Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The global Islamic finance market looks likely to experience stable—and potentially more sustainable—growth this year.

Accounting of institutions that cater to Muslim market participants by raising capital in accordance with Islamic law, the market is set to expand 10%-12% this year, according to S&P Global Ratings’ 2022 outlook for the industry. The market operates via banking assets, funds, cooperative insurance plans called takaful, and financial certificates similar to Western markets’ bonds known as sukuk. If Islamic banking assets in Gulf Cooperation Council (GCC) countries continue to grow and sukuk issuance strengthens, the Islamic finance market’s projected growth follows the $2.2 trillion industry’s 17.3% expansion in 2019 prior the pandemic and 10.6% growth in 2020 during the coronavirus crisis-caused downturn.

In 2021, Islamic indices enjoyed broad gains throughout the year and outperformed their conventional counterparts with a near 2% advantage, according to S&P Dow Jones Indices.

Still, lower and costlier global and regional liquidity, increased complexity, and reduced financing needs for core Islamic finance countries could make for flat for sukuk issuance this year, according to a separate S&P Global Ratings outlook.

“Total sukuk issuance stabilized at $147.4 billion last year compared with $148.4 billion in 2020, but foreign currency denominated issuance increased 10%. Shrinking global liquidity and increasing complexity related to regulatory standards are likely to hold back sukuk issuance in 2022, assuming any adverse COVID-19-related disruption in core Islamic finance countries remains in check,” S&P Global Ratings said in a report this week. “We also expect lower financing needs in some core Islamic finance countries. Therefore, we forecast total issuance of about $145 billion-$150 billion in 2022.”

Higher oil prices, strong capitalization, supportive government spending, normalizing non-oil activity, and lower global liquidity will likely support GCC banks’ recoveries from the pandemic-prompted disruption, which began in October of last year, through 2022.

“GCC banks are positively geared to rising interest rates. On average, a 100-basis-point increase in rates would result in a 14% increase in earnings and 1% capital accretion,” S&P Global Ratings said in its recent 2022 outlook for GCC banks. “We do not expect a major slowdown in lending growth following a rate increase as this is more dependent on government spending and oil prices. However, external funding might become scarce and more expensive and asset quality indicators could be impacted in case of a faster than expected increase in rates.”

This year and next may also bring more advancement in the Islamic finance industry’s standardization and integration, alongside more frequent issuance of dedicated social Islamic finance instruments and green sukuk, according to S&P Global Ratings. Market participants will be closely watching oil prices and the overall recoveries of GCC countries for outcomes that could sway such outlooks.

Today is Wednesday, January 19, 2022, and here is today’s essential intelligence.

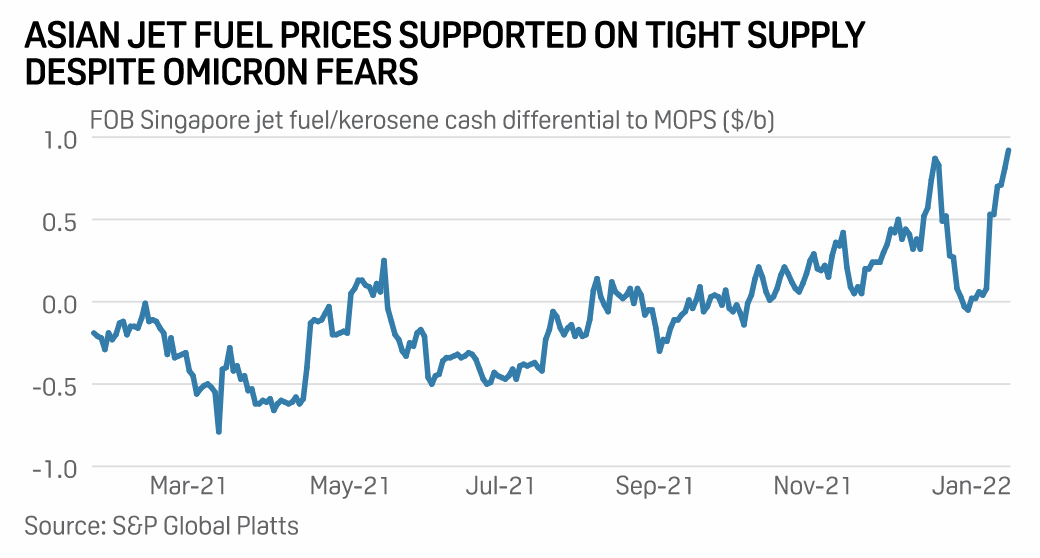

Australia's Jet Fuel Demand Battered By Omicron, But Medium-Term Outlook Brighter

The prospects of near-term recovery in Australia's jet fuel demand remain bleak as a surge in omicron infections upend staffing levels and summer holiday plans despite the country's high vaccination rates, industry sources said. However, the outlook for the medium term is more optimistic, with industry sources deeming the dent in the country's immediate jet fuel demand a temporary setback as the number of omicron cases was seen to be nearing it is peak in the most populous eastern states.

—Read the full article from S&P Global Platts

Access more insights on the global economy >

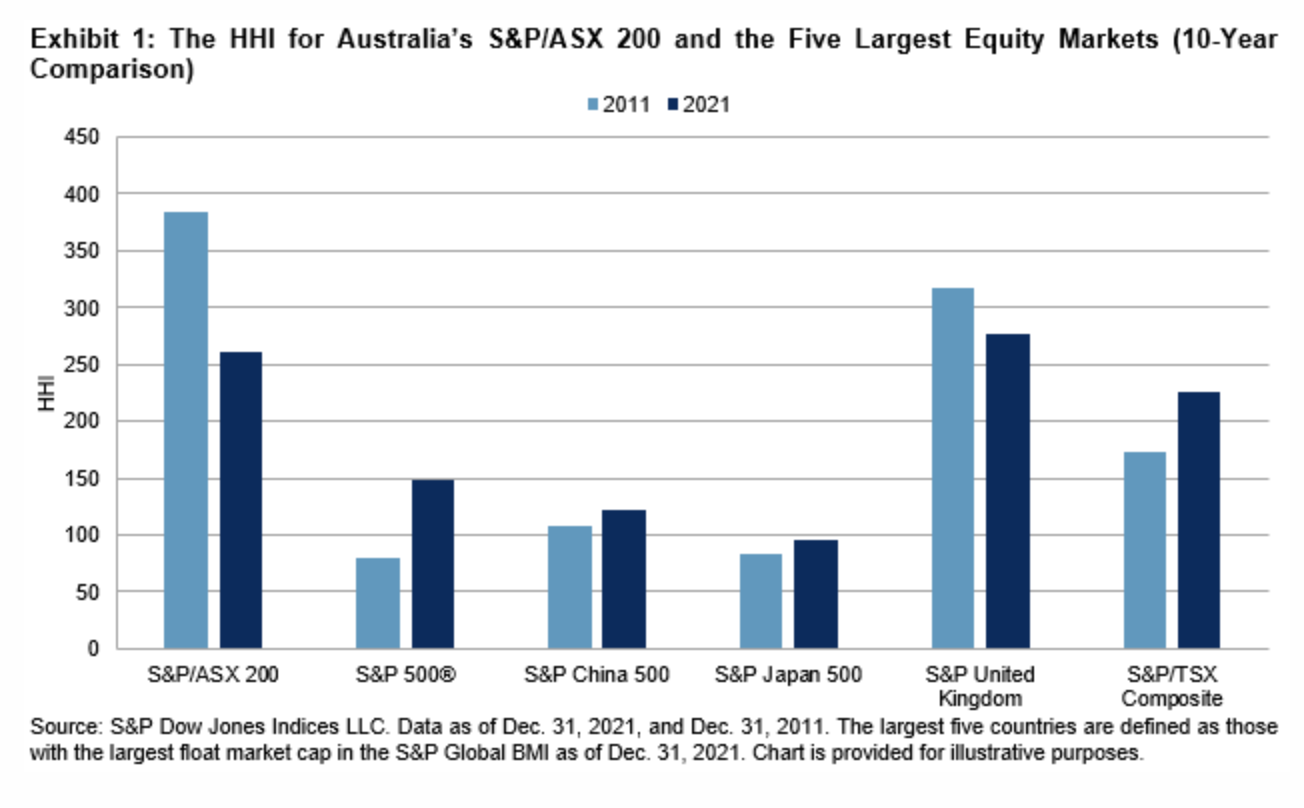

Increasing Diversification Of The Australian Equity Market

Equity markets have changed considerably over the past 10 years, reflecting the growth of stocks and sectors in each market. While this growth has led to increased concentration in most of the world’s largest equity markets, Australia is a notable exception, as diversification has improved both in terms of stock concentration and along sector lines. S&P Dow Jones Indices can analyze stock concentration at a high level by using the Herfindahl-Hirschman Index, a widely used measure of market concentration that can also be applied to stock market indices.

—Read the full article from S&P Dow Jones Indices

Access more insights on capital markets >

Listen: Platts Analytics Sees Geopolitical Risks Rising For Energy Markets In 2022

The latest episode of Capitol Crude looks at three key geopolitical angles that have some common ties: the Russia-Ukraine tensions, the recent unrest in Kazakhstan, and fuel subsidies in general. Paul Sheldon, chief geopolitical adviser for S&P Global Platts Analytics, joined senior editor Meghan Gordon to discuss how each of these issues could impact oil and other energy markets this year. Stick around after the interview for Jordan Blum with the Market Minute, a look at near-term oil market drivers.

Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Access more insights on global trade >

Green Energy Ambitions Of India's Richest Tycoons To Spur Nation Toward Net-Zero

India's journey to net-zero emissions will get a shot in the arm from nearly $150 billion of planned investments in green energy announced by its two richest tycoons, who both owe their fortunes to carbon. Reliance Industries Ltd., the flagship of Asia's richest man, Mukesh Ambani, announced plans to invest nearly 5.6 trillion Indian rupees, or $75 billion, in green energy projects in the western Gujarat state.

—Read the full article from S&P Global Market Intelligence

OPEC Doesn't Expect Oil Market Recovery To Be Derailed By Central Banks' Inflation Fight

OPEC warned Jan. 18 of a choppy oil market ahead, between lingering COVID-19 hotspots, surging inflation, and ongoing supply chain disruptions, but said the continued emergence of the world economy from the pandemic in 2022 should keep crude prices supported throughout the year. In its closely watched monthly oil market report, the producer bloc noted the likelihood of central banks responding to rising inflation rates by tightening monetary supply.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

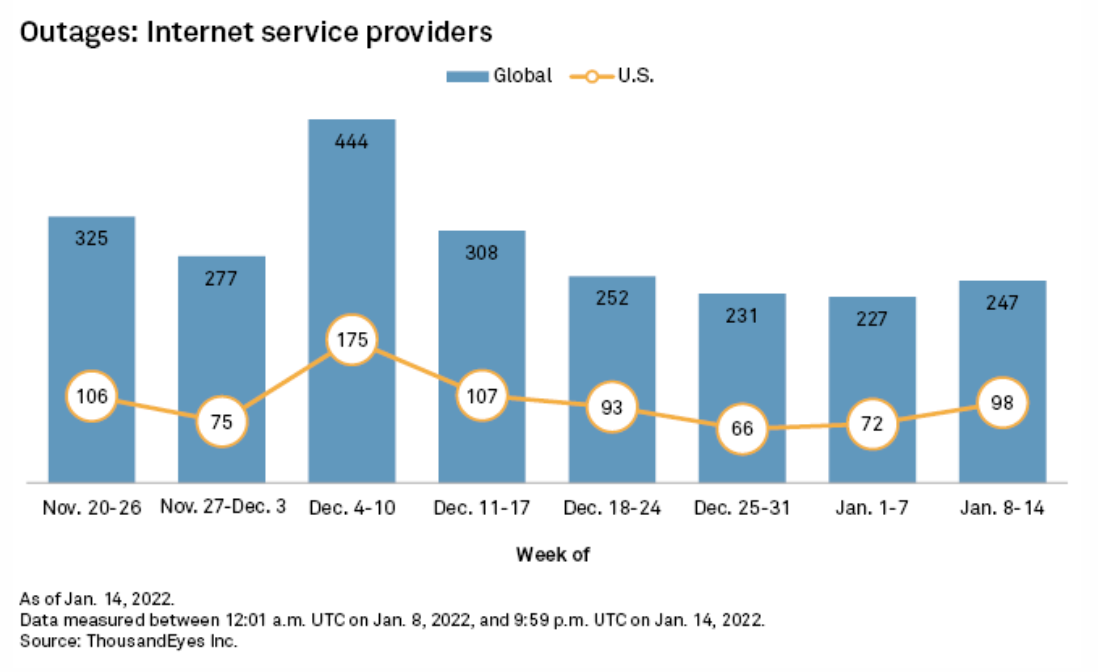

Global Internet Outages Up 9% In 2nd Week Of 2022

A month-long downward trend in the volume of global internet outages ended in the week of Jan. 14, with a 9% increase to 247, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. U.S. interruptions surged 36% to 98 from 72 in the prior week. The latest total comprised 40% of all global outages, up from 32% in the week of Jan. 7. ThousandEyes recorded two notable disruptions last week, including one Jan. 12 at network transit provider Hurricane Electric LLC that affected downstream partners and customers in the U.S., Hong Kong and five other countries.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.