Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The global steel industry is starting the year with cautious optimism, buoyed by improving economic conditions and demand and tempered by accelerating decarbonization efforts.

Steelmakers across many regions are anticipating a continuing recovery in 2022 and are focusing on how regulation, overall demand, and the rebounds in construction and manufacturing all take shape. This revival from the pandemic-prompted downturn is unfurling as the industry that accounts for approximately 7% of global carbon emissions forges on with net-zero actions. 2022 could challenge the industry’s commitment to decarbonization in the face of surging steel demand—calling into question whether steel is ready to get clean and go green.

Steel market regionalization took prominence last year with the creation of bilateral or regional trade deals, which could flourish in 2022 with decarbonization partnerships. In one instance, the U.S. and EU’s decision to suspend Section 232 tariffs and counter penalties on steel included provisions to address the climate implications of steel overcapacity.

"Since mid-last year when most countries were coming out of the first waves of the pandemic and lockdowns, the global steel markets have largely split into east and west," Paul Bartholomew, lead analyst with S&P Global Platts' Metals Analytics, told S&P Global Platts. "Steel prices in the U.S. and EU soared to record highs, due largely to supply constraints and a recovery in downstream demand. Meanwhile, prices in China and India rose but not to the same extent as in the EU and U.S. This resulted in India lifting exports to the U.S. and especially the EU and countries such as Vietnam targeting the US for the first time due to the wide steel spreads."

In the U.S., the largest groups representing the industry—the American Iron and Steel Institute and the Steel Manufacturers Association—told S&P Global Platts that 2022’s top priorities for steelmaking will be enforcing U.S. trade laws, specifically Section 232 tariffs and continuing decarbonization efforts. The Biden Administration’s taxpayer-infused infrastructure spending is set to boost demand for steel and aluminum industries now and in the coming years as projects get underway. This is already evident in trade activity. The U.S.’s imports of electric steel, used in transformers across the power grid, skyrocketed nearly 150% year-over-year from January through September of last year to total 35,171 tonnes of imports, according to S&P Global Market Intelligence data.

"Electrical steel is actually in very, very high demand right now because these companies that produce transformers, they are preparing for the work that will come in the next several months. They are looking ahead,” Lourenco Goncalves, the chairman, president, and CEO of mining company Cleveland-Cliffs, told S&P Global Market Intelligence of the infrastructure spending in a Jan. 6 interview. "Right now, demand is a lot bigger than what our installed capacity can produce … That's a huge change."

In the U.K., some market participants have expressed uncertainty about how high electricity prices, the government’s procurement methodology, and the potential continuation of U.S. import tariffs could affect the recovery in U.K. steel production and demand, according to S&P Global Platts.

"For this year, the demand for steel is looking overall positive, but not as strong as Q2-Q3 2021," Gareth Stace, director general of U.K. Steel, the trade group for the British-based industry, told S&P Global Platts in an interview. "We saw here in the U.K. large important construction projects, and if the semi-conductor shortages will ease, this will allow the automotive demand to properly recover. Our members have mixed views as to whether this is likely to occur in the first or second half of the year."

Although the shift toward green steel production is set to be a key theme for the steel industry in 2022, resurgent steel demand may put the industry at odds with its own ambitions unless production methods can change. Of the 30 largest metals and mining companies by market capitalization worldwide, 21 have set some level of net-zero greenhouse gas emissions target or are already claiming carbon neutrality, according to an S&P Global Market Intelligence analysis.

Risks to steel demand outlooks remain. The fallout from property development giant China Evergrande Group’s missed debt payments could create complicated conditions for the industry, considering that China accounts for nearly 56% of global steel demand and property development is responsible for nearly 40% of that demand, according to S&P Global Market Intelligence. Additionally, S&P Global Platts’ monthly steel sentiment survey found that the Mexican steel market maintained a bearish outlook in January.

"We are facing uncertain times," a distributor respondent said, explaining that increased supply and lacking demand continued to pressure flat steel prices.

Today is Tuesday, January 11, 2022, and here is today’s essential intelligence.

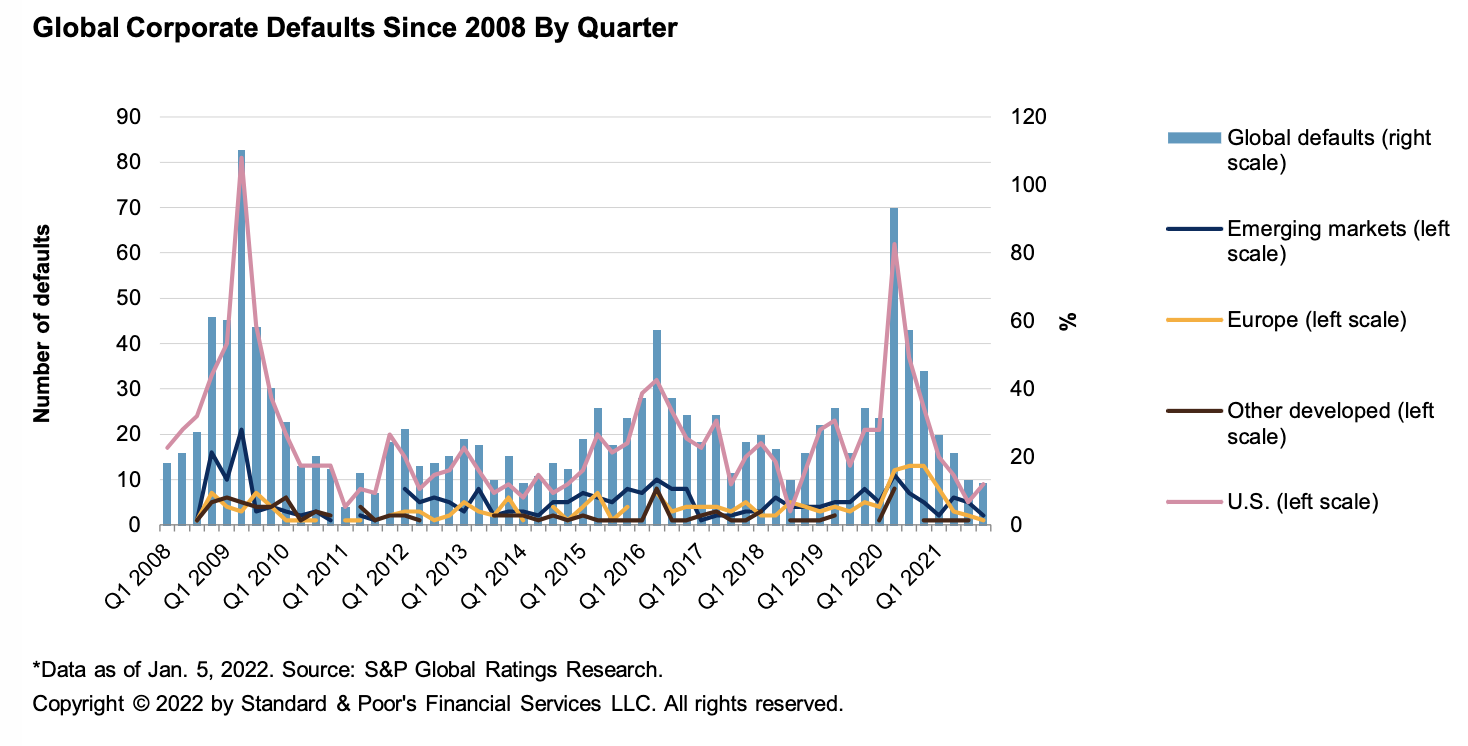

Default, Transition, And Recovery: Global Corporate Defaults Drop Nearly 70% In 2021

At 72, total defaults in 2021 were the lowest since 2014 while the fourth-quarter 2021 total of 12 defaults was the lowest since first-quarter 2014. The U.S. led defaults in 2021 with 40, followed by emerging markets with 15. By sector, homebuilders and real estate led the 2021 tally with 10 defaults, driven by an increase in defaults from China-based issuers. In 2021, 51% of defaults were related to distressed exchanges, up from 35% in 2020.

—Read the full report from S&P Global Ratings

U.S. BSL CLO Top Obligors And Industries Report: Fourth-Quarter 2021

For the past several years, the top 250 obligors have represented about half of the assets under management across U.S. BSL CLO exposures rated by S&P Global Ratings. Historically, the top 250 obligors have had stronger credit quality, as measured by ratings, relative to the remaining U.S. BSL CLO obligors rated.

—Read the full report from S&P Global Ratings

SF Credit Brief: U.S. CMBS Delinquency Rate Fell 335 Bps To 3.6% In 2021; All Property Types Improved, Except Office

The U.S. commercial mortgage-backed securities overall delinquency (DQ) rate increased 8 basis points (bps) month over month to 3.6% in December but fell 335 bps from 7.0% a year earlier. By dollar amount, total DQs increased to $25.7 billion, representing a net increase of $1.0 billion month over month and a net decline of $16.5 billion year over year.

—Read the full report from S&P Global Ratings

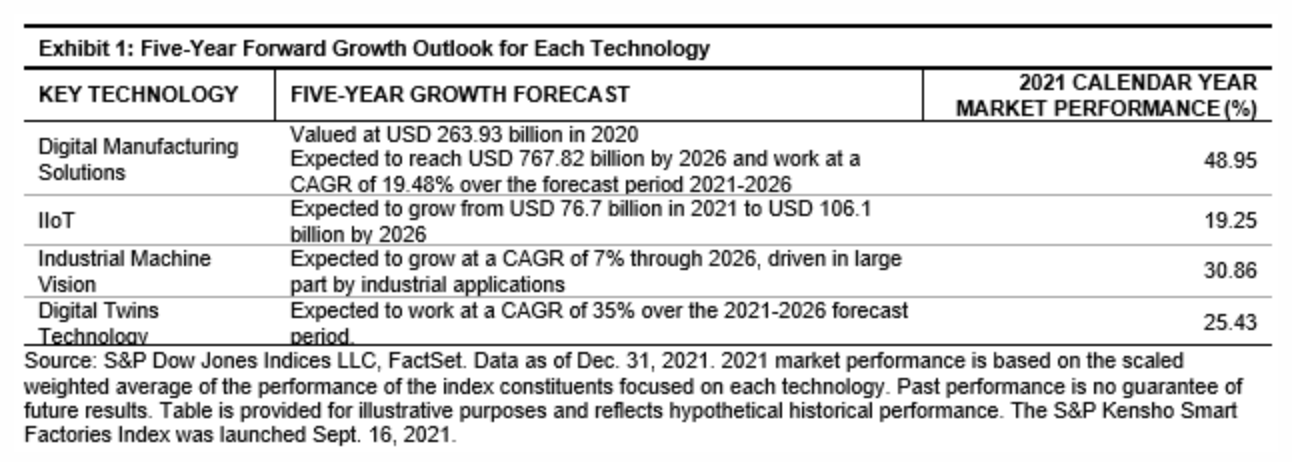

Smart Factories To The Supply Rescue

With the global economy ramping up from the depths of the COVID-19 pandemic, labor shortages and supply chain bottlenecks are hampering manufacturers. Fortunately, there is relief on the way. Digitalization is sweeping through manufacturing plants and transforming today’s sleepy mills into the smart factories of tomorrow. The catalysts include several of the technological forces driving the Fourth Industrial Revolution: exponential computing power, Big Data, artificial intelligence, and machine learning.

—Read the full article from S&P Dow Jones Indices

U.S. Internet Outages Jump 9% In 1st Week Of 2022

2022 opened with the number of global internet disruptions down 2% to 227 in the week of Jan. 7, continuing a downward trend that started in mid-December 2021, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. Meanwhile, U.S. disruptions increased 9% to 72 from 66 in the prior week, with the recent total comprising 32% of all global outages.

—Read the full article from S&P Global Market Intelligence

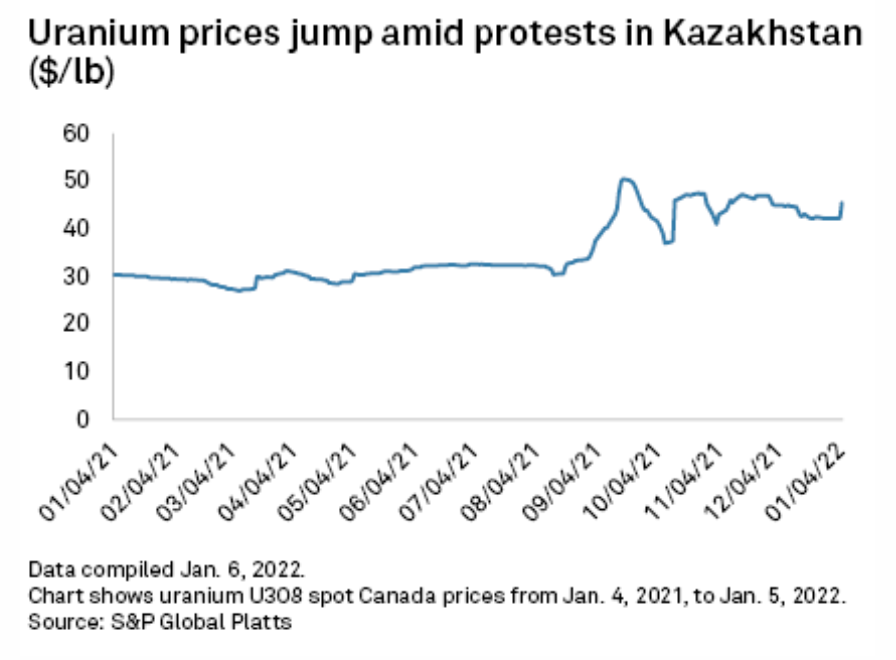

Uranium Heavyweights Flirt With Reopening Mothballed Mines Amid Kazakh Unrest

Kazakhstan, which produces almost half of the world's uranium, has been embroiled in a week of protests, with civilians rebelling against soaring fuel prices, corruption, and economic disparities. The volatility in the country has not yet disrupted shipments, but prices have responded. S&P Global Platts assessed the month spot price of U3O8 to Canada at $42.25/lb on Jan. 4 and $45.75/lb on Jan. 6, an 8.3% jump.

—Read the full article from S&P Global Market Intelligence

Asian Finance Executives Renew Call For ESG Investment Standards

As the global economy emerges from the COVID-19 pandemic, the increasing severity and frequency of extreme weather events have prompted renewed efforts to counter climate change. Among major Asian economies, India surprised the United Nations climate change conference in October with its announcement to reach net-zero by 2070 and China reiterated its own climate goals as the nation struggled with a coal power crunch.

—Read the full article from S&P Global Market Intelligence

Listen: Will Oil Prices Spike To $100/B In 2022?

Global oil markets are starting 2022 with a number of factors that could make for another volatile year. OPEC is continuing its monthly supply increases but taking a cautious approach so far given uncertain demand. A return of Iran barrels is not a sure thing as the nuclear talks stretch into a second year. The U.S. tapped the Strategic Petroleum Reserve in a big way at the end of last year, but that did little to soften prices.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Commodities 2022: Asia's Oil Demand Revival Seen Resilient, OPEC+ Response Key

The maiden decision in 2022 by OPEC and its Russia-led partners to approve another hike in production quotas—betting the market can absorb more oil in the coming months despite surging COVID-19 infections—will be music to the ears of Asian oil importers witnessing a fragile economic revival.

—Read the full article from S&P Global Platts

Libyan Oil Output Recovers To Around 900,000 b/d, Western Blockade Still In Place

Libyan crude output has recovered to around 900,000 b/d after pipeline maintenance at the eastern Waha oil fields was complete, but around 300,000 b/d of production still remained shut-in as a blockade at its key western oil fields remained in place, Libya-based sources said Jan. 10. This comes a few days after crude production had fallen to a 14-month low of 729,000 b/d, according to a statement from state-owned National Oil Corporation.

—Read the full article from S&P Global Platts

Feature: USAC 2021 Gasoline Imports Exceed Pre-Pandemic Levels On Strong Demand, Backwardation

Gasoline imports into the U.S. Atlantic Coast in 2021, largely from Northwest Europe, surpassed pre-coronavirus pandemic levels on strong demand, weak regional inventories, and pandemic-driven market dynamics, though imports weakened towards the end of the year. Multiple lockdowns and increased pandemic-related restrictions in Northwest Europe curtailed gasoline demand there, leading exporters to look to that key USAC market to absorb excess barrels.

—Read the full article from S&P Global Platts

Commodities 2022: Supply Woes, Volatility To Keep India's Coal Importers On Edge

Indian coal importers are bracing for another year of market volatility and supply upheaval as China's efforts to absorb plentiful cargoes to make up for the Australian supply vacuum, as well as production hurdles at mines across the globe due to the pandemic, will keep the market on tenterhooks.

—Read the full article from S&P Global Platts

Mexican Steel Sentiment Less Bearish In January: Platts Survey

Bearish sentiment persists in the Mexican steel market, although expectations of further price declines are softer compared to December, data from the monthly steel sentiment survey by S&P Global Platts shows. The index for finished steel price development stood at 48.3, increasing 15.4 from an index of 33 in December (an index of 50 indicates stability).

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language