Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Private Equity Market Set to Bounce Back After Significantly Slow Year

After years of fast-paced growth, the private equity market slowed to a crawl in 2023 as the headwinds that took hold in 2022 persisted. Even the world's biggest private equity investor, Blackstone, recognized that it will look back at 2023 as the "cyclical bottom” for the firm. Yet 2024 shows signs of a recovery as market conditions start to improve and the likelihood of interest rate cuts increases.

Private equity's growth over the past decade has been largely driven by a low interest rate environment, which made it easier and cheaper for buyout firms to land debt financing for deals. That era of cheap debt came to an end when central banks began raising interest rates in early 2022 to tame a wave of inflation that started when the Russia-Ukraine war broke out and disrupted global supply chains. As interest rates soared in 2023, valuation multiples dropped, lending conditions tightened, and recession fears rose. Obtaining debt to fund leveraged buyouts became difficult and expensive for private equity shops.

As a result, private equity activity was subdued on various fronts by the end of 2023. Entries into new investments dipped to the lowest levels since at least 2019, at $474.14 billion across 12,016 deals. Private equity investments hit a four-year low in Japan, while the rest of Asia-Pacific recorded the lowest year-end total in at least five years.

High inflation, rising interest rates and recession risk all helped to pause dealmaking across verticals, from IT and biotechnology to movies and entertainment. Private equity-backed deals with sovereign wealth funds as coinvestors likewise plummeted. The persistent economic headwinds also dampened venture capital deployment globally.

Given the difficult macroeconomic conditions, more private equity-backed deals were terminated in the last quarter of 2023 than in previous quarters since the start of 2020. The bankruptcy rate among private equity-backed companies in the US also surged to a record high in 2023 as they struggled with the combined challenges of inflation, rate hikes and the dwindling effect of pandemic-era stimulus spending.

Even with signs of improving conditions for IPOs and sales to strategic buyers, private equity exit activity was muted in 2023. Many sellers stayed on the sidelines as they awaited valuations to return to more reasonable levels. Similarly, private equity fundraising slowed in 2023 as reduced exit activity disrupted the flow of capital back to limited partners. Preqin data shows that the aggregate amount of fundraising in 2023 was the lowest since 2017, while the number of funds closed in the past year was the smallest since at least 2015.

The slow pace of entries and exits only enlarged the pool of dry powder — the amount of capital raised that has yet to be invested — that private equity firms are sitting on. The global private equity dry powder ballooned to $2.59 trillion in 2023 as firms had limited opportunities to deploy capital raised in previous years. Executing deals was challenging as rate hikes increased the cost of financing acquisitions, and valuation gaps kept buyers and sellers apart.

The private equity outlook is improving in 2024, thanks to better public market sentiment and growing expectations for interest rate cuts. M&A activity is predicted to pick up, particularly in the technology, energy, healthcare and infrastructure sectors, "likely not at the fever pitch that was being experienced in 2022 but certainly at a much greater rate than what we have seen in 2023," said Chris Zochowski, a private equity partner at Shearman & Sterling.

Fundraising is expected to rebound gradually as deal recovery would result in more distributions that limited partners can use to invest in new funds. General partner-led secondaries also offer a new way to provide liquidity for investors and free up capital for new fund allocations.

"Everything is pointing in the right direction in terms of dealmaking, exiting companies in the public markets, stability, reduction of interest rates," Asante Capital Managing Partner Fraser van Rensburg said, adding that fundraising is likely to improve from the second half of 2024.

Today is Friday, February 16, 2024, and here is today's essential intelligence.

Written by Pam Rosacia.

Migrants And Asylum Seekers Pose Budgetary Challenges In New York City, Chicago And Denver

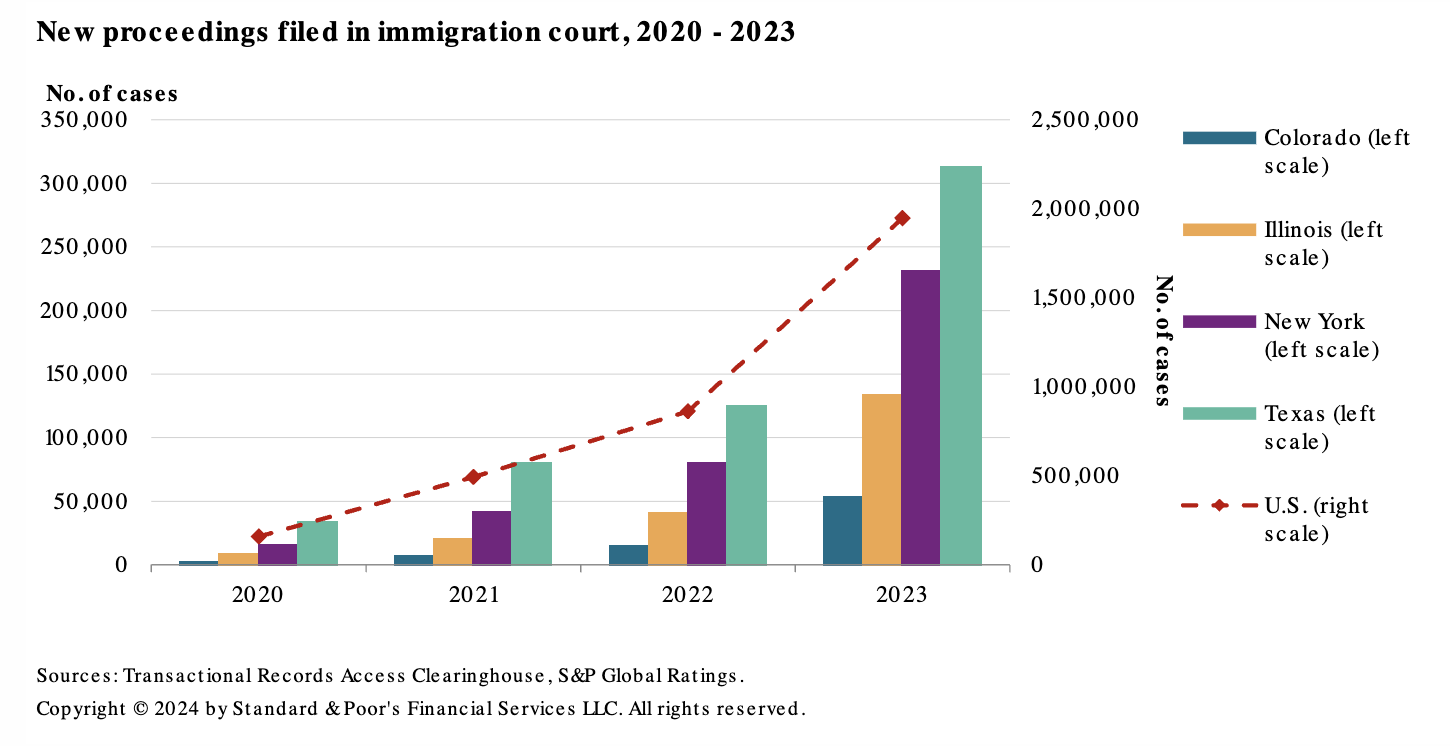

The number of migrants and asylum seekers gaining entrance to the US along the country's southern border has been increasing in recent years and the influx is straining government budgets. Although much of the pressure affects localities in border states, some of the largest cities across the US, including New York City, Chicago and Denver, are also feeling the impact. These cities are adjusting their budgets to accommodate rising expenditures, but without state and federal government support, these costs are significant enough to strain budgets and could pressure credit quality.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

US Equity REIT Capital Market Offerings Spike In January

Capital market activity by US equity real estate investment trusts is off to a strong start in 2024, with the industry collecting $7.10 billion in January. The amount represents an approximately 88% increase from December 2023 and a 6.8% hike from a year earlier. The majority of capital raised in January came through debt offerings, at $6.99 billion, while common equity offerings accounted for the remaining $115.6 million, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: EP25: The Storm Before The Storm - Q1’24 Trade And Supply Chain Outlook

2023 was a year of recovery, giving the air of a return to normal. Unfortunately, normal for supply chains means guiding operations through the middle of a storm of potential disruptions. Some are already visible, including the knock-on from conflict in the Middle East and the prospect of a renewed wave of trade protectionism. Others will emerge by surprise.

—Listen and subscribe to Maritime and Trade Talk, a podcast from S&P Global Market Intelligence

Access more insights on global trade >

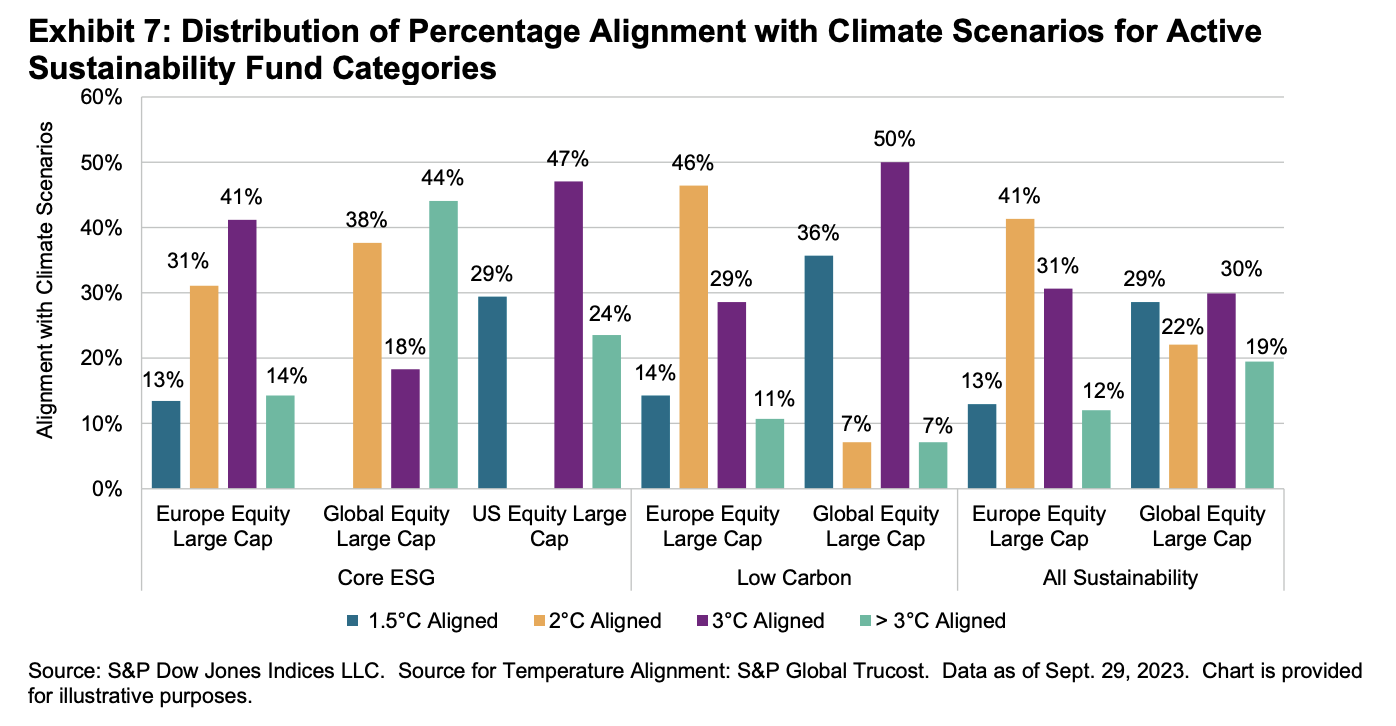

SPIVA Sustainability Scorecard: September 2023

The semiannual SPIVA Europe Scorecard was first published in 2014 and reports on the performance of actively managed funds domiciled across Europe. In this report, S&P Dow Jones Indices complements the traditional scorecard with a comparison of sustainability-focused actively managed funds and indices. In addition to performance, it also assesses changes in the sustainability profile relative to the broad equity benchmarks and tracking error characteristics.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

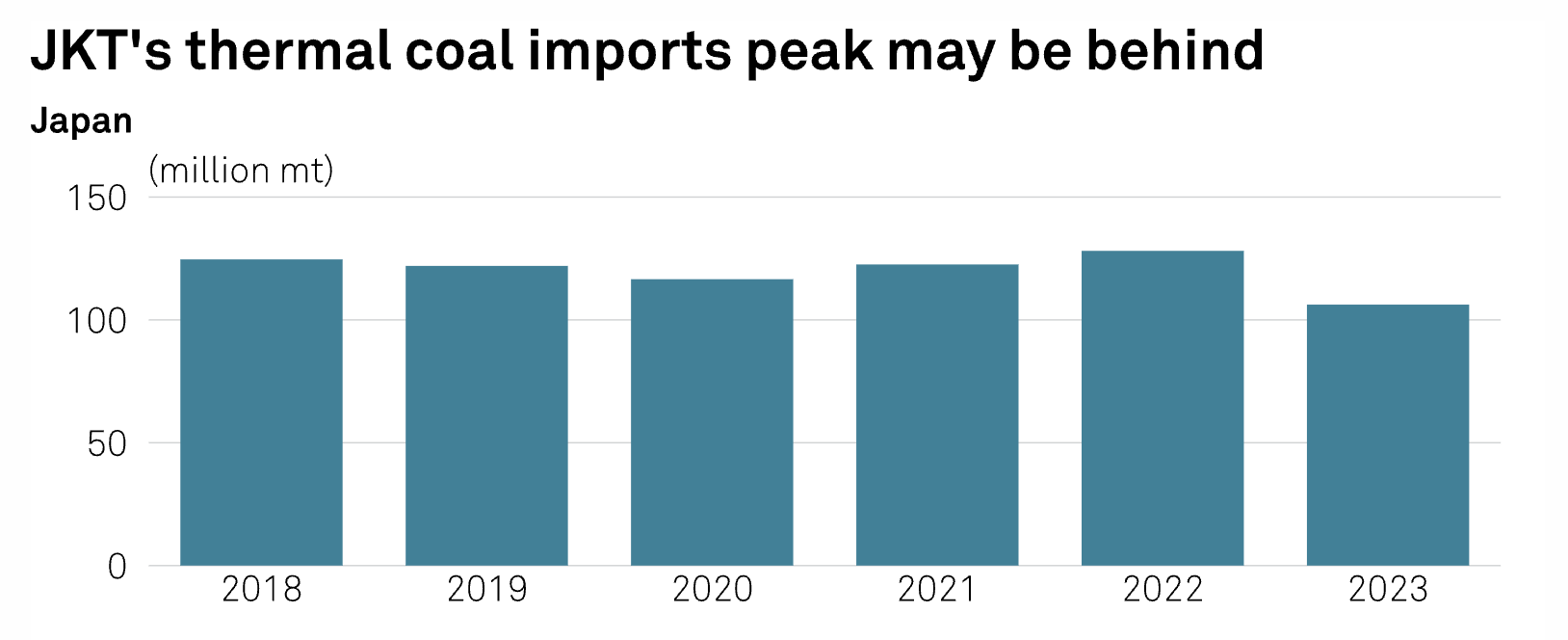

JKT Coal Reliance Faces Threat From Renewables, Nuclear Power

Thermal coal demand in Japan, South Korea and Taiwan could start taking a back seat over the next few years amid the region's tight net-zero targets and better alternative fuel supplies for power generation, increasing high-calorific value coal inventory in the market.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

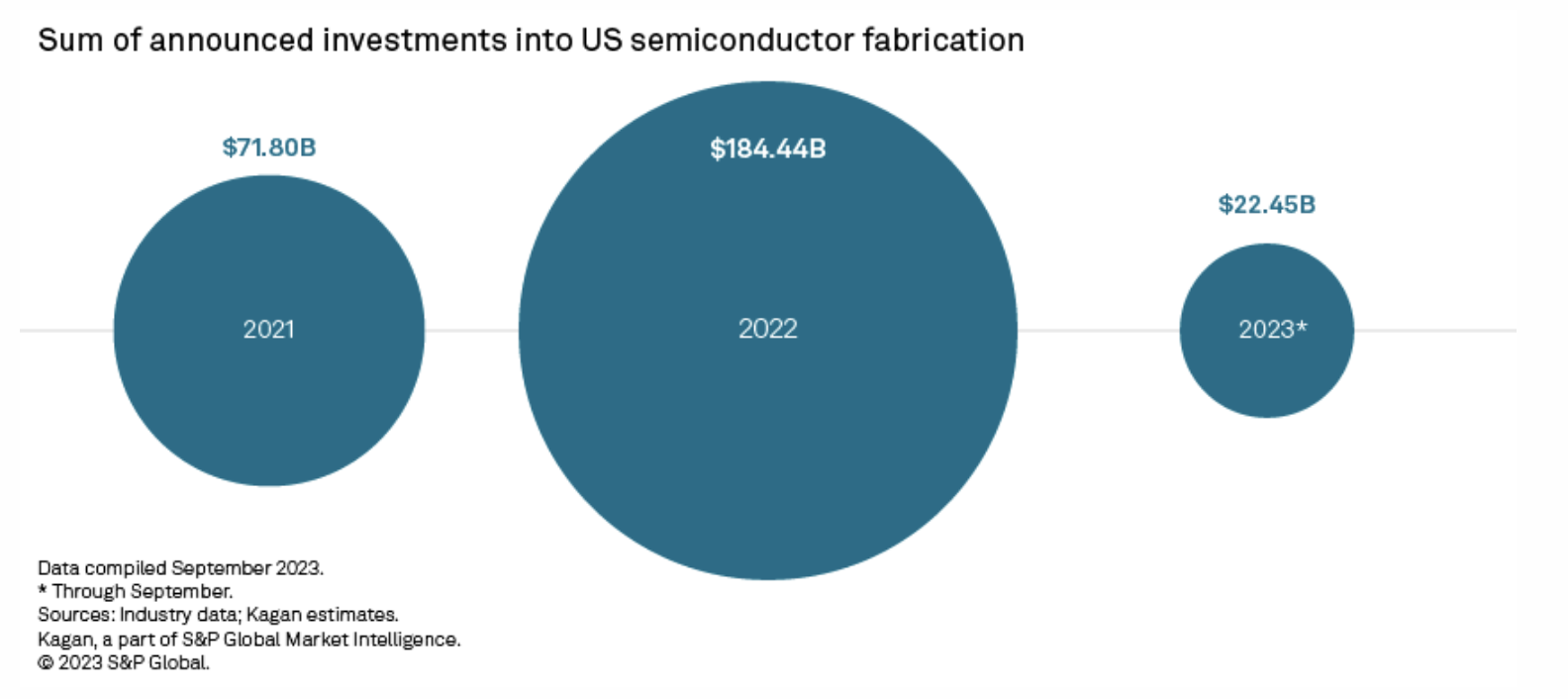

Path To Net-Zero: Chipmakers Balance Physical Vs. Carbon Footprint Growth

Chipmakers are simultaneously trying to ramp up production while cutting back on emissions, creating a challenge that any individual company cannot solve alone. The semiconductor industry is seeing unprecedented demand as advances in artificial intelligence and the internet of things make the world smarter and more connected. Chips are at the heart of this transformation, going into everything from cars to phones to thermostats. As a result, according to estimates from McKinsey & Co., the semiconductor industry is on track to reach over $1 trillion in revenue by 2030, up from around $600 billion now.

—Read the article from S&P Global Market Intelligence

Content Type

Theme

Segment

Language