Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Electric Vehicles are a Silver Lining for the Auto Industry

It’s been a brutal year for the automobile industry. Inflation has squeezed margins for manufacturers, while supply chain disruptions—particularly affecting semiconductors, electric steel, and battery metals—have made it hard for automakers to meet demand. But electric vehicles (EVs) provide a silver lining to this dark cloud.

So far in 2022, sales of new light vehicles have declined 12% to 35.3 million units, according to S&P Global Mobility. One of the reasons for that decline has been the ongoing semiconductor shortage which has limited the number of cars that can be manufactured. S&P Global Ratings has projected that while production uncertainty due to supply chains may ease somewhat, stop-and-go production could linger for the next six months. Though a gradual supply increase is expected in 2023, the possibility of higher sticker prices due to inflation could curb pent-up demand.

Looking on the bright side, growth in low emissions vehicles has been robust. While the market for internal-combustion-engine vehicles has shrunk by 18% in 2022, the market for plug-in hybrids (up 26%) and pure battery electric vehicles (up 72%) has been quite healthy. This year, approximately one in 12 vehicles sold globally have been EV’s, according to S&P Global Mobility.

Looking forward, S&P Global Ratings projects that EV sales could exceed a base-case of 15% of U.S. light vehicle sales by 2025. S&P Global Mobility analysts estimate that currently 2.2 million BEVs and plug-in hybrid electric vehicles (PHEVs) are on the road in the US. They project that this number should grow to 32 million by 2030. While charging infrastructure has been a sometime source of frustration for EV owners, this is starting to change. Increases in EV sales and charging infrastructure creates a virtuous circle that leads to further adoption of the technology.

Capital market activity also indicates the relative health of the traditional auto industry as compared to the growth in new EV manufacturers, according to S&P Global Mobility. The autos sector contains some of the cheapest and the most expensive companies in the world. A traditional automaker like Volkswagen (VW) has traded inexpensively relative to their earnings (4.5x price/earnings), while Tesla has traded at an enviable 52x price/earnings. This could be part of the reason why VW has been aggressively ramping up production of electric vehicles.

“Undoubtedly the growth of BEVs and the commensurate decline in ICEs (Internal Combustion Engine) will be the industry's most critical transition since its inception early last century - this will certainly not be smooth,” S&P Global Mobility wrote in a recent report.

While electric vehicles appear on a solid growth trajectory, S&P Global Ratings warns that a recession may slow adoption, especially in Europe, where the growth has been quite strong.

Today is Thursday, July 21, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

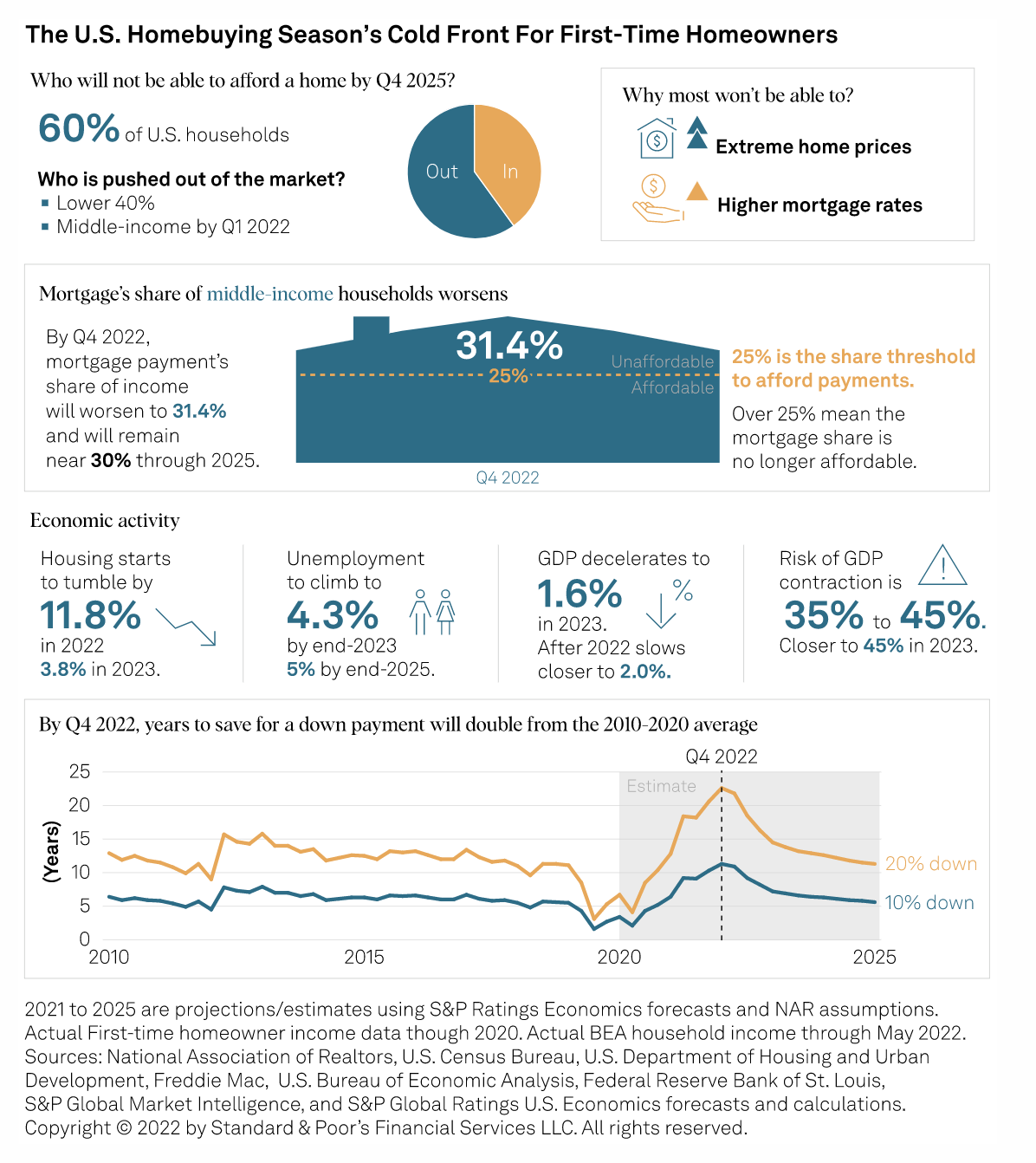

Economic Research: The American Dream May No Longer Be In Reach

There is a cold wind blowing in the U.S. and it is not the weather or the potential for a recession. A freeze has started to set in on what is quite often considered the American Dream: home ownership. It now takes households over twice as many years to save for a down payment as it took them before the pandemic took hold. By fourth-quarter 2022, it will take a prospective homeowner 11.3 years to save for a 10% down payment and 22.6 years to save for a 20% down payment—both over twice their pre-pandemic rates of five and 10 years, respectively.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

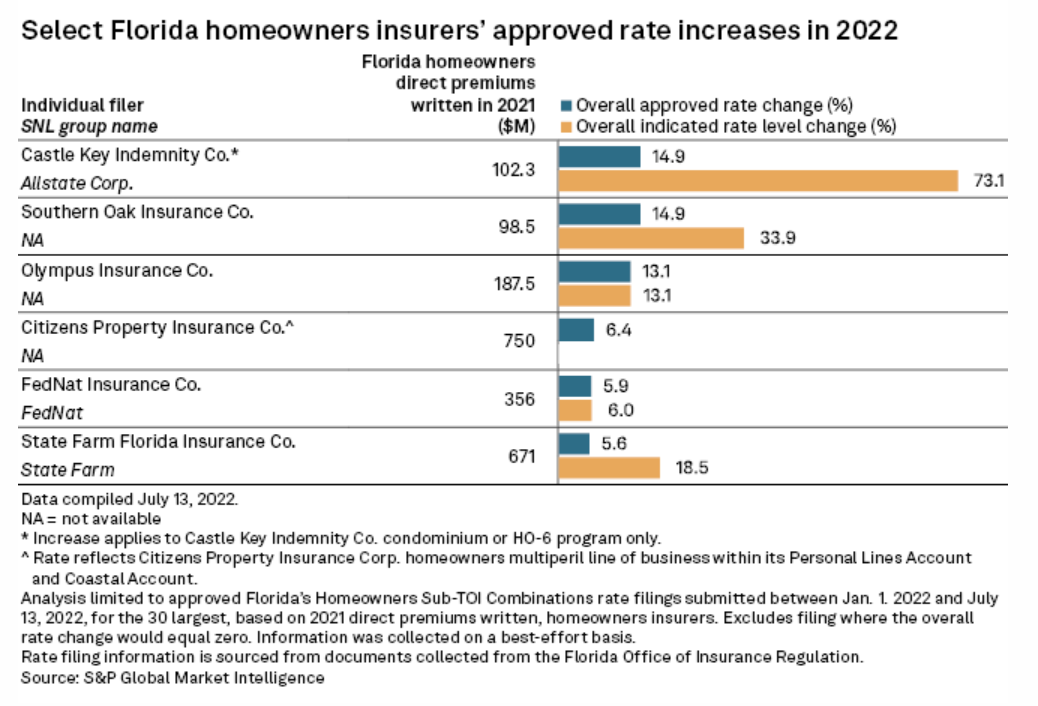

Florida's New Reinsurance Program To Pass Little Savings To Homeowners

Annual rate increases sought by Florida property insurers overshadow any savings the new state-backed reinsurance program would provide to policyholders, according to an analysis of rate filings by S&P Global Market Intelligence. The Reinsurance to Assist Policyholders program, or RAP, was created during a special legislative session at the end of May to help Florida property insurers struggling to obtain enough reinsurance and provide some premium relief for policyholders.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

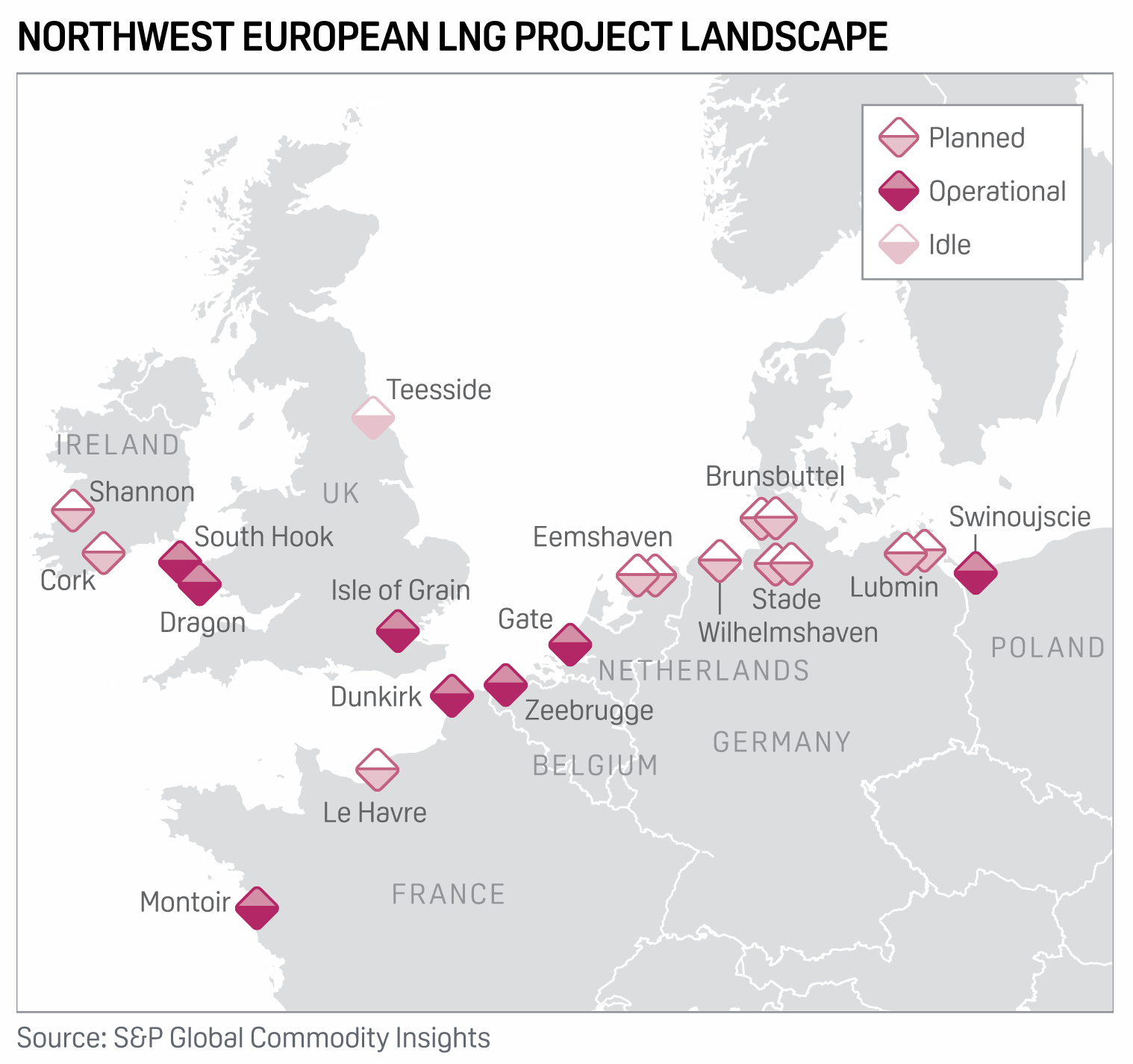

Russian Gas Share In Germany Sinks As Utilities Eye LNG Supply: Ministry

The share of Russian gas in German supply dropped to just 26% at the end of June, down from a recent average of 55%, the German economy ministry said July 20. In its latest energy security report—the third since Russia invaded Ukraine in February—the ministry said Germany continued its efforts to replace Russian gas, including through increased supply from Norway and the Netherlands and the deployment of LNG import infrastructure.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

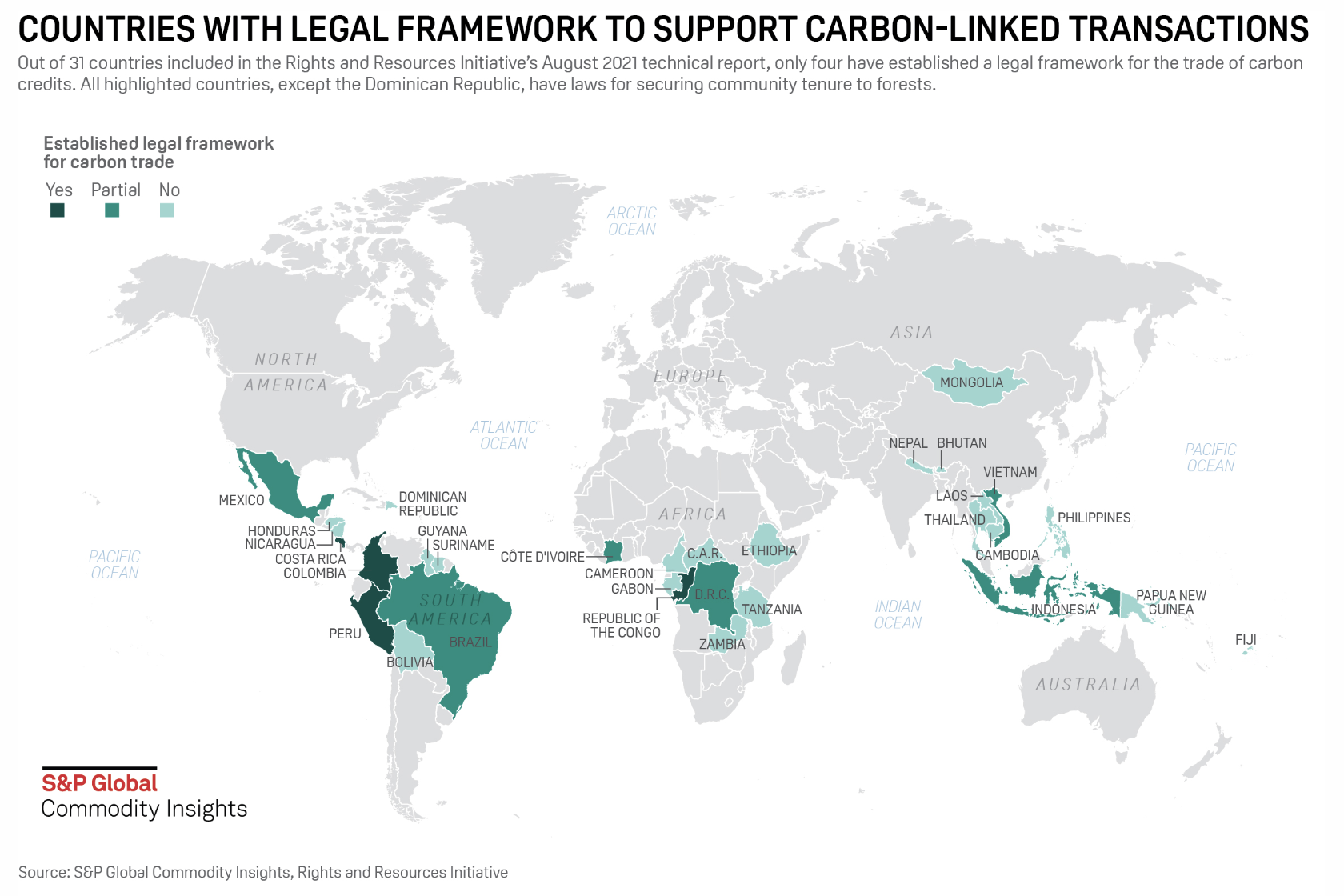

Carbon Credits Conundrum: What’s Left For Countries Hosting Carbon Projects As VCMs Develop?

As efforts to develop Article 6-compliant carbon markets step up and voluntary carbon market activities develop, host countries are becoming increasingly concerned about the impact that international carbon projects may have on their future. While concerns differ from country to country, governments are interested in securing fair compensation for local communities involved in voluntary carbon projects, retain some of the value generated by the international sale of carbon credits, and—most importantly—keep enough of the carbon credits produced on their soil to be able to meet their Nationally Determined Contributions, the goals set by the Paris Agreement.

—Read the article from S&P Global Commodity Insights

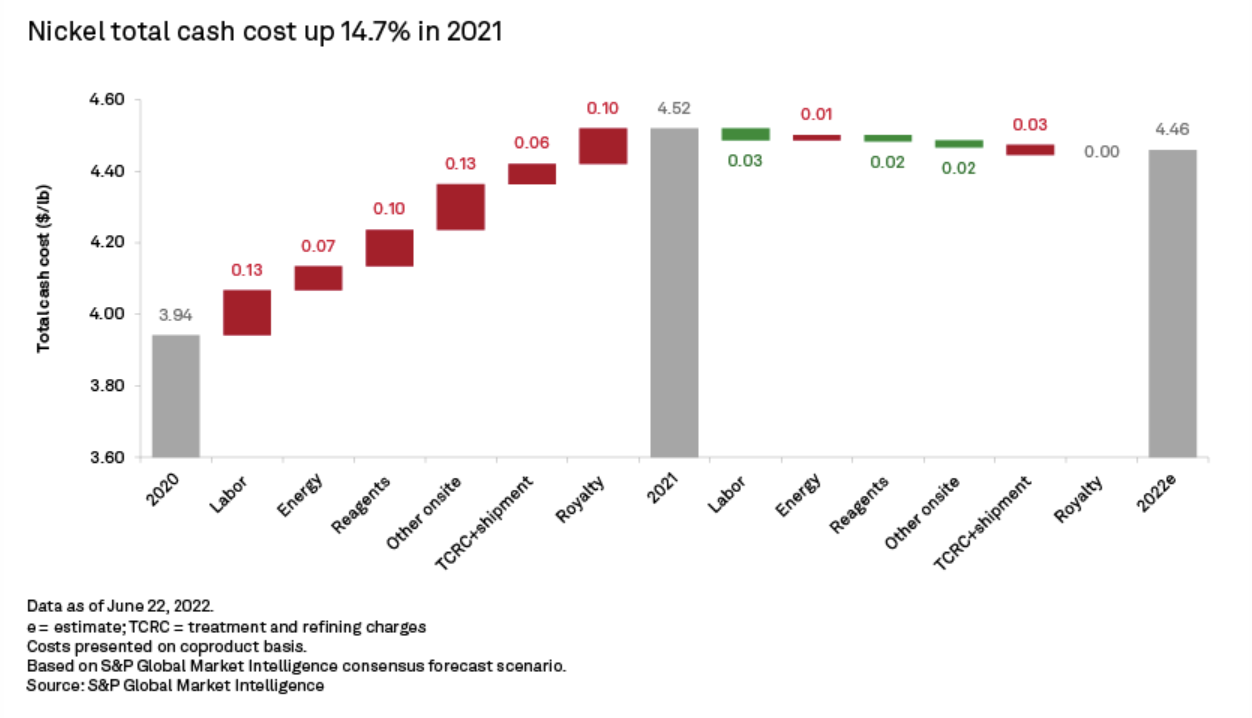

Nickel Industry Margins Surged In 2021 Amid Stronger Nickel Prices

The average total cash cost of nickel production increased 14.7% year over year in 2021, reaching $4.52 per pound based on increased minesite operating costs, including labor, energy inflation, and freight. With future efforts on cost controls partially offset by high inflation and volatile exchange rates, S&P Global Market Intelligence forecasts the total cash cost to decrease 1.3% to $4.46/lb in 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

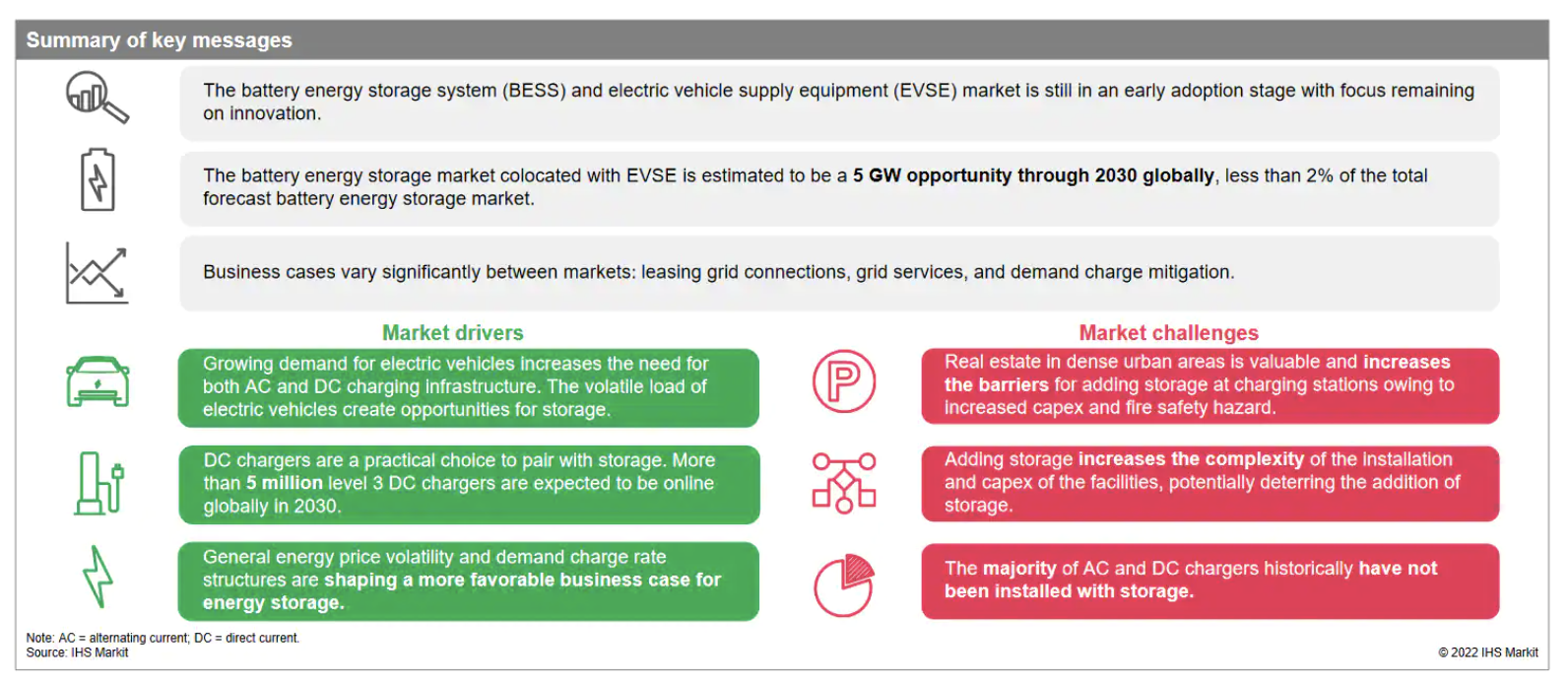

Energy Storage And EV Charging Are Becoming A Natural Pairing

Energy storage will play a growing role for EV chargers where demand charges are high, limited interconnection locations exist, and where EV charging can be a revenue source for batteries primarily participating in other market services. Opportunities for storage exist where the infrastructure is deployed out of step with EV uptake. Revenues earned by energy storage through grid services can support the system until EV demand increases. Conversely, if demand charges are increased or if increased infrastructure needs exceed installed power capacity, batteries can be retrofitted to accommodate those needs.

—Read the article from S&P Global Mobility