages and corporate earnings.

The big UK banks are expected to navigate any rate cuts with lending income and margins largely intact. During the first half of 2024, higher existing rates will cut into net interest margins from lending activity for UK banks. In the second half, a recovery is expected as deposit and mortgage pricing pressures ease.

All of this is good news for bank shareholders. Dividends are expected to increase in 2024 as the big UK banks look to boost shareholder distributions while posting strong profits and keeping costs in line. In 2023, banks returned over £27 billion to shareholders in the form of dividends and share buybacks. All five major banks have announced plans to continue boosting investor returns with further dividends and buybacks in 2024 and beyond. A focus on cost discipline and efficiency may mean that the rush hour crowds packing London’s Canary Wharf station won’t become unmanageable, but UK bankers and bank shareholders are still looking ahead to better days.

Today is Friday, March 22, 2024, and here is today's essential intelligence.

Written by Nathan Hunt

US Equity Investors' Risk Appetite Improves Amid Growing Positive Sentiment

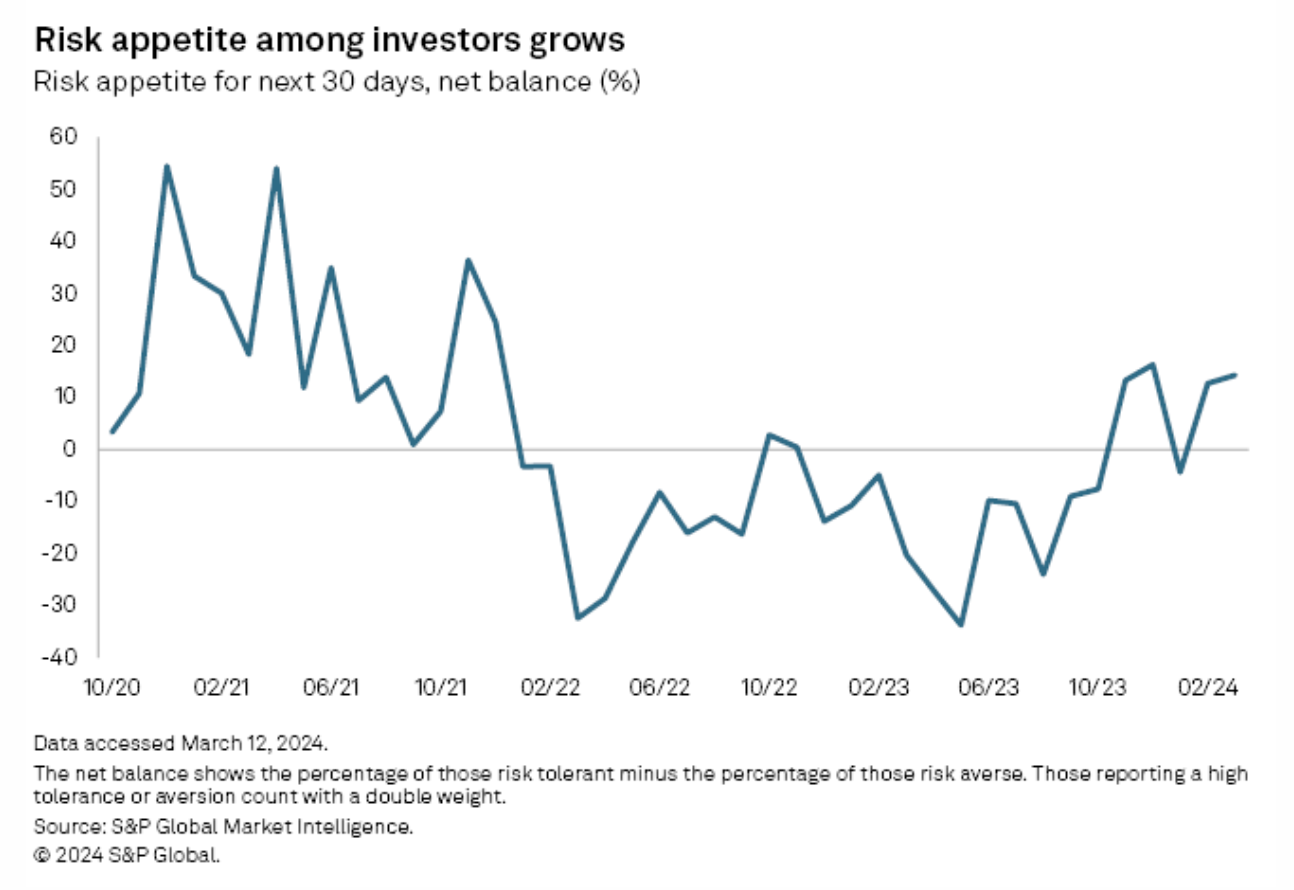

US equity investors' risk appetite grew in March, according to the latest results from S&P Global's Investment Manager Index survey. Investors' outlook on equity market returns, however, fell deeper into negative territory. Risk appetite among US equity investors grew to 14% in March, up slightly from 13% the previous month, according to the survey's Risk Appetite Index. Except for a dip into risk aversion in January, investors have shown a consistent degree of risk tolerance since November, following a nearly two-year period of risk aversion.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Diversification, Equity & Indices

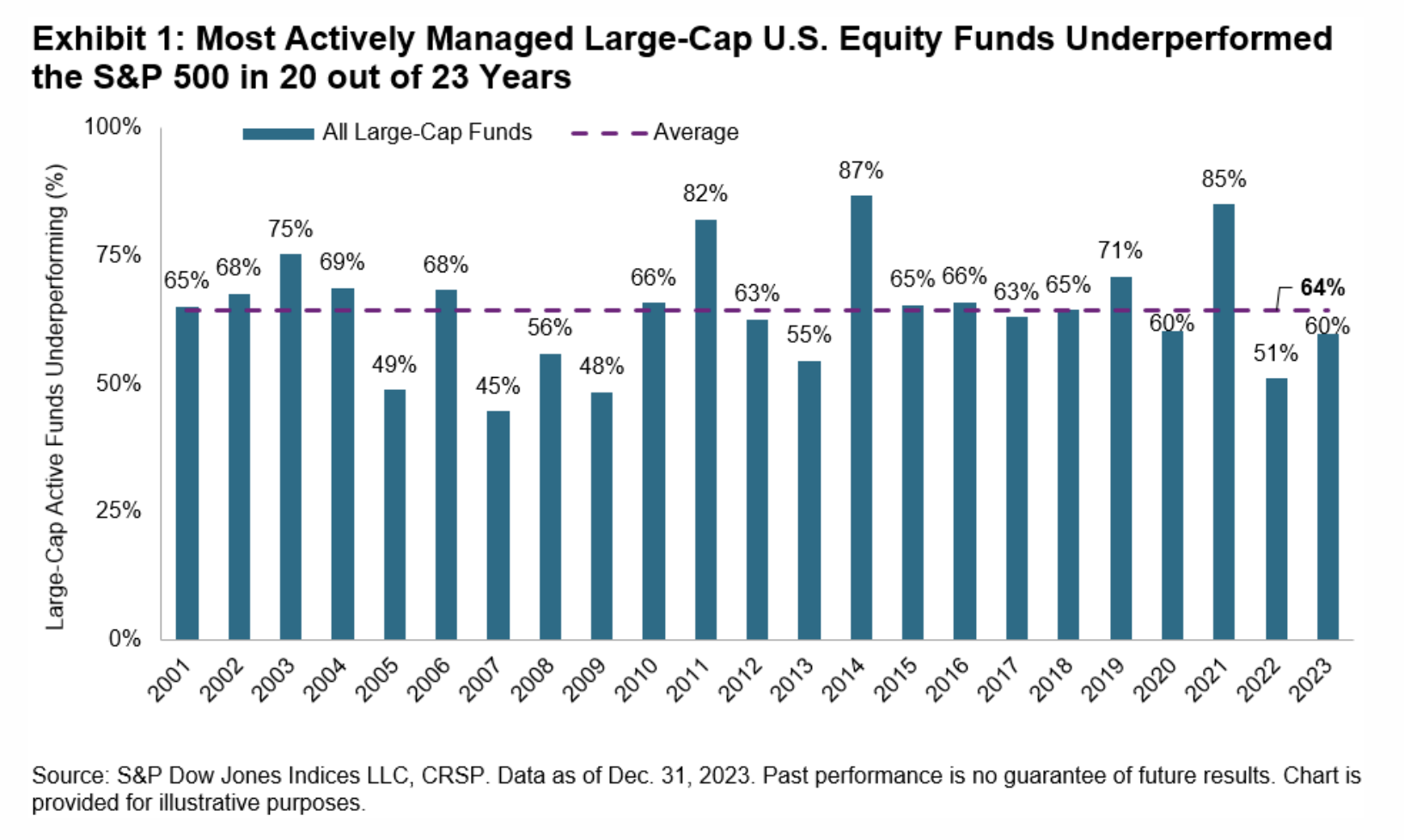

The results of S&P DJI’s latest SPIVA US Scorecard are in: Most large-cap active managers underperformed the S&P 500 for the 14th consecutive year in a row. 60% of active large-cap funds underperformed the S&P 500 in 2023, slightly better than the long-term average of 64%, and a relatively benign result considering the dominance of the US equity market’s largest stocks.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Oil Product Stocks Jump To 8-Month High Amid Ramadan

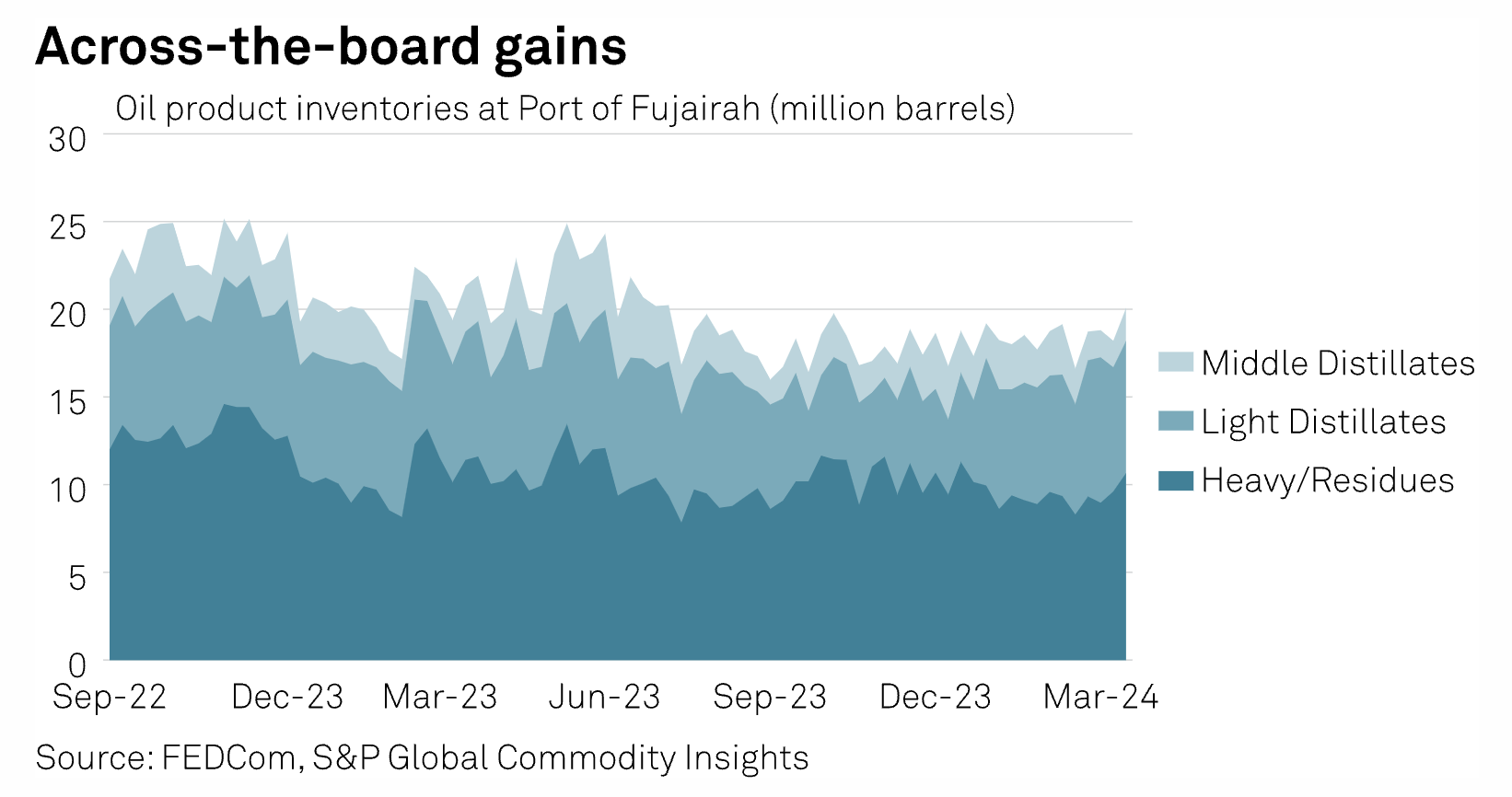

Stockpiles of oil products at the UAE's Port of Fujairah jumped 10% to an eight-month high in the week ended March 18, with regional demand for some products typically slowing during Ramadan observations, according to the Fujairah Oil Industry Zone and historical data. Total inventories increased to 20.049 million barrels as of March 18, the highest since July 10, the FOIZ data published March 20 showed. Stockpiles have increased 16% since the end of 2023.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Washington State Carbon Market Prices Drop Sharply Amid Threat Of Program Repeal

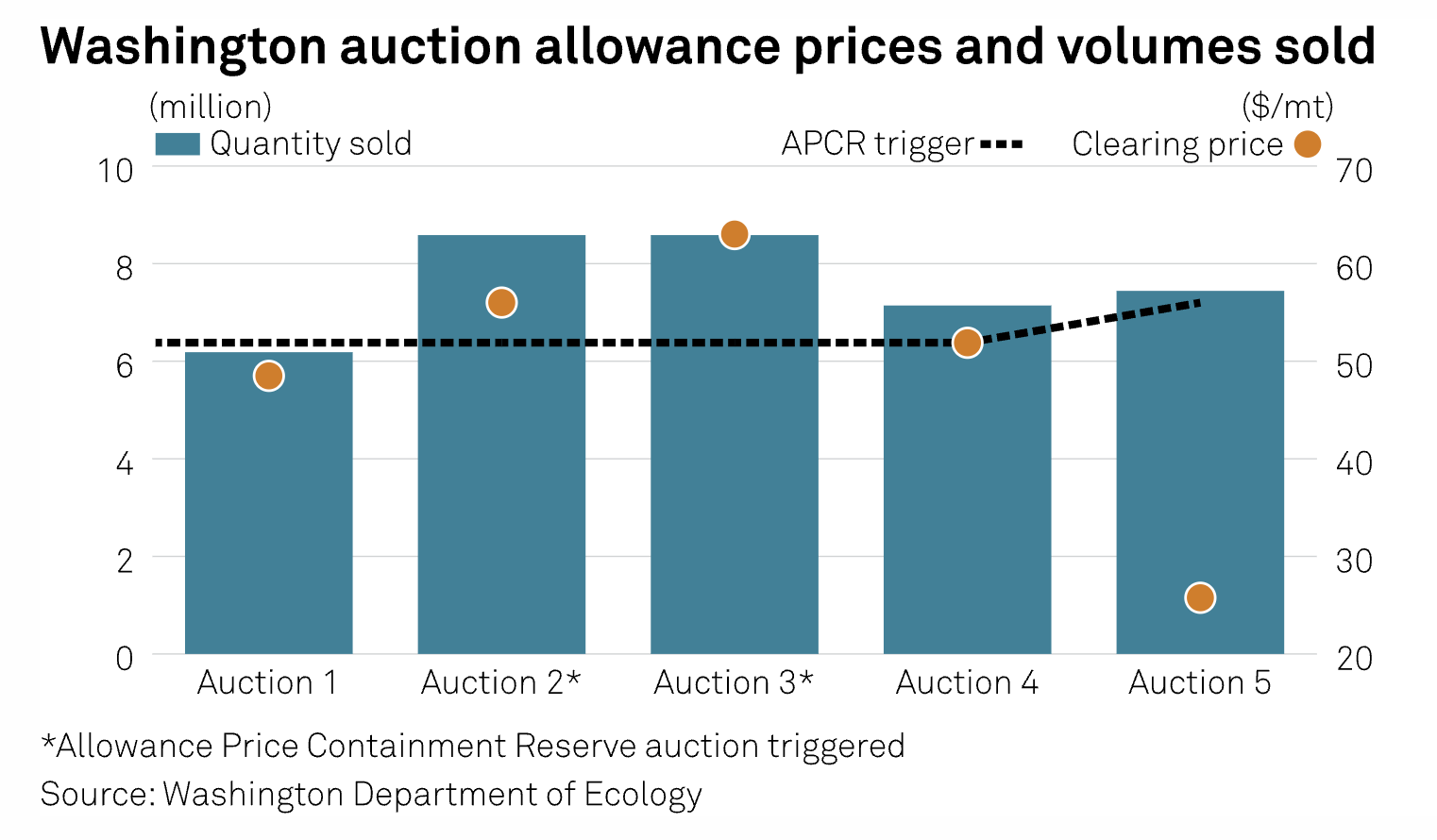

Washington’s carbon market saw a sharp drop in prices in its latest emissions auction, state Department of Ecology data showed March 13, as the program faces repeal in the upcoming November election. The settlement price for Auction No. 5, held March 6, was $25.76/mt, a 50.36% drop from the previous quarter and only $1.74/mt above the current floor price. The Washington Department of Ecology oversees the state's cap-and-investment trading program, which Washington's Climate Commitment Act created in 2021. An initiative will appear on ballots in November giving Washington voters an option to repeal the CCA, effectively eliminating the carbon market.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Bonus Episode: What Are The Key Themes For WPC 2024?

With the World Petrochemical Conference by S&P Global getting underway in Houston, join Chemical Week editors Clay Boswell, Mark Thomas and Vincent Valk for a special episode on key trends for the petrochemicals sector in 2024 and what to watch out for at WPC. Topics the outlook for demand and margins, the diverging fortunes of the European and American industry,and why Asia can attract investment despite subpar economics.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

Generative AI Digest: A Roundup Of Latest Breakthroughs And Developments

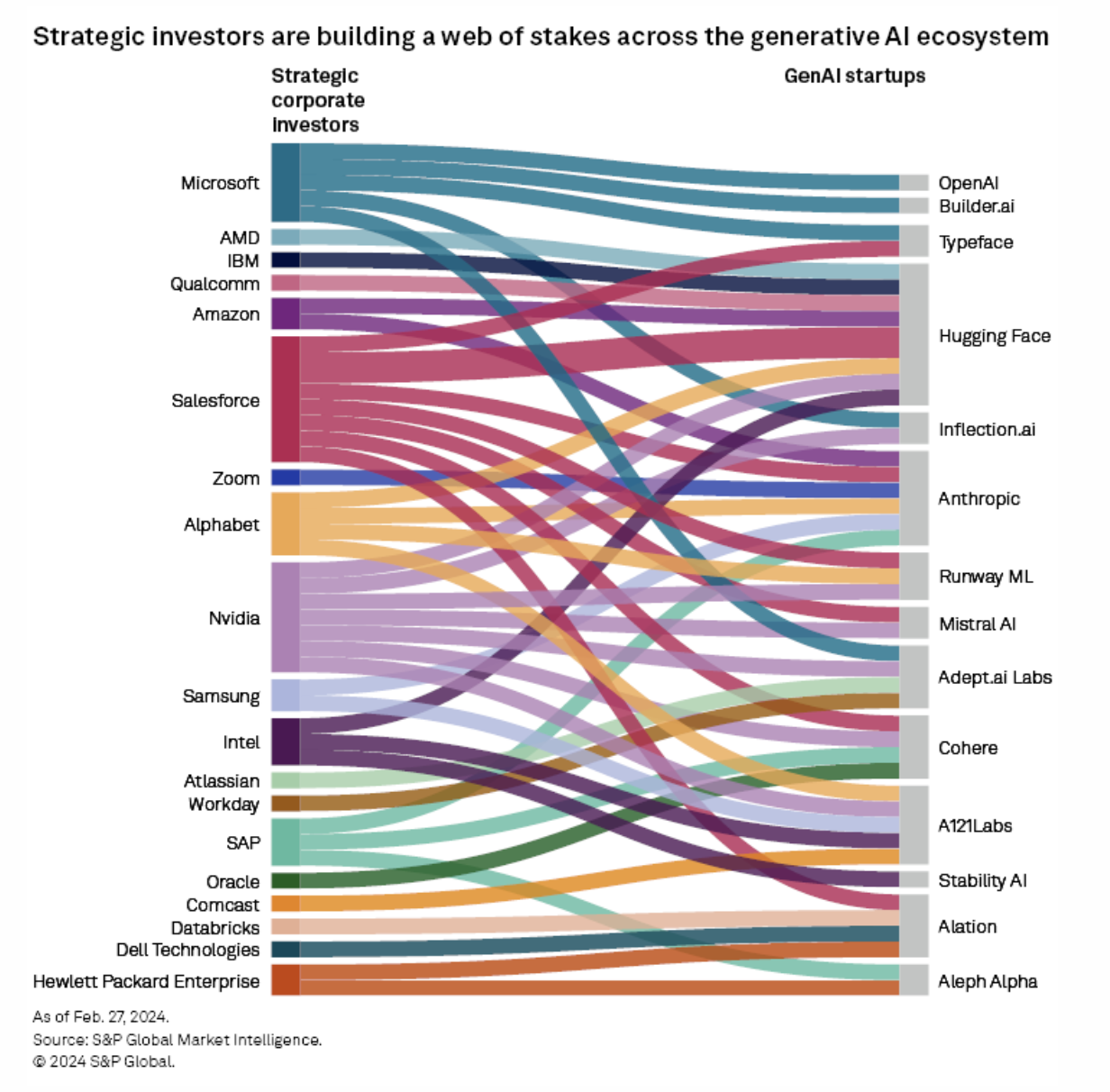

The start of the year has seen a robust pipeline for releases from the largest generative AI technology providers, with Google particularly prolific over the past few weeks. It has also brought us a bundle of funding announcements, with a set of early-stage funding rounds setting the scene for a new set of generative AI giants. Other updates explored in this month's report include further progress with the EU AI Act, Jasper AI's acquisition of Clipdrop, Microsoft Corp. partnering with Mistral AI and an accord on AI election interference.

—Read the article from S&P Global Market Intelligence