Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

This week marked the anniversary of two ominous moments in recent history—one that feels like a decade ago and another that truly was. One year ago, on March 11, 2020, the global community was transformed when the World Health Organization declared that the coronavirus outbreak was a pandemic. The same day marked 10 years since the Great East Japan Earthquake struck offshore of Fukushima and launched a fatal tsunami.

Both events have reshaped the global economy’s response to “black swan” events.

The preceding 12 months have seen 118.5 million people infected with the coronavirus and 2.6 million killed by the COVID-19 disease. Economic activity has ebbed and flowed, throwing many people into joblessness and instability. In response, governments have committed to building their countries back from the sudden-stop recession with an emphasis on stronger social safety nets and clean energy transitions. Now, the innovations born from the crisis will carry the global community forward as current conditions indicate signs of recovery.

Despite global debt climbing to a record $201 trillion (or 267% of GDP) last year, S&P Global Ratings doesn’t anticipate a near-term debt crisis, due to the recovery fueled by the successful vaccine rollout, availability of credit, and rebounding demand. By year-end, global debt-to-GDP will likely ease to 258% and stabilize at 255%-256% in 2022-2023, according to S&P Global Ratings.

Meanwhile, positive signs are shining in the world’s largest economy. In the U.S., the risk of default is declining in many industries, due to ample access to capital, less competition in the marketplace, and the anticipated economic rebound, according to S&P Global Market Intelligence.

The positive outlook is owed to the rapid development of vaccines to combat COVID-19. "We found new ways to use digital technology, to partner with regulators and to perform tasks in parallel rather than sequentially—all of which allowed our scientists and clinicians to advance the clinical trials for our COVID-19 vaccine with unprecedented speed, without compromising safety or quality,” Pfizer CEO Albert Bourla said in a March 11 open letter to mark the period since the W.H.O. characterized the pandemic. "We watched as human ingenuity solved problems that we hadn't even pondered just 12 months ago."

Parallels can be drawn to the different crisis that pummeled Japan in 2011. After the magnitude-9 earthquake and subsequent tsunami wiped out a sizable amount of Japan’s nuclear power generation and refining capacity, the country focused on its vulnerabilities to chart a path forward. Japan has spent the past decade creating resiliency against supply disruptions, and will spend the coming decades combatting greenhouse gas emissions.

"In the wake of the earthquake disaster, we believe we have significantly enhanced domestic supply chains … Our focus of fuels policy in the aftermath of the earthquake was to secure alternative energy as nuclear power generation halts," Ryo Minami, the director-general of oil, gas, and mineral resources at Japan’s Ministry of Economy, Trade, and Industry, told S&P Global Platts. Now, the country is pursuing carbon neutrality by 2050 and “will ensure stable [energy] supply for daily lives and industry while we will take the challenge of this transition by lowering transitional costs as much as possible.”

Today is Friday, March 12, 2021, and here is today’s essential intelligence.

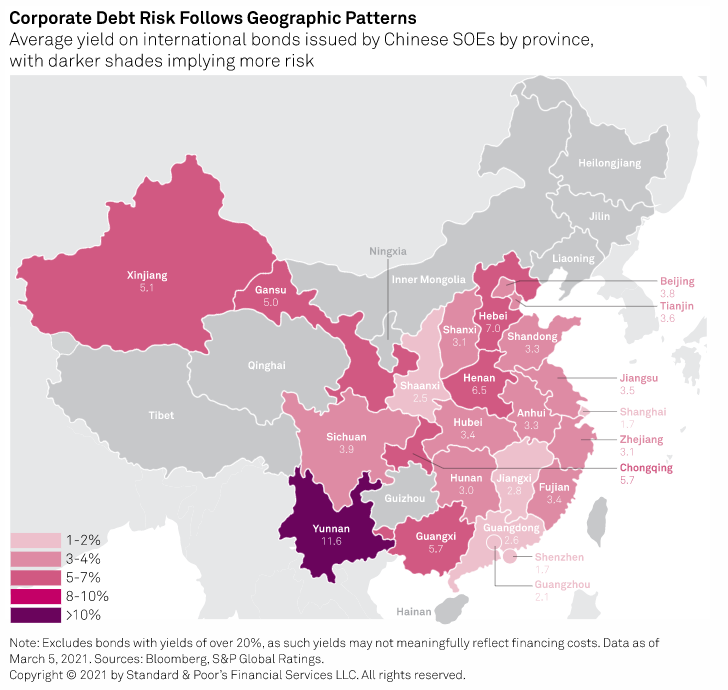

China Defaults Flag Provincial Risks

Yields on U.S.-dollar debt issued by Chinese local government-owned entities have climbed 100-300 basis points on average following a series of high-profile defaults.

—Read the full report from S&P Global Ratings

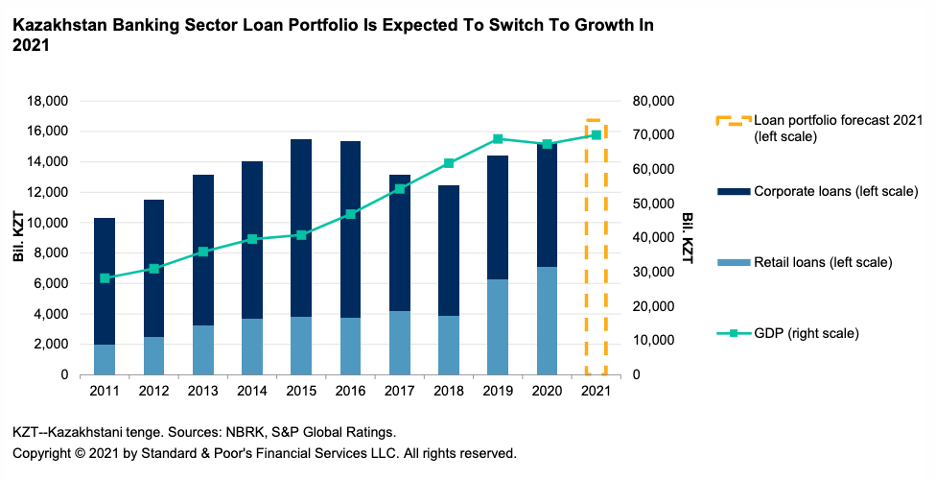

Kazakh Banking Outlook 2021: A Windy Road To Recovery

S&P Global Ratings expects the loan book of Kazakh banks to increase 8%-10% in nominal terms this year on the back of reviving economic activity, pension reform, and government support programs.

—Read the full report from S&P Global Ratings

How COVID-19 Is Affecting Bank Ratings: March 2021 Update

S&P Global Ratings continues to believe that COVID-19-related downgrades to banks will be limited by banks' strengthened balance sheets over the past 10 years. Furthermore, S&P Global Ratings expects that support from public authorities to households and companies will be only gradually removed as the economic recovery takes hold later this year.

—Read the full report from S&P Global Ratings

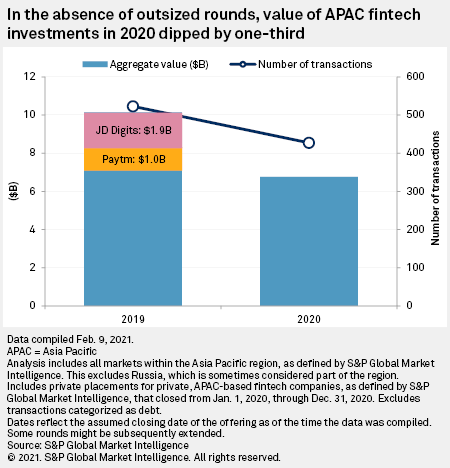

Vcs Reopen Funding Tap for Asia-Pacific Fintechs In Q4'20; Brighter Days In 2021

Although Asia-Pacific saw a decline in financial technology investments in 2020, the surge in both deal value and volume in the last quarter of the year pointed to a brightening outlook for the fundraising environment in 2021.

—Read the full article from S&P Global Market Intelligence

Microsoft Cyberattack Impact Lingers as Hackers Exploit Backdoors, Analysts Say

The cyberattack on Microsoft Corp.'s email server software has mushroomed into a global crisis that cybersecurity experts say will likely claim many more victims due to the sophisticated nature of the hack.

—Read the full article from S&P Global Market Intelligence

From iPhones To Baby Yodas: Target Ramps Up Store-Within-A-Store Concept

Even as the pandemic has sent more shoppers online, Target Corp. is increasingly teaming up with major brands such as Apple Inc. and The Walt Disney Co. to create mini stores within its own retail locations to boost sales and drive foot traffic.

—Read the full article from S&P Global Market Intelligence

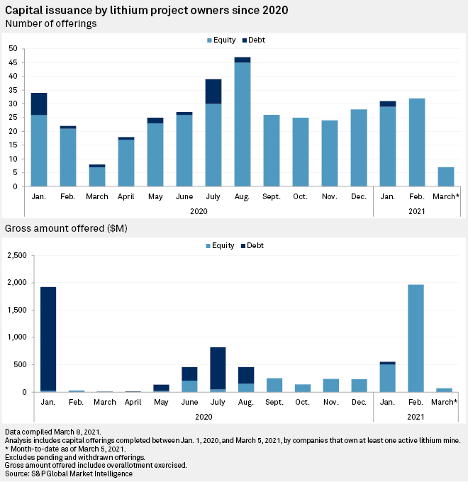

High Cash Injections, Battery-Grade Lithium Prices Point to Rapid EV Expansions

Lithium majors raising large chunks of cash in recent months and battery-grade lithium prices skyrocketing since the new year are indications that electric vehicle sales will accelerate and that themes driving growth for such commodities are here to stay, according to industry experts.

—Read the full article from S&P Global Market Intelligence

In Wake Of Texas Power Crisis, U.S. Senate Examines Threats To Grid Resilience

With Texas still reeling from the fallout of widespread power outages in February, a U.S. Senate panel held a March 11 hearing on the reliability, resilience and affordability of the nation's electric grid.

—Read the full article from S&P Global Market Intelligence

Recycled Plastics Market Becoming More Liquid And Globalized As Demand Soars

On January 1, 2021 the EU introduced a plastics tax of Eur800/mt on plastic packaging that is not recycled. The levy is just one example of policies being enacted by governments across the world to tackle the issue of plastic pollution.

—Read the full article from S&P Global Platts

Market Movers Asia, Mar 8-12: Oil Prices in Focus After Attacks at Saudi Oil Facilities

The highlights on S&P Global Platts Market Movers - Asia with Agriculture Editor Mugunthan Kesavan: Brent crude futures rise above $70/b as Ras Tanura attack extends rally, Asian refiners hopeful for resumption in Iranian oil trade, lessons from Fukushima in focus as Japan plans to become a carbon neutral country by 2050, strong ABS demand drives prices to record high, buyers await Brazil's Conab and USDA's WASDE data for updates on grain and oilseeds supply and demand.

—Watch and share this Market Movers video from S&P Global Platts

Commodities Bull Market Set To Run But Faces Risk of Near-Term Correction: Saxo's Hansen

Key commodities such as oil and copper remain on track for a multi-year bull market due to tightening fundamentals but could be set for a near-term correction after investors "jumped the gun" over the anticipated demand rebound as the world emerges from the COIVD-19 pandemic, according to Saxo Bank's head of commodity strategy Ole Hansen.

—Read the full article from S&P Global Platts

OPEC Bullish On H2 Oil Recovery As It Seeks Tighter Market

Global oil demand will rebound strongly in the second half of 2021, but the call on OPEC crude will be lower than previously expected, the producer group's latest analysis showed, providing some backing for Saudi Arabia's decision not to relax its output cuts through April.

—Read the full article from S&P Global Platts

Listen: Pandemic, Politics Usher Uncertainty Into Brazil’s Diesel Market

Rising prices and a failed trucker strike last month have rocked the Brazilian diesel market this year. Petrobras, Brazil's state-owned oil company, has raised fuel prices several times this year after pressure from independent importers, angering consumers and trucking unions. Petrobras' CEO was recently ousted by Brazilian President Jair Bolsonaro, all while Petrobras sells off eight of its 13 refineries.

—Listen and subscribe to Platts Oil Markets Podcast, from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language