Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Despite Sanctions, Russian Energy Exports Continue To Find Customers

Almost a year and a half into the Russian invasion of Ukraine, the war has not played out as anyone predicted. On the battlefield, there is something close to a stalemate on the front lines as Russian forces bitterly contest Ukrainian advances. On the diplomatic front, sanctions that were predicted to bring the Russian government to the brink of collapse have had little effect. Russian oil and natural gas continue to flow to export markets around the world, although the loss of European markets has been painful and costly for Russian energy companies. A fundamental reorientation has taken place in energy markets. Even if a truce were to be declared tomorrow, Europe would remain a reluctant market for Russian energy exports.

One of the peculiarities of energy markets is that, even in war, Russian and Ukrainian companies reluctantly collaborate to supply natural gas to Europe. Much less Russian gas is flowing through pipelines to Europe, with June deliveries down 63%. The TurkStream pipeline that feeds Russian gas into Serbia and Hungary has continued to be reliable, although it shut down during June for maintenance. But it is the connection through Ukraine and the relationship between Russia’s Gazprom and Ukraine’s Naftogaz that are both surprising and tenuous. Russian gas continues to flow through Ukraine under the terms of a December 2019 deal that is scheduled to expire this December. Gazprom and Naftogaz have been locked in acrimonious lawsuits over the terms of the deal. Both Ukraine and Russia have threatened to end the commercial relationship, but for now the gas flows well below prewar levels.

Russian crude and refined oil products are taking even more circuitous routes to global markets. With most European states imposing a price cap or an outright ban on Russian oil, Russia has lost its largest market for crude. However, Russia has been active in looking for new markets and attempting to subvert sanctions. S&P Global Commodity Insights suggests that Russia has been engaged in a “charm offensive” in Africa. Sergei Lavrov, Russia's foreign minister, recently returned from visiting seven African countries. The purpose of the trip was believed to be an attempt to build ties with key countries and to open up new markets for Russian oil products. Russia's refined product exports to Africa have increased 14-fold following the imposition of European sanctions. Morocco, Libya and Egypt have been particularly active in importing Russian oil, leading observers to suggest that some North African countries may be blending Russian crude with domestic crude and then reexporting to Europe.

India remains a major market for Russian crude. Russia and the Middle East are each taking about 40%-45% of the Indian market. India's oil demand rose 9% year over year in May, and the country has been happy to export discounted Russian crude to meet that demand.

"We don't have bias against crude of any origin and grade as long as prices remain within our reach and this policy holds true for Russian grades as well," an Indian oil ministry official told S&P Global Commodity Insights.

Russian oil prices remain lower than forward Dated Brent prices, reflecting the impact of European sanctions. However, that price discount has fallen to just $9.60 a barrel, which is the smallest discount since S&P Global Commodity Insights started measuring the difference in January. Two factors may be reducing the discount for Russian crude. First, Russia has committed to surprise voluntary export cuts recently. Second, measures designed to circumvent sanctions, such as offshore ship-to-ship transfers and the practice of ships switching off their automatic identification systems, have been on the rise.

Today is Monday, July 10, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Vietnam Economy Moderates In First Half Of 2023 As Exports Slump

Vietnam's GDP growth rate moderated to a pace of 3.7% year-on-year (y/y) in the first half of 2023, after rapid GDP growth of 8.0% y/y in 2022. Vietnam's manufacturing export sector has faced increasing headwinds due to slowing growth in the US and EU, which are two key export markets accounting for over 40% of Vietnam's goods exports. Vietnam's goods exports fell by 12.3% y/y in the five months of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit FAQ: Bulgaria Reaffirms Eurozone Commitment With Parallel Currency Discussion

Bulgaria's long road to euro ascension continues. Last week, Finance Minister Asen Vasilev confirmed that the country had begun negotiations with the European Commission on introducing the euro as parallel legal tender for transactions in the country from Jan. 1, 2024, in addition to the lev. Bulgaria has operated a currency board with the euro since 1997. When Bulgaria joined the EU in 2007, the accession treaty included a requirement for the country to eventually join the eurozone if it meets the "convergence criteria." In 2020, Bulgaria acceded to the Exchange Rate Mechanism (ERM II) — the waiting room for eurozone accession. However, elevated post-COVID-19 inflationary stress and a prolonged period of reform inertia has stalled progress.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Subdued China Recovery Dampens Q3 Dry Bulk Shipping Prospects

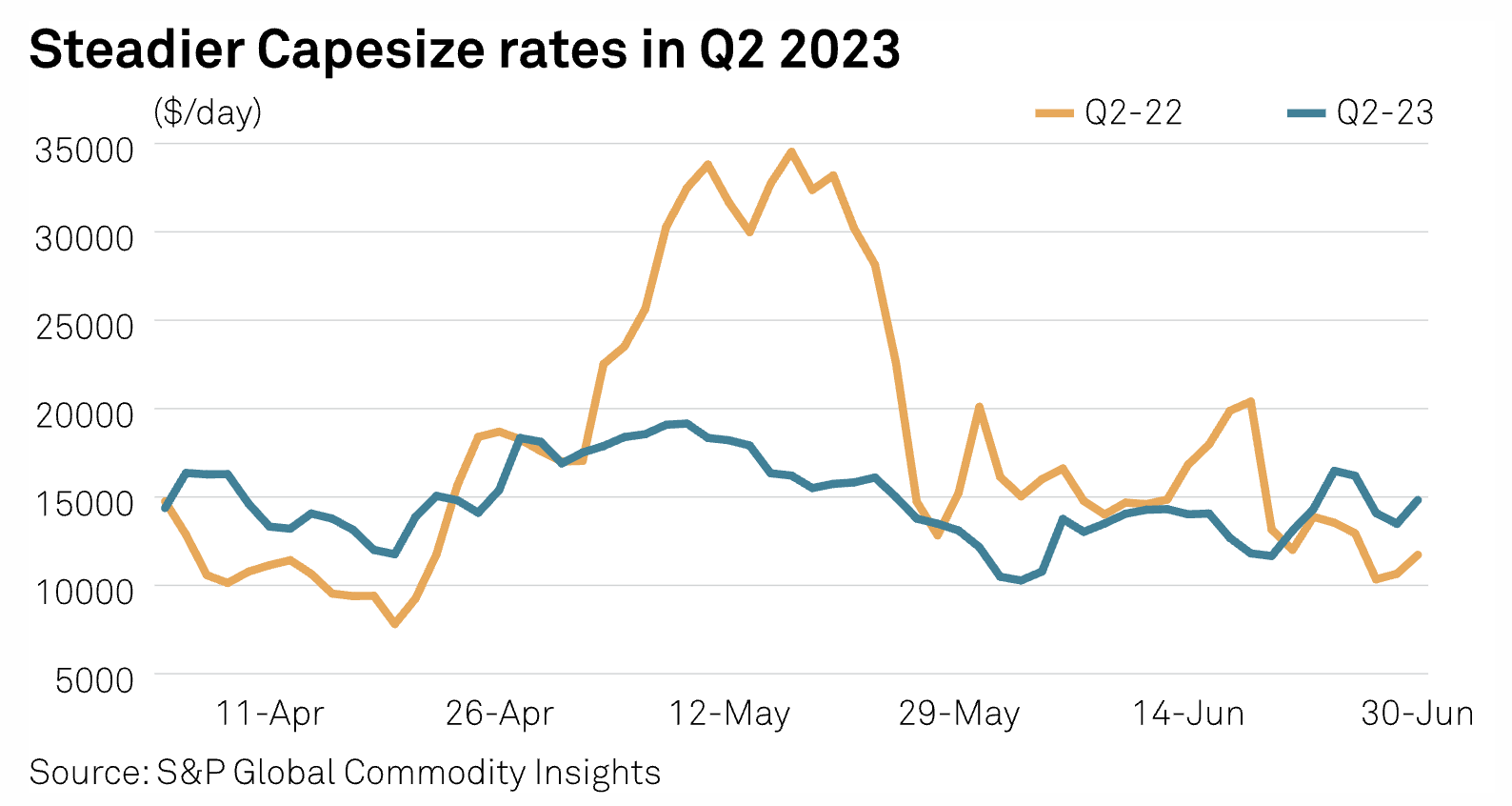

Global macro-economic weakness may pressure the dry bulk freight market during the third quarter of this year, which would be an extension of lower returns witnessed in the previous quarter due to China's sluggish economic recovery and weak commodity demand. The Platts Capesize T4 Index, a global ton-mile weighted average index of four Capesize routes, stood at an average of $14,481/d in Q2, down from an average of $17,848/d in Q2 2022, S&P Global Commodity Insights data showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

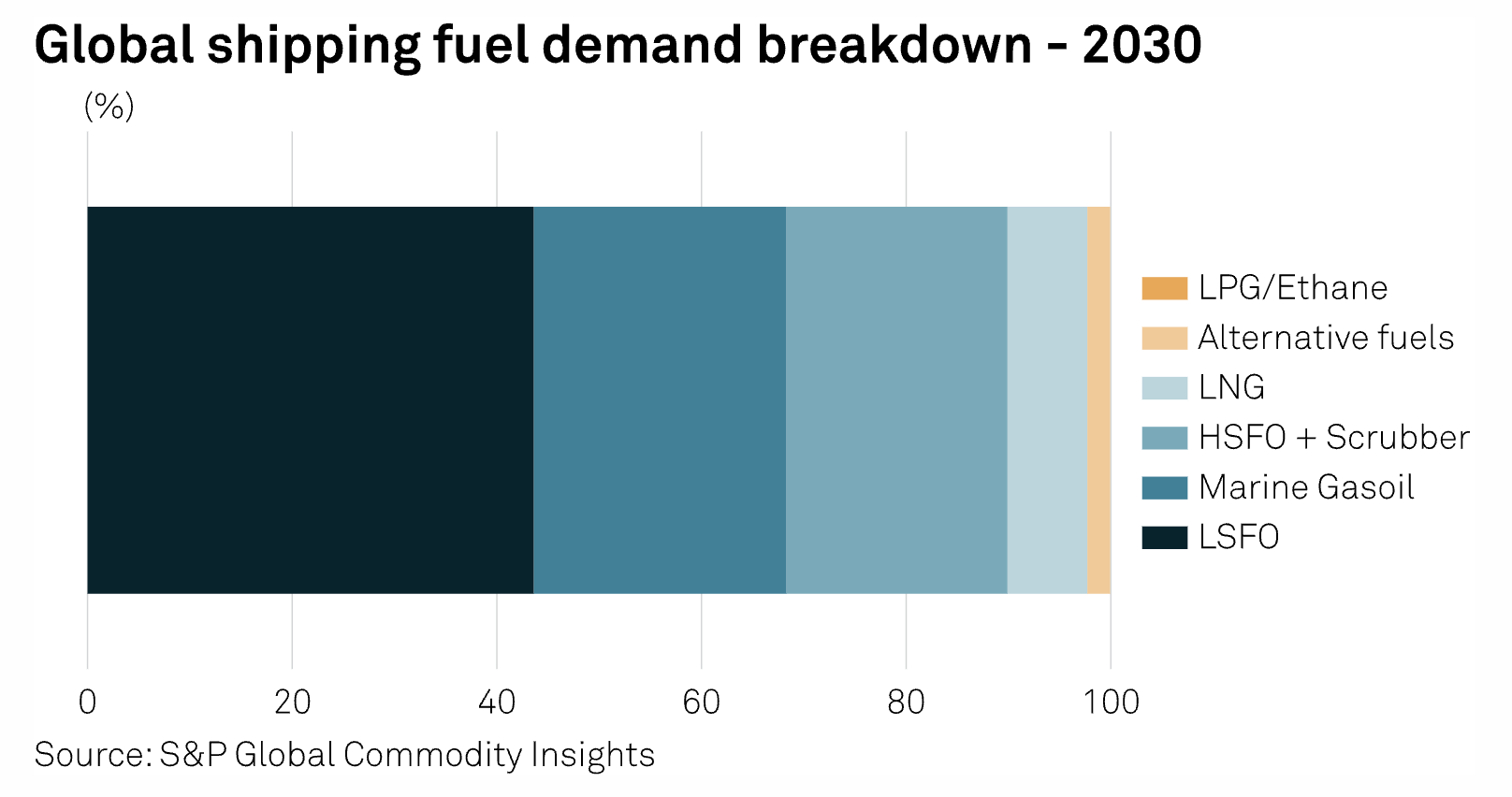

IMO Agrees Net-Zero Goal, Confirms GHG Pricing And New Fuel Rules Development

The International Maritime Organization announced July 7 tightened decarbonization targets for shipping, as well as confirming the development of new fuel standards and a pricing mechanism for greenhouse gas emissions, but industry stakeholders said the compromise deal might fail to accelerate emissions reductions sufficiently. Following a week of discussions at the Marine Environment Protection Committee, IMO member states adopted a revised GHG reduction strategy that includes an eventual goal of reaching net-zero emissions from international shipping "close to" 2050 on a life-cycle basis.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

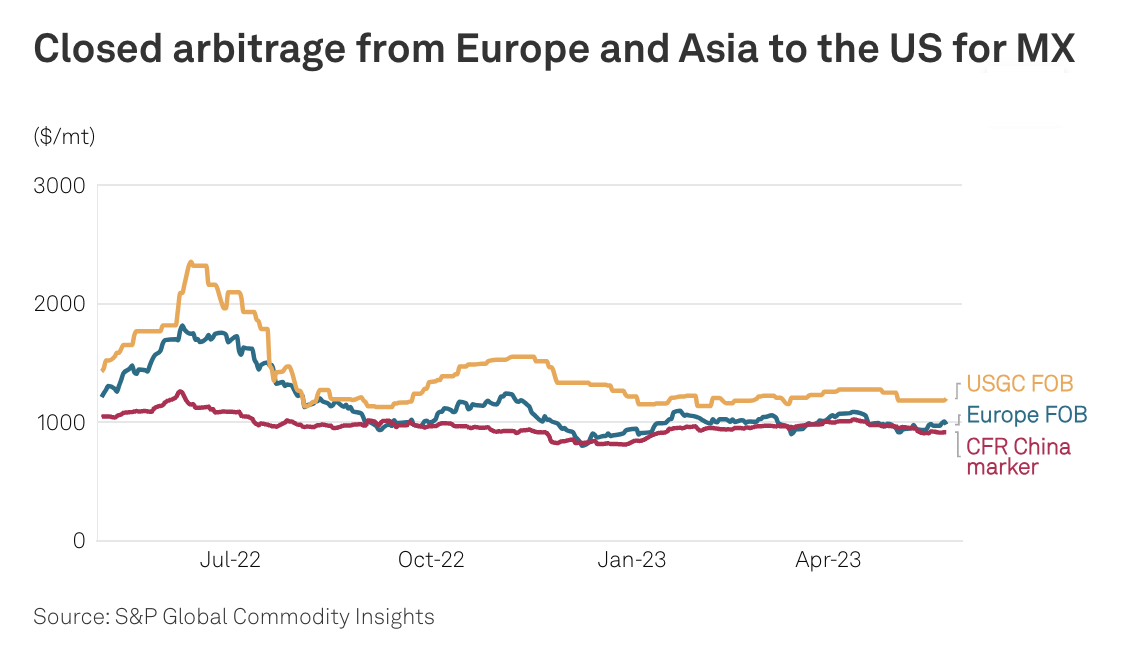

Chemical Trends H2 2023: Weak Global Economic Outlook Puts Pressure On Chemical Markets

S&P Global Commodity Insights takes a closer look at the trends shaping key chemical markets through the latter half of 2023. Macroeconomic conditions are in focus, as high inflation and interest rates pose a barrier to recovery for chemical commodities after a slow start to the year in many markets due to low demand.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

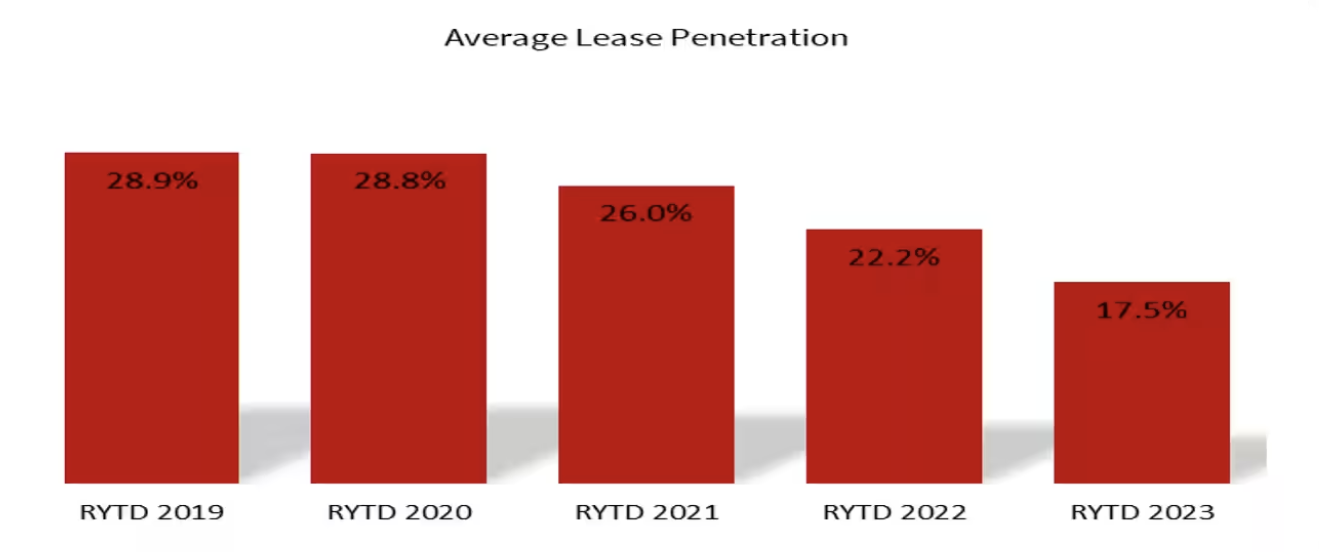

Why Leasing Matters — June 2023

In the years before the pandemic, leasing accounted for 25-30% of all retail transactions, and were as high as 53% in the luxury market. But in the most recent 12 months, lease penetration is down over 10 points to only 17%. Rising interest rates and new vehicle prices are driving this trend. Instead of leasing, customers are increasingly financing new vehicle purchases for longer terms. 84+ month loans have grown from 5.4% of retail loan in 2021 to 10.4% in 2023.

—Read the article from S&P Global Mobility

Content Type

Segment

Language