Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Feb, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Market participants and policymakers around the world have been talking about the global energy transition, but appear to have not yet invested enough into their companies’ and countries’ net-zero actions to counter carbon dioxide emissions and their calamitous associated risks.

After 2020 solidified how companies need strong engagement with ESG principles, the momentum continued through 2021 and culminated with the 26th U.N. Climate Change Conference’s two weeks of deliberations among political and corporate leaders from around the globe on how to best combat climate change. Now, S&P Global Sustainable1 anticipates that investors, corporate boards, and government leaders will face a number of intersecting pressures and challenges that will advance their transparency, disclosures, and actions in environmental, social, and governance decision-making. This year will once again be a mixed bag for the energy transition. Looking ahead, 2022 could potentially see CO2 emissions hit a historic high, underperforming renewable power send already-overheated power prices higher, supply chain disruptions curtail supply for electric vehicles and renewable energy installations while making them more expensive, and the gap between hydrogen’s ambitions and realities be tested, according to S&P Global Platts.

While S&P Global Ratings expects global sustainable bond issuance to surpass $1.5 trillion in 2022, S&P Global Platts Analytics expects CO2 emissions from energy combustion to grow by 2.5%. This dichotomy raises questions over whether investment in the energy transition can overcome the mounting risks to achieving net-zero and keep pace with the need to decarbonize the global economy.

The amount of capital needed to "fundamentally transform the energy system as we know it today" and address the climate crisis by 2050 is the "most catalytic part" of current energy transition discussions, Sarah Ladislaw, managing director of the zero-carbon energy advocacy non-profit RMI's U.S. program, said during a Feb. 9 Bipartisan Policy Center panel, according to S&P Global Platts.

Fossil fuel majors like Duke Energy, Exxon, and BP have recently allocated significant portions of their capital expenditures to their net-zero plans, according to S&P Global Market Intelligence. The 2021 S&P Global Corporate Sustainability Assessment found that more companies are creating climate change preparedness strategies, and that nearly one-quarter of companies surveyed see climate change as a “material issue.”

But many of the ambitious plans to combat the projected record emissions levels appear to be lacking the necessary political, regulatory, and financial backing.

“There are significant risks to domestic environmental policy agendas from elections in 2022,” S&P Global Platts said in its energy transition trend forecast for 2022. “Record high carbon prices in Europe have triggered market intervention reviews. Midterm elections in the U.S. have the potential to affect significantly the Biden Administration's environmental agenda. In Australia, focus is on the opposition party and whether a prioritization of more aggressive environmental targets will win political and popular support. Such elections are reminders that ‘all politics are local’ and the fate of global agreements often get determined by domestic elections, local public sentiment, and local policy shifts.”

Only 36.8% of the approximately 5,300 companies reviewed in the CSA announced plans to curb direct emissions and/or emissions associated with their purchased energy, according to S&P Global Sustainable1. The Biden Administration’s Build Back Better plan that seeks to invigorate the country’s renewable infrastructure and economy in the long-term has faced roadblocks that have prevented the package from passing. Last year, Europe's largest banks appear to have contradicted their own net-zero commitments by providing $55 billion in financing to companies expanding oil and gas production, according to research by the ESG and corporate responsibility advocacy organization ShareAction.

Companies could respond as investors demand more attention to climate risks in the potential absence of government policy, "which gives governments fundamentally far less control over the decisions that they make,” RMI’s Ladislaw said. “The environment for rewarding positive green behavior and being able to illustrate good returns on those types of investments is going to be given a premium, and that's a different place for us to be with that much capital focused on that kind of behavior. We could be in a real transformational stage for, quite frankly, anybody who can prove that they've cracked that code … What it means is that nobody involved in today's energy system is inevitable."

Today is Tuesday, February 15,2022, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Data: Solid Job Gains, Surging Prices Fuel The Fed's Policy Rocket

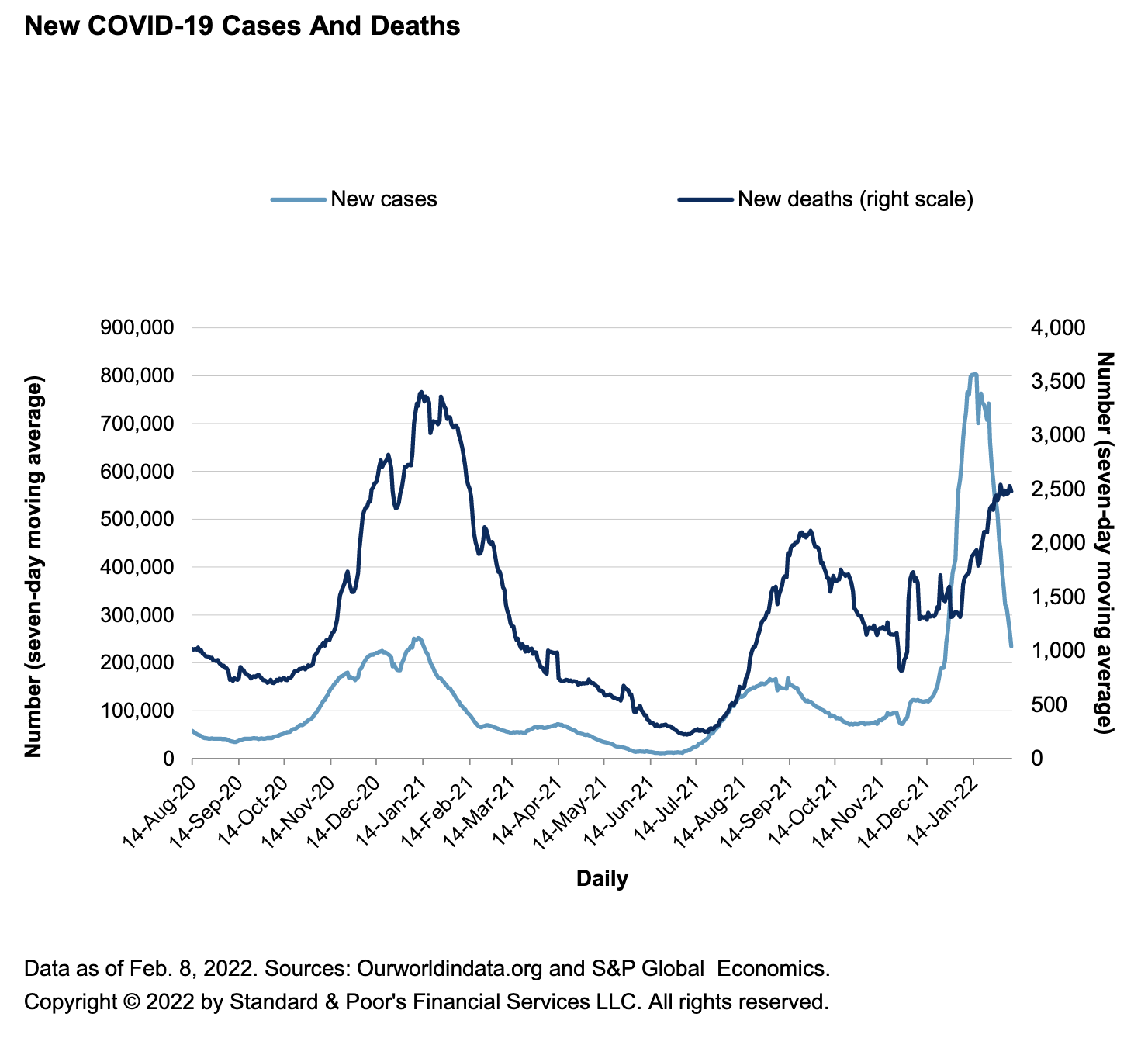

The massive drop in U.S. omicron cases through Feb. 8 echoes relatively healthy economic data reported by S&P Global Economics' U.S. real-time data tracker. In fact, the improving public health situation in the U.S., if it continues, points to a solid February outlook overall. With long-term inflation expectation indicators advancing to a decade high, the Federal Reserve has reason to be concerned that elevated inflation expectations are here to stay.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

For European Banks, Net-Zero Pledge Permits Financing Oil And Gas Expanders

Europe's largest banks provided $55 billion in financing in 2021 to companies expanding oil and gas production, which the shareholder group behind the research says is a clear contravention of climate science and banks' own net-zero commitments. ShareAction, which coordinates shareholder campaigns, examined loans and issuance underwriting services by 25 of the biggest European banks to 50 companies with large oil and gas expansion plans, excluding any sustainable, transition, or non-fossil fuel-related financing. It found that some $33.2 billion was supplied to fossil fuel expanders after the banks committed to ambitious climate goals through the Net-Zero Banking Alliance throughout last year.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Middle East LPG Suppliers Eye Boosting Exports To Capture Asian Demand

Asia's LPG demand has been growing over the last decade, led by China's mushrooming petrochemical sector. India's LPG demand has also grown due to large subsidy-driven household consumption. But major Middle Eastern exporters have to grapple with growing competition from other producers, led by the shale-driven U.S. natural gas liquids sector. In a move to win back traditional buyers and entrench themselves in a bullish LPG market, Middle Eastern producers are projected to boost export volumes in 2022. S&P Global Platts’ Wendy Wells, Ramthan Hussain, and Joshua Ong discuss what lies ahead for the LPG markets in 2022.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Access more insights on the global trade >

Listen: How One Of The World’s Largest Insurers Is Tackling Climate Chang

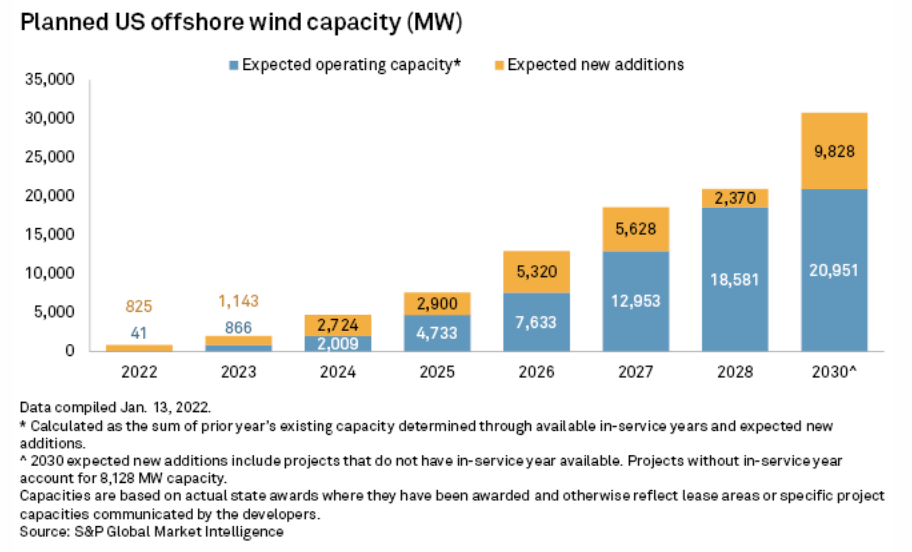

The U.S. has a 30.7-GW pipeline of offshore wind projects, enough to meet President Joe Biden's target of 30 GW by 2030, according to an S&P Global Market Intelligence analysis. But the Biden administration faces a time crunch in reaching the goal: By 2025, the U.S. will have 4,733 MW of operating offshore wind capacity if all projects are built on time, the data show. Another 16,218 MW of capacity is scheduled for completion between 2025 and 2030, when the U.S. will have 20,951 MW of operating capacity. Newer project proposals totaling 8,128 MW of capacity have not disclosed in-service dates.

—Read the full article from S&P Global Market Intelligence

Listen: Will U.S. Oil Supply React To $90/B Prices?

Where is U.S. oil production headed with prices at $90/b and some analysts seeing triple digits ahead? The latest episode of Capitol Crude digs into the U.S. upstream outlook from several angles, with Mitch Fane, Ernst & Young's Americas energy leader, on what's driving capital decisions, uncertainty around ESG disclosure requirements, and the state of industry consolidation and digital transformation; Nathan Hasbrook, analyst for S&P Global Platts Analytics, who shares the outlook for 2022 supply and a longer view of U.S. shale's future; and Starr Spencer, Platts senior editor for Americas oil news, with the Market Minute on the demand for premium drilling rigs, an example of cost pressures hitting the industry.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Access more insights on energy and commodities >

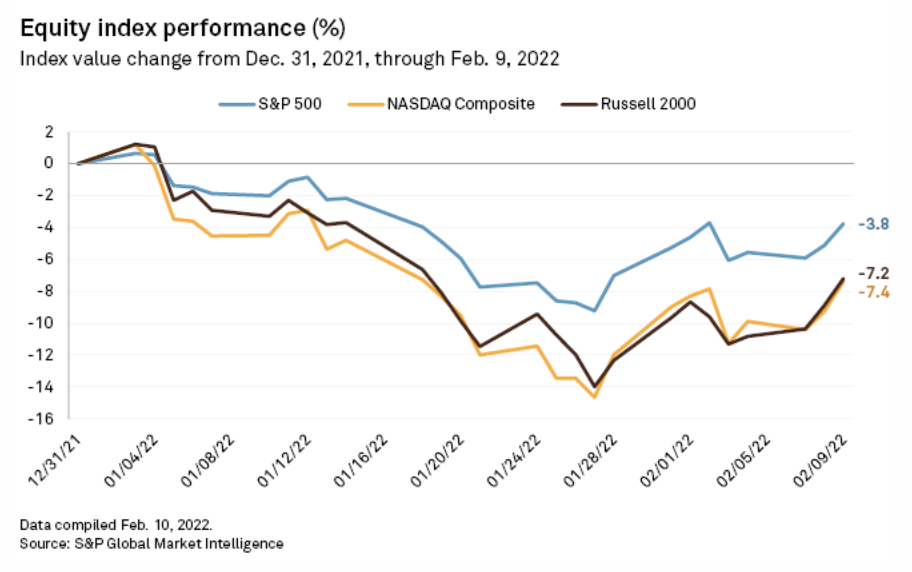

Tech Market Volatility Could Resolve Midyear After Stormy January

The steep correction that technology valuations saw in the first weeks of 2022 may ultimately prove to be more boon than gloom for the long-term health of the market. Following a boom in tech values during the pandemic, the new year brought a period of review. As individual and corporate wealth accumulated and supply chains tightened, inflation began soaring at historic rates. The U.S. Federal Reserve has signaled it will raise its benchmark interest rates in an attempt to realign markets. Investors are now rethinking the massive valuations they have put on growth companies, technology tickers in particular, as they assess the potential risks of an economy in flux.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.

Content Type

Location

Language