Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Fed Makes The First Move

The U.S. Federal Reserve raised interest rates in the first of several expected monetary policy normalization changes—marking its first rate hike since 2018.

At the conclusion of its March 15-16 Federal Open Market Committee meeting, the Fed raised its benchmark interest rate 25 basis points (bps) after keeping it at near zero since the beginning of the COVID pandemic. The Fed indicated that the year ahead will see seven total interest rate hikes, culminating in a 1.9% federal funds rate by year-end, followed by four more in 2023. The Fed’s plans are more or less in line with S&P Global Economics’ previous projections for the central bank’s actions. S&P Global Economics anticipated the Fed to raise interest rates six times this year, followed by five rate hikes across 2023-2024.

The Fed also changed its economic and inflation forecasts for 2022, now expecting full-year growth of 2.8%, from 4% previously, and inflation to swell to 4.3%, from 2.6% in their earlier projections.

On the back of higher interest rates and the impacts from the Russian-Ukraine crisis, S&P Global Economics expects U.S. growth to fall 70 bps short of its earlier forecast, to 3.2% this year, driven primarily by the Fed’s policy changes and, to an extent, by the Russia-Ukraine crisis. This projection is still in expansion territory and well above the U.S. economy’s potential growth rate of approximately 2%, according to S&P Global Ratings Chief U.S. Economist Beth Ann Bovino.

"Above all, the Fed doesn't want to shock the market," Callie Cox, a U.S. investment analyst at the financial services firm eToro, told S&P Global Market Intelligence. "There's already enough uncertainty out there. And shocking the market isn't this Fed regime's style."

The FOMC noted in a statement at the conclusion of its meetings yesterday that “inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures” and that Russia’s invasion of Ukraine and related events “are likely to create additional upward pressure on inflation and weigh on economic activity.” Additionally, the central bankers said in the statement that they expect to begin reducing the Fed’s nearly $9 trillion balance sheet at a forthcoming meeting.

“While the Fed’s statement following [yesterday’s] rate hike was notable for shifting the focus from COVID-19 to the Russia-Ukraine crisis, one thing was clear: The FOMC has taken out its sledgehammer to fight extreme price gains,” Dr. Bovino told the Daily Update. “Given their dramatic ‘reset,’ the statement had dramatic changes, as well. However, with the continued mention of high inflation, this time along with high energy prices—not surprising because gasoline prices are now at record highs—it’s clear that the idea of ‘broader price pressures’ has fully ended any idea of a transitory factor tied to ‘reopening’ items. It’s clear that the Fed sees inflation as here to stay, and plans to do something about it.”

While uncertainty continues as inflation remains at a 40-year high and the Russia-Ukraine conflict continues destabilizing energy markets, some clarity is developing. Banks across the U.S., eurozone, and U.A.E. stand to benefit from higher interest rates, according to S&P Global Ratings. And equities markets may not experience additional volatility from the interest rate hikes.

“In theory, all else being equal, higher interest rates make equity investments less appealing, as they reduce the present value of corporate cash flows, and higher rates result in higher borrowing costs that eat into corporate earnings. Consistent with such theories, the prospect of monetary tightening has triggered declines in U.S. equities, with the S&P 500 starting the year with its worst January since 2009. But history offers caution against assuming a rate hike would necessarily imply the end of the bull run,” Benedek Vörös, director of index investment strategy at S&P Dow Jones Indices, said in a recent commentary. “The experiences of the past half century do not back the popular narrative that the start of a rate hike cycle necessarily goes hand in hand with broad-based losses for U.S. large caps.”

Today is Thursday, March 17, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Asia-Pacific Banks And The Ukraine Crisis: Small Exposures But Secondary Impacts Could Bite

For Asia-Pacific banks, the lack of material direct exposures to Russia and Ukraine counterparties will soften the impact of the conflict. But proximate downside risks—in particular, actual and potential secondary economic and other risks—lie ahead. The biggest risk of the Ukraine conflict is market volatility and higher commodity prices; emerging economies with large energy imports are most at risk. A widening of the conflict or further sanctions could push investors to haven positions, involving capital outflow from emerging markets, hitting assets, and currencies.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Banks, U.K. Government Set For Showdown Over COVID-19 Loan Guarantees

Banks are headed for a legal battle with the U.K. government over the terms of a state-guaranteed COVID-19 recovery loan scheme. The U.K. government's Department for Business, Energy and Industrial Strategy has estimated that £17.2 billion of such "bounce back" loans will not be repaid, with £4.9 billion of that due to fraud. Lawyers have said legal action could follow if the government believes banks have not acted properly—for instance, by carrying out insufficient checks on borrowers—and refuses to honor the guarantee.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Feature: U.S. Coal Producers Cannot Ramp Up To Feed Russia's European Customers

The global coal market cannot scale up to supply Russia's European customers, top coal producers said recently, which is reflected in coal prices and may hasten coal-fired generation retirements, especially in light of federal plans that would discourage coal burning. Since Russia invaded Ukraine Feb. 24, the Platts assessed normalized coal price, FOB Baltimore, has averaged about $178.75/mt, including a high of $240.70/mt on March 8-9, according to S&P Global Commodity Insights. The Platts assessment, since April 2018, has averaged $64.55/mt through the end of 2021, with a high of less than $146/mt Oct. 6-7, 2021.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Renewable Penetration Will Drive Erosion Of North American Capture Prices

As more renewable energy enters the grid, wind and solar generators increasingly compete for the same revenue streams. This results in a price cannibalization risk, in which renewables erode their own value over time. Recent renewable penetration trends in North America with wind and solar capacity additions are already showing signs of eroding prices in regions such as ERCOT and SPP. Managing Editor of Global Power Pricing Amy Gasca, Power Pricing Analyst Daryna Kotenko, and Senior Power Analyst Giuliano Bordignon discuss these trends in North America for historical capture price indexes, outlook on risks, and other expected technology drivers.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Distressed Russian Cargoes May Do Little To Ease Asia's Pain From High Prices

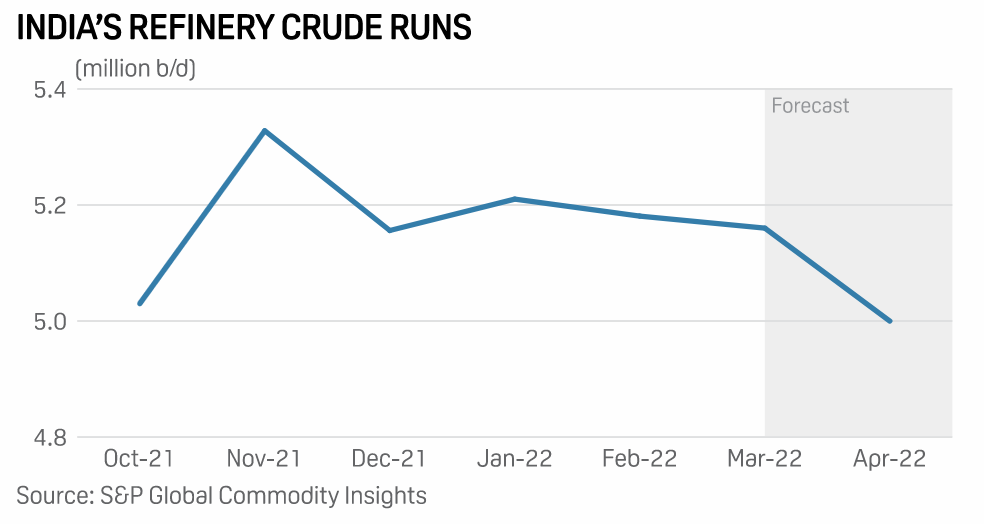

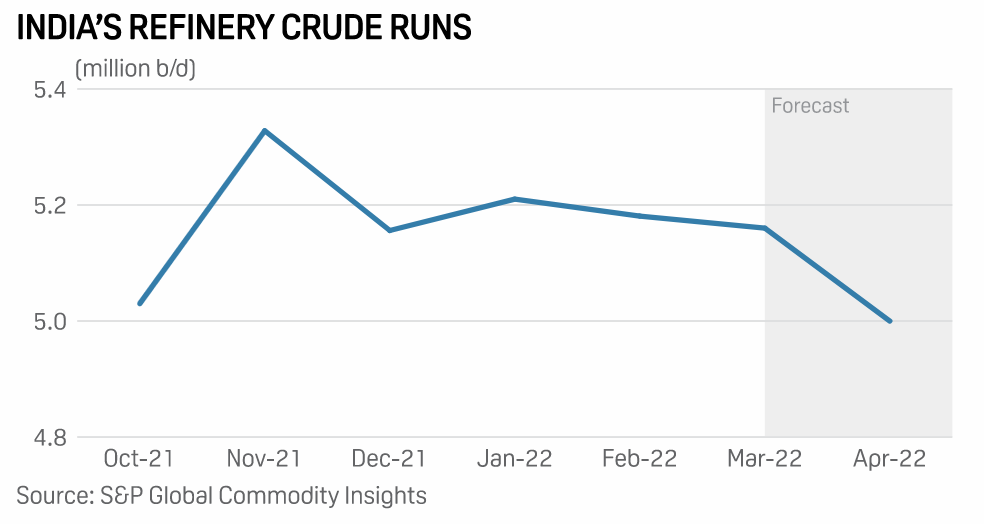

Asia's run rates and oil demand will come under pressure in coming months on the back of high oil prices and tight feedstock availability, and the swelling availability of spot Russian cargoes shunned by buyers elsewhere may do little to ease Asia's pain, speakers at the S&P Global Commodity Insights Asian Refining and Petrochemicals Summit said. In addition, higher energy prices are already adding to the headache of policymakers in Asia due to rising inflation and its potential impact on prices of food and agricultural commodities, the delegates said.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

2021 France Consumer Insights Survey: France No Longer Lags In SVOD Adoption

Due to the increased use of online video services during the height of the pandemic in 2020 and continued subscriber expansion in 2021, the adoption of online subscription video services in France is now on par with other Western European countries. Subscription video-on-demand adoption in France continued to expand in 2021, with 78% of internet households subscribing to at least one online subscription video service—up 5 percentage points from 2020. Growth in SVOD use is primarily from new households subscribing for the first time. Survey data shows that the average hours spent on digital entertainment returned to pre-pandemic levels during 2021. The survey also documents a shift away from live TV to more VOD viewing, with limited SVOD stacking.

—Read the full article from S&P Global Market Intelligence