Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Jun, 2020

By S&P Global

On Monday, the U.S. Federal Reserve said banks could start registering for its long-awaited Main Street Lending Program and announced it will begin purchasing billions of dollars worth of corporate bonds in the secondary market. On Tuesday, Fed Chairman Jerome Powell told the Senate Banking Committee that already-disadvantaged Americans would continue to disproportionally feel the worst of the economic downturn’s effects if it continues. On Wednesday, Mr. Powell told the House Financial Services Committee it would be “appropriate” for Congress to release additional stimulus to support monetary-policy actions, and warned against withdrawing fiscal support too soon. On Thursday, the Fed’s balance sheet dropped to $7.14 trillion, down $74.2 billion from the previous week, to the lowest level since February.

“Since the week of Feb. 26, 2020, when the COVID-19 pandemic became front and center in major economies outside Asia, the Federal Open Market Committee has found itself flexing its crisis management muscles in an unprecedented manner,” S&P Global Ratings’ Senior Economist Satyam Panday said in a June 18 report. “The environment remains extremely uncertain, which means we wouldn't be surprised if the Fed reaches further into its policy toolkit in the second half of this year and beyond.”

For the 13th consecutive week, more than 1 million Americans filed initial jobless claims, with Labor Department data showing approximately 1.5 million people applied for benefits last week. According to Mr. Panday, “the Fed is solely focused on one thing at the moment: getting the economy back to full employment, which we project is at least a multiyear process.”

The central bank “has committed to increasing purchases of government-backed bonds by at least their current pace, a clear indication that they're likely to do more than less in the future,” Mr. Panday said, projecting that “the size of Fed's balance sheet is likely to reach 40% of GDP by year's end—a 21 percentage point climb over the year, reflecting about an additional 3 percentage point equivalent policy rate cut.”

“On June 8, 2020, the S&P 500 stock index completed its recovery to its year-end 2019 level … ‘Explosive’ fairly describes the stock market’s rebound from its trough over a period of just 2.5 months. From March 23 to June 8, prices rose by 44.5%, as measured by the S&P 500, and by an even greater 53.3% over the same span based on the Russell 2000 Index,” Martin Fridson, the chief investment officer of Lehmann Livian Fridson Advisors LLC and a contributing analyst to S&P Global Market Intelligence, said in recent commentary. “By comparison, over a comparable interval following the Great Recession low on March 9, 2009, the S&P 500 gained ‘just’ 34.6% and the Russell 2000 rose by 45.8%.”

“At the individual stock level, a noteworthy feature of the recent rally was the inverse correlation between credit quality and performance,” Mr. Fridson said. “No such relationship characterized the downturn from year-end 2019 through the March 23 low. We see these facts as evidence that the equity rally was driven mainly by the Federal Reserve’s aggressive moves to support the credit market, rather than prospects for a normal recovery in economic activity and corporate earnings.”

The majority of experts foresee the world living with the virus well into 2021.

“Until the public is confident that this disease is contained, a full recovery is unlikely. Moreover, the longer the downturn lasts, the greater the potential for longer-term damage from permanent job loss and business closures,” Mr. Powell said on June 16.

Today is Friday, June 19, 2020, and here is today’s essential intelligence.

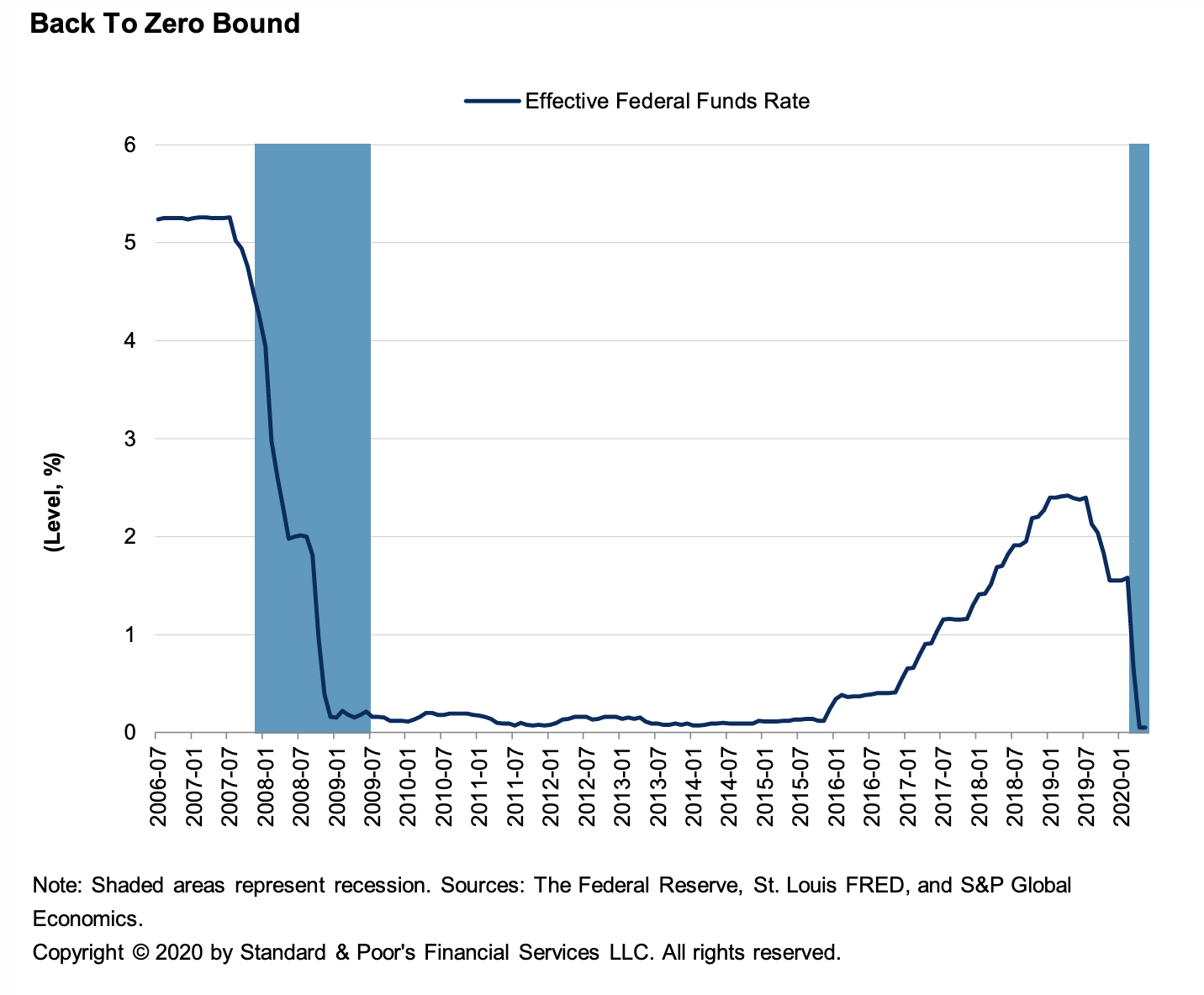

Economic Research: The Federal Reserve Performs A Rebalancing Act To Ease Conditions

"We are not even thinking about thinking about raising rates," Fed Chairman Jerome Powell said on June 10, 2020. The primary takeaway from the June Federal Open Market Committee (FOMC) meeting was that the Fed is not moving away from its ultra-easing monetary stance, unless the outlook for the economy changes dramatically, which we think at this point remains unlikely. The Fed is solely focused on one thing at the moment: getting the economy back to full employment, which we project is at least a multiyear process. Rates are staying low, even if the stock market powers forward. This comes against the backdrop of the COVID-19 recession, which has been unprecedented in scope and speed compared with other downturns since WWII and unique in that it is due to the coronavirus and mitigation measures taken to curb its toll on society.

—Read the full report from S&P Global Ratings

U.S. Health Care Staffing Companies See A Rough Road To Recovery, Filled With Detours, Risks, And Behavioral Changes

U.S. health care staffing companies are on their way to a slow recovery, with patients who had delayed elective procedures now returning to their providers of care. However, the pace of recovery will be uneven, depending on the mix of service lines and geography. The collapse in patient volume following the abrupt government directive in mid-March to delay all elective procedures to conserve hospital capacity to treat COVID-19 patients and patient fears of visiting health care providers during the pandemic, has cascaded through the health system, resulting in a dramatic reduction in health care staffing companies' revenues and cash flows. At the trough in April, anesthesiology services were down almost 70%, radiology volume was down about 60%, and emergency department (ED) visits were down consistently over 40%.

—Read the full report from S&P Global Ratings

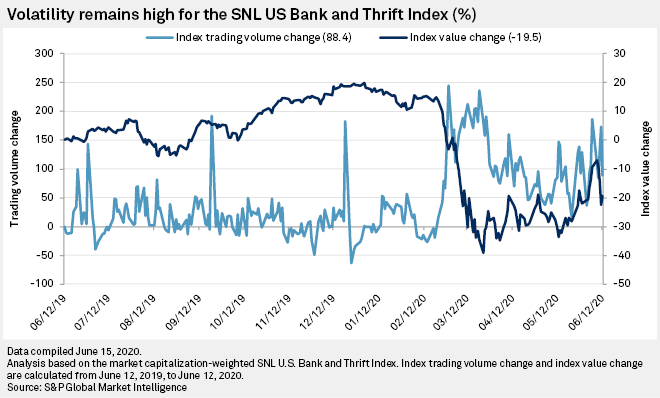

Beat-up bank stocks rally 25% or more in single month

Bank stocks were a favored punching bag when equity markets sank as the COVID-19 pandemic triggered shutdowns. Now that some U.S. states are re-opening and green shoots have appeared, bank stocks are outpacing the broader markets on the way up, too. Among banks traded on major exchanges and with significant volume and market capitalization, the median gain was 12.0% for the one-month period ended June 12. The S&P 500 gained 6.0% over that time. CIT Group Inc. posted the largest gain, shooting up 62.3% in a single month. Cadence Bancorp. was not too far behind with a one-month gain of 49.7%. However, both stocks still lag peers on a year-to-date basis and trade well below book value at 46.8% and 56.0%, respectively.

—Read the full article from S&P Global Market Intelligence

Murky PPP guidance has some participants facing troubled waters

For months, lenders and borrowers have tried to navigate the Paycheck Protection Program without clear guidance, and now big banks are facing backlash for alleged practices that were not explicitly prohibited from the onset, experts say. The House Select Subcommittee on the Coronavirus Crisis has initiated a probe into whether some of the nation's biggest banks, including JPMorgan Chase & Co., Bank of America Corp., Wells Fargo & Co. and Citigroup Inc., gave major companies favorable treatment when processing the Small Business Administration's emergency loans, according to a Bloomberg report. Those interviewed by S&P Global Market Intelligence did not comment specifically on the probe, but they noted that banks might not have had the clearest instructions on the program as time-crunched regulators worked quickly to draft guidance on the legislation in an effort to combat the rapid economic fallout from the pandemic.

—Read the full article from S&P Global Market Intelligence

COVID spurs greater fintech use in Mexico, but financial inclusion lags

Financial technology companies in Mexico are seeing rapid growth of new clients during the coronavirus outbreak, though experts note the trend is having little impact on the country's massive unbanked population. On average, new account openings for digital wallets and neobanks are up 30%, while transactions, including bill payments and money transfers, have soared by an estimated 80%, according to Fintech México, an association for firms in the industry. "We are seeing a radical change in consumption methods, and the growth [in fintech users] has been quite pronounced," the association's general director, Luis Silva de la Torre, told S&P Global Market Intelligence. However, the growth in fintech adoption is occurring primarily among younger individuals who already have a financial account, de la Torre noted.

—Read the full article from S&P Global Market Intelligence

Polish banks' profits, net interest margin to dive as rate cuts bite

Polish banks, already hit by the economic impact of the coronavirus, will see between a third and half of their profits wiped out and their net interest margins sharply decline over the next year following three interest rate cuts by Poland's central bank, analysts predict. The National Bank of Poland's Monetary Policy Council slashed the country's reference rate to 0.10% May 28. This was down from an historic low of 0.5%, reached following reductions totaling 1 percentage point in March and April that aimed to soften loan repayments for households and companies.

—Read the full article from S&P Global Market Intelligence

Bank of England sees UK economy picking up but increases QE by £100B

Green shoots are appearing in the U.K. economy with consumer spending and services picking up following a disastrous 20% contraction of GDP in April, according to the Bank of England. In a widely expected move, the Bank of England's monetary policy committee, or MPC, voted in favor of increasing its Asset Purchase Facility, or APF, by £100 billion, taking the total size of the bank's quantitative easing program to buy U.K. government and nonfinancial investment-grade bonds to £745 billion. Despite the prospect of extra money printing, sterling rallied toward $1.26 in the aftermath of the announcement, almost wiping out the 0.5% fall in the morning trading, as the bank expressed a degree of confidence in the recovery of the economy.

—Read the full article from S&P Global Market Intelligence

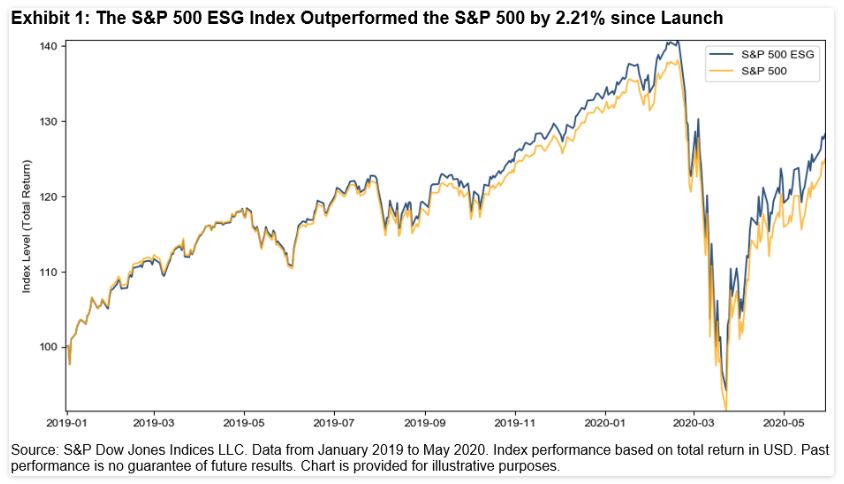

Is ESG a Factor The S&P 500 ESG Index’s Steady Outperformance

Since launching the S&P ESG Index Series, we have been continuously asked the same question: Can environmental, social, and governance (ESG) be considered a factor that outperforms? In short, since its launch in January 2019, the S&P 500® ESG Index has outperformed. S&P Dow Jones Indices further analyzed the performance characteristics of the S&P 500 ESG Index against our suite of S&P Factor and Style Indices.

—Read the full article from S&P Dow Jones Indices

IEA outlines three-year plan for sustainable recovery

Governments can spur economic growth and jobs at the same time as cutting greenhouse gas emissions, the International Energy Agency said Thursday in a $1 trillion per year pandemic recovery plan. The plan seeks to show governments how they can help their economies recover from the coronavirus pandemic at the same time as putting energy and other sectors on a track for lower carbon growth. "Our Sustainable Recovery Plan shows it is possible to simultaneously spur economic growth, create millions of jobs and put emissions into structural decline," the IEA said in the report released June 18.

—Read the full article from S&P Global Platts

Oil and gas producers' methane emissions could rise in COVID-19 aftermath: IEA

Methane emissions by the global oil and gas industry could rise rather than fall in the aftermath of the COVID-19 crisis, contrasting with an expected reduction in CO2 emissions, as weak prices and policy shifts hamper efforts to contain the potent greenhouse gas, the IEA said June 18. In its 'Sustainable Recovery' report responding to the industry downturn, the IEA said it would cost $15 billion annually to reduce by three-quarters the industry's methane emissions, and regulators and companies needed to take action.

—Read the full article from S&P Global Platts

EC's draft EU hydrogen plan calls for robust GOs, demand targets

Guarantees of origin and demand targets are some of the ways the EU could drive green hydrogen growth to cut carbon emissions, according to an unofficial European Commission draft EU hydrogen strategy. The goal is to design an "open and competitive green hydrogen market" with "commodity-like" quantities available to industry, as part of the EU's efforts to be climate neutral by 2050, according to the draft made available to the Euractiv news agency on June 18. An EC spokesperson was not immediately available to comment on the draft, but on June 16 confirmed the official strategy would be presented on July 8, along with an EU energy system integration strategy.

—Read the full article from S&P Global Platts

EU carbon prices hit 3-month high as market weighs reforms

EU carbon allowance prices rallied to a three-month high June 18 as the market eyed planned reforms that are likely to tighten supply in the long run as well as on supportive, technical factors. EU Allowance futures contracts for December 2020 delivery on the ICE Futures Europe exchange rallied as high as Eur24.15/mt ($26.66/mt) June 18, up from Eur22.75/mt at the close June 17, and setting the highest intra-day price since March 10. Carbon prices appeared to react to media reports this week quoting a European Commission official saying that the commission would consider setting a price floor for carbon allowances under the EU Emissions Trading System.

—Read the full article from S&P Global Platts

Floyd protests loom over NFL ratings, advertising dollars

With the death of George Floyd sparking widespread protests over police brutality and social injustice, the sports industry will be watching to see if player demonstrations could have an impact on National Football League Inc. ratings and advertising dollars. Richard Lapchick, an activist and director of The Institute for Diversity & Ethics in Sport and professor at the University of Central Florida's Devos Sport Business Management program, noted that protests related to racial injustice in the past often lasted for just a couple of weeks or a month. This time, though, he believes the protests could be sustained for far longer, as more than 350 athletes, coaches and executives across various leagues and sports have expressed outrage.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Asia, Jun 15-19: China's key indicators to help market gauge post-COVID-19 economic recovery

The highlights in Asia this week on Platts Market Movers, with Sebastian Lewis, head of content in China: Brisk trading expected for August-loading crude cargoes from the Middle East; steel markets keep an eye on China's infrastructure and property investment data; and weak demand drags freight rates to lowest levels this year. Also in this episode: healthy olefins margins could drive naphtha crackers' LPG use and Australian coal prices seen firming up ahead of summer.

—Watch and share this video from S&P Global Platts

Crude Oil Can Get Carried Away by Contango

The long-term impact of the COVID-19 pandemic on commodities markets is not yet known. There have undoubtedly been short-term impacts on supply and demand, ranging from a collapse in oil demand to supply disruptions at individual mines as a result of COVID-19 infections among mine employees. The longer-term implications of these demand and supply shocks, while uncertain, will likely follow a well-trodden path that eventually leads to market equilibrium. What is less clear is the long-term impact on the commodity investment landscape. The negative price action in the WTI crude oil futures market in April 2020 may well force investors to rethink the standard narrative around investing in commodities.

—Read the full article from S&P Dow Jones Indices

Written and compiled by Molly Mintz.

Content Type

Location

Language