Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Mar, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Corporate Defaults Creep Upward

A company that can afford its debt at close to 0% interest rates could find that debt suddenly unmanageable as interest rates climb. With higher interest rates and softening economic growth, some companies are confronting a reality that the pain of public default is the only path forward. S&P Global Market Intelligence anticipates credit deterioration in 2024, particularly in lower-rated credits and sectors exposed to declining consumer spending. The challenge for investors is spotting the early warning signs of credit deterioration to identify companies experiencing financial distress before it results in potential default. When payment on a nonhybrid financial instrument, such as a broadly syndicated loan, is not made on the date that payment was due, the company is defined as being in default.

According to S&P Global Ratings, corporate defaults in January 2024 reached their highest level since 2010. The long-term average number of defaults per month is nine; in January, there were 14 global corporate defaults. Defaults were concentrated in those companies most exposed to consumer spending: Four of the defaults were from the consumer products sector, and another three were from media and entertainment companies. Common factors across the issuers that defaulted in January were weak business risks profiles, highly leveraged capital structures and looming debt maturities.

S&P Global Ratings expects that defaults will continue to rise during 2024, as they did in 2023, particularly among lower-rated issuers in the CCC+ and below rating category. These defaults are expected to be concentrated among North American issuers.

Meanwhile, the default rate appears to be stabilizing for European issuers. S&P Global Ratings forecasts that the trailing-12-month speculative-grade corporate default rate for European corporates to stand at 3.5% by December 2024. That is the same as the trailing-12-month average from December 2023. It is possible that this default rate for European issuers could rise to 5% if there is a prolonged economic slowdown in the eurozone.

As in North America, defaults in Europe are anticipated to be concentrated in consumer-reliant sectors, such as consumer products and media and entertainment. The higher interest rates have yet to affect many European issuers who are still operating with loans issued at lower interest rates. Upcoming fixed-rate maturities will force many issuers to reissue debt at interest rates 2% higher.

The full impact of higher interest rates for corporate issuers can take months or even years to manifest as debt matures. This poses a challenge to central bankers, who must anticipate the eventual, rather than the immediate, impacts of interest rate changes to tame inflation.

Today is Wednesday, March 13, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

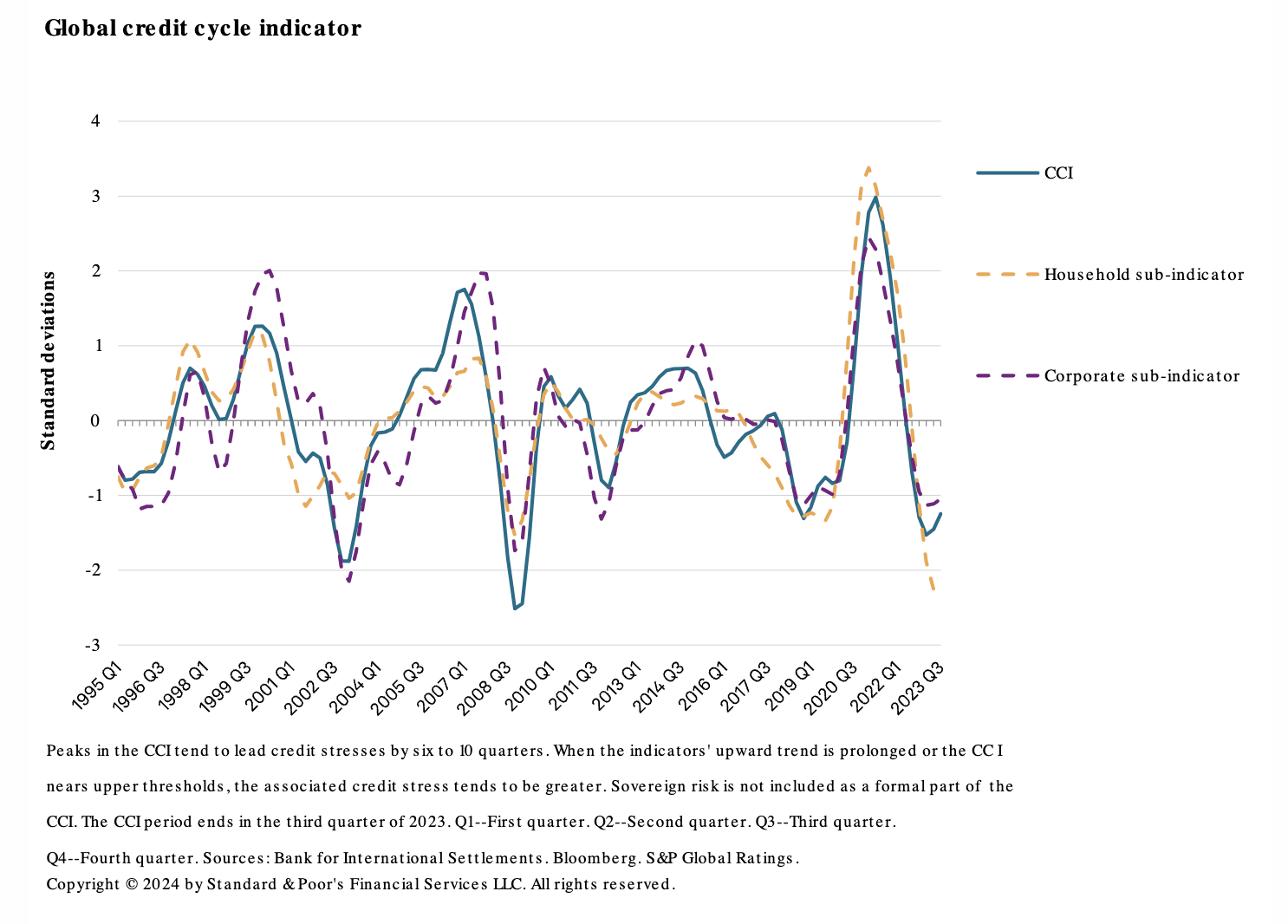

Credit Cycle Indicator Q2 2024: Upward Momentum For A Recovery In 2025

S&P Global Ratings’ global CCI is signaling a potential credit recovery in 2025. Globally, the decline in private sector debt-to-GDP, which started in early 2021, seems to be moderating. Market anticipation of a soft economic landing and interest rate cuts by central banks have boosted confidence. Equity prices are improving, benchmark bond yields coming down and spreads tightening. There are green shoots of market access returning even for lower-quality borrowers early this year.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

GCC Real Estate: How Credit Stories Have Evolved

Rated GCC real estate companies have stable credit quality after a volatile few years that saw downgrades, recovery and a restoration of credit profiles for most in the sector. Drivers include steady economic and population growth, a rebound in tourism and supportive oil prices.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

Listen: Red Sea Crisis Forces Carriers And Shippers To Rethink Strategies As Cost Of Operation Rises

Red sea crisis has forced carriers and shippers alike to adjust strategies. Container freight rates not only reached yearly high after receding throughout 2023 but carriers also seized a profit making opportunity they were looking for after the post pandemic lull. The change in this dynamic has forced shippers to again look for alternatives in the hopes of making their supply chain more agile. S&P Global Commodity Insights containers editor Tanya Kalra speaks with Chris Rogers, head of supply chain and research at S&P Global Market Intelligence; Greg Knowler, senior editor for the Journal of Commerce; and Mohammed Al Ansare, associate editor of EMEA containers at S&P Global Commodity Insights, about the changing dynamics in the containers market and how carriers and shippers are navigating through them.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

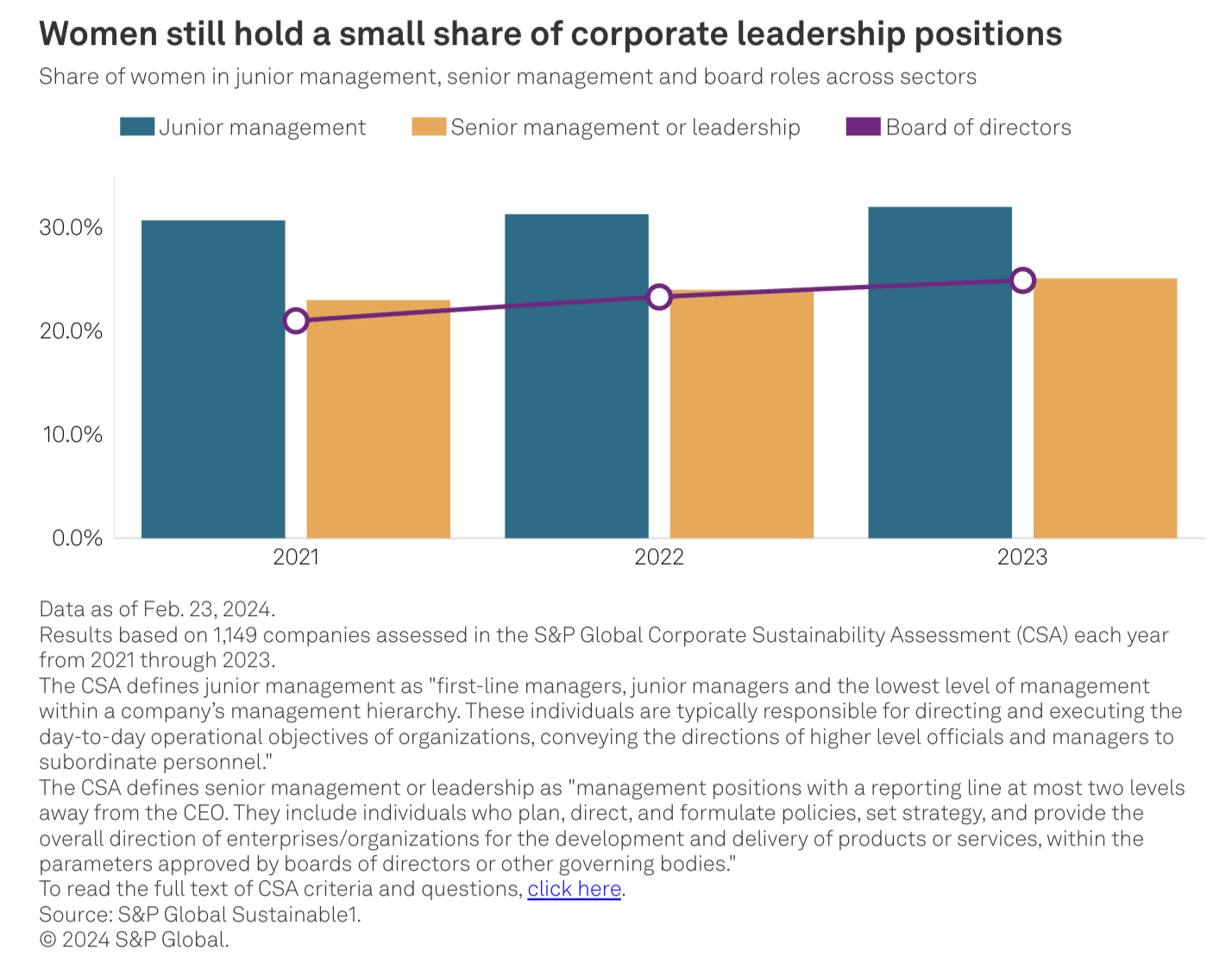

Women In Leadership: What’s The Holdup?

Despite corporate attention paid to gender diversity in recent years, progress toward parity in senior roles remains slow. A new analysis by S&P Global Sustainable1 shows that this is true across junior management positions that feed into more senior roles. It is also true for senior management: 75.0% of these roles are still held by men. Women hold just 29.0% of management roles with a revenue-generating function — the kind of role that can be a stepping stone to the C-suite. This data point sheds light on how the pipeline to the top narrows for women.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

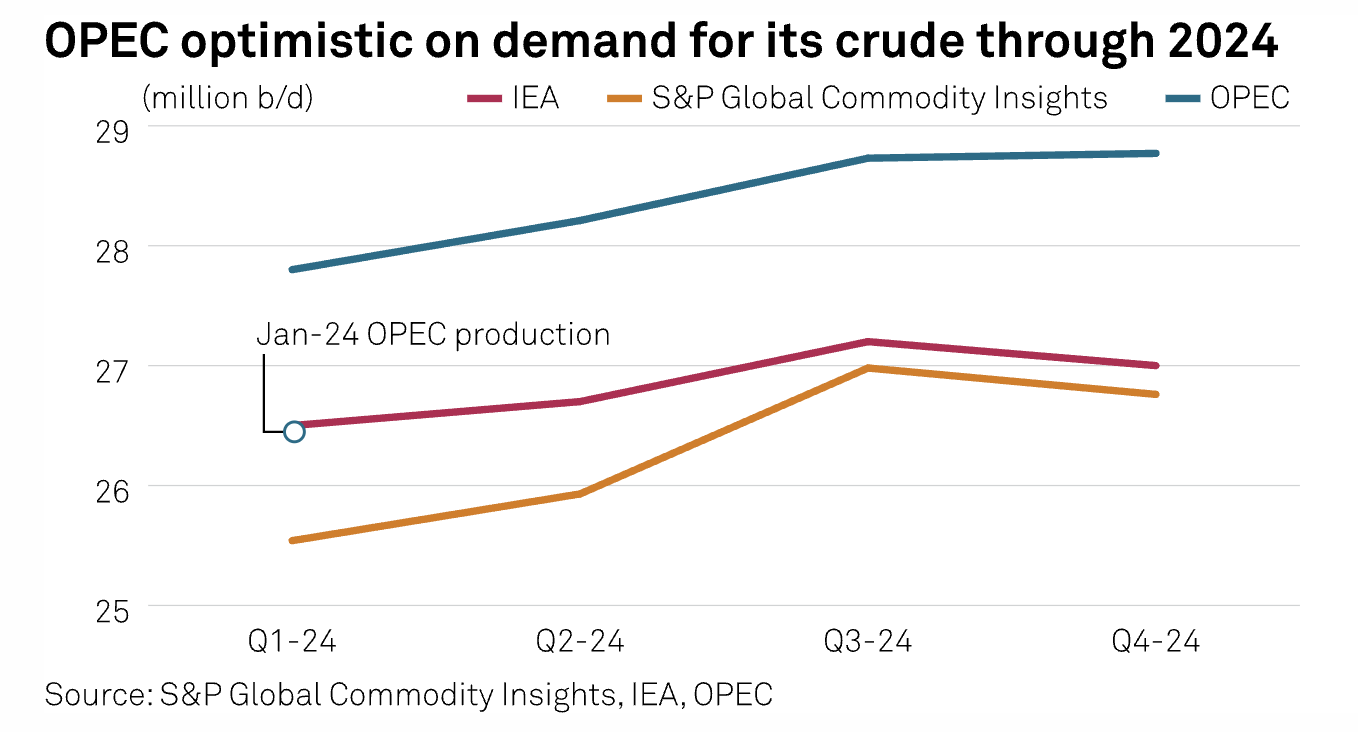

Aramco Sees 'Healthy' Oil Demand Growth Of 1.5 Million B/D This Year

Saudi Aramco's CEO Amin Nasser said on March 10 that he expects oil demand growth to average 1.5 million b/d in 2024 and be "robust" in 2025. "With regard to the oil demand, we expect the global oil market to remain healthy over the remainder of this year and we expect it to be fairly robust," he said. "We're looking at a growth of about 1.5 million b/d," he told reporters during a call to discuss the company's 2023 full-year financial results.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

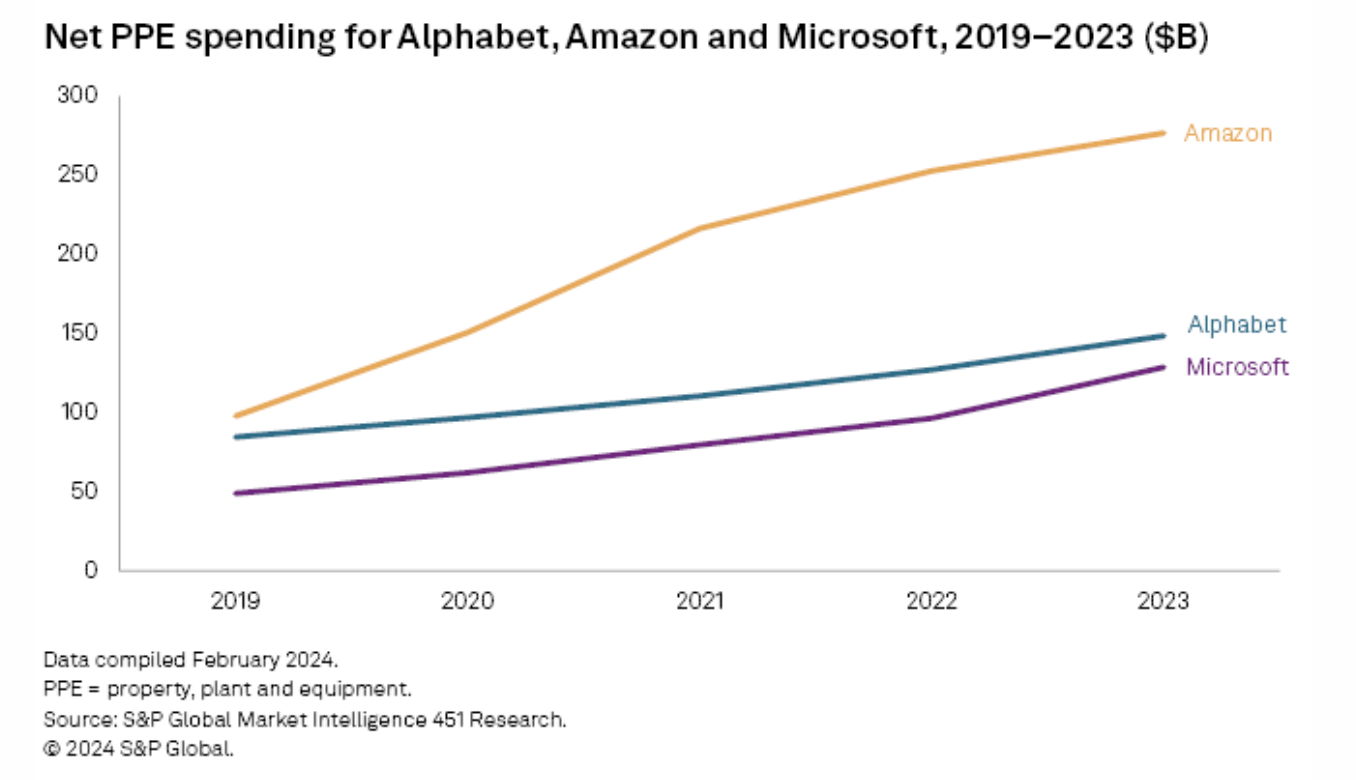

AWS, Azure And Google Cloud Intensify Capex To Prevent Customer Churn

Cloud provider parent companies Amazon.com Inc., Microsoft Corp. and Alphabet Inc. are stepping up capital investment to power AI offerings at the infrastructure, platform and application levels. For the first time since the dawn of the cloud era, enterprises are reassessing their primary cloud supplier as they seek the best partner to guide them through the coming AI revolution. The challenge now is to avoid churn for future workloads while satisfying existing, substantial customer bases.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language