Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Passive Investing in Fixed Income Markets

High-profile active investment managers and their enthusiasts in the financial media dislike the practice of passive investing in index funds. This is understandable since active investors on a hot streak may believe that their outperformance will continue — due perhaps to recency bias and supreme self-confidence. Nothing is more likely to irritate successful, and therefore famous, active investors than a chart that proves the superior performance of passive investing over longer time horizons. Such charts notwithstanding, active investors have always been able to comfort themselves with their continued outperformance in fixed income markets. Fixed income markets are too complex, with too much turnover and downside potential. Fixed income indexes are difficult to maintain and weight properly. However, a group of researchers at S&P Global Dow Jones Indices recently examined passive investing’s potential in fixed income markets in the article “The Hare and the Tortoise.” As in the fable of the same name, results run counter to expectations.

As of July 2023, the global bond market was valued at $135 trillion, with rated corporate debt making up $23 trillion of the total. Fewer and fewer of these bonds are held by individual investors who increasingly get exposure to credit markets through mutual funds. In equity markets, passive investment through index funds makes up half of all invested capital. But most bond funds are still actively managed, meaning that an investment management team decides which bonds to buy. These investment teams need to be paid, and successful investors tend to be very well paid. This means that the returns for an actively invested fund need to be offset against the cost of active management. Passive funds, which are tied to an index, typically charge much lower management fees.

Passive investing in bond funds has taken a long time to catch on. Creating an index for bond markets is more difficult than equity markets, practically speaking. First, there just aren’t that many securities for an equity market index to choose from. The 100 largest stocks capture three-fifths of the total US equity market capitalization. Meanwhile, S&P Dow Jones Indices’ index of corporate bonds, comprising issuances from the S&P 500’s constituent companies, contains over 6,000 distinct securities. As a result, fixed income benchmarks are broader and less concentrated. A single bond also costs more than a single share of stock, and bond funds require more maintenance since old bonds are always maturing and new bonds are always being issued. This means that the amount of trading required to maintain a bond fund is 10 times that of an equity fund.

The complications of the bond market seem to support the contention that active management is superior to passive investing for fixed income funds. However, evidence points to index-based bond funds sometimes outperforming actively managed funds due to the benefits of diversification. Bonds have the unusual quality that, unlike equities, the value of a bond may be reduced to zero if the underlying institution chooses to default on its debt. The protection against this possibility of total loss is to hold many different bonds from many different issuing entities. However, an active investor may believe that they have spotted an opportunity in bond markets that naturally requires them to concentrate their investments. Whether they are right or wrong, they are eschewing the protection of diversification.

Over the past decade or so, between 72% and 94% of actively managed funds underperformed S&P Dow Jones Indices’ fixed income benchmarks, depending upon the region and the issuer type. Naturally, most active managers will believe that they are part of the 6%-28% who outperform the benchmark. Mathematically, this cannot be true for all of them.

Today is Thursday, February 15, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Financial Aid Delay Is The Latest Hurdle For US Higher Education

The Department of Education announced recently that student applications for financial aid (FAFSA) for the 2024-2025 academic year will not be available for US colleges and universities to review until at least March. Colleges and universities will have less time to determine financial aid packages for students and aid offers could be delayed. The current expected timing would leave students with less than a month before they're typically expected to commit to a college (May 1), so many schools could extend their deposit deadlines. The potential delay in financial aid offerings to students could affect college and university matriculations, as well as fiscal 2025 operating budgets if fall 2024 institutional financial aid ends up being materially higher than anticipated.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

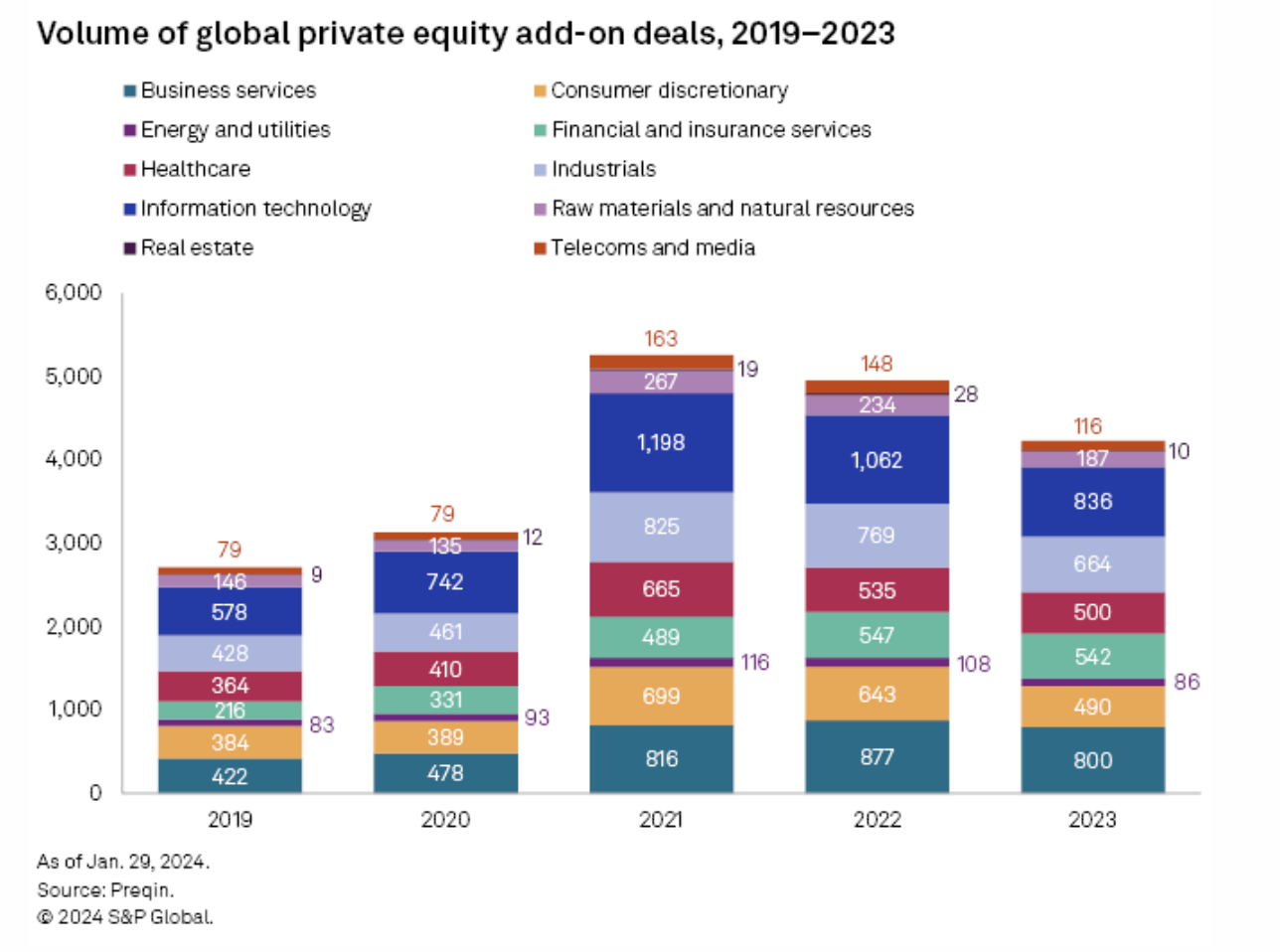

New US Merger Guidelines Threaten To Increase Pressure On PE Add-On Deals

Add-on acquisitions, a common value creation strategy for private equity firms, face the possibility of increased regulatory scrutiny after the US Justice Department and the Federal Trade Commission released a new set of merger guidelines in December 2023. "Add-on transactions, particularly if viewed as part of a roll-up strategy by a PE firm, will be much more closely scrutinized," Paul Weiss Rifkind Wharton & Garrison LLP partner Scott Sher wrote in emailed comments to S&P Global Market Intelligence.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

An Unstoppable China, With Curious Trade Pattern To Keep Prices Lower

A record-high thermal coal imports by China in 2023, attributed to rebounding demand after the COVID-19 pandemic, did not quite stir the markets since it was largely expected that an economy of such scale and population would not stop any time soon as far as energy needs are concerned. But what did occur to many was the stark reversal of the long-standing fundamental market belief that seaborne coal prices rise when China buys, and sellers concede when the latter stays away from the buying business.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability Insights Research: Sustainable Bond Issuance To Approach $1 Trillion In 2024

Despite global macroeconomic uncertainty in some key regions, S&P Global Ratings anticipates that GSSSB issuance will increase modestly to $0.95 trillion-$1.05 trillion in 2024, from $0.98 trillion in 2023. Green bonds will continue their dominance in GSSSB markets, buoyed by increased demand for environmental projects across all geographies. Transition and blue bonds may also gain traction in the GSSSB market in 2024.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Infographic — Indonesia Election: Policy Direction To Test Commodity Clout

Indonesia, home to huge natural resources and a key global commodity player, is set to witness its general elections on Feb. 14. The spotlight is on the top three candidates and how their policy actions could influence commodities that are closely linked to the minerals and energy transition industry. The elections come at a very crucial time when Indonesia has doubled down on the nationalization of its resources. An ongoing policy helmed by the current president, Joko Widodo, led to an export ban on raw minerals aimed at promoting higher-value industrialization.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: How One Of The World’s Biggest Software Companies Approaches Collaboration

At the ESG Insider podcast, we’ve been hearing a key theme on repeat: Solutions to climate change and biodiversity loss require collaboration across silos. In this 'Breaking down silos' miniseries of the podcast, we’re bringing you examples of how collaboration across different groups of stakeholders happens in practice. Today in Part II, hear the perspective of one of the world’s largest software companies in an interview with SAP’s Global Head of Circular Economy Solutions Stephen Jamieson.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1