Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Bounce Back Year for Sustainable Bonds

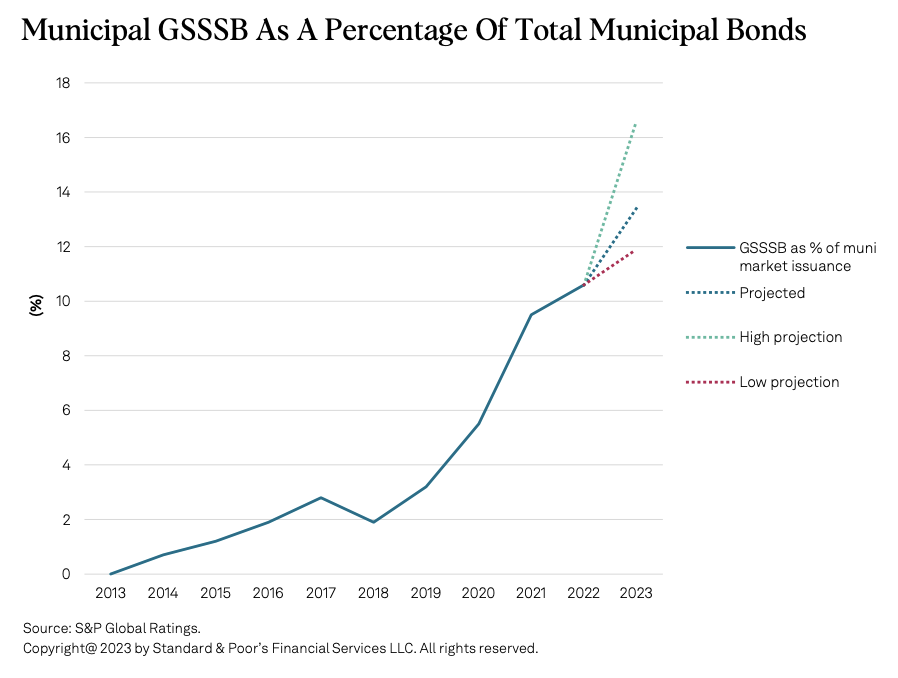

In 2022, the issuance of green and sustainable bonds fell due to changing monetary policy and macroeconomic uncertainty. But the new year brings new life to the green, social, sustainability and sustainability-linked bond, or GSSSB, market as issuance is expected to increase to 17% from 5%, growth that is anticipated to outpace the broader bond market. However, challenges remain due to questions about regulation, transparency and the risk of recession.

In 2022, the global green bond supply fell by 25.6%. Issuers sold only $443.72 billion of green bonds, down from $596.30 billion in 2021. Green bonds issued by sovereigns fell 38.1%, and issuance from nonfinancial corporates dropped 35.8%. Other sustainable bonds experienced similar declines.

But there is cause for cautious optimism that 2023 may be a bounce back year for sustainable bonds. Researchers at S&P Global Ratings and Sustainable1 forecast that the sustainable bond market will return to growth this year. GSSSB issuance is expected to grow to between $900 billion and $1 trillion in 2023, representing 6%-18% year-over-year growth. Supporting this growth are initiatives — notably, China's Green Bond Principles, published in July 2022, and the U.S. Inflation Reduction Act, which will increase green energy and climate investment — to standardize the GSSSB market and provide greater transparency.

A detailed analysis of the sustainable bond market provided by S&P Global Ratings suggests that the market share of GSSSBs could reach 14%-16% in 2023, driven primarily by European and Asian issuance. Growth in GSSSB issuance is expected to continue in the financial services sector in 2023.

Green bonds will continue to dominate the market in 2023, followed by social bonds and sustainability bonds, which combine aspects of green and social spending. The market for sustainability-linked bonds may be at an inflection point. Sustainability-linked bonds, which are different from sustainability bonds, gained initial favor with issuers and investors due to their more flexible requirements. However, doubts have grown over the effectiveness of sustainability-linked bonds in achieving meaningful targets and have led to claims of greenwashing.

The continued strength of green bond issuance and demand in Asia, even during 2021, may be due to the predicted impact of physical climate risk on Asia, which is disproportionately exposed. South Asia is over 10 times more exposed than Europe to gross domestic product risks from water stress, heat waves and physical events. However, Europe remains the biggest market for GSSSB. Green bond-financed renewables have over twice the impact in Africa than in any other region, according to S&P Global Sustainable1.

Absent an economic recovery, it is possible that private companies may choose to sit out the market this year. This would be a blow to the hopes coming out of the 2022 United Nations Climate Change Conference that multilateral development banks might step up their use of blended finance to attract private capital. Given the public goals related to adaption and mitigation of climate change, there will remain a clear shortage of money.

Today is Friday, February 10, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

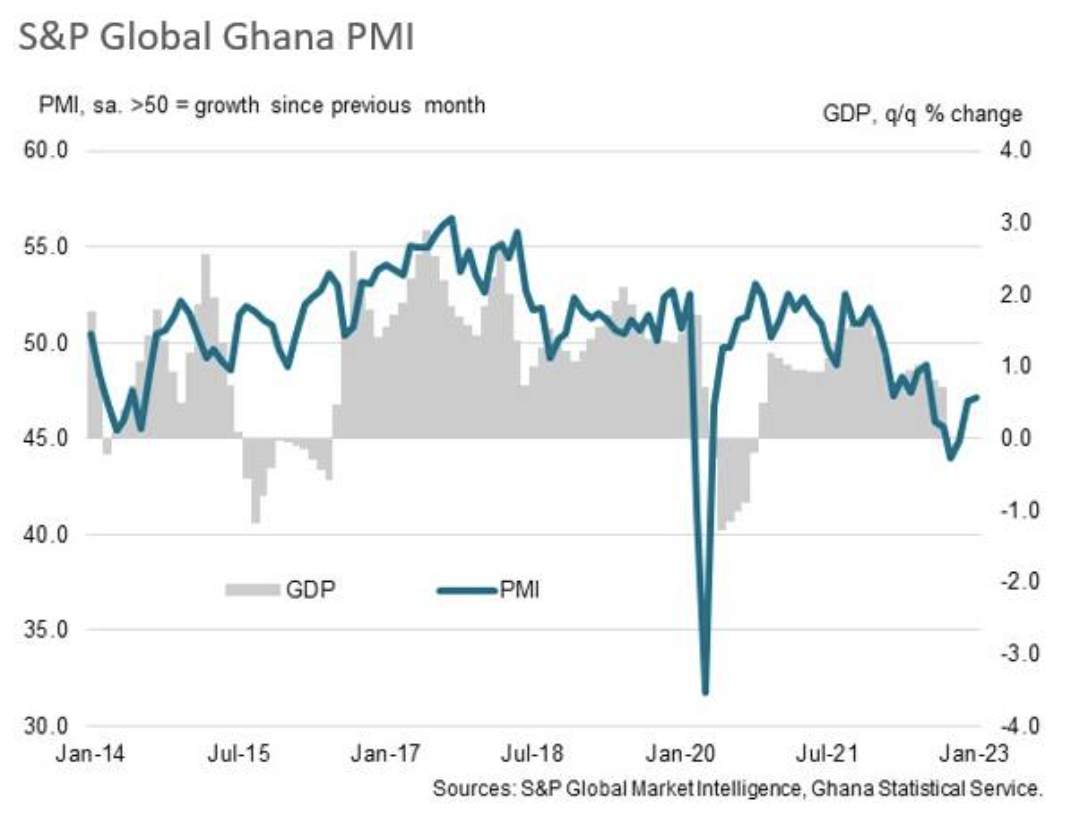

Ghana's Economic Downturn Moderates Amid Debt Deal

The economic downturn in Ghana's private sector softened at the start of 2023 as inflationary pressures showed signs of easing. This, allied with an agreement with the IMF and a deal on a debt exchange programme, provides hope that the economy can move into recovery mode in the coming months. Indeed, companies were at their most optimistic for a year in January. The January S&P Global Ghana PMI survey signalled a further marked reduction in business activity in the private sector as intense inflationary pressures again acted to restrict customer demand. That said, the latest fall in output was the softest since August last year, suggesting that the worst of the downturn may have passed.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Funding Pressure A Theme For Community Banks Across US

Community banks across the U.S. are seeing pressure on funding, with deposits either declining or growing at a slower rate as the Federal Reserve tightens monetary policy and consumers use some of the excess savings accumulated during the COVID-19 pandemic. In every region of the country, median trends indicate that while year-end 2022 deposit balances at community banks were higher than year-ago levels, growth slowed considerably from the double-digit rates of 2021.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

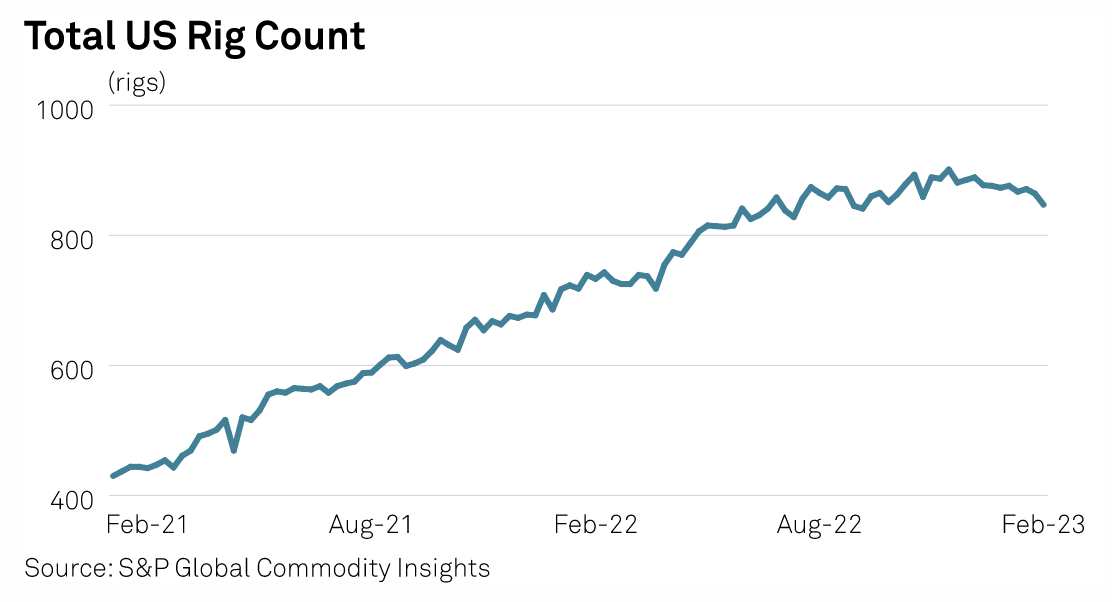

US Gas Production Growth Outlook In 2023 Dims Amid Falling IRRs, Slower Rig Activity

Falling internal rates of return for dry gas producers and a faltering rig count could mean slower-than-expected growth in US natural gas production this year as producers adapt to a weaker market outlook in 2023. From December to January, percentage returns for many gas producers fell by double digits, tracking a steep decline in Henry Hub gas prices, according to a recent analysis by S&P Global Commodity Insights. Over the same period, the US rig count appears to have peaked, settling into a gradual decline recently – mostly reflecting a drop in rig activity across the smallest, and likely least-profitable, basins.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

U.S. Municipal Sustainable Bond Issuance Outlook 2023: Momentum To Continue

Continued robust growth: Total green, social, sustainability, and sustainability-linked bond (GSSSB) issuance by U.S. municipal entities will reach approximately $54 billion; we expect market share to increase for a fifth consecutive year, likely ranging from 12% to 17% of total municipal bond issuance. Mixed impact from policy: The U.S. Inflation Reduction Act may boost GSSSB issuance, but objections to environmental, social, and governance (ESG) factors as discrete investment or financial considerations from some policymakers, issuers, and investors may hinder growth.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

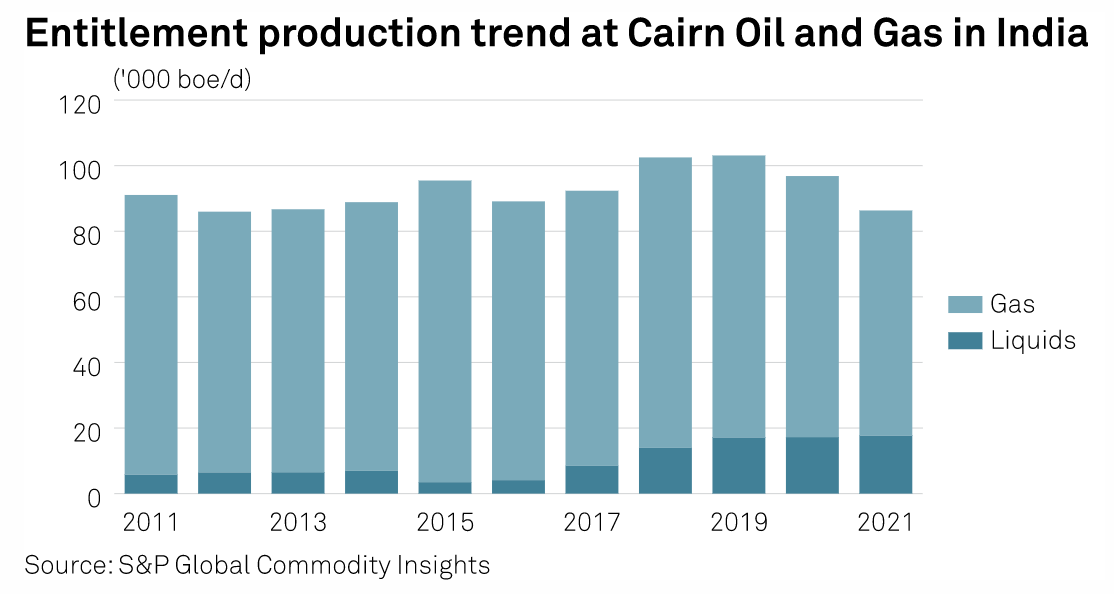

Interview: Cairn India To Accelerate Oil, Gas Exploration Despite Energy Transition, Says CEO

India's Cairn Oil and Gas will continue to invest billions of dollars in exploration in an effort to double its share in the country's oil and gas production in the coming years but with a lower carbon footprint, as it strongly believes that fossil fuels will remain an important part of the energy mix for decades, the company's new chief executive officer told S&P Global Commodity Insights. Cairn, part of Vedanta Resources, has set a target to raise its share of domestic production to 50% from the current 25%, as the upstream investment climate had improved. Many of the policies have also been simplified, although some still need to be addressed, the company's CEO Nick Walker said in an interview.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

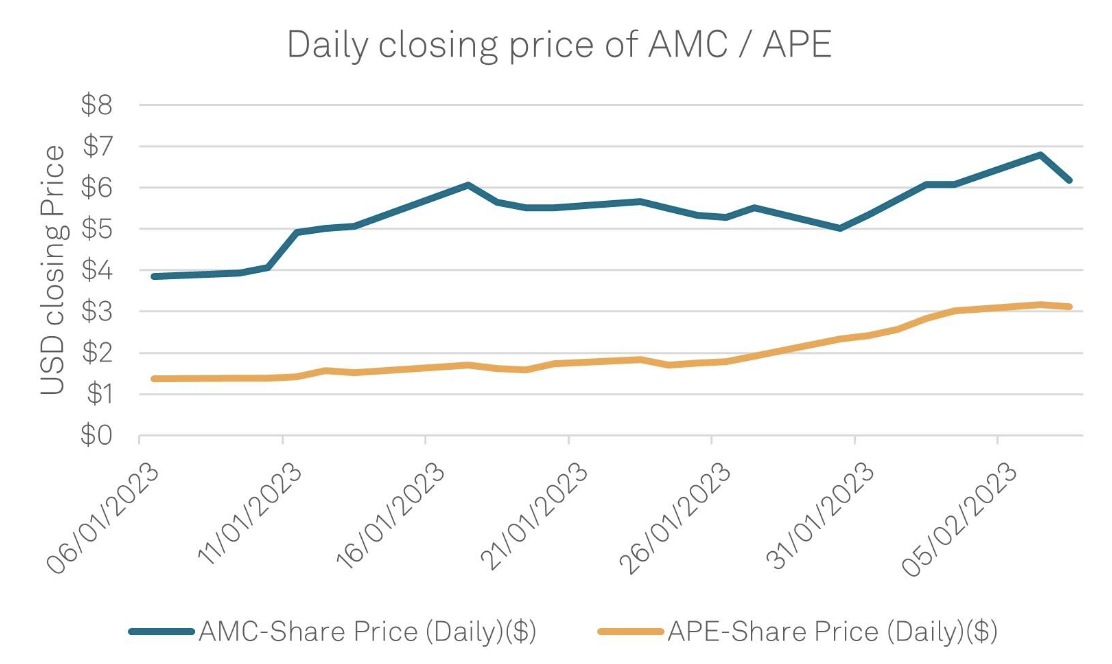

AMC, The Best Show In Town

Borrowing activity in AMC continues to increase following market expectation that an upcoming vote will give permission for a 1:1 share offer to take place between the ordinary line (AMC) and its preference shares line (APE), as part of an ongoing cash raising and refinancing program. On the 7th February 2023, AMC shares were valued at $6.80, APE shares were valued at $3.11. The price gap is still significant ($3.69) but has been closing over the last few weeks.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

Finance At CERAWeek 2023: Evolving Energy Transition Drives Capital Evolution

Join this live webinar and prepare for more than three dozen dedicated financial and capital markets sessions across every segment, fuel type and industry sector at CERAWeek 2023.

—Register for the webinar from CERAWeek