Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Jun, 2020

By S&P Global

South Africa reported a record number of new coronavirus cases for the second consecutive day. French President Emanuel Macron expedited his country’s reopening schedule. Chinese authorities shut down parts of Beijing, the country’s political hub, and reinstated some restrictions after a new cluster of cases was traced to a massive meat and vegetable market.

While New Zealand completely eradicated the virus from its population—reporting no new cases for weeks, through rigorous restrictions—and life in Iceland has almost returned to normal due to consistent testing and contact tracing, most other nations have rapidly climbing infection totals, alongside omnipresent lockdown fatigue and often-changing containment rules. More than 7.9 million cases of coronavirus have been confirmed worldwide, and more than 433,000 people have died, with the U.S., Brazil, and Russia accounting for the most cases, according to Johns Hopkins University.

Spiking infections worldwide are igniting fears of an additional economic blow, and calling into question whether the global economy can coexist with the health pandemic. Against this backdrop, global economic activity shows signs of a mixed recovery. Health and economic experts agree that a quick recovery is unlikely.

In the U.S., “new business applications with planned wages remain 9% below last year on year-to-date comparison but have recovered close to normal on year-over-year trend basis. Although not all new applications convert into business formations, getting back to trend rate is a good sign,” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said in a June 11 report. “Even better would be if applications surpass the trend rate to make up for lost potential from March to May. Mortgage applications have recovered strongly, now back to January levels, which bodes well for housing activity in the summer months.”

The market is trying to sort out "what is cyclical and what is secular" in terms of the changes that the economy is currently experiencing, CFRA Research analyst Cathy Seifert told S&P Global Market Intelligence in an interview, explaining that worries about the pandemic's effects are generating the most significant pressure on markets as investors aim to assess where permanent structural changes in the economy will surface and whether the virus will lead to permanent demand destruction in some areas.

"I think that issue is weighing on the market — not that it doesn't have enough stuff already weighing on it," Ms. Siefert said.

After a fierce rally, equities experienced their worst day since March on June 11, and the S&P 500 finished the week ended June 12 down 4.78% at 3,041.31.

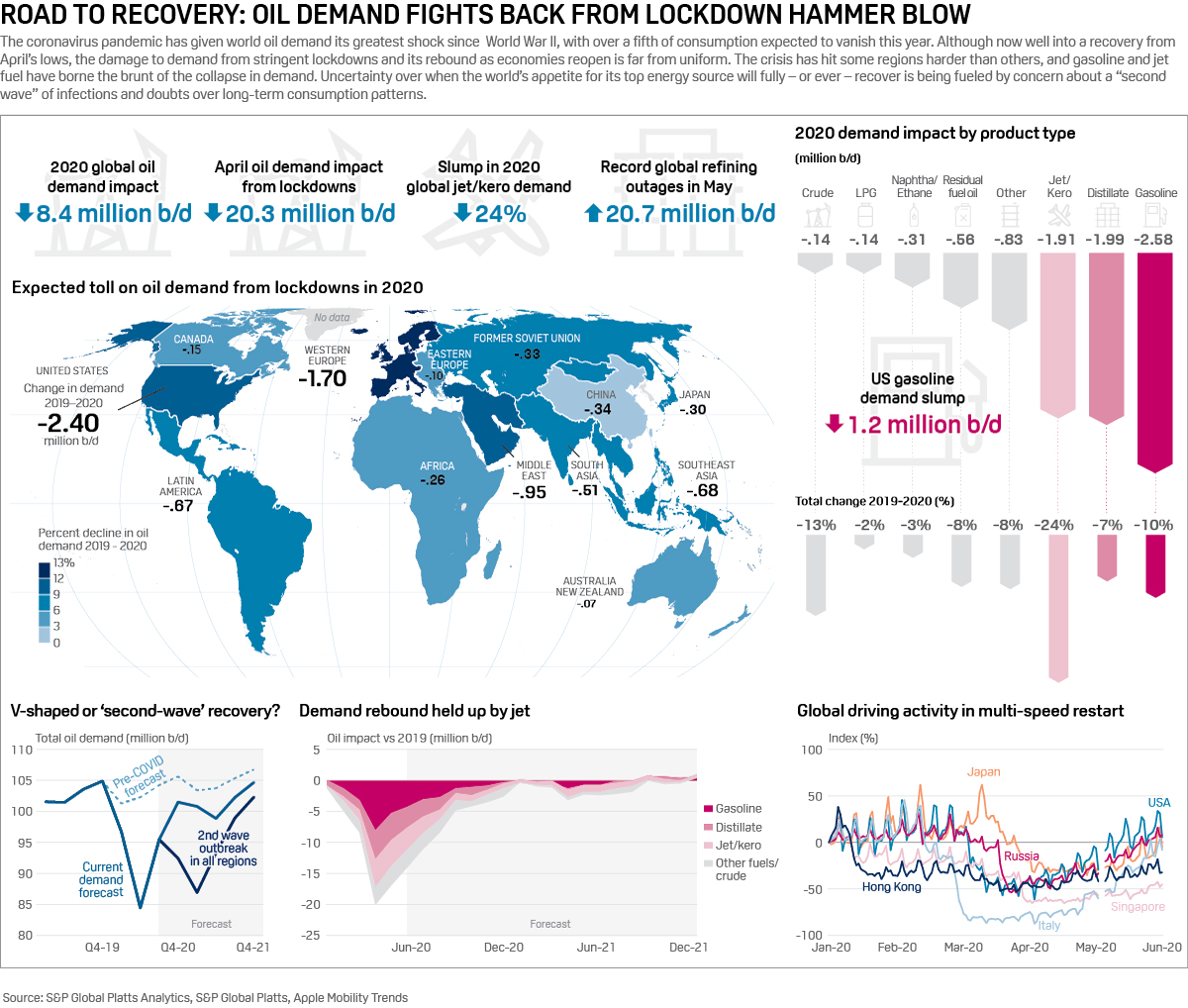

Global oil prices have, in a dizzying feat, recovered from April’s unprecedented lows as the market experienced its greatest shock since World War II, with more than one-fifth of consumption expected to vanish this year, according to S&P Global Platts.

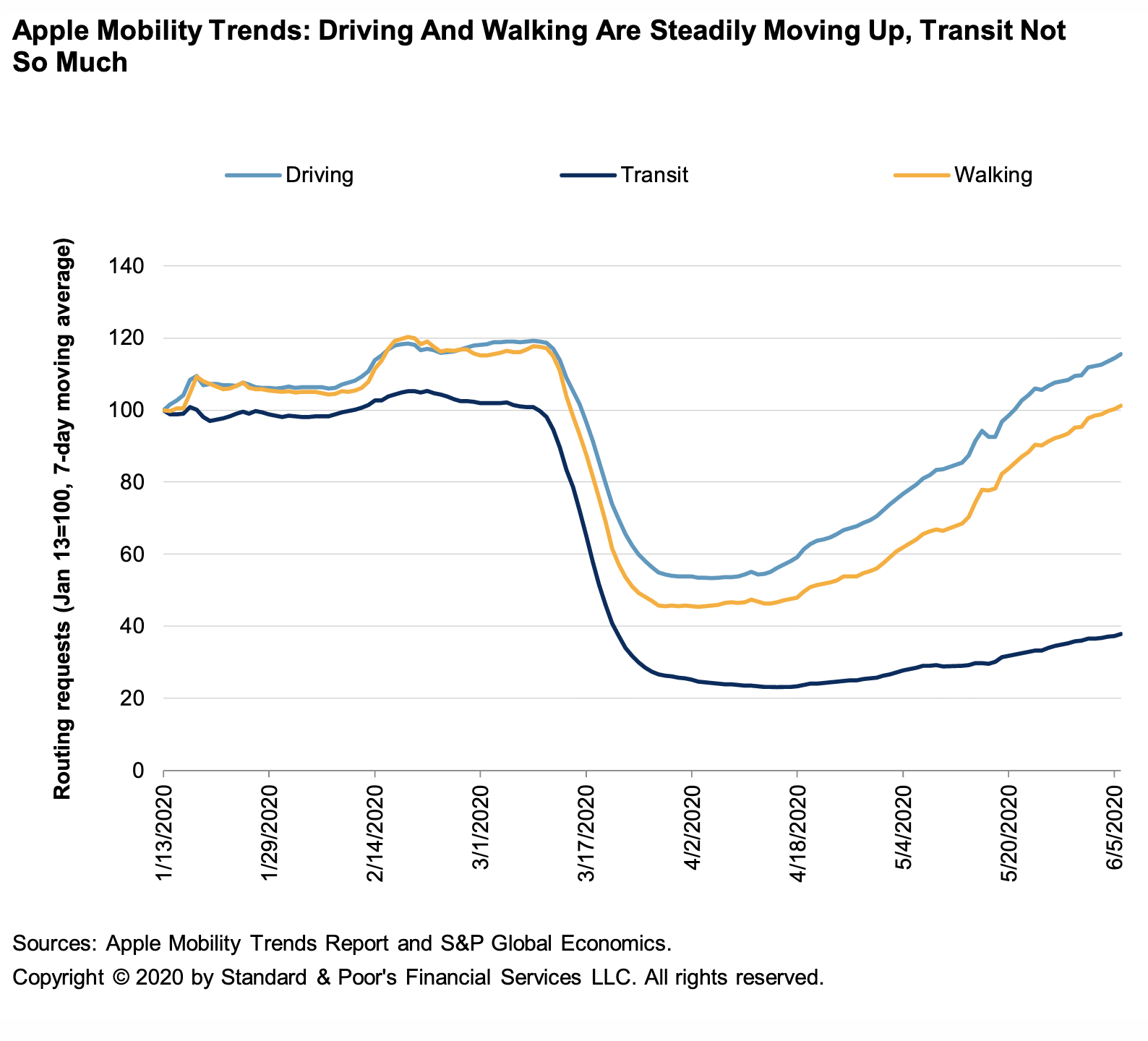

“Apple and Google mobility data continue to show normalization of movement [in the U.S.], with a strong bias toward driving, walking, and park visits,” Ms. Bovino said. “Although mobility data in retail and recreation—which are more indicative of economic activity that track consumer spending—show only a weak recovery so far, hard data on light-vehicle sales showed a respectable rebound in May helped by generous promotions. Sales were up 40% to a 12.2 million annualized rate from 8.7 million in April and up 7% versus March when the lockdowns started.”.

However, the damage to oil demand from stringent lockdowns and its rebound as economies reopen is far from uniform, as some regions suffer more than others.

“We will be able to turn the page on the crisis that we have lived through,” Mr. Macron said in a televised address on June 13 announcing that France will lift most of its lockdown restrictions. “This does not mean that the virus has completely disappeared or that we can lower our guard . . . but like you I am happy about this victory over the virus.”

Today is Monday, June 15, 2020, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Economic Data Shows A Mixed Picture As Lockdowns Ease

As the restrictions on economic and social activities continue to loosen, new coronavirus cases have moved sideways nationally (versus downward), just as trends in mobility continue to rise. State-wide actions reveal that policymakers' preference is to tolerate rather than eradicated the virus.

—Read the full report from S&P Global Ratings

Economic Research: The Paycheck Protection Program Update Shows Small Improvements Are In Reach

Since S&P Global Economics' last report on the Paycheck Protection Program (PPP), the Small Business Association (SBA) has released more information on total loan approvals, broken down both by industry and state. In our view, the breadth of industry reach seemed to improve with the second round of PPP. While there is no data available on how canceled loans were later lent, the first SBA report on the first round of loan approvals showed average loans that were larger in size and more concentrated in states and industries less affected by social distancing measures. We also found that later loan approvals, after the first round, likely didn't offset the concentration of the first round of loans to industries less affected by social distancing.

—Read the full report from S&P Global Ratings

US REITs draw down $37B from revolving credit facilities in Q1

As the coronavirus pandemic gripped the world in the first quarter, U.S. real estate investment trusts drew down $37.19 billion from their credit facilities. At March 31, REITs in aggregate had drawn down $61.90 billion, a 150.5% increase compared to the $24.71 billion drawn at year-end 2019. Economic conditions deteriorated rapidly in the first quarter as municipalities enacted social distancing policies in an effort to combat the spread of COVID-19. Retail and hotel landlords, which both saw their properties closed and/or operations drastically scaled back, were the most aggressive in tapping their credit facilities.

—Read the full article from S&P Global Market Intelligence

Undeterred by pandemic, Europe continues climate policy push

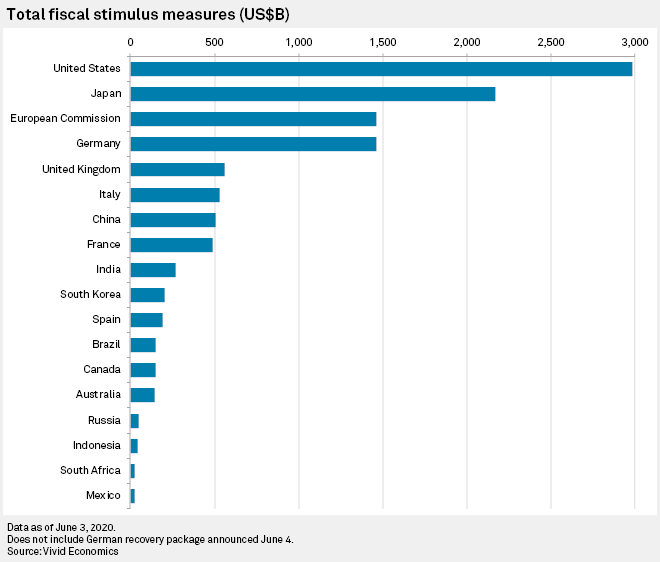

European policymakers have pushed ahead with climate-focused policies despite the impact of the coronavirus crisis on their economies, partially dispelling concerns that the pandemic could derail efforts to rein in global emissions and slow investment in clean technologies. Despite being consumed by efforts to contain the health crisis, national governments and the European Commission, the EU's executive arm, have put forward spending plans that heavily emphasize environmental sustainability and clean energy. A quarter of both the EU's €750 billion stimulus proposal and its €1.1 trillion budget for the coming decade is earmarked for climate action and designed to steer member states towards green investments. The proposal has been widely hailed as the most sustainable stimulus proposal to date.

—Read the full article from S&P Global Market Intelligence

INTERVIEW: Total sees need for subsidies for blue, green hydrogen developments

Some form of subsidy is required to help scale up the development of hydrogen in Europe, with the current price of CO2 insufficient to incentivize projects, a senior official at France's Total said. Philippe Sauquet, Total's president of gas, renewables and power, said in an interview that the blending of hydrogen into the gas grid would be one way to accelerate the development of the gas.

—Read the full article from S&P Global Platts

Brazilian carbon credit first trade at near $10/CBIO

The new Brazilian carbon credit, called CBIOs, had their first trade of 100 units at a cost of Real 50/CBIO ($10/CBIO) on June 12, in which the Datagro Conference company was the buyer and an ethanol producer Adecoagro was the seller. The deal was mediated by Sucden, a sugar and ethanol trading company. The CBIOs will be used to neutralize carbon emissions during Datagro events in 2020, according to company director Luiz Felipe Nastari.

—Read the full article from S&P Global Platts

Businesses grapple with 'ambiguity' of Calif. privacy law as enforcement nears

While California Attorney General Xavier Becerra has committed to begin enforcing the state's new privacy law on July 1, some businesses are scrambling to comply with a law that may not have final regulations in place when enforcement begins. The proposed final regulations are meant to provide guidance to businesses for how to comply with the law, but a scenario is emerging where the attorney general could begin enforcement before the final regulations are approved. Legal experts warn this could cause great uncertainty for some businesses attempting to comply with the law. "It's just an incredibly challenging environment for business," said Adam Connolly, a California-based partner who advises clients on privacy at the law firm Cooley LLP, in an interview.

—Read the full article from S&P Global Market Intelligence

Oil demand recovery under spotlight as lockdowns ease

Optimism over a swift and steady economic rebound from crushing pandemic lockdowns have helped global oil prices stage a dizzying rebound from near two-decade lows in April. Nearly all the oil demand metrics have been encouraging so far. After bottoming out in early to mid-April, global economic indicators are improving with the exception of aviation activity which remains well below seasonal norms. Implied driving activity is already well above pre-crisis levels in both the US and Germany, Europe's biggest economy and user of fuels.

—Read the full article from S&P Global Platts

Once a 'safe haven' in energy investment, Chevron now facing analyst downgrades

Chevron Corp.'s reign as a favored energy stock by the investment community is being challenged, as the oil industry continues to navigate the difficult market conditions brought about by the COVID-19 pandemic. Known for its capital discipline, Chevron headed into the epic oil price crash with one of the strongest balance sheets and credit metric profiles across the integrated oil and gas sector. But many analysts are turning more bearish, suggesting the company's solid valuation compared to most of its peers has little potential for more growth right now in light of the residing economic uncertainty.

—Read the full article from S&P Global Market Intelligence

ANALYSIS: US gas exports to Mexico hit new record high on weather, economic reopening

US gas pipeline exports to Mexico surged to a new single-day record high this week, propelled by warming summer weather and a soft opening of Mexico's economy earlier this month. On June 10, US exports jumped to nearly 5.9 Bcf/d according to final cycle data now confirmed by S&P Global Platts Analytics. On June 12, evening cycle data, which could be yet revised, showed export volumes down significantly from the earlier high at an estimated 5.5 Bcf/d.

—Read the full article from S&P Global Platts

Explorers reboot mining sector fieldwork, but COVID-19 protocols slow the pace

As COVID-19 restrictions ease around the world, metals explorers have started to reboot field programs as they look for new deposits and flesh out existing ones. But working under COVID-19 protocols has meant making significant changes to field operations, while other issues such as travel restrictions remain a key obstacle to efficient exploration, industry veterans told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language