Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Jun, 2020

By S&P Global

Brazil’s health ministry, after pulling down its coronavirus statistics website and rebooting it without any historical data on June 5, has ceased disclosing comprehensive data on confirmed cases and deaths—infuriating lawmakers, health experts, and civilians as the country’s infection total, the second-highest in the world, continues to skyrocket.

The strict lockdown in the epicenter of Russia’s outbreak, which ordered Moscow’s citizens to stay at home for more than 10 weeks, was lifted on June 9 alongside guidelines outlining that much of the city’s activity would be fully restarted within two weeks. Russia has almost 485,000 reported cases of the virus, according to Johns Hopkins University data.

In India, the world’s second-most populous country, more coronavirus-containment measures were lifted on June 8—allowing populations to pray at religious sites, go shopping in malls, and eat in restaurants—even as cases spiked to the highest levels seen during the pandemic on the same day.

The Chinese government negated a not-yet peer-reviewed Harvard Medical School study citing satellite images of hospitals in Wuhan, where the contagion originated, and symptom search data that suggested the coronavirus was spreading as early as August of last year. At a June 4 news briefing, Chinese Foreign Ministry spokeswoman Hua Chunying said that it is “incredibly ridiculous to come up with this conclusion based on superficial observations such as traffic volume."

The pandemic’s stage in the U.S. and Europe is dramatically different than that unfolding across emerging markets. Although activity is picking up, high-frequency data confirm that a precipitous slowdown in activity occurred in April across emerging markets globally and lockdown fatigue, driven by mounting political pressures and economic costs, is now developing, according to S&P Global Ratings. Easing lockdowns as coronavirus cases rise could undermine recovery for such countries.

Emerging markets and developing economies “are forecast to contract this year due to the COVID-19 pandemic. The impact is expected to be most severe for [countries] with large domestic outbreaks and those that rely on global trade, tourism, commodity exports, and external financing. Per capita incomes are projected to contract deeply as a result, causing the first net rise in global poverty in more than 20 years,” according to the World Bank’s June 2020 Global Economic Prospects report.

For India’s economy in particular, S&P Global Ratings expects a sharp contraction of 5% for the 2020-2021 fiscal year as the pandemic and subsequent lockdowns have frozen economic activity across the country. Hurt most are the services sectors, which are large employers and have suffered widespread job losses. Notably, migrant workers have been geographically displaced.

India’s central bank since February has cut policy rates by 115 basis points, but banks remain unwilling to lend.

Regional central banks across Latin America have implemented measures to support financial systems during the coronavirus crisis similar to those deployed by developed economies worldwide—including credit facilities for financial institutions, loan moratoriums, looser loan classification and provisioning and capital requirements, and government and special trust guarantees on loans to small- to medium-size enterprises—to allow credit to continue flowing to households and corporations, according to S&P Global Ratings. Nonetheless, their effectiveness, timeliness, and scope differentiate across countries in the region. More comprehensive measures are visible in Chile, Peru, and Brazil, while Mexico’s have been slower, and Colombia and Argentina's responses have fallen in the middle.

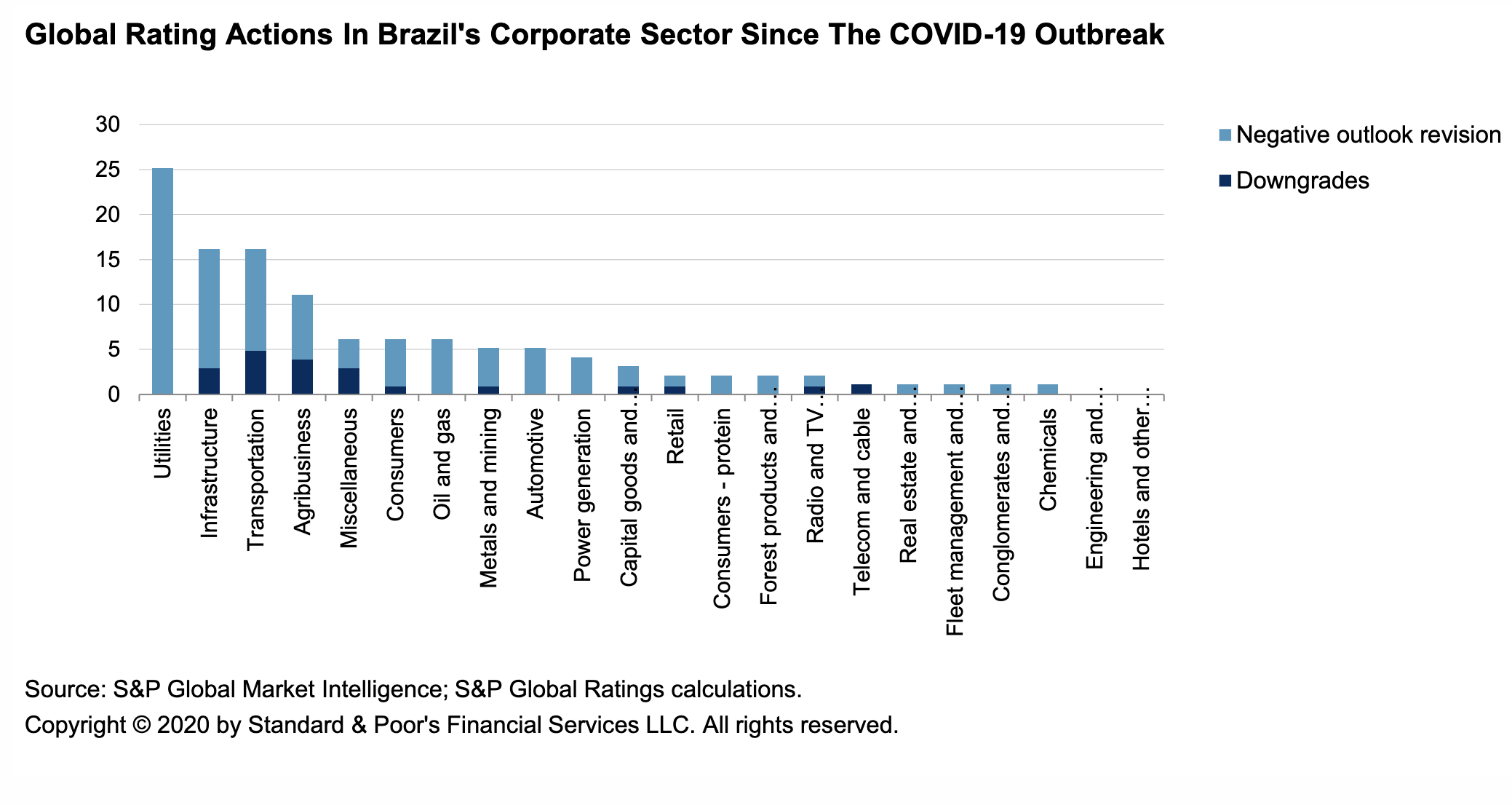

Since the pandemic took hold of Brazil, S&P Global Ratings has lowered 21 global scale and 17 national scale ratings, and revised 95 outlooks to negative, on Brazilian corporations, with approximately 65% still having a negative bias. Utilities, infrastructure assets, and transportation and agricultural business companies have taken the hardest hits.

Meanwhile, Russia’s goods exports and imports declined sharply in April, reflecting dampened external demand from key trading partners, dropping domestic demand, and the oil price decline.

China’s manufacturing activity is gradually normalizing, but the country’s commodities sector is still suffering even as the economy heals. S&P Global Ratings’ Chief APAC Economist Shaun Roache estimated that three months after China’s COVID-19 outbreak peaked in early February, large industrial firms recovered 95% of normal capacity. Although S&P Global Ratings has revised outlooks on approximately one-fifth of publicly rated Chinese commodities firms since the crisis started, a meaningful recovery in the second half is anticipated, where China's cement and steel sectors will be best positioned for a rebound.

“Growth in [emerging markets and developing economies] is projected to pick up in 2021, on the back of firming trade and investment as the effects of the pandemic wane,” the World Bank said. “Prospects for subdued commodity prices, however, are expected to temper the recovery in commodity exporters.”

Today is Wednesday, June 10, 2020, and here is today’s essential intelligence.

Brazilian Companies Are Struggling Under The Burden Of COVID-19

With more than 710,000 confirmed COVID-19 cases and 37,000 casualties as of June 8, Brazil is the hardest hit country in Latin America. A combination of densely populated cities and poorly coordinated prevention measures contributed to the surge that's straining the medical system. S&P Global Ratings has lowered 21 global scale and 17 national scale ratings, and revised 95 outlooks to negative on Brazilian corporations. About 65% of them still have a negative bias (either a negative outlook or CreditWatch negative). Utilities, infrastructure assets, and transportation and agribusiness companies bore the brunt of the actions so far. The outlook revisions on utilities, infrastructure, and transportation entities followed mostly our outlook revision on Brazil, and to a lesser extent, the lockdown measures, either government mandated or self-imposed. while the changes on agribusiness entities mostly occurred among sugar and ethanol producers that are suffering from sharply lower ethanol demand and prices.

—Read the full report from S&P Global Ratings

Dividend Indices in Unprecedented Times – A Latin American Perspective

It’s time to look at dividend indices through the lens of these “unprecedented times.” Many market participants seek the comfort of dividend strategies, precisely for the yield they can generate. However, dividend investing is under siege, since many companies have announced reduced dividends or have suspended them altogether given the impact of the COVID-19 pandemic on the global economy. A crystal ball might come in handy to foretell the future. In the absence of that, we can look at historical periods of financial crisis to see how these strategies performed.

—Read the full article from S&P Dow Jones Indices

Apparel brands cut back orders, portending slow holiday season after COVID-19

Apparel companies are preparing for a slower end-of-year holiday season in the wake of the coronavirus, and they are managing their inventory accordingly. Retailers and apparel brands such as The Gap Inc., American Eagle Outfitters Inc., Urban Outfitters Inc. and Steven Madden Ltd. are already coping with reopening stores and deciding what to do with spring and summer inventory after missing most of the season to sell that merchandise. Now they need to figure out how much to order for the fall and winter, including the key holiday shopping season, as the U.S. economy attempts to recover from a pandemic-fueled recession.

—Read the full article from S&P Global Market Intelligence

US will release $25B in relief to Medicaid care providers, safety-net hospitals

The U.S. Department of Health and Human Services will distribute an additional $25 billion to certain hospitals and healthcare providers that have been impacted by the coronavirus pandemic. HHS will distribute approximately $15 billion to healthcare providers that participate in Medicaid and the Children's Health Insurance Program, or CHIP, and have not yet received federal economic relief funds, according to a June 9 statement. The agency will also distribute $10 billion to safety-net hospitals, which are facilities that treat large volumes of patients who are covered by Medicaid or who are uninsured.

—Read the full article from S&P Global Market Intelligence

European PE managers cautious but ready to 'get back to business'

In the immediate aftermath of the coronavirus lockdown, European private equity fund managers put in place liquidity management plans and drew down on revolvers to shore up their portfolio companies. A few months on, they are gearing up to invest in new assets. "The phase that we're definitely in now is [one] of looking towards the horizon. We'd like to get on and get back to business," Inflexion Pvt. Equity Partners LLP partner Richard Swann said. U.K. midmarket firm Graphite Capital Management LLP does not "want to sit on its hands," managing partner Markus Golser said. "We really need to make sure opportunities continue to be investigated."

—Read the full article from S&P Global Market Intelligence

COVID-19: Fiscal Response Will Lift Local And Regional Government Borrowing To Record High

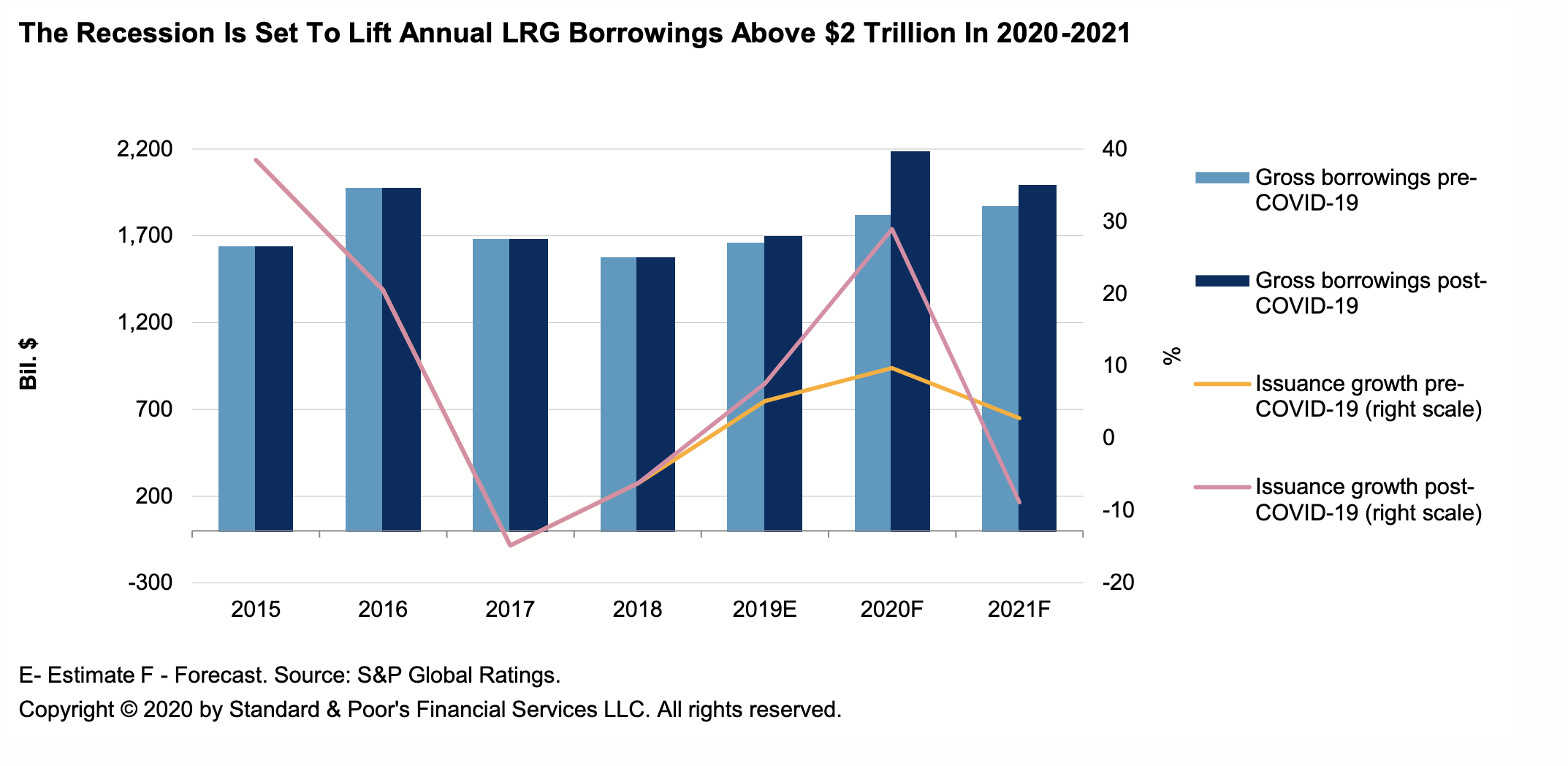

S&P Global Ratings assumes that a continuing global recession will further increase the funding needs of local and regional governments in 2020-2021. We estimate that annual borrowings will now rise about 10%, compared with our previous forecast for 6% growth. As a result, borrowings will exceed US$2 trillion a year on average over the next two years. Widespread social-distancing measures are leading to a much weaker economic performance than we projected three months ago. As a result of a reduction in activity, local and regional governments (LRGs) will face a reduction in their own revenue. Their borrowing needs will depend on the depth and longevity of recession, availability of additional transfers from the central government, and appetite of subnational governments to pursue a countercyclical financial policy.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: The European Speculative-Grade Corporate Default Rate Could Reach 8.5% By March 2021

S&P Global Ratings expects the European trailing-12-month speculative-grade corporate default rate to rise to 8.5% by March 2021 from 2.4% in March 2020, and 2.7% in April. To reach this baseline forecast, 62 speculative-grade companies would need to default. In S&P Global Ratings’ optimistic scenario, we expect the default rate to rise to 3.5% by March 2021 (25 defaults), and in our pessimistic scenario, we expect the default rate to expand to 11.5% (84 defaults). Similar to our U.S. forecast, we present a wide range of possibilities reflecting a large range between leading credit and economic indicators, and fixed-income market risk pricing. Expansive monetary and fiscal support could lessen defaults over the near term, but much assistance to date adds to existing debt piles at a time when basic revenue is lacking, which could lead to a protracted period of higher defaults, rather than typical cyclical behavior.

—Read the full report from S&P Global Ratings

Fed weighs using yield curve caps to reinforce intention to keep rates low

With few expecting a quick rebound for the U.S. economy, the Federal Reserve is set to discuss new ways to hammer home to markets that it is committed to keeping interest rates low for the foreseeable future. That includes consideration of an approach the Fed last adopted during World War II: yield curve control. The discussions are still at an early stage, and whether the Fed will end up setting a cap on some portion of the Treasury yield curve is unclear. But top Fed officials have said they are reviewing the potential benefits of yield curve caps, a move that analysts say would help emphasize to the public that low rates are here to stay.

—Read the full article from S&P Global Market Intelligence

PPP loans saturate small businesses, but geographic imbalances persist

The federal government's small business rescue has been praised for shoveling out hundreds of billions of dollars in much-needed relief over a few short months, but criticism persists that aid has not gotten everywhere it should and that the program has been marred by unfair access. Roughly three-quarters of small businesses across the country have received Paycheck Protection Program loans so far, according to an S&P Global Market Intelligence analysis comparing state-level loan data released by the Small Business Administration with the Census Bureau's count of small businesses. But while loan counts suggest that nearly every small business in states like North Dakota, Mississippi, South Dakota and Nebraska has received PPP funding, the data shows a penetration rate of just 69.2% in California and 63% in New York.

—Read the full article from S&P Global Market Intelligence

CVB Financial, BankUnited among banks with highest exposure to office borrowers

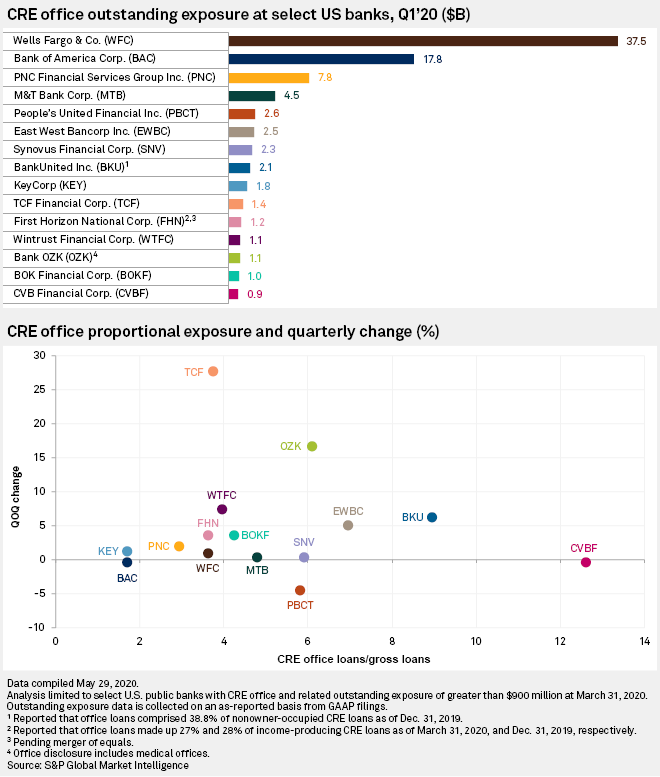

CVB Financial Corp. was among U.S. banks that reported the most significant exposure to commercial office real estate borrowers, at more than 12% of gross lending, according to a review of the industry's first-quarter filings. BankUnited Inc. and East West Bancorp Inc. also had relatively high proportional exposure. Of reporting lenders, TCF Financial Corp. saw the largest increase quarter over quarter, at more than 25%, in its outstanding office loans. Wells Fargo & Co. had the highest commercial office loan balance at March 31 at $37.5 billion. That was more than double the $17.8 billion held by Bank of America Corp., the bank with the second-highest office loan balance, and more than quadruple the $7.8 billion held by PNC Financial Services Group Inc.

—Read the full article from S&P Global Market Intelligence

Coronavirus brings lasting shift to digital in German payments market

The coronavirus pandemic may serve as the last straw to end cash dominance in Germany's payments market and set it on a clear digital course, with mobile use expected to grow rapidly in the near term, market observers said. The outbreak has led to an abrupt shift in customers' behavior, with contactless payments and online shopping increasing rapidly in recent months. Within a short period of time, card and mobile payments have become prevalent in traditional retail, where typically cash was the preferred means to pay.

—Read the full article from S&P Global Market Intelligence

Funds may continue to elude Indian nonbank lenders amid risk aversion

Many Indian nonbanking financial companies may remain short of funds as investors become more cautious and the economy contracts, adding risks to the broader financial system. Indian authorities have recently stepped up efforts to improve liquidity for nonbanking financial companies, or NBFCs, as the coronavirus pandemic halted the economy for several weeks, adding strain on the nonbank lending sector that was already hit by a funding squeeze after a few high-profile defaults. Now, as the wheels of the world's fifth-biggest economy begin to turn again, analysts doubt whether the smaller and weaker NBFCs will still find favor.

—Read the full article from S&P Global Market Intelligence

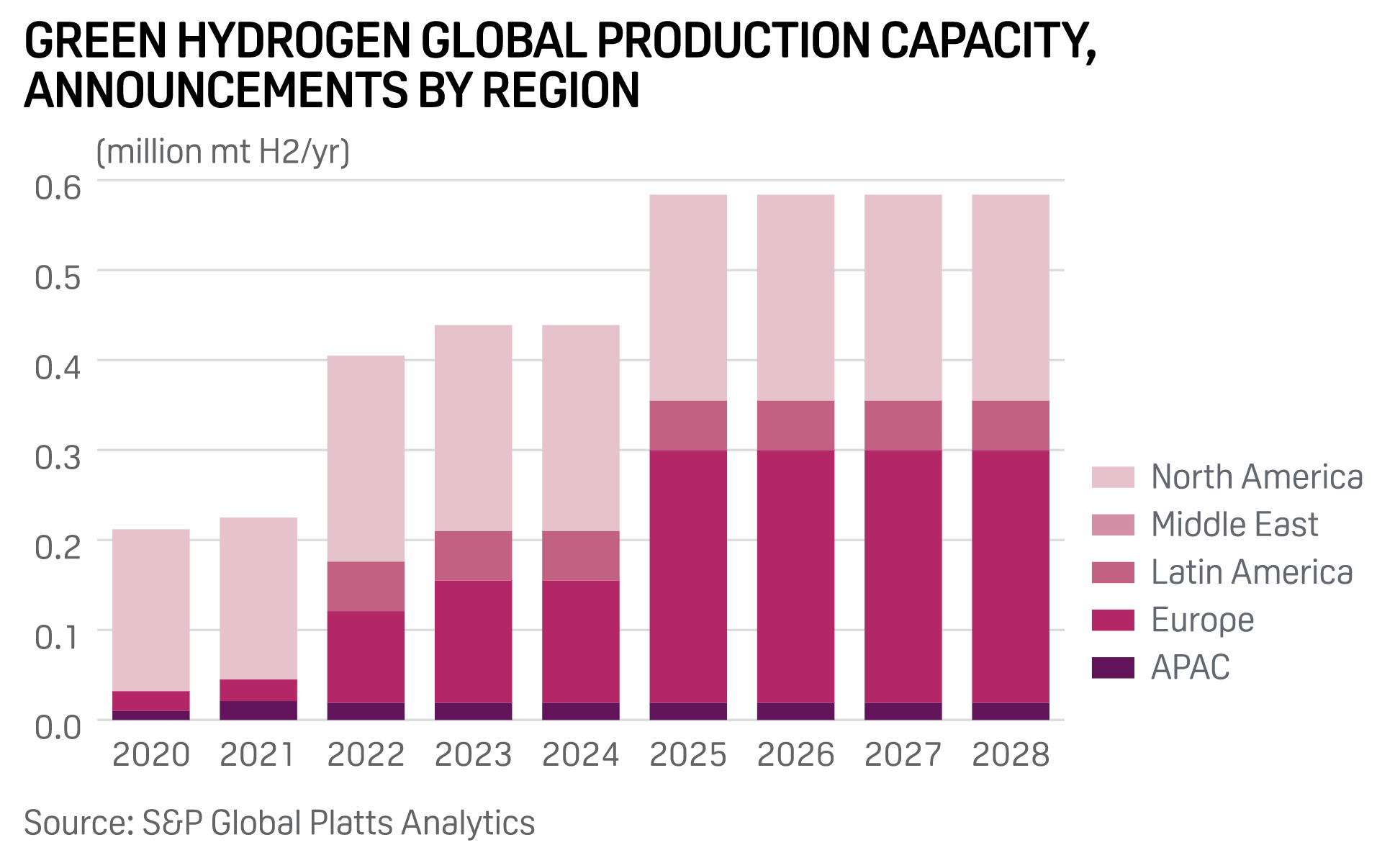

Zero-carbon hydrogen could be cost-competitive in transport sector by 2030

Zero-carbon hydrogen fuel could realistically be produced at scale at a plant-gate cost of just $2-$3/kg by 2030, making the fuel an economically viable alternative for the transportation sector and industrial end-users, according to a recent study published by the University of California, Irvine. The research, sponsored by the California Energy Commission, provides a roadmap for rapid development of the renewable hydrogen production capacity needed to help the state meet an aggressive target to fully decarbonize the its economy by 2050.

—Read the full article from S&P Global Platts

Hurricanes, pandemic may pressure US utilities' rate recovery

A potentially active 2020 hurricane season coinciding with a global pandemic could compound financial pressures on U.S. utilities and test the ability of regulators to balance electric providers' right to earn returns on prudent expenses with consumers' capacity for higher bills in a recession. The National Oceanic and Atmospheric Administration estimated that 13 to 19 named storms will form in the northern Atlantic Ocean area this season, with up to six becoming Category 3 or higher. While Southeast U.S. utilities have experience with outage restoration after strong storms, the ongoing coronavirus outbreak will likely add to costs for companies' disaster recovery.

—Read the full article from S&P Global Market Intelligence

FEATURE: Canada developing national hydrogen strategy; US taking different approach

Canada is preparing a national hydrogen strategy, making it the first country in North America to develop a plan to use the gas to reduce its reliance on fossil fuels and to cut CO2 emissions. An official with Natural Resources Canada mentioned work is underway on the strategy in a recent webinar hosted by the Canadian Hydrogen and Fuel Cell Association. The strategy does not have an expected release date, according to the agency.

—Read the full article from S&P Global Platts

EU plans Eur1 billion call for renewables, hydrogen, CCS projects

The European Commission will open its first annual Eur1 billion ($1.1 billion) call to fund large-scale renewables, clean hydrogen, energy storage, and carbon capture and storage/use projects by the end of July, according to a senior official. The goal is to get companies to invest now in the low-carbon technologies needed for the EU to achieve its goal of being climate neutral by 2050. The money comes from the EU's Innovation Fund, which is funded until 2030 by selling 450 million EU Emissions Trading System allowances. It has a budget of around Eur10 billion over 10 years at current EU carbon prices.

—Read the full article from S&P Global Platts

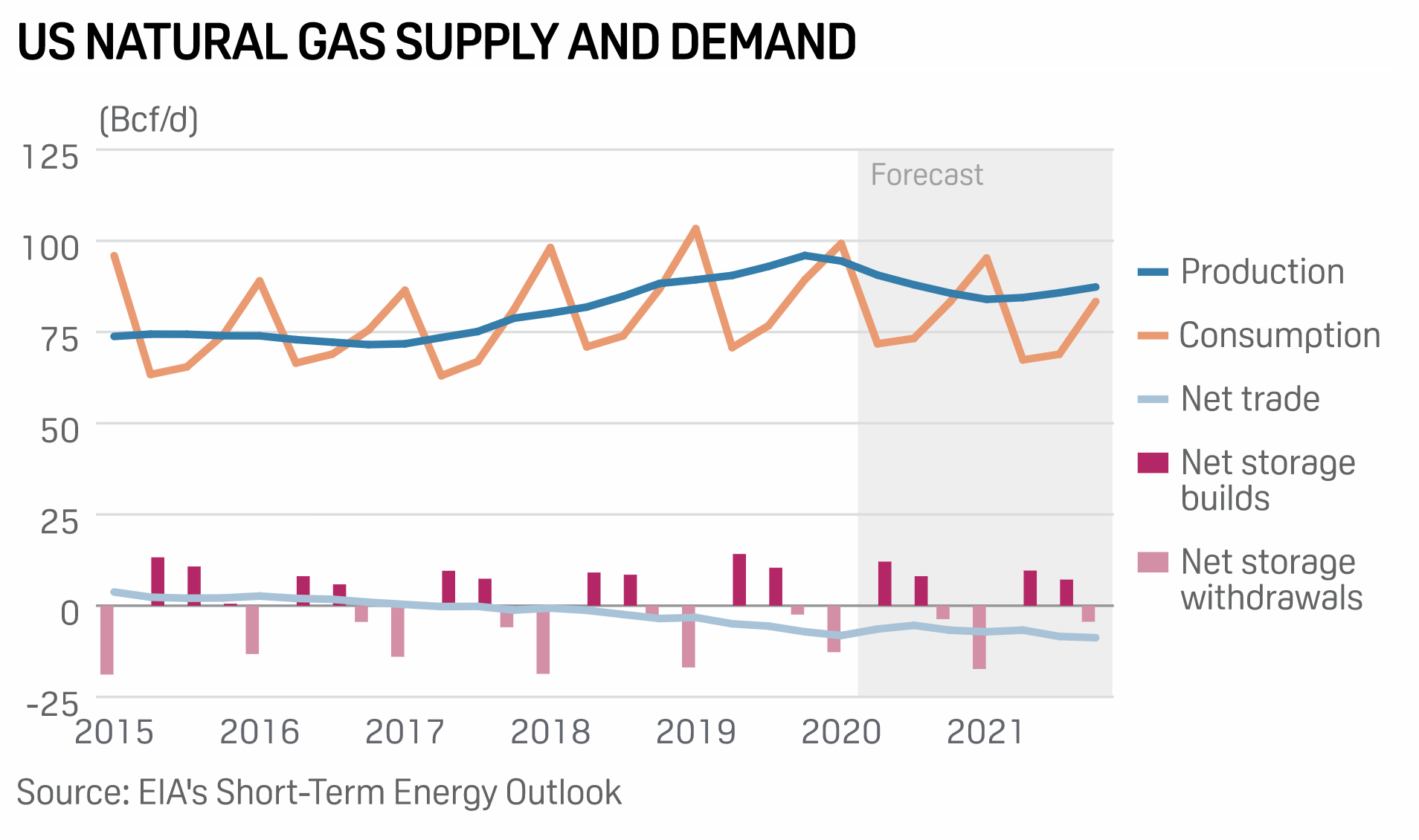

US EIA trims 2020 gas production, price forecasts; expects increases in 2021

Amid weak gas and power demand, the US Energy Information Administration on June 9 cut its forecast for total US natural gas marketed production for the remainder of the year, even as it expected production to rise beginning in the second quarter of 2021 propelled by higher prices.

—Read the full article from S&P Global Platts

'Only partial recovery' for European power prices in 2021-23

A partial recovery in European power prices is expected between 2021 and 2023 as demand rebounds and more coal and nuclear power plants are shut down, but forecast prices are now about 20% below November 2019 estimates, S&P Global Ratings said June 9. This was despite a drastic cut in French nuclear power production rates over the next three years, the ratings agency said in a semi-annual report. The report provides credit insights for Europe's key utilities and power markets supported by market and price forecasts from S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Oil prices spike late on slow Gulf of Mexico rebound, bullish 2021 EIA report

Crude oil prices spiked late June 9, ending in positive territory after trading down for most of the day, following a bullish US government report on 2021 global oil demand and news that Gulf of Mexico production was returning slower after Tropical Storm Cristobal. After falling below $38/b, front-month NYMEX WTI ended up rising 75 cents/b and settled at $38.94/b, while ICE July Brent ticked up 38 cents/b and settled at $41.18/b. On June 8, WTI had retreated after flirting with $40/b late in the week ending June 6 as OPEC+ agreed to keep additional barrels offline, at least through July. After its historic negative-pricing event in April, WTI has climbed to almost $40/b from $10/b as parts of the world began reopening post the coronavirus pandemic.

—Read the full article from S&P Global Platts

CHINA DATA: Shandong independent refiners' run rates hit record high in May

China's independent refineries raised run rates to a fresh record high of 77.9% in May, with refining margins remaining thick throughout the month, according to S&P Global Platts calculations based on raw data from JLC. The last record high of 73.9% was seen in November 2019. Along with higher run rates, the consumption of feedstock also hit a new record of 11.39 million mt, or 2.69 million b/d, up 6% from April. In May, a total of 32 grades of imported crudes were cracked by the 45 surveyed refineries, down from 34 in April. Among all the crudes processed last month, the consumption of Johan Sverdrup rose to top second at 1.17 million mt, up 64.8% on the month.

—Read the full article from S&P Global Platts

US soybean farmers stare at inventory, price challenges amid US-China tensions, Brazil competition

Uncertain US-China relations is leaving American soybean farmers grappling with the potential buildup of stocks and falling prices in the new marketing year, starting in September, while facing increasing competition from Brazilian beans. If US-China tensions increase to the point of sanctions, US soybean farmers could face higher stocks in 2020-21, said Pete Meyer, head of Grain and Oilseed Analytics at S&P Global Platts Analytics. Although the 2020-21 soybean inventory levels are not forecast to be as high as 2018-19 levels of 24.7 million mt, they are still above the analysts' expectations, amid the optimism of US-China Phase 1 deal, signed in January 15.

—Read the full article from S&P Global Platts

Global copper market wonders if price rally is too speculative

The global copper market was this week weighing up whether prices have got ahead of themselves, defying fundamentals that show a divergence in physical and paper trading, sources said. The London Metal Exchange copper price has been on a tear over the past few weeks, spurred by China coming out of pandemic-induced lockdown and swathes of stimulus from global central banks, chiefly the US Federal Reserve and People's Bank of China. Copper had been hammered down towards $4,300/mt in March, as stock markets went into free-fall as the pandemic took hold.

—Read the full article from S&P Global Platts

Gold’s Time to Shine

The first half of 2020 has been gold’s time to shine. The double-digit YTD gains outpaced equities and other safe-haven assets during these uncertain recessionary times. As of May 29, 2020, the S&P GSCI Gold was up 13.94% YTD. Unprecedented global fiscal and monetary stimulus measures have significantly increased sovereign debt levels, leading to concerns of currency devaluation. Historically, such environments have been constructive for gold as a globally recognized store of value. Low to negative global real yields and gold’s low correlation to other assets add to the positive catalysts in the current environment.

—Read the full article from S&P Dow Jones Indices

Written and compiled by Molly Mintz.

Content Type

Location

Language